Transaction Monitoring Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Application, End Use Industry, and Region, 2025-2033

Transaction Monitoring Software Market Size and Share:

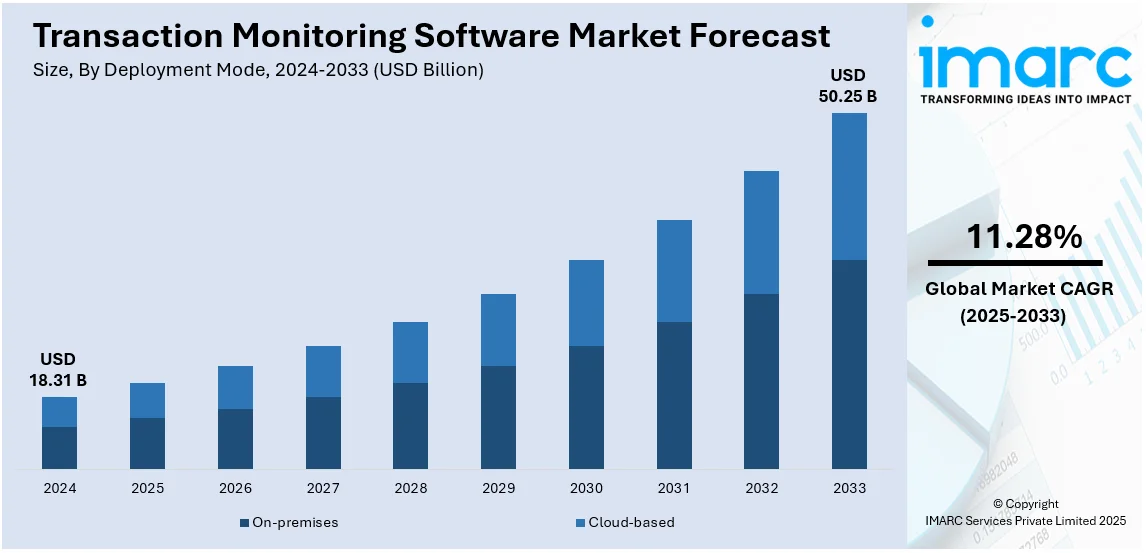

The global transaction monitoring software market size was valued at USD 18.31 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 50.25 Billion by 2033, exhibiting a CAGR of 11.28% from 2025-2033. North America currently dominates the market, holding a significant market share of 32.8% in 2024. The market growth in the region is driven by the globalization of commerce and finance, the rising online banking services, the growth of fintech companies, the escalating adoption of cryptocurrencies, the emphasis on customer experience, and the advances in data analytics and artificial intelligence (AI).

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 18.31 Billion |

|

Market Forecast in 2033

|

USD 50.25 Billion |

| Market Growth Rate (2025-2033) | 11.28% |

The global transaction monitoring software market is expanding due to the rise in digital payments spurring the need for effective monitoring solutions to detect and prevent financial crimes. Financial institutions are adopting advanced analytics and artificial intelligence to identify high-risk activities and comply with stringent regulatory requirements. The growing use of online banking services and the expansion of fintech companies have further driven the demand for robust transaction monitoring systems. Additionally, the integration of these solutions with other cybersecurity tools enhances their effectiveness, contributing to market growth.

To get more information on this market, Request Sample

The U.S. transaction monitoring software market is expanding due to the rise in digital payments, which has increased the need for effective monitoring solutions to detect and prevent financial crimes. Moreover, financial institutions are adopting advanced analytics and artificial intelligence to identify high-risk activities and comply with stringent regulatory requirements. In confluence with this, the growing use of online banking services and the expansion of fintech companies have further driven the demand for robust transaction monitoring systems, creating a positive outlook for market expansion. Furthermore, the surging integration of these solutions with other cybersecurity tools enhances their effectiveness, thereby contributing to market growth.

