Thin-Film Battery Market Size, Share, Trends and Forecast by Technology, Battery Type, Voltage Type, Applications, and Region, 2025-2033

Thin-Film Battery Market Size and Share:

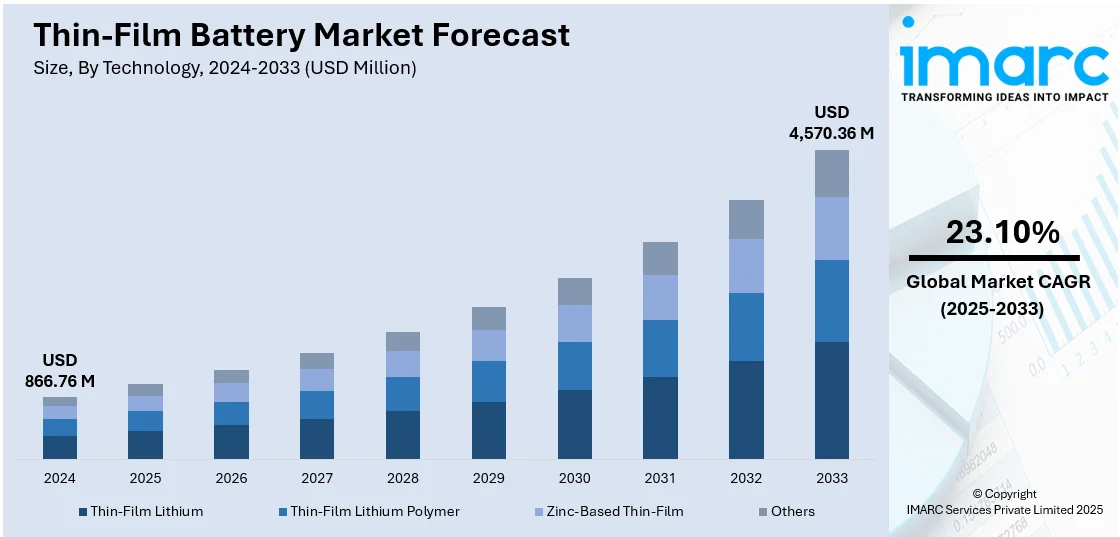

The global thin-film battery market size was valued at USD 866.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 4,570.36 Million by 2033, exhibiting a CAGR of 23.10% from 2025-2033. North America currently dominates the market, as it is experiencing steady growth driven by the rising demand for smartwatches, fitness trackers, and other wearable devices, the increasing shift towards renewable energy sources, and the growing adoption of the Internet of Things (IoT) across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 866.76 Million |

|

Market Forecast in 2033

|

USD 4,570.36 Million |

| Market Growth Rate (2025-2033) | 23.10% |

One major driver in the thin-film battery market is the increasing demand for portable and wearable electronic devices. As consumer electronics, such as smartwatches, fitness trackers, and wireless earbuds, become more advanced, the need for lightweight, flexible, and high-energy-density power sources grows. Thin-film batteries, known for their compact size, flexibility, and efficient energy storage, are ideal for powering these devices. Their ability to fit into small spaces while offering longer battery life is driving innovation and adoption across the wearable tech and portable electronics sectors, significantly fueling the growth of the thin-film battery market.

The U.S. thin-film battery market is driven by advancements in consumer electronics, renewable energy, and defense applications. As the demand for portable devices like wearables and IoT devices increases, thin-film batteries are gaining traction due to their compact size, light weight, and flexibility. The U.S. is home to numerous tech companies investing in the development of next-generation batteries, further bolstering the market growth. Additionally, the country's focus on clean energy solutions is boosting the use of thin-film batteries in renewable energy storage. Government funding and research initiatives also play a significant role in advancing thin-film battery technology.

