Thailand Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2025-2033

Thailand Vegetable Oil Market Overview:

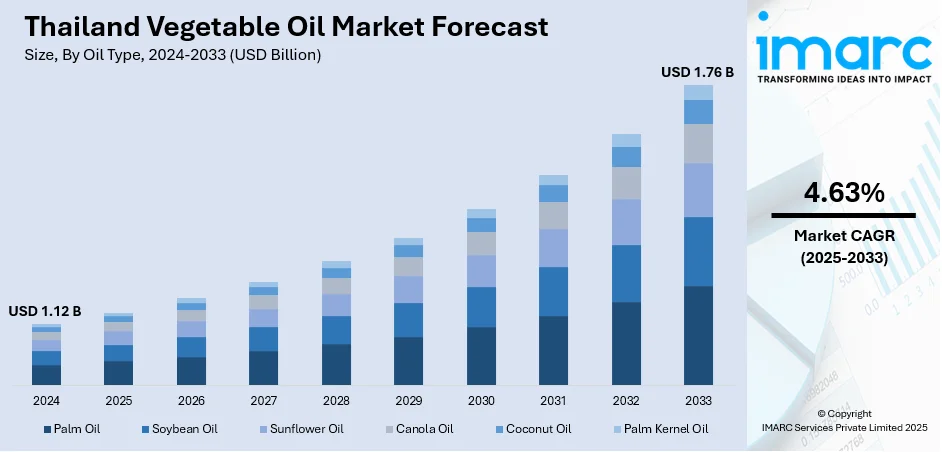

The Thailand vegetable oil market size reached USD 1.12 Billion in 2024. Looking forward, the market is projected to reach USD 1.76 Billion by 2033, exhibiting a growth rate (CAGR) of 4.63% during 2025-2033. The market is driven by strong palm and soybean oil production that supports household affordability and culinary authenticity. Rising demand from food exports and packaged goods manufacturers ensures industrial uptake and quality refinement. Health trends and functional oil innovations are further augmenting the Thailand vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.12 Billion |

| Market Forecast in 2033 | USD 1.76 Billion |

| Market Growth Rate 2025-2033 | 4.63% |

Thailand Vegetable Oil Market Trends:

Strong Domestic Production of Palm and Soybean Oil

Thailand is a major producer of palm oil and soybean oil, with well-established cultivation, extraction, and refining systems. Thailand is the third-largest producer of palm oil globally, with an oil palm harvested area of 6.55 million rai. The production volume of oil palm in Thailand is 18.27 million metric tons (MT), with palm oil being the most produced vegetable oil in the country, given its high yields and low production costs. Crude palm oil is processed into cooking-grade refined oil by domestic refineries, supplying both household and industrial segments. The government regulates pricing and supply to ensure affordability for low-income consumers, especially during global price fluctuations. Palm oil is the dominant edible oil due to its versatility and integration into Thai cuisine, used for deep frying, curry bases, stir-fries, and snack preparation. Soybean oil, though slightly more expensive, is preferred in urban households for its neutral flavor and health perception. Both oils are widely distributed through traditional markets and modern retail channels in various pack sizes. Thailand’s rural-urban divide ensures continued demand for both loose and packaged oil formats, depending on region and income level. Public health authorities promote vitamin A-fortified oil to combat nutritional deficiencies, especially among children. The Ministry of Commerce and Office of Agricultural Economics provide consistent oversight of production, storage, and retail dynamics to maintain national food security. A strong agricultural base and well-organized supply chains sustain reliable consumption and support Thailand vegetable oil market growth across household, commercial, and institutional use cases.

To get more information on this market, Request Sample

Expansion of Packaged Foods and Culinary Exports

Thailand’s rapidly growing packaged food industry, particularly in noodles, snacks, frozen meals, and seasoning pastes, has increased the need for high-quality vegetable oils. Local brands and export-focused manufacturers require oils with specific thermal stability, shelf life, and neutral sensory properties. Refined palm, sunflower, and soybean oils are widely used in frying, shortening, and as carriers in flavor delivery systems. In MY 2023/24, Thailand's soybean oil production is forecasted to be 475,000 MT, with a 4% growth expected in MY 2024/25, bringing the total to 495,000 MT. The crushing volume for soybean oil in MY 2023/24 is 2,640,000 MT, and it is expected to increase to 2,750,000 MT in MY 2024/25. Thailand’s growing global reputation as a food exporter, especially to Japan, the U.S., and Europe, drives investments in food processing technology and ingredient standardization, including traceable and sustainably sourced oils. Firms are also responding to overseas demand for non-GMO and allergen-free formulations, leading to the adoption of blended and specialty oils. Domestic consumers, influenced by health trends and international cuisines, have increased their demand for sunflower, canola, and rice bran oils, encouraging local refiners to diversify product portfolios. Moreover, the rise in ready-to-eat and on-the-go meal consumption across urban centers such as Bangkok, Chiang Mai, and Khon Kaen reinforces the food industry’s reliance on reliable vegetable oil supplies. The synergy between domestic consumption and export-oriented processing sustains volume growth and supports product innovation across oil types and categories.

Thailand Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

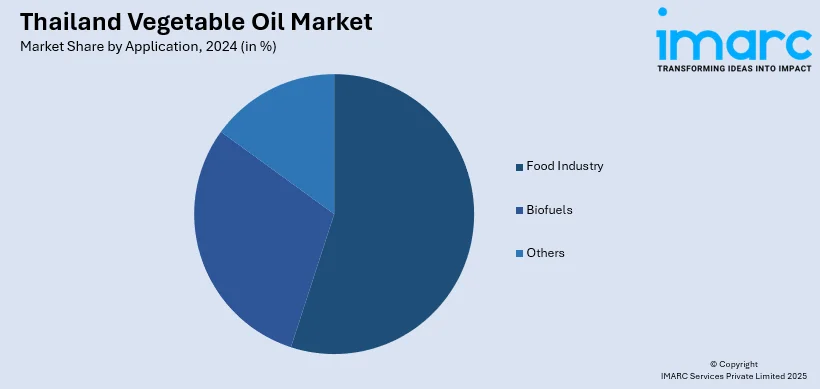

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Vegetable Oil Market News:

- On July 30, 2024, Thai Vegetable Oil Public Company Limited (TVO) received the “FDA Quality Award 2024” from Thailand’s Ministry of Public Health for excellence in the food establishment category. The recognition underscores TVO’s commitment to high-quality vegetable oil production, social responsibility, and sustainable environmental practices.

Thailand Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand vegetable oil market on the basis of oil type?

- What is the breakup of the Thailand vegetable oil market on the basis of application?

- What is the breakup of the Thailand vegetable oil market on the basis of region?

- What are the various stages in the value chain of the Thailand vegetable oil market?

- What are the key driving factors and challenges in the Thailand vegetable oil market?

- What is the structure of the Thailand vegetable oil market and who are the key players?

- What is the degree of competition in the Thailand vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)