Transaction Monitoring Software Market Trends:

The rise in digital payments

The exponential rise in digital payments is bolstering market growth. With the expansion of online and mobile payment platforms, consumers and businesses conduct more financial transactions electronically. In India, for instance, the UPI processed 16.58 billion transactions in October 2024, with a 45% increase from October 2023 and a transaction value of INR 23.49 Lakh Crores (USD 270 Billion), as per an industry report. This rise in digital payment methods has escalated the risk of financial crimes, including money laundering, fraud, and cyberattacks. This software has become an indispensable tool in this landscape, offering real-time and historical analysis of digital transactions to detect and prevent illicit activities. It allows financial institutions and businesses to scrutinize payment data, identify unusual patterns, and generate alerts when potentially fraudulent transactions occur. This proactive approach is critical for maintaining the security and integrity of digital payment ecosystems. Furthermore, regulatory authorities worldwide are mandating stringent compliance standards, requiring financial institutions to implement robust monitoring solutions to ensure adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations. As digital payment methods continue to gain prominence, this software stands as a crucial defense against financial crimes, fostering its widespread adoption and driving the growth of this dynamic market.

Increasing instances of money laundering

The growing cases of money laundering are fueling the market. Money laundering is a sophisticated financial crime that involves the process of obscuring the source of illegally acquired funds by passing them through legitimate financial channels. According to the Federal Trade Commission, in 2023, U.S. losses from fraud exceeded USD 10 billion. As the global financial system becomes more and more integrated, criminals have discovered new ways to launder money, and thus, a strong response is required. This software has emerged as a frontline defense against money laundering activities. It uses advanced data analytics, artificial intelligence, and machine learning algorithms to scrutinize vast volumes of financial transactions in real time. This enables it to detect unusual patterns and behaviors indicative of potential money laundering attempts. When such irregularities are identified, the software generates alerts, allowing financial institutions and authorities to promptly investigate and take necessary action. Moreover, regulatory bodies around the world are tightening anti-money laundering (AML) regulations, which require transaction monitoring software for compliance. Therefore, financial institutions are forced to invest in these solutions to meet regulatory requirements, thereby boosting market demand.

Growing need for managing counter-terrorist financing (CTF) activities

The growing need for managing counter-terrorist financing (CTF) activities is propelling the market growth. In an era marked by heightened security concerns and the global fight against terrorism, authorities, and financial institutions are under increasing pressure to prevent the flow of funds to terrorist organizations and individuals involved in illicit activities. According to the FATF, the financial institutions in more than 40% of countries are being directly regulated toward combating terrorist financing. This tool is very integral to the activities of CTF as it properly scrutinizes a financial transaction while identifying patterns typical of suspicious and illegal funding practices. It enables the real-time monitoring of vast volumes of transactions across the financial ecosystem, allowing for the rapid detection and reporting of potentially illicit transfers. Regulatory bodies worldwide impose stringent requirements for detecting and reporting suspicious transactions linked to terrorist financing. Financial institutions, therefore, rely on advanced transaction monitoring solutions to ensure compliance with these regulations. The software's ability to enhance the identification and prevention of CTF activities is instrumental in maintaining global financial security. As the global community remains committed to combating terrorism and its financial support networks, the demand for this software continues to grow, making it an essential tool in the ongoing battle against terrorist financing and a driving force behind the market's sustained expansion.

Transaction Monitoring Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global transaction monitoring software market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment mode, enterprise size, application, and end-use industry.