Thin-Film Battery Market Trends:

Growing aerospace and defense use

Thin-film batteries are regarded as critical in the aerospace and defense sector by big players in that sector due to the fact that they contribute towards the creation of various benefits concerning energy density, longevity and resilience in adverse environments. In aerospace, they have application through their utilization in UAVs, satellites and even space probes to serve particular needs for dependable and minimal weight power supplies. Despite this, many researchers and scientists are continuously discovering their passion in creating resilient satellites and UAVs. An example is Bengaluru's National Aerospace Laboratories (NAL), who successfully conducted a first test run of a solar-powered "pseudo satellite," which is a state-of-the-art UAV that would be able to significantly enhance the surveillance and monitoring capacity of India in the frontier regions. Developmental innovations of this kind are further supporting the use of thin-film batteries in the discipline. Likewise, in military applications, thin-film batteries drive all sorts of equipment, ranging from remote sensors to advanced communication systems. Furthermore, the government officials of different countries are emphasizing the modernization and upgrading of the current defense feet, which is also providing a positive outlook for the overall market. For instance, the Royal New Zealand Navy recently put out a worldwide tender in September 2023 to modernize its fleet. Increasing war and exploratory trends, including autonomous drones, soldier-wearable tech, and longer-duration space missions, are likely to propel the uptake of thin-film batteries for defense systems over the course of the next few years.

Rapid medical device innovations

The healthcare sector is experiencing notable advancements in medical devices, like the introduction of sensors that can be implanted inside the body for delivering medicine. According to an industrial report, the medical devices industry is projected to register a reasonable growth rate of 5.68% during 2024-2029. Many of these devices necessitate compact, compatible, and safe power sources that can work for a long time inside the body without causing any problems. Thin-film batteries prove highly suitable, offering design flexibility for bioresorbability and low toxicity. They find applications in drug patches, transcutaneous electrical nerve stimulation (TENS) devices, biosensors, diagnostic devices, and patient monitoring devices. Moreover, various key market players are increasingly investing in research and development (R&D) activities to launch bio-compatible thin-film batteries that can be easily implanted in the human body. For instance, the research team of Yonggang Wang from the Fudan University in China has developed a thin, flexible battery suited to implantable devices that does away with dangerous chemicals and replaces them with biologically compatible liquids. Ongoing research and development are expected to create more advanced medical devices that are equipped with thin-film batteries. This, in turn, is projected to augment the thin film battery market revenue in the coming years.

Increasing product utilization in consumer electronics

The increasing demand for smaller, lighter, and more efficient power sources in the consumer electronics sector is further catalyzing the growth of the global thin film battery market. Moreover, the proliferation of portable devices, such as smartphones, wearables, and tablets, has led to the augmenting need for compact and flexible energy solutions. Moreover, the inflating spending power of individuals across the globe is also bolstering the adoption of smartphones and laptops, which, in turn, is creating a positive outlook for the market. For instance, according to the Startseite, Bitkom e. V., 21.6 million smartphones have been sold in Germany in 2022. Furthermore, various key companies are engaging in research and development activities to introduce enhanced batteries with improved battery life and can seamlessly integrate with a wide array of consumer electronic devices. In August 2023, researchers from German and British universities announced the successful development of T-Nb₂O₅ thin films, enabling faster movement of Li-ions—a significant breakthrough. This advancement paves the way for improved battery performance and progress in computing and lighting technologies, marking a notable leap in consumer electronics. Projections suggest increased battery energy density and longer recharge cycles, presenting promising opportunities in the consumer electronics market.

Thin-Film Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global thin-film battery market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, battery type, voltage type, and applications.

Analysis by Technology:

- Thin-Film Lithium

- Thin-Film Lithium Polymer

- Zinc-Based Thin-Film

- Others

Thin film lithium stands as the largest component in 2024 due to their superior energy density, lightweight, and flexible characteristics, which make them ideal for a variety of applications. These batteries are particularly popular in portable electronics, such as wearables, smartwatches, and IoT devices, where space is limited, and long battery life is crucial. Their thin profile and ability to be integrated into compact and curved designs are key advantages. Additionally, the growing adoption of electric vehicles (EVs) and advancements in renewable energy storage further drive the demand for thin-film lithium batteries. As the technology matures, efficiency improvements and cost reductions are expected, ensuring their dominance in 2024 and beyond.

Analysis by Battery Type:

- Rechargeable

- Disposable

Rechargeable leads the market in 2024 due to their long cycle life, sustainability, and cost-effectiveness. Unlike traditional disposable batteries, rechargeable thin-film batteries can be used multiple times, making them highly desirable for applications that require frequent recharging, such as portable electronics, wearable devices, and medical implants. Their ability to retain a significant portion of their capacity over numerous charge cycles reduces waste and offers a more environmentally friendly solution. Moreover, advancements in energy density and efficiency have enhanced their performance, increasing their adoption across various sectors. With continuous improvements in technology and decreasing production costs, rechargeable thin-film batteries are poised to dominate the market, catering to both consumer and industrial demands for reliable, long-lasting power sources.

