Transformer Oil Market Size, Share, Trends and Forecast by Type, Function, End Use, Application, and Region, 2025-2033

Transformer Oil Market Size and Share:

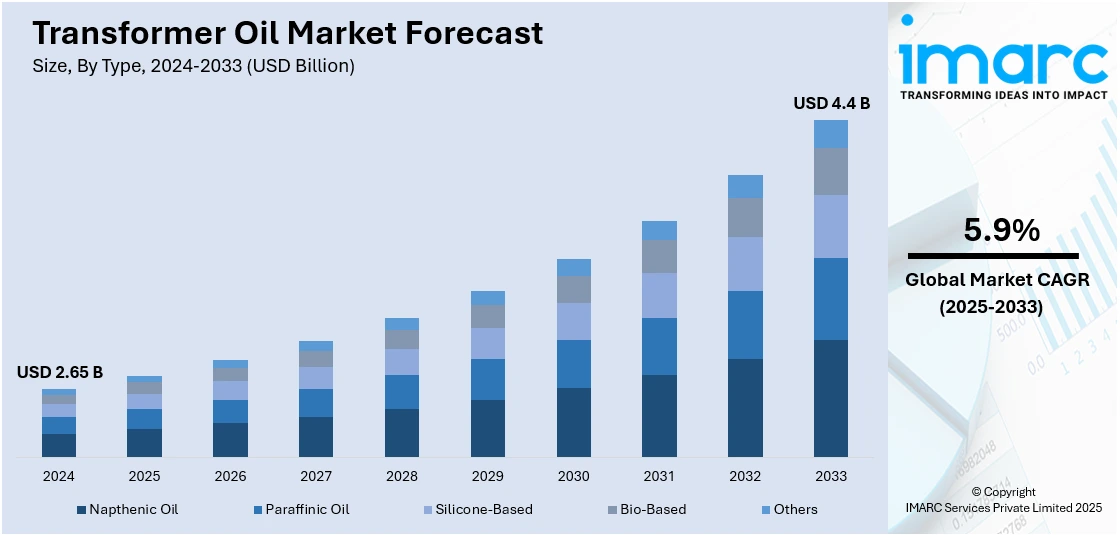

The global transformer oil market size was valued at USD 2.65 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.4 Billion by 2033, exhibiting a CAGR of 5.9% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 55.8% in 2024. The market is experiencing growth due to the enforcement of stricter environmental regulations that promote the use of safer, eco-friendly products. This has increased demand for bio-based and synthetic oil variants, which offer superior performance and lower environmental impact compared to traditional mineral oils. Additionally, the expanding need for new transformer installations, driven by urbanization and industrial growth, along with the necessity for regular maintenance and replacement of aging electrical infrastructure, further supports the steady rise in transformer oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.65 Billion |

| Market Forecast in 2033 | USD 4.4 Billion |

| Market Growth Rate (2025-2033) | 5.9% |

One major driver in the transformer oil market is the rapid growth of renewable energy infrastructure. As solar farms and wind parks expand globally, grid operators increasingly rely on transformers to step up and step down voltage efficiently. Transformer oil—particularly high-performance and biodegradable variants such as natural esters plays critical role in cooling and insulating these transformers. The shift toward eco‑friendly renewable installations boosts demand not only for conventional mineral oil but also for greener alternatives that meet sustainability criteria. Consequently, transformer oil manufacturers are investing in research to develop high‑fire‑point, low‑environmental‑impact formulations. Overall, the expansion of renewable energy infrastructure is significantly fueling transformer oil market growth by driving both higher consumption volumes and diversification in product offerings.

The U.S. holds a significant position in the global transformer oil market, largely driven by its efforts to modernize an aging power infrastructure. According to the U.S. Department of Energy (DOE), around 55% of in-service distribution transformers are over 33 years old, highlighting the urgent need for replacement and maintenance to ensure grid reliability and efficiency. This aging equipment requires high-performance transformer oils for effective insulation and cooling. Furthermore, the rapid adoption of renewable energy sources like wind and solar is creating additional demand for advanced transformer oils that can meet the needs of modern, eco-friendly energy systems. Rising environmental concerns and strict government regulations are also accelerating the shift towards biodegradable and less toxic oil variants, boosting the transformer oil market growth and importance globally.

