Torque Vectoring Market Report by Technology (Active Torque Vectoring System (ATVS), Passive Torque Vectoring System (PTVS)), Clutch Actuation Type (Hydraulic Clutch, Electronic Clutch), Vehicle Type (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles), Propulsion (Front Wheel Drive (FWD), Rear Wheel Drive (RWD), All Wheel Drive/Four Wheel Drive (AWD/4WD)), and Region 2025-2033

Market Overview:

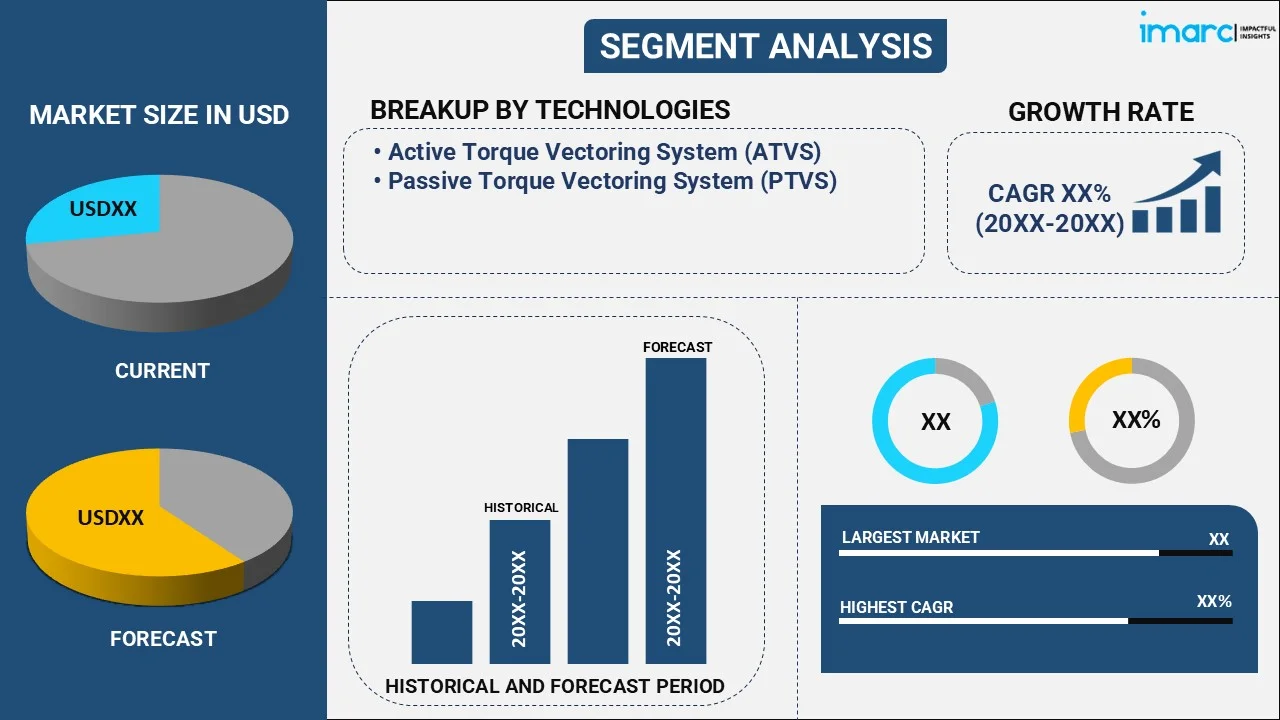

The global torque vectoring market size reached USD 11.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 34.6 Billion by 2033, exhibiting a growth rate (CAGR) of 13.11% during 2025-2033. The growing demand for improved vehicle handling, increasing focus on fuel efficiency, and rising demand for electric and hybrid vehicles, represent some of the key factors driving the market. At present, North America dominates the market because of advancements in automotive technology.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.4 Billion |

| Market Forecast in 2033 | USD 34.6 Billion |

| Market Growth Rate (2025-2033) | 13.11% |

Torque Vectoring Market Analysis:

- Major Market Drivers: The rising demand for improved vehicle stability, especially in high-performance cars, is propelling the torque vectoring market growth.

- Key Market Trends: The growing reliance on electric and hybrid vehicles worldwide is positively influencing the market.