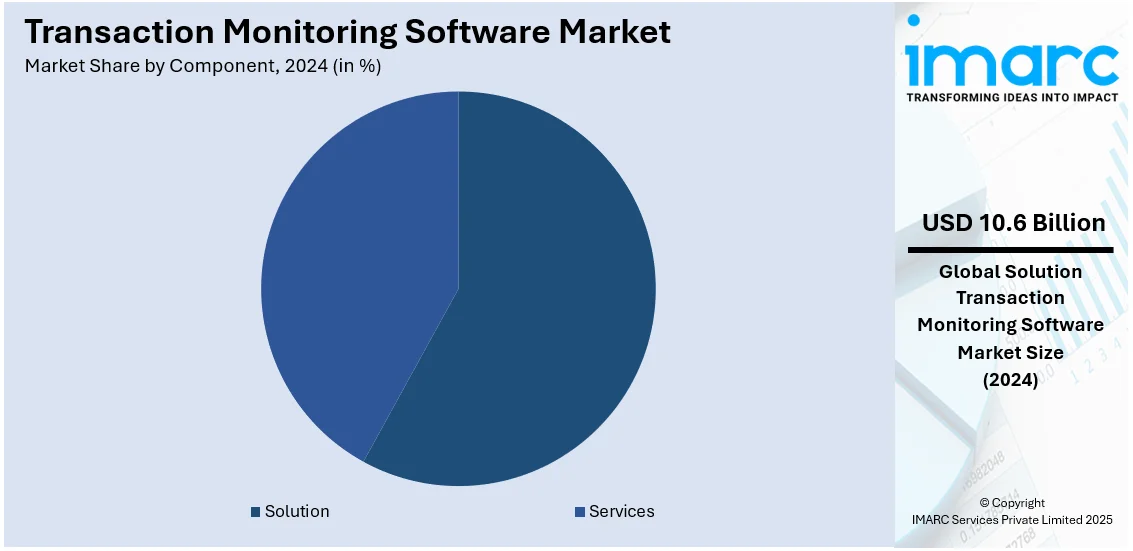

Analysis by Component:

- Solution

- Services

Solution stands as the largest component in 2024, accounting for a market share of 58%. As financial transactions become increasingly complex and digital, the need for comprehensive and agile solutions to detect and prevent financial crimes such as money laundering, fraud, and terrorist financing has increased. Transaction monitoring software solutions stand at the forefront of this battle against illicit activities, offering real-time monitoring, anomaly detection, and predictive analytics capabilities.

The stringent regulatory bodies that govern and advise financial institutions, be they banks or fintech companies, further demand and make it necessary to have proper transaction monitoring systems. In addition, the changing nature of payment and the global nature of financial transactions further suggest a dynamic environment that only adaptable and scalable software solutions can cope with.

In a time when data volumes are going up, such solutions use sophisticated technologies like artificial intelligence and machine learning to search for suspicious patterns in massive data and threats in real time. It thereby increases security while reducing false positives, thereby simplifying compliance and operational efficiency.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises leads the market in 2024. In this day and age, where data security and regulatory compliance are the most important factors, many organizations, especially those operating in highly regulated industries such as finance and healthcare, prefer on-premises solutions for maintaining control over sensitive data. On-premises deployment gives organizations a dedicated and customized software environment tailored to meet specific security and compliance requirements. This level of control and customization is essential to ensure that transaction monitoring will align seamlessly with an organization's existing infrastructure and security protocols.

Moreover, on-premises solutions ensure greater data privacy because sensitive information is within the physical boundaries of the organization and is thus not exposed to any data breach risk. This is particularly relevant as cyber threats grow more recurrent and sophisticated. As organizations deal with the complexity of compliance regulation and the added imperative to protect sensitive financial and customer data, on-premises deployment continues to be the mode of choice. This fuels the adoption and expansion of the software developed specifically to meet these security and compliance requirements. Large enterprises often have stricter regulatory requirements, and hence the need for sophisticated software that can keep up with the changing standards of compliance.

Analysis by Enterprise Size:

- Small and Medium-sized Enterprises

- Large Enterprises

In 2024, large enterprises held the largest market share of 65%. Large enterprises, with their vast operations and high transaction volumes, have unique challenges in compliance, fraud detection, and risk management. Therefore, they increasingly turn to transaction monitoring software to address these challenges comprehensively. They benefit from the scalability and robust capabilities offered by transaction monitoring solutions, which can handle the substantial transaction data generated daily. Such solutions enable large organizations to monitor and analyze transactions in real-time, thereby quickly detecting anomalies, suspicious activities, and potential fraud.

Transaction monitoring software helps in automating compliance checks, reducing manual efforts, and ensuring adherence to complex regulations. Large enterprises must stay agile and secure in the ever-evolving landscape of financial technology and global transactions. The software provides them with the means to maintain operational efficiency, protect their assets, and remain compliant with regulatory frameworks, making large enterprises a vital driver in the continued market expansion.

