Tooling Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2026-2034

Tooling Market Size and Share:

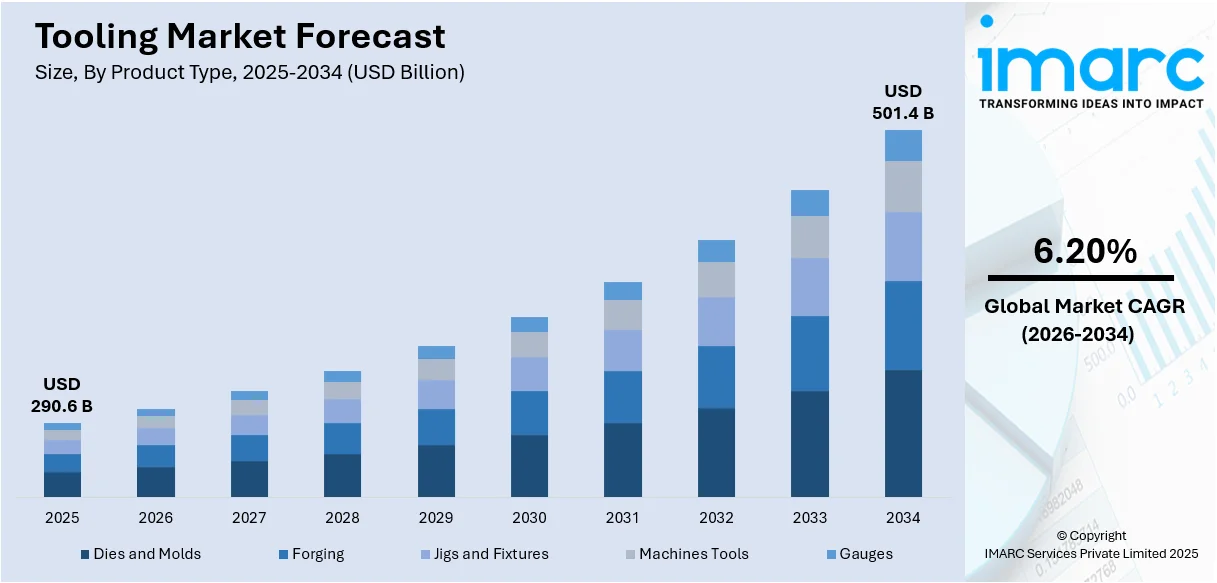

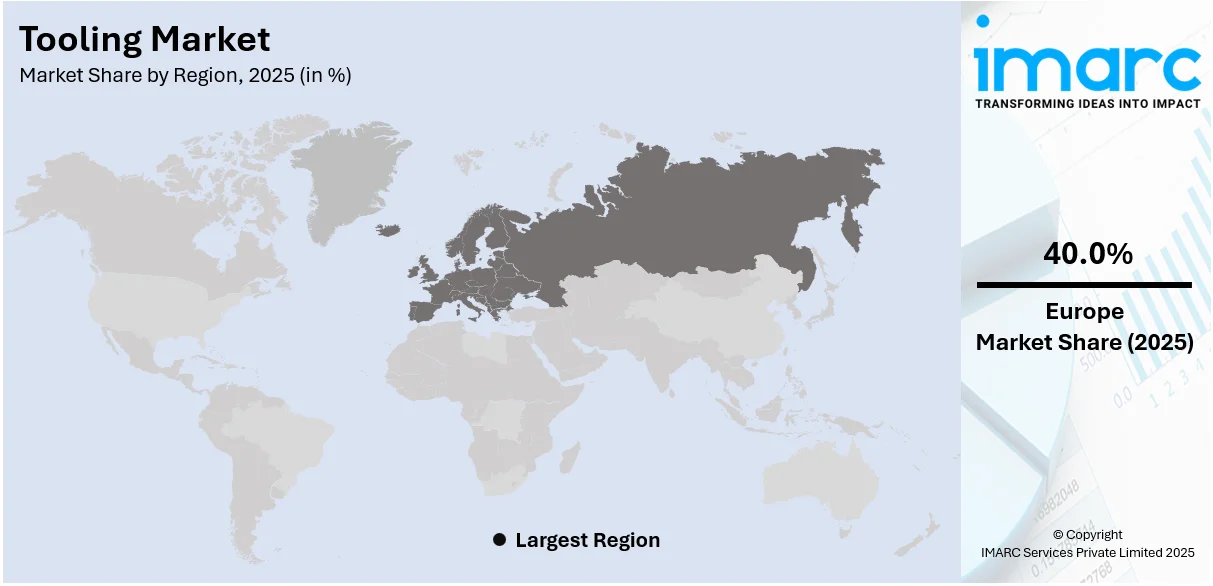

The global tooling market size was valued at USD 290.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 501.4 Billion by 2034, exhibiting a CAGR of 6.20% from 2026-2034. Europe currently dominates the market, holding a market share of 40.00% in 2025. The tooling market share is growing in the European region owing to its strong manufacturing base, advanced technology adoption, and presence of leading automotive and aerospace industries. Government support for innovation, skilled workforce, and investments in precision engineering is further enhancing Europe’s competitive edge in the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 290.6 Billion |

|

Market Forecast in 2034

|

USD 501.4 Billion |

| Market Growth Rate 2026-2034 | 6.20% |

The automotive and aerospace sectors are significant users of tooling because they require the mass production of highly accurate, long-lasting parts. In the automotive industry, tools are necessary for engine components, body panels, transmission systems, and others. Aerospace requires precision tools for safety-sensitive components, such as turbine blades and structural parts. In addition to this, tooling technologies are advancing considerably with the incorporation of computer numerical control (CNC) machines, robotics, and additive manufacturing. These developments enable enhanced accuracy, quicker manufacturing, and the formation of intricate shapes. Intelligent tool systems equipped with sensors are also arising, providing real-time information on tool effectiveness and wear, which minimizes downtime and enhances productivity.

To get more information on this market Request Sample

The United States plays a vital role in the market, fueled by the implementation of digitalization tools that improve productivity and operational efficiency. In 2024, Siemens introduced its MACHINUM digitalization software suite in the US during IMTS in Chicago. MACHINUM improved shopfloor efficiency with Smart Machine, Smart Shopfloor, and Smart Virtual Machine elements, facilitating digital transformation in manufacturing settings. It collaborated with Siemens Xcelerator and featured Adaptive Control and Monitoring, which contributed to a decrease in machining time by as much as 15%. In addition to this, the US hosts significant automotive and aerospace producers that need high-precision tooling for efficiently and mass-producing components. The transition to electric vehicles (EVs) and heightened spending on aerospace defense have increased the need for advanced tooling solutions.