Transformer Oil Market Trends:

Increasing electrification and infrastructure development

Some of the most fundamental drivers of the global market for the industry include the rising rate of electrification and infrastructure construction, especially in the developing world. As nations concentrate on upgrading their electrical grids to accommodate rising demand for electricity, the demand for transformers, and hence transformers' oil, surges enormously. The International Energy Agency (IEA) estimates that world electricity consumption grew by about 1,100 terawatt-hours in 2024, or 4.3%. Moreover, governments and the private sector are investing significantly in constructing new power plants, substations, and transmission lines to make sure that electricity is generated and distributed efficiently. High-quality transformer oil is imperative in these efforts, as it acts as an insulating and cooling agent for the complex internal parts of transformers. Without proper oil for transformers, transformer failure risk and the resulting electrical outages escalate, which has a negative impact on critical services and the economy as well. Thus, with growing electrification, particularly in areas striving to improve their energy infrastructure, market demand is likely to witness strong growth.

Technological advancements in the power industry

The electric power sector is undergoing tremendous technology growth with advances such as the building of smart grids, renewable energy sources, and energy-efficient infrastructure. The global smart grid market, as per the Global Smart Energy Federation, reached USD 100.3 Billion in 2022 and is expected to grow to USD 185.6 Billion by 2032 at a CAGR of 6.75% from 2023 and 2032. These developments require highly efficient and reliable transformers, which means that the demand for high-quality transformer oil is greater. Concurrently with this, high-performance transformers are now being engineered to support increased electrical load, higher frequency of load changes, and changing voltage conditions. This development necessitates better oil for transformers that provide insulation and cooling capabilities, durability, and stability to degradation. Besides this, developments within the oil formulations are therefore emerging as critical, providing a platform for manufacturers to engineer specialized products to address these shifting requirements.

Rapid industrialization and urbanization

Increased industrialization and urbanization across the globe are a combination of drivers pushing the market demand. Based on the United Nations Industrial Development Organization (UNIDO), there was a 2.3% increase in industrial sectors around the globe in 2023, marking a high industrialization rate. With expanding cities and increasing industries, electricity supply assurance becomes a top priority. New industrial plants, business centers, and housing complexes need transformers to be installed in order to supply their power needs. Furthermore, the health of such transformers also greatly depends on the type of oil used. Since these environments are not able to sustain frequent disruptions due to failed transformers, the need for quality transformer oil is irresistibly increasing. In addition, numerous industrial processes require special electrical demands, which usually need specialized transformer oil types. As such, with industrialization and urbanization on the rise, the market is experiencing a favorable transformer oil market outlook.

Transformer Oil Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global transformer oil market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, function, end use, and application.

Analysis by Type:

- Napthenic Oil

- Paraffinic Oil

- Silicone-Based

- Bio-Based

- Others

Naphthenic oil accounts for the majority share in the transformer oil market due to its excellent thermal and oxidation stability, making it ideal for transformer insulation and cooling applications. Its low pour point ensures superior performance in varying and low-temperature environments, which is crucial for reliable transformer operation across different climates. Naphthenic oil also offers high solvency, which helps dissolve additives effectively, enhancing the oil’s insulating properties and lifespan. Its cost-effectiveness compared to other oil types, such as synthetic or bio-based oils, further boosts its preference among manufacturers and utilities. Additionally, the widespread availability of naphthenic crude sources supports its large-scale production and use, reinforcing its dominant position in the global transformer oil market.

Analysis by Function:

- Insulator

- Cooling Agent

- Lubricant

- Chemical Stabilizer

Based on the transformer oil market forecast, the insulators dominate the market demand due to their critical role in ensuring the safety, efficiency, and longevity of transformers. Transformer oil acts as both a coolant and an insulating medium, preventing electrical discharges and short circuits by maintaining proper insulation between internal components. As power transmission networks expand and modernize, the need for reliable insulation becomes even more essential to handle higher voltage levels and prevent equipment failures. Additionally, rising demand for energy efficiency and transformer durability in renewable energy grids, smart infrastructure, and industrial applications further boosts the requirement for superior insulating oils. Strict regulatory standards regarding transformer safety and performance also drive the market for high-quality insulating oils, solidifying their leading position in overall market demand.

Analysis by End-Use:

- Small Transformers

- Large Transformers

- Utility

- Others

Small transformers represent the majority share of 38.3% in the transformer oil market primarily because of their widespread use in residential, commercial, and light industrial applications. These transformers are essential for distributing electricity efficiently across short distances, such as in homes, offices, and small manufacturing units. The rising urbanization, along with growing demand for stable power supply in rural electrification projects, particularly in developing economies, has significantly increased the installation of small transformers. Moreover, their lower cost, ease of installation, and adaptability to decentralized power systems like rooftop solar panels make them a preferred choice. Regular maintenance needs and frequent replacements of these units also contribute to higher consumption of transformer oil in this segment, ensuring its dominant market share.