Analysis by Application:

- Anti-Money Laundering

- Customer Identity Management

- Fraud Detection and Prevention

- Compliance Management

The fraud detection and prevention segment is the largest market. In today’s world that is increasingly connected and digitalized, financial fraud has emerged as the most significant threat to companies of all sectors. Transaction monitoring software stays at the heart of protecting any business from fraudulent transactions, as it provides real-time monitoring, pattern recognition, and anomaly detection capabilities. Large financial institutions, e-commerce platforms, and even smaller businesses rely on these software solutions to detect and prevent fraud, including payment fraud, identity theft, and account takeovers. Transaction monitoring software must evolve to include the latest technologies such as artificial intelligence and machine learning in order to keep pace with the increasing sophistication of fraudulent schemes.

In addition, regulatory bodies and industry standards necessitate strong fraud detection and prevention controls, making such applications indispensable for compliance. Financial losses, reputational damage, and legal repercussions from fraud point to the vital role of transaction monitoring software in safeguarding businesses and their customers.

Analysis by End Use Industry:

- BFSI

- Government and Defense

- IT and Telecom

- Retail

- Healthcare

- Energy and Utilities

- Manufacturing

- Others

The Banking, Financial Services, and Insurance (BFSI) sector significantly propelled the market growth. This industry is highly regulated and prone to financial crimes, making comprehensive transaction monitoring essential. Transaction monitoring software is deployed extensively in BFSI to detect and prevent fraudulent activities, money laundering, and compliance violations. Large financial institutions, banks, insurance companies, and fintech firms rely on these solutions to analyze vast volumes of financial transactions in real-time. They use advanced algorithms and artificial intelligence to identify unusual patterns, flagging potentially fraudulent transactions for further investigation.

Moreover, regulatory bodies worldwide continually evolve compliance standards, placing a growing burden on BFSI organizations to ensure adherence. Transaction monitoring software helps automate compliance checks, reducing the risk of regulatory penalties and reputational damage. As the BFSI sector embraces digital transformation and online transactions, the importance of robust transaction monitoring becomes even more pronounced. Consequently, the BFSI industry remains a pivotal driver in the continuous expansion of the market, ensuring the security and compliance of financial transactions.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America had the majority of the market share of 32.8%. This region, particularly in the United States, has a highly regulated financial sector. Regulatory bodies like the Financial Crimes Enforcement Network (FinCEN) impose strict anti-money laundering (AML) and know-your-customer (KYC) regulations. This necessitates the adoption of transaction monitoring software to ensure compliance, detect suspicious activities, and prevent financial crimes. The region has a vast and complex financial industry, including major banks, investment firms, and fintech startups. These organizations handle enormous transaction volumes daily, making robust transaction monitoring necessary to manage risk and protect against fraud.

Furthermore, the region is at the forefront of technological innovation, which extends to adopting advanced transaction monitoring solutions. The region often leads in developing and implementing cutting-edge technologies like artificial intelligence and machine learning for fraud detection and prevention. As cyber threats become more sophisticated, organizations in North America recognize the importance of proactive cybersecurity measures. Transaction monitoring software helps identify and respond to cybersecurity threats in real-time, safeguarding financial data. Additionally, North American financial institutions operate globally, necessitating cross-border transaction monitoring. This global reach further boosts the demand for the software.

Key Regional Takeaways:

United States Transaction Monitoring Software Market Analysis

Strict regulations and increasing financial crime risks are the primary factors supporting the U.S. transaction monitoring software market. As per the Federal Trade Commission, in 2023, U.S. losses from fraud surpassed USD 10 billion, thus increasing demand for such strong monitoring systems. Financial institutions are allocating significant budgets to comply with Anti-Money Laundering and Know Your Customer requirements. According to an industry report, over 4.6 million Suspicious Activity Reports (SARs) were filed in the U.S. in 2023, and advanced software solutions are needed. Market leaders such as Oracle and FICO provide AI-driven tools to enhance fraud detection and compliance. The rapid adoption of digital banking and real-time payments further fuels demand for monitoring systems. Federal regulations and investments in fintech innovation ensure a competitive landscape, while U.S. firms increasingly look toward global markets to take advantage of export opportunities.