Tooling Market Trends:

Technological Advancements

Ongoing technological progress and the incorporation of industry 4.0, marked by the blending of digital technologies into production methods, signify a major factor supporting the market growth. As per Invest India, the NASSCOM report on the adoption of Industry 4.0 in India estimates that by 2025, digital technologies will represent 40% of overall manufacturing spending. Moreover, the Internet of Things (IoT) facilitates real-time gathering and analysis of data, enabling manufacturers to track tooling efficiency, anticipate maintenance requirements, and enhance production workflows. In addition, linked tools enable remote supervision and management, improving overall effectiveness and decreasing downtime. Consistent with this, the extensive use of additive manufacturing for swiftly creating prototypes and producing intricate tooling parts presents a promising market forecast. 3D printing allows tooling firms to produce tailored, complex designs, decreasing lead times and manufacturing expenses. It also aids in creating lightweight but robust tooling solutions. Besides this, robotic systems are being utilized more frequently for activities such as material handling, tool swapping, and quality assessment. This automation simplifies production, improves accuracy, and lessens reliance on manual work.

Growing Demand in Emerging Industries

The rising need for tooling from emerging industries is strengthening the growth of the market. These industries often require specialized and precise tooling solutions to support their unique manufacturing needs. In addition, the increasing reliance of the renewable energy sector, particularly wind and solar power, on specialized tooling for the manufacturing of components like turbine blades and solar panels is creating a positive tooling market outlook. The International Energy Agency predicts that the adoption of renewable energy across the electricity, heating, and transportation sectors will increase by nearly 60% from 2024 to 2030. Apart from this, rising sales of EVs are catalyzing the demand for tooling solutions optimized for the production of EV components, including batteries and electric drivetrains. Moreover, the increasing worldwide security issues and the persistent growth in air travel are fueling the demand for high-precision tools for the production of aircraft parts and defense systems. In accordance with this, the growing use of tools in the healthcare industry for manufacturing surgical instruments, implants, and medical devices is fostering market expansion.