Analysis by Application:

- Residential

- Commercial

- Industrial

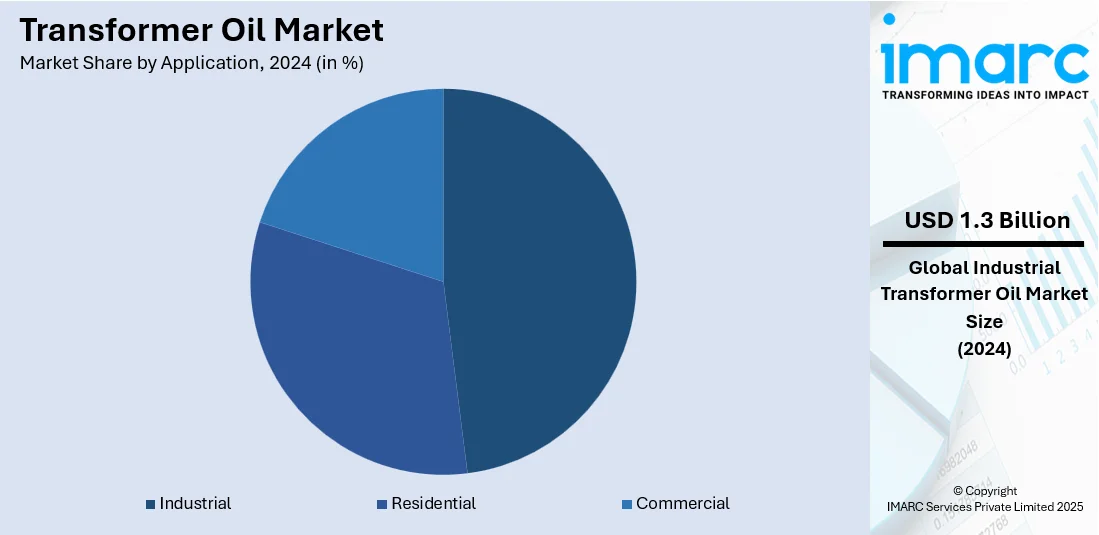

The industrial sector holds the largest market share of 47.6% in the transformer oil market due to the high demand for reliable and efficient power supply across various manufacturing, processing, and heavy-duty industries. Industrial operations require a stable and uninterrupted electricity flow to ensure continuous production, which drives the installation and maintenance of transformers filled with quality insulating oils. Additionally, the expansion of industries such as steel, automotive, chemicals, and electronics in emerging economies increases the need for advanced electrical infrastructure. The sector also emphasizes energy efficiency, equipment longevity, and safety, further boosting the demand for high-performance transformer oils. Ongoing industrialization and modernization efforts, especially in developing regions, continue to fuel this strong market share within the industrial segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific holds the majority share of 55.8% in the transformer oil market, primarily due to rapid industrialization, urbanization, and extensive power infrastructure development across the region. Countries like China, India, Japan, and South Korea are investing heavily in expanding and modernizing their electricity grids to meet growing energy demands from residential, commercial, and industrial sectors. The region's large population base, increasing renewable energy projects, and government initiatives for rural electrification also contribute to this dominance. Additionally, the replacement of aging transformers and the adoption of smart grid technologies drive further demand for high-quality transformer oils. Local manufacturing capabilities and the presence of numerous power utilities further strengthen the market position of Asia Pacific in this sector.

Key Regional Takeaways:

North America Transformer Oil Market Analysis

The North America transformer oil market is witnessing steady growth driven by rising demand for electricity, grid modernization, and the expansion of renewable energy infrastructure. The region’s aging power grid requires frequent upgrades and maintenance, boosting the need for transformer oil to ensure efficient insulation and cooling of transformers. Additionally, the shift towards smart grids and energy-efficient power distribution systems encourages the use of high-performance transformer oils with superior thermal and oxidation stability. Environmental awareness is also shaping the market, with a gradual transition from traditional mineral-based oils to biodegradable and less toxic alternatives such as synthetic and natural ester-based oils. The industrial, commercial, and residential sectors all contribute to the rising need for reliable power distribution, further supporting the market. However, fluctuating crude oil prices and stringent environmental regulations pose potential challenges. Despite this, technological advancements in oil formulations and transformer designs are expected to provide new growth opportunities, making the North American transformer oil market dynamic and evolving.