Europe Transaction Monitoring Software Market Analysis

Europe's transaction monitoring software market is boosted by the increasing regulatory compliance and growing efforts in the detection of financial crime. According to industry reports, more than 2,000 SARs were filed in Germany in 2023; over 1,000 in France; and over 500 in Sweden, representing a strong financial crime detection framework. Advanced monitoring solutions are emphasized at the European Central Bank because fraud prevention remains a prime priority. SAS and NICE Actimize continue their innovation with AI-based capabilities to enhance compliance. Countries, such as Germany and France, are investing significantly in their digital transformation agendas, therefore increasing the demand for real-time monitoring of transactions. The ongoing R&D efforts with funds from the EU create robust solutions that are advanced technology-wise, so that transaction monitoring in Europe stays cutting-edge. These efforts place Europe as a crucial actor in the determination of international compliance standards.

Asia Pacific Transaction Monitoring Software Market Analysis

The Asia Pacific transaction monitoring software market is growing with high speed as financial fraud is increasingly committed and regulation is strict. According to an industrial report, in India, 18,461 cases have been reported in the first half of the fiscal year, whereas this year's number is recorded at 28% against last year. The amount involved has surged eightfold to Rs 21,367 crore (USD 256.4 million), out of which 85.3% of cases and 44.7% of the amount were linked to internet and card frauds. Private sector banks had a share of 67.1% of cases, while public sector banks had the highest amount involved. Penalties on banks doubled to INR 86.1 crore (USD 10.07 Million) from last year, underlining the necessity for strong monitoring tools. The trend is also gaining in countries like Japan and Australia, mainly due to mandates from regulators and the growth of digital payments. Market players like BAE Systems and Temenos are integrating AI and blockchain technologies to enhance monitoring capabilities. Government-backed initiatives like India's Digital Payments Index encourage financial inclusivity while necessitating robust compliance measures. The region's focus on smart technologies and fintech collaboration positions it as a key contributor to the global transaction monitoring market.

Latin America Transaction Monitoring Software Market Analysis

Financial fraud and growing digital vulnerabilities boost Latin America's transaction monitoring software market. According to industrial reports, in Brazil, scams accounted for an estimated financial loss of USD 66.35 billion in 2023, equivalent to 3.2% of the GDP, according to a report by GASA and Feedzai. About 67.9 million Brazilians became victims of fraud, with an average loss of USD 976. Phone calls and SMS were the most common vectors, while WhatsApp and Gmail were among the most exploited platforms. Although losses were high, only 40% of the victims reported the incident to the authorities, and only 9% recovered their financial losses. Shopping scams, identity theft, and investment scams lead the threat landscape, and trust in digital commerce is being undermined. The urgent need for advanced transaction monitoring solutions in the region, along with growing awareness, positions it as a key area for technological adoption to counter fraud effectively.

Middle East and Africa Transaction Monitoring Software Market Analysis

The market for Middle East and Africa transaction monitoring software is expanding at a rapid pace with growing cybercrime and financial fraud. According to an industrial report, in South Africa, the financial crimes in 2023 had resulted in a loss of nearly ZAR 3.3 billion (USD 176 million), which were dominated by digital fraud and card fraud. The threat was mainly through banking app fraud, which formed 60% of digital banking crimes. In the Middle East, the average cost of a cybercrime incident exceeded USD 8 million in 2023, with Saudi Arabia and the UAE being the second worldwide in terms of financial damage. Such trends have indicated that the demand for more advanced transaction monitoring solutions is increasing. AI-driven tools are increasingly adopted by governments and financial institutions to fight fraud, and regional collaboration aims to upgrade the cybersecurity framework. This proactive approach places the region as a prime market for innovative solutions in fraud detection and prevention.