Focus on Sustainability and Eco-Friendly Tooling

Rising focus of tooling manufacturers to adopt eco-friendly practices and materials is influencing the market positively. In addition, the implementation of stringent environmental regulations and emissions targets is encouraging industries to reduce their carbon footprint. As reported by IEA, CO2 emissions from energy combustion increased by approximately 1.3% or 423 Mt in 2022, whereas CO2 emissions from industrial processes decreased by 102 Mt. Tooling companies are developing sustainable manufacturing processes and materials. They are also examining the application of recycled materials and embracing circular economy concepts to decrease waste and lessen the environmental effects of their activities. In addition to this, the increasing transition to lightweight materials, including composites and aluminum, in sectors like automotive and aerospace is lowering fuel usage and creating a demand for innovative tooling solutions tailored for these materials. Moreover, the growing need for solutions that enhance manufacturing efficiency and align with sustainability objectives is positively influencing the market. Additionally, the advancement of sophisticated tool technologies, such as AI and predictive maintenance, assists in decreasing scrap and defects during production, lowering resource waste and energy usage.

Tooling Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global tooling market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, material type, and end use industry.

Analysis by Product Type:

- Dies and Molds

- Forging

- Jigs and Fixtures

- Machines Tools

- Gauges

Dies and molds stand as the largest component in 2025, holding 40.8% of the market due to their essential function in mass production across different sectors, including automotive, electronics, and consumer goods. These instruments are vital for molding and crafting materials into defined components with great accuracy, which is vital for ensuring product quality and uniformity in mass production. The growing need for intricate and tailored products is driving the requirement for advanced die and mold technologies, allowing manufacturers to produce complex designs and attain high accuracy levels. Moreover, the growth of automation and precision engineering has enhanced the use of dies and molds, as they play a crucial role in effective, rapid production methodologies. Additionally, the continued focus on minimizing material waste and enhancing energy efficiency in production is resulting in advancements in dies and molds, guaranteeing improved durability and performance.

Analysis by Material Type:

- Stainless Steel

- Iron

- Aluminum

- Others

Stainless steel holds a significant share in the market due to its excellent strength, durability, and resistance to corrosion. It is widely used in the production of high-performance tooling for industries like automotive, aerospace, and medical devices. The ability of stainless steel to withstand extreme temperatures, pressure, and harsh environments makes it the preferred choice for precision tooling applications. Additionally, its longevity and ability to maintain sharp edges under continuous use add to its popularity.

Iron is a cost-effective and versatile material in the market, often used for manufacturing larger, heavy-duty tools and dies. Its ability to provide structural strength and resist wear and tear makes it suitable for applications in the automotive, construction, and heavy machinery sectors. Iron tooling is favored for its affordability, availability, and ability to handle large-scale manufacturing operations, though it is less resistant to corrosion compared to other materials.

Aluminum is gaining traction in the market because of its lightweight nature, corrosion resistance, and ease of machining. It is commonly used in industries that require tools with high speed, such as in the production of electronic components, medical devices, and consumer goods. Aluminum’s excellent thermal conductivity also makes it ideal for tooling in industries where temperature management is crucial. The lower weight reduces tool wear and tear, improving efficiency and extending tool life.

Others include materials such as copper, brass, and specialized composites that are used for specific applications. These materials are selected for their unique properties, such as conductivity, resistance to heat, and specific mechanical characteristics required by niche industries like electronics, energy, and defense.