Analysis by Voltage Type:

- Below 1.5V

- 1.5V to 3V

- Above 3V

Batteries below 1.5V are typically used in low-power applications such as medical devices, sensors, and small consumer electronics. These batteries are preferred for their compact size and ability to deliver reliable, long-lasting power in low-voltage environments, where higher voltage levels are unnecessary.

Also, the batteries within the 1.5V to 3V range are commonly found in a variety of consumer electronics, including hearing aids, smartwatches, and IoT devices. This voltage range strikes a balance between power output and energy efficiency, making these batteries suitable for devices that require moderate power over extended periods.

Furthermore, the batteries above 3V are used in high-power applications, such as electric vehicles, renewable energy storage, and larger consumer electronics. The higher voltage enables greater energy storage and efficiency, supporting devices that demand more power for extended operation or those that integrate multiple components requiring higher voltage levels.

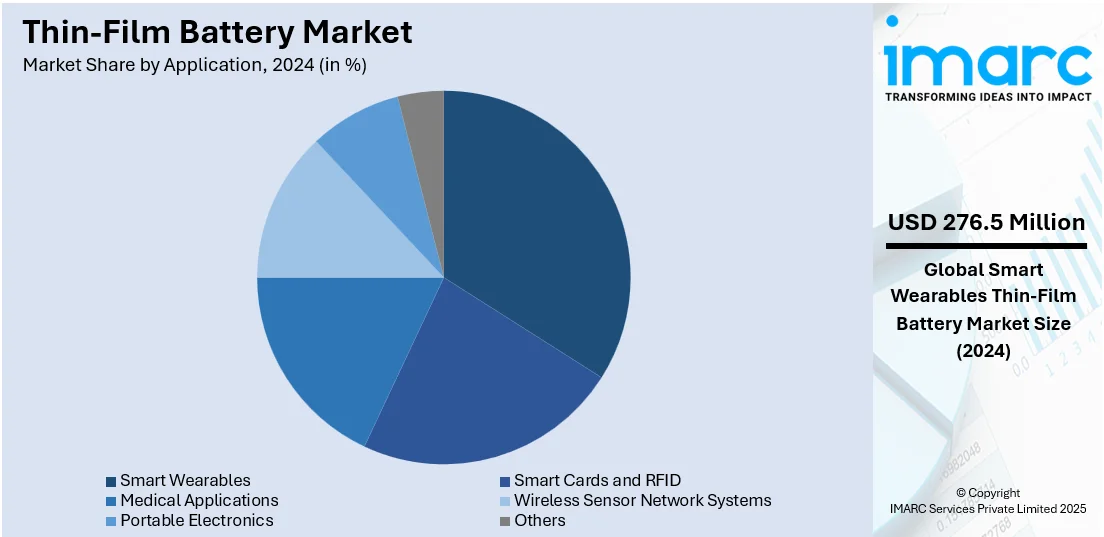

Analysis by Application:

- Smart Cards and RFID

- Medical Applications

- Smart Wearables

- Wireless Sensor Network Systems

- Portable Electronics

- Others

Smart wearables represented the leading market segment, due to their increasing demand for compact, lightweight, and high-performance power solutions. Devices like smartwatches, fitness trackers, and wearables for health monitoring require long-lasting power with batteries capable of fitting into small spaces. Thin-film batteries are ideal because they exhibit flexibility, high energy density, and the ability to maintain consistent power delivery in a thin profile. This, together with the increasing need among consumers for health and fitness, will require them to have smart wearables capable of continuous heart rate monitoring, GPS tracking, as well as longer-lasting power. Besides this, as continuous innovation occurs in wearable technology coupled with improved battery efficiency, there is a guarantee that in the coming years, thin-film batteries will continue being the primary power source.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

In 2024, North America accounted for the largest market share driven by the region's technological advancements, high demand for consumer electronics, and strong focus on innovation. The U.S., in particular, is a major hub for tech companies and startups developing next-generation wearable devices, medical implants, and IoT applications, all of which require compact and efficient power sources like thin-film batteries. Additionally, the increasing adoption of electric vehicles (EVs) and renewable energy solutions in North America further boosts the demand for these batteries. Government initiatives supporting clean energy and sustainable technologies also contribute to market growth. With continuous investment in R&D and the presence of leading manufacturers, North America is poised to maintain its dominant position in 2024.