- Geographical Trends: North America enjoys the leading position in the market because of the increasing demand for improved vehicle performance.

- Competitive Landscape: Some of the major market players in the industry include American Axle & Manufacturing Inc., Borgwarner Inc., Eaton Corporation Plc, GKN Ltd. (Melrose Industries PLC), and Magna International Inc., among many others.

- Challenges and Opportunities: Challenges in the market include high system costs and complex integration, while opportunities arise from the increasing demand for enhanced vehicle stability and performance.

Torque vectoring refers to a technology used in automobiles to improve their handling and stability. It is a system that can vary the power distribution between the wheels of a vehicle to optimize its performance. It works by using a combination of sensors, algorithms, and differentials to monitor the speed, acceleration, steering angle and other parameters of vehicles, and adjust the torque delivery to individual wheels accordingly. The system can apply more power to the outer wheels during cornering, thereby reducing understeer, and improving traction, stability and handling. It can also transfer power from a spinning wheel to one with a better grip, enhancing the vehicle's control and preventing skidding. Torque vectoring is commonly used in high-performance cars, such as sports cars and racing vehicles; however, it is also gaining traction in mainstream vehicles, including SUVs and crossovers.

Torque Vectoring Market Trends:

One of the primary factors driving the market is the growing demand for improved vehicle handling and stability, especially in high-performance cars. Additionally, the increasing focus on fuel efficiency and emission reduction is creating a positive torque vectoring market outlook. Torque vectoring systems reduce the energy wasted during cornering and provide better traction on slippery surfaces, improving fuel economy and reducing emissions. Other than this, this technology can extend the life of tires, reducing waste and the environmental impact of tire disposal, thereby positively influencing the market growth. Besides this, with the growing demand for electric and hybrid vehicles, which require advanced technologies to manage the electric motor torque, torque vectoring systems are used to optimize the power delivery to the wheels, thus improving performance and efficiency. In line with this, the increasing popularity of advanced driver assistance systems (ADAS) is accelerating the product adoption rate as torque vectoring systems can be integrated with ADAS to provide better stability control and improve safety features such as lane departure warning, adaptive cruise control, and emergency braking. It can also enable semi-autonomous driving features, thus enhancing the driving experience and safety.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global torque vectoring market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on technology, actuation type, vehicle type, and propulsion.

Technology Insights:

- Active Torque Vectoring System (ATVS)

- Passive Torque Vectoring System (PTVS)

Passive torque vectoring system (PTVS) represents the leading market segment

The report has provided a detailed breakup and analysis of the torque vectoring market based on technology. This includes active torque vectoring system and passive torque vectoring system. According to the report, passive torque vectoring system (PTVS) represented the largest segment.

Passive torque vectoring system (PTVS) is the largest segment in the market because of its affordability and suitability for mass-market vehicles. Unlike its active counterpart, PTVS functions using simpler mechanical components rather than relying on advanced electronics or software to actively control torque distribution. This results in lower production costs and easier integration into a wide range of vehicles, making it an attractive option for manufacturers focused on cost-efficiency. PTVS is particularly favored in conventional internal combustion engine (ICE) vehicles, where the demand for complex electronic systems is lower, and basic mechanical solutions are sufficient to enhance vehicle stability and cornering performance.

Clutch Actuation Type Insights:

- Hydraulic Clutch

- Electronic Clutch

Hydraulic clutch exhibits a clear dominance in the market

A detailed breakup and analysis of the torque vectoring market based on the clutch actuation type has also been provided in the report. This includes hydraulic clutch and electronic clutch. According to the report, hydraulic clutch accounted for the largest torque vectoring market share.

Hydraulic clutch leads the market, driven by its widespread use in traditional ICE vehicles, where hydraulic systems are favored for their reliability and efficiency. Hydraulic clutch provides precise control over torque distribution, enabling smoother power delivery and improved vehicle stability, especially during cornering and acceleration. The established infrastructure and familiarity with hydraulic systems among automotive manufacturers further contribute to its strong market position. Additionally, the relatively lower costs and high durability of hydraulic systems make them more appealing for mass-market and performance vehicles alike, ensuring the dominance of the segment in the market.