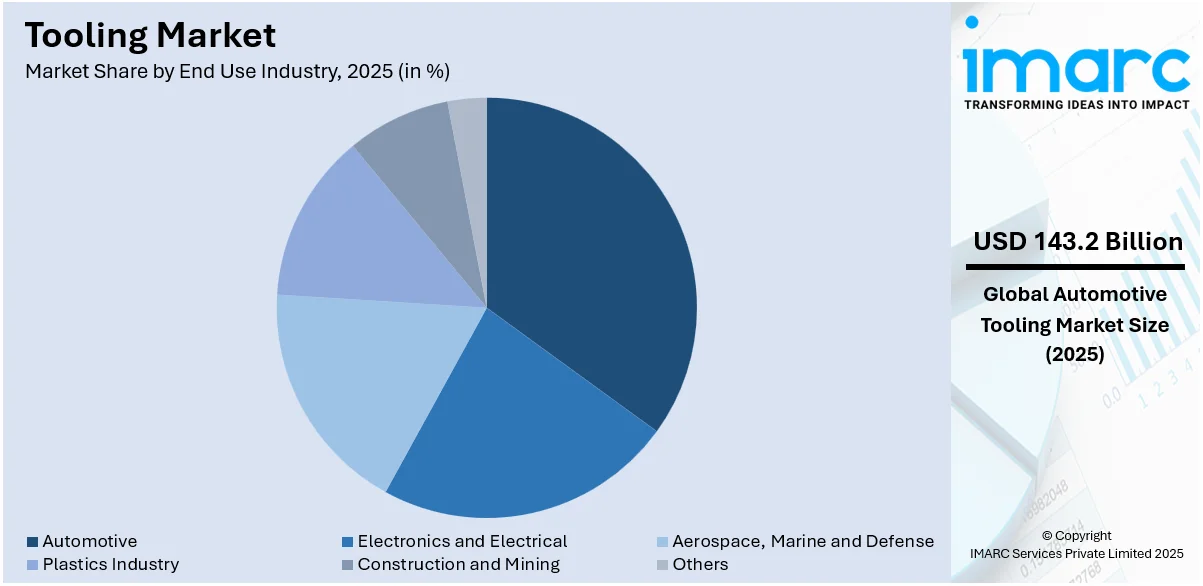

Analysis by End Use Industry:

Access the comprehensive market breakdown Request Sample

- Automotive

- Electronics and Electrical

- Aerospace, Marine and Defense

- Plastics Industry

- Construction and Mining

- Others

Automotive leads the market with 52.5% of market share in 2025because of its ongoing need for precision components and cutting-edge manufacturing technologies. Automotive producers need tooling solutions for creating intricate components, such as engine parts, body structures, and interior features, which must adhere to rigorous performance and safety requirements. The transition to EVs and hybrid models increases the demand for innovative tooling, as these advanced technologies necessitate new components and manufacturing methods. Furthermore, the automotive industry is embracing automation and robotic technologies, leading to a greater need for specialized tools for effective, high-volume manufacturing. As car designs progress to include lighter materials and more complex elements, tooling solutions need to advance accordingly. The continuous emphasis on boosting productivity, lowering expenses, and improving product quality further supports the automotive industry's leading position in the segment.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Europe held the largest market share of over 40.00% owing to its robust manufacturing infrastructure, technological proficiency, and significant influence in high-precision sectors like automotive, aerospace, and medical equipment. The region enjoys a talented labor pool, very efficient manufacturing methods, and ongoing advancements in high-tech machining technologies. Additionally, firms in Europe prioritize sustainability and environmental accountability, incorporating eco-conscious methods into tooling manufacturing, which corresponds with progressively tougher regulations. The region's dedication to R&D guarantees the creation of innovative solutions, such as smart tools and automation, that improve efficiency and minimize waste. In 2024, GTMA launched the UK Tooling Alliance (UKTA) at the PDM exhibition to provide a unified, turnkey procurement solution from multiple UK toolmakers. The initiative aimed to support local manufacturing, reduce product cycle times, and enhance early supplier involvement. UKTA combined the expertise of over 100 toolmakers with a joint turnover of over £20 million.

Key Regional Takeaways:

United States Tooling Market Analysis

In North America, the market portion held by the United States was 83.90% due to manufacturing advancements, rising demand from aerospace, automotive, and electronics sectors, and automation adoption. The integration of CNC machines and additive manufacturing technologies is improving efficiency and precision. Sustainability and energy efficiency are influencing material selection and production techniques. R&D investments are fostering high-performance tooling solutions. The expanding construction sector and infrastructure projects are also contributing to market demand. Digitalization in manufacturing is enhancing productivity and reducing operational costs. The shift toward EVs is evolving tooling requirements in automotive manufacturing. Additionally, government initiatives aimed at boosting domestic semiconductor production are expected to drive further growth in tooling demand. As stated by the U.S. Department of Commerce, the Biden-Harris Administration revealed that the department has granted Samsung Electronics up to USD 4.745 Billion in direct funding through the CHIPS Incentives Program’s Funding Opportunity for Commercial Fabrication facilities. Such investments in semiconductor manufacturing are expected to strengthen the demand for precision tooling solutions required in chip fabrication and related industries. The use of lightweight and durable materials is gaining traction, enabling improved performance and longevity in tooling applications.