Key Regional Takeaways:

United States Thin-Film Battery Market Analysis

Developments in thin-film storage technology and increased demand for energy solutions, which are small, lightweight, and flexible, have the US as an important source of business in thin-film batteries. Another key factor is the growth in application of thin-film batteries in wearable electronics, medical devices, and Internet of Things (IoT) applications—where thin-film technology is used to achieve a much-needed energy density and limitations in space. Furthermore, there is a growing emphasis on sustainability, and this is driving innovation in energy storage technology, like the development of rechargeable, environmentally friendly thin-film batteries. According to a recent report on US internet data, 331 Million Americans will be online in 2023, and most of those devices are connected to IoT. The United States also benefits from the strengths of a strong R&D industry, with many top institutions and tech firms focusing on developing thin-film battery technology. The move towards electric cars (EVs) and government support for clean energy projects are also significant catalysts as EVs and renewable energy sources like solar power rely on energy storage systems.

Europe Thin-Film Battery Market Analysis

The market for thin-film batteries in Europe is growing rapidly due to the increased need for small, effective energy storage solutions in a variety of industries such as consumer electronics, automotive, and renewable energy. The region's emphasis on energy efficiency and sustainability coupled with EU laws that support green technologies is one of the major drivers. Another critical consideration is the shift of the automobile industry towards electric vehicles. Thin-film batteries are the best solution for EVs, which require energy storage devices that are lightweight, compact, and highly efficient. Additionally, Europe is dotted with battery technology innovators, particularly in countries like Sweden, Germany, and the UK, where companies are investing in the development of thin-film battery prototypes. The demand for thin-film batteries in the region has been heightened by the proliferation of wearable technology and the Internet of Things gadgets, increasing interest in renewable energy sources. According to the International Data Corporation, by 2026, there will be 49 Million installed devices connected to the IoT against about 40 Million connected devices in 2023, growing at 7% per annum. About 75% of the European organization employ IoT or will employ going forward.

Asia Pacific Thin-Film Battery Market Analysis

Asia-Pacific leads the market for thin-film battery, which accounts for a large share of the world's demand. Rapid electronic development is driving the region's growth, and South Korea, China, and Japan are key markets for thin-film batteries in wearables, medical equipment, and mobile devices. Another driving force behind the market is the increasing demand for energy efficiency in renewable sources, especially in solar devices. According to the industry reports, the size of added value of electronic information manufacturing industries grew 13.6% annually from January to April in 2024. 496 Million units were produced with a year-on-year increase of 12.6%, which is higher than that of the general industrial sector and the high-tech manufacturing sector by 7.3 and 5.2 percentage points, respectively. The smartphones category accounted for 367 million units, a 14.1% increase. Concentrating on smart cities and IoT infrastructure is driving the requirement for small and efficient power sources in the Asia-Pacific region. Development of thin-film battery technology in this region is further supported by government initiatives promoting the use of green technologies and enhancing R&D expenditures. Further demand for such advanced energy storage technologies is also seen with the increase in electric cars across the country, China.

Latin America Thin-Film Battery Market Analysis

Increasing demand for advanced energy storage technology for consumer electronics and renewable power sources is driving the growth of the Latin American thin-film battery market in a steady manner. Interest in wearable technology, IoT devices, and solar systems is increasing in Brazil, Mexico, and Argentina; thus, these countries lead in adopting thin-film battery technology. The industry forecast states that 72.5 Million households or 92.5% of households had Internet access in 2023. This is an increase in IoT connected devices. Thin-film battery uptake is also being helped by the region's focus on renewable energy and environmental sustainability. Compact, lightweight, and effective energy storage technologies are in more and more demand as Latin America invests more in innovation and infrastructure.