Vehicle Type Insights:

- Passenger Car

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Passenger car dominates the market

The report has provided a detailed breakup and analysis of the torque vectoring market based on the vehicle type. This includes passenger car, light commercial vehicles, and heavy commercial vehicles. According to the report, passenger car represented the largest segment.

Passenger car holds the biggest market share owing to the growing user demand for enhanced safety, improved handling, and overall vehicle performance in everyday driving conditions. As passenger cars make up the majority of vehicle sales, manufacturers are integrating advanced torque vectoring systems to differentiate their offerings and meet the rising expectations for driving dynamics and stability. Additionally, the shift toward electric and hybrid vehicles, which are predominantly passenger cars, is encouraging the adoption of torque vectoring technology to enhance power distribution and efficiency. The emphasis on passenger comfort and performance is a crucial factor in strengthening the market growth.

Propulsion Insights:

- Front Wheel Drive (FWD)

- Rear Wheel Drive (RWD)

- All Wheel Drive/Four Wheel Drive (AWD/4WD)

All wheel drive/four wheel drive (AWD/4WD) holds the biggest share

A detailed breakup and analysis of the torque vectoring market based on the propulsion has also been provided in the report. This includes front wheel drive (FWD), rear wheel drive (RWD), and all wheel drive/four wheel drive (AWD/4WD). According to the report, all wheel drive/four-wheel drive (AWD/4WD) accounted for the largest market share.

All wheel drive/four wheel drive (AWD/4WD) dominates the market due to the superior traction, stability, and performance that they offer across a variety of terrains and driving conditions. This makes them highly sought after in both premium passenger vehicles and off-road capable models. The growing user preference for sports utility vehicles (SUVs) and crossovers, which predominantly feature AWD/4WD systems, is driving the demand for torque vectoring technology in this segment. Torque vectoring enhances the capability of AWD/4WD vehicles by precisely distributing power to individual wheels, ensuring better control and handling, particularly in challenging weather conditions or during high-performance driving.

Regional Insights:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest torque vectoring market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market for torque vectoring.

North America dominates the market, driven by a strong demand for advanced vehicle technologies focused on safety, performance, and innovation. The region benefits from a robust automotive industry, with leading manufacturers and technology providers continuously developing and integrating torque vectoring systems. High purchasing power and a preference for premium vehicles further support the adoption of these systems in the market. Additionally, investments in the development of electric and autonomous vehicles, which often rely on advanced power distribution technologies, are supporting the market growth. In 2024, BorgWarner launched its first electric Torque Vectoring and Disconnect (eTVD) system for BEVs, debuting in the Polestar 3 SUV. This innovative system integrates torque vectoring with an on-demand disconnect function, eliminating the need for a conventional differential.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global torque vectoring market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include:

- American Axle & Manufacturing Inc.

- Borgwarner Inc.

- Eaton Corporation Plc

- GKN Ltd. (Melrose Industries PLC)

- Magna International Inc.

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Torque Vectoring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Active Torque Vectoring System (ATVS), Passive Torque Vectoring System (PTVS) |

| Clutch Actuation Types Covered | Hydraulic Clutch, Electronic Clutch |

| Vehicle Types Covered | Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Propulsions Covered | Front Wheel Drive (FWD), Rear Wheel Drive (RWD), All Wheel Drive/Four Wheel Drive (AWD/4WD) |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Axle & Manufacturing Inc., Borgwarner Inc., Eaton Corporation Plc, GKN Ltd. (Melrose Industries PLC), Magna International Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global torque vectoring market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global torque vectoring market?

- What is the impact of each driver, restraint, and opportunity on the global torque vectoring market?

- What are the key regional markets?

- Which countries represent the most attractive torque vectoring market?

- What is the breakup of the market based on technology?

- Which is the most attractive technology in the torque vectoring market?

- What is the breakup of the market based on the clutch actuation type?

- Which is the most attractive clutch actuation type in the torque vectoring market?

- What is the breakup of the market based on the vehicle type?

- Which is the most attractive vehicle type in the torque vectoring market?

- What is the most attractive propulsion in the torque vectoring market?

- What is the breakup of the market based on the propulsion?

- What is the competitive structure of the global torque vectoring market?

- Who are the key players/companies in the global torque vectoring market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the torque vectoring market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global torque vectoring market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the torque vectoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)