Competitive Landscape:

Top companies are strengthening the market through their commitment to innovation, reliability, and strategic partnerships. These industry frontrunners invest significantly in research and development to continuously enhance the capabilities of their software solutions. By integrating cutting-edge technologies such as artificial intelligence (AI) and machine learning (ML), they improve the accuracy and efficiency of transaction monitoring, enabling real-time detection of suspicious activities and fraud. Moreover, these top companies prioritize scalability and adaptability, ensuring that their software can accommodate the evolving needs of financial institutions and various industries. They also offer customizable solutions that cater to specific compliance requirements, which is crucial given the diversity of global regulations. Additionally, these companies actively partner with financial institutions, cybersecurity firms, and regulatory bodies to stay at the forefront of industry trends and compliance standards. By collaborating on best practices and sharing insights, they contribute to continuously improving transaction monitoring capabilities across the financial ecosystem. Furthermore, top companies prioritize user-friendly interfaces and seamless integration with existing systems, making it easier for businesses to implement and benefit from their solutions. This approach strengthens the market's growth and ensures that transaction monitoring remains a cornerstone of financial security and compliance in an increasingly digital world.

The report provides a comprehensive analysis of the competitive landscape in the transaction monitoring software market with detailed profiles of all major companies, including:

- ACI Worldwide

- ComplyAdvantage

- Experian Information Solutions, Inc

- Fenergo

- FICO

- FIS

- Fiserv, Inc

- LexisNexis Risk Solutions

- NICE Actimize

- Oracle Corporation

- SAS Institute Inc.

Latest News and Developments:

- November 2024: NICE Actimize's AML Essentials solutions, an AI-driven AML suite, will be applied by Sweden-based digital bank, TF Bank, to improve financial crime prevention programs. The AML suite provided includes Transaction Monitoring, Customer Due Diligence and Screening, providing faster speed of deployment, cost benefits, and greater automation as a means to improve fraud detection, and compliance.

- August 2024: Experian announced that it has acquired NeuroID, to enrich its fraud detection suite with advanced behavioral analytics. This solution is integrated on Experian Ascend via CrossCore, which allows real-time monitoring of digital user behavior to prevent fraud.

- May 2024: FICO announced that they have collaborated with Net.Bit to strengthen EMEA-based financial institutions in fraud monitoring. Net.Bit will deploy FICO Blaze Advisor, which will thereby boost operational efficiency and compliance through SaaS decision management solutions.

- April 2024: Oracle Financial Services introduced its AI-based Oracle Financial Services Compliance Agent to assist banks on anti-money laundering (AML) initiatives. The instrument strengthens transaction monitoring systems that let banks conduct cost-effective tests, optimize controls, measure AML risk profiles; thereby, it decreases the expenditure of compliance and helps optimize decision-making in risk modelling.

- March 2024: FIS announced that they have partnered with Stratyfy to improve its SecurLOCK™ card fraud management solution. This will help them detect fraud and avoid false positives and hence enhance a safer experience for card payment. It comes at the right time as by 2027, businesses will be expecting fraud to cost them more than USD 40 billion annually.

Transaction Monitoring Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Applications Covered | Anti-Money Laundering, Customer Identity Management, Fraud Detection and Prevention, Compliance Management |

| End Use Industries Covered | BFSI, Government and Defense, IT and Telecom, Retail, Healthcare, Energy and Utilities, Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACI Worldwide, ComplyAdvantage, Experian Information Solutions, Inc, Fenergo, FICO, FIS, Fiserv, Inc, LexisNexis Risk Solutions, NICE Actimize, Oracle Corporation, SAS Institute Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the transaction monitoring software market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global transaction monitoring software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the transaction monitoring software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global transaction monitoring software market was valued at USD 18.31 Billion in 2024.

The global transaction monitoring software market is estimated to reach USD 50.25 Billion by 2033, exhibiting a CAGR of 11.28% from 2025-2033.

The market is driven by the rise in digital payments, stringent regulatory requirements, increasing instances of financial crimes, and advancements in artificial intelligence and machine learning.

North America currently dominates the market, holding a significant market share of 32.8% in 2024. The market growth in the region is driven by the globalization of commerce and finance, the rising online banking services, the growth of fintech companies, the escalating adoption of cryptocurrencies, the emphasis on customer experience, and the advances in data analytics and artificial intelligence (AI).

Some of the major players in the global transaction monitoring software market include ACI Worldwide, ComplyAdvantage, Experian Information Solutions, Inc, Fenergo, FICO, FIS, Fiserv, Inc, LexisNexis Risk Solutions, NICE Actimize, Oracle Corporation, SAS Institute Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)