Middle East and Africa Thin-Film Battery Market Analysis

The thin-film battery market in MEA is likely to grow and the growth is expected to be driven by the increasing demand for portable electronics and renewable energy technology. Thin-film batteries are increasingly used for energy storage in solar power projects, which is being funded by countries such as Saudi Arabia and UAE. In great extent, the three solar power projects - Al Ajban Solar PV Project, and others including Al Dhafra Solar PV Project, and Noor Abu Dhabi, are the major tools toward making the UAE Energy Strategy 2050 as well as the Net Zero by 2050 strategic objective materialize. Another area where demand is created is through the growing region with regards to medical gadgets as well as wearable electronics. As regional governments promote energy efficiency and sustainability, the growth of the thin-film battery market will be heightened.

Competitive Landscape:

The key players in the market are driving growth through strategic initiatives, innovation, and a focus on meeting changing consumer and industry demands. These companies, often at the forefront of technological advancements, invest significantly in research and development (R&D) to enhance the efficiency, energy density, and sustainability of thin-film batteries. By introducing cutting-edge technologies and collaborating with diverse industries, key players expand the scope of applications for thin-film batteries, driving market growth. Furthermore, these players engage in partnerships, mergers, and acquisitions to strengthen their market position and broaden their product portfolios. They actively respond to emerging trends, such as the increasing demand for sustainable and eco-friendly energy solutions, by aligning their offerings with market needs. Additionally, the key players leverage their global presence and distribution networks to tap into diverse regional markets, ensuring a widespread adoption of thin-film battery technologies.

The report provides a comprehensive analysis of the competitive landscape in the thin-film battery market with detailed profiles of all major companies, including:

- Blue Spark Technologies

- BrightVolt

- Enfucell Oy

- STMicroelectronics N.V.

- Cymbet Corporation

- Imprint Energy

- Ilika PLC

- LG Chem, Ltd

- Paper Battery Company

- Jenax Inc.

Latest News and Developments:

- In February 2024, Netherlands-based Lionvolt acquired the battery cell production line of beleaguered company AMTE Power located at Thurso in Scotland. This acquisition will bring new complementary capabilities, setting the stage for its next phase of growth, according to the company.

- In January 2024, battery start-up BTRY raised CHF 900,000 in pre-seed financing. The round was led by HTGF with participation from Zürcher Kantonalbank. The spin-off from Empa and ETH Zurich is developing a new type of lithium-ion thin-film solid-state battery that combines significant advantages for various commercial applications.

- In September 2023, the startup BTRY, founded by the EMPA researchers, introduced an innovative lithium metal-based solid-state battery that can charge in one minute, is non-flammable, and outlasts traditional lithium-ion batteries.

Thin-Film Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Thin-Film Lithium, Thin-Film Lithium Polymer, Zinc-Based Thin-Film, Others |

| Battery Types Covered | Rechargeable, Disposable |

| Voltage Types Covered | Below 1.5V, 1.5V to 3V, Above 3V |

| Applications Covered | Smart Cards and RFID, Medical Applications, Smart Wearables, Wireless Sensor Network Systems, Portable Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Blue Spark Technologies, BrightVolt, Enfucell Oy, STMicroelectronics N.V., Cymbet Corporation, Imprint Energy, Ilika PLC, LG Chem, Ltd, Paper Battery Company, Jenax Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the thin-film battery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global thin-film battery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the thin-film battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A thin-film battery is a type of energy storage device that utilizes thin layers of active material to store and release energy. These batteries are lightweight, flexible, and compact, making them ideal for applications in portable electronics, wearables, medical devices, and energy storage systems where space and efficiency are critical.

The global thin-film battery market was valued at USD 866.76 Million in 2024.

IMARC estimates the global thin-film battery market to exhibit a CAGR of 23.10% during 2025-2033.

Key factors driving the global thin-film battery market include the rising demand for portable, lightweight, and flexible power sources in consumer electronics, wearables, and IoT devices. Additionally, advancements in energy density, the shift toward renewable energy storage, and continuous technological innovations are fueling market growth across various industries.

In 2024, thin film lithium represented the largest segment by technology, driven by its high energy density, compact size, and suitability for portable electronics.

Rechargeable leads the market by battery type owing to their long cycle life, cost-effectiveness, and suitability for frequent recharging applications.

The smart wearables is the leading segment by application, driven by the growing demand for compact, long-lasting, and efficient power solutions in devices.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global thin-film battery market include Blue Spark Technologies, BrightVolt, Enfucell Oy, STMicroelectronics N.V., Cymbet Corporation, Imprint Energy, Ilika PLC, LG Chem, Ltd, Paper Battery Company, Jenax Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)