Europe Tooling Market Analysis

The Europe tooling market is experiencing significant growth due to industrial automation, technological advancements, and increasing demand from key manufacturing sectors like automotive, aerospace, and electronics. Precision engineering, advanced materials, and sustainability initiatives are enhancing tooling efficiency and durability. Industry 4.0 is driving innovation through digitalization and smart manufacturing solutions. The increasing demand for lightweight, high-strength tools is promoting sustainable materials and benefiting the renewable energy sector, as specialized tooling is required for green energy projects. Investments in research and development continue to drive advancements in tooling technologies, ensuring enhanced precision and efficiency. In line with this, the European Commission declares that the EU is set to allocate €180 Million for innovative digital technologies, following the most recent announcement in a series of Horizon Europe Programme calls that enhance collaborative R&D throughout the Union. Such initiatives are expected to accelerate innovation in the tooling sector, strengthening Europe’s position as a leader in advanced manufacturing.

Asia Pacific Tooling Market Analysis

The Asia Pacific tooling market is expanding due to the region's growing manufacturing sector, industrialization, and advanced technologies. High-precision tooling solutions are needed in industries like automotive, aerospace, and consumer electronics. Automation, CNC machining, and additive manufacturing are improving efficiency and reducing costs. The shift toward EVs and renewable energy solutions creates new opportunities for specialized tooling applications. Additionally, the region's strong focus on infrastructure development is contributing to increased demand for construction-related tooling solutions. According to the National Bureau of Statistics of China, investment in infrastructure (not including the generation and distribution of electricity, thermal energy, gas, and water) rose by 4.4 percent compared to the previous year, further driving the need for advanced tooling solutions in construction and manufacturing. Tooling providers are investing in high-performance materials and energy-efficient manufacturing to improve durability and precision. Digital transformation streamlines operations, leading to better resource management and productivity. Skilled labor, cost-effective production, and foreign investments boost tooling market growth.

Latin America Tooling Market Analysis

The Latin America tooling market is growing due to industrialization, manufacturing activities, and infrastructure projects. Key industries like automotive, aerospace, and electronics demand precision tooling. Advanced automation technologies and sustainable manufacturing practices are improving productivity. The construction sector is also contributing to the market, with specialized tools needed for infrastructure projects. Furthermore, growing foreign investments in the manufacturing sector are fostering the adoption of high-quality tooling solutions. Government-led initiatives are also playing a role in market expansion. According to reports, the Mexican government has introduced the National Strategy for the Electricity Sector 2024-2030, allocating USB 23 Billion for investment in the state-owned Federal Electricity Commission (CFE). This initiative is expected to drive infrastructure development and energy sector advancements, further boosting demand for precision tooling solutions.

Middle East and Africa Tooling Market Analysis

The Middle East and Africa market is expanding due to industrialization, infrastructure development, and rising demand from key manufacturing sectors, bolstered by automation and advanced manufacturing technologies. The construction and energy sectors are significant contributors to market demand, driving the need for high-quality and durable tooling solutions. According to the Saudi British Joint Business Council, there is a pipeline of USD 1.8 Trillion in infrastructure initiatives is either planned or in progress, with the municipal infrastructure budget set at USD 17.3 Billion for 2024 and expected to rise to USD 21.3 Billion by 2025. This surge in infrastructure investment is expected to fuel the demand for advanced tooling solutions across various industries. Digitalization and smart manufacturing are improving operational efficiency, reducing downtime, and optimizing production processes through high-performance materials, energy-efficient solutions, foreign investments, and 3D printing. The tooling market forecast indicates sustained growth driven by infrastructure expansion, smart manufacturing technologies, and increasing industrial automation across the region.

Competitive Landscape:

Major participants in the market are progressively putting money into cutting-edge technologies such as automation, AI, and 3D printing to enhance efficiency and accuracy in manufacturing procedures. They are concentrating on providing tailored solutions to address the varying demands of sectors like automotive, aerospace, and electronics. Businesses are also broadening their product ranges to incorporate more sustainable and energy-efficient tooling alternatives, reflecting increasing environmental worries. Strategic alliances, mergers, and acquisitions are being sought to improve capabilities and increase market presence. Moreover, these companies are emphasizing R&D to foster innovation and maintain competitiveness in a swiftly changing market. The increasing emphasis on technological advancements and knowledge-sharing initiatives by industry leaders is further bolstering the market growth. In 2024, TaeguTec India and Machine Maker launched the "PRECISION UNLOCKED" Cutting Tool Knowledge Series. The seven-episode series aimed to educate manufacturers on optimizing cutting tools to enhance machining productivity.

The report provides a comprehensive analysis of the competitive landscape in the tooling market with detailed profiles of all major companies, including:

- Agathon AG

- Bharat Forge Limited

- Carlson Tool & Manufacturing Corp.

- DN Solutions

- Godrej Enterprises

- Motherson Techno Tools Ltd.

- Omega Tool Corp.

- Parpas S.p.A

- Sandvik Coromant

- Siemens AG

- Stratasys, Ltd.

- Unique Tool & Gauge Inc.

- Yamazaki Mazak Corporation

Latest News and Developments:

- March 2025: Hyundai Motor India Limited (HMIL) approved a ₹694 crore investment to establish a new Tooling Centre, following its recent board meeting. The upcoming facility will focus on manufacturing stamping tools and vehicle panels, aimed at strengthening Hyundai’s local production capabilities and supply chain stability. Tooling involves specialized equipment used to produce automotive parts with high precision and consistency, supporting efficient mass production.

- January 2025: At IMTEX 2025, Siemens announced the launch of MACHINUM, a groundbreaking digitalization portfolio aimed at accelerating the speed, agility, and endurance of the Indian machine tool industry. MACHINUM is designed to support the growing demand for high-precision and technologically integrated manufacturing. According to Siemens, the platform can reduce setup time by up to 20% and cut both cycle times and energy usage by up to 18%.

- March 2025: Automotive components manufacturer Samvardhana Motherson International Limited announced a ₹200 crore investment in its aerospace subsidiary, CIM Tools Private Limited, marking a strategic expansion into the aviation manufacturing sector.

- September 2024: REGO-FIX partnered with Omega TMM in September 2024 to develop ORION powered by REGO-FIX, a tool measuring machine combining REGO-FIX’s powRgrip® tool holding system with Omega TMM’s presetting technology. The collaboration aimed to enhance precision, reliability, and ease of use for industries like aerospace, automotive, and medical devices.

Tooling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Coverage | Dies and Molds, Forging, Jigs and Fixtures, Machines Tools, Gauges |

| Material Types Coverage | Stainless Steel, Iron, Aluminum, Others |

| End Use Industries Coverage | Automotive, Electronics and Electrical, Aerospace, Marine and Defense, Plastics Industry, Construction and Mining, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agathon AG, Bharat Forge Limited, Carlson Tool & Manufacturing Corp., DN Solutions, Godrej Enterprises, Motherson Techno Tools Ltd., Omega Tool Corp., Parpas S.p.A, Sandvik Coromant, Siemens AG, Stratasys, Ltd., Unique Tool & Gauge Inc., Yamazaki Mazak Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the tooling market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global tooling market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the tooling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tooling market was valued at USD 290.6 Billion in 2025.

The tooling market is projected to exhibit a CAGR of 6.20% during 2026-2034, reaching a value of USD 501.4 Billion by 2034.

The tooling market is driven by rising industrial automation, increased demand for precision manufacturing, and advancements in CNC and 3D printing technologies. Growth in automotive, aerospace, and electronics sectors further fuels the demand. Additionally, rapid urbanization, evolving user needs, and a focus on cost-efficiency and productivity enhancement are pivotal in propelling the industry growth.

Europe currently dominates the tooling market, accounting for a share of 40.00%. The market dominance of the region is growing owing to its strong manufacturing base, advanced technology adoption, and presence of leading automotive and aerospace industries. Government support for innovation, skilled workforce, and investments in precision engineering further enhance the region’s competitive edge in the market.

Some of the major players in the tooling market include Agathon AG, Bharat Forge Limited, Carlson Tool & Manufacturing Corp., DN Solutions, Godrej Enterprises, Motherson Techno Tools Ltd., Omega Tool Corp., Parpas S.p.A, Sandvik Coromant, Siemens AG, Stratasys, Ltd., Unique Tool & Gauge Inc., Yamazaki Mazak Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)