United States Transformer Oil Market Analysis

The United States transformer oil market is dominated by the increasing demand for power generation and the development of the power transmission and distribution (T&D) network. Total electricity generation in the United States, as reported by the International Energy Agency (IEA), was 4,439,413 GWh in 2023. As the demand for efficient and consistent electricity supply rises, there is an increased demand for transformers, reflecting directly on transformer oil demand. The increasing volume of renewable energy projects, including wind and solar power, is also creating a greater demand for improved power distribution systems, which in turn is fueling the market for transformer oil. For example, wind power accounted for 22% of all new electricity capacity added in the U.S. in 2022, which translates into USD 12 Billion in capital investment, as per the U.S. Department of Energy. Also, the on-going replacement and maintenance of aging transformers in the U.S. are adding to the continued demand for oil, given that these systems need oil for cooling and insulation purposes. Also, advancements in transformer oil, including the creation of environmentally safe and biodegradable alternatives, are driving market growth by responding to rising environmental and regulatory requirements. Government policies and incentives to augment energy infrastructure and mitigate emissions are also boosting industry growth.

Asia Pacific Transformer Oil Market Analysis

The Asia Pacific transformer oil market is expanding due to the region’s expanding power generation capacity and the growing demand for electricity. For instance, in India, per capita electricity consumption reached 1,395 kWh in 2023-24, recording a growth of 45.8% in comparison to 2013-14 at 957 kWh, as per the Press Information Bureau (PIB). Countries such as China and India are investing heavily in the modernization of their energy infrastructure, including the development of new power plants and distribution networks. This expansion is increasing the need for transformers and transformer oils to ensure optimal functionality. Additionally, the rising focus on energy security and grid stability across the region is leading to the deployment of advanced transformer systems, which require high-quality oils for cooling and insulation. The increasing adoption of industrial automation and the need for continuous power supply in sectors such as manufacturing and data centers are also contributing substantially to market growth.

Europe Transformer Oil Market Analysis

The growth of the Europe transformer oil market is largely fueled by the increasing demand for efficient and reliable power distribution systems. As the region continues to shift toward cleaner and more sustainable energy solutions, there is an increasing demand for upgraded and efficient power transmission systems. Additionally, the European Union's focus on grid modernization and smart grid development is creating more opportunities for advanced transformer technologies that require high-quality oil for cooling and insulation. For instance, in October 2022, the European Commission launched the Digitalization of Energy Action Plan to promote investments in smart grids and support projects aimed at the digitization of the European electricity system. Other than this, the trend toward decentralizing energy production through microgrids and local power solutions is creating various new opportunities for transformer oil applications in distributed energy networks. The ongoing focus on improving electrical grid resilience and reliability in both urban and rural areas is further strengthening the demand for transformer oil across the region.

Latin America Transformer Oil Market Analysis

The Latin America transformer oil market is significantly influenced by the region's increasing focus on expanding its power generation capacity, particularly in response to rising energy consumption. For instance, in Brazil, per capita electricity consumption reached 2.723 MWh in 2022, recording a 44% upward trend over 2000-2022, as per the International Energy Agency (IEA). Additionally, the integration of renewable energy sources such as wind and solar power is boosting demand for advanced transformer technologies, as these systems require efficient cooling and insulation. For instance, wind and solar installations accounted for 21% of total electricity generation capacity in Brazil in 2023, highlighting a significant increase in comparison to 2022 at 17% and 2016 at 5.8%. Besides this, the growing awareness about environmental sustainability is increasing the demand for eco-friendly transformer oils, further facilitating industry expansion.

Middle East and Africa Transformer Oil Market Analysis

The Middle East and Africa transformer oil market is experiencing robust growth, driven by rapid infrastructure development, particularly in energy-rich countries such as Saudi Arabia, the UAE, and South Africa, where the demand for power generation and transmission is increasing. As these regions focus on modernizing their electrical grids and expanding renewable energy projects, the need for transformers and transformer oil for efficient cooling and insulation rises. For instance, in Saudi Arabia, 2,100 MW of renewable energy installations were added to the system since 2022, increasing the installed renewable energy capacity to 2,800 MW (2.8 GW) in 2023 and recording a growth of 300%, according to industry reports. Increasing government investments in energy infrastructure and the shift toward eco-friendly transformer oils are also contributing substantially to industry expansion in the region.

Competitive Landscape:

The competitive landscape of the transformer oil market is characterized by strong rivalry among established players and emerging manufacturers. Competition largely revolves around innovation, product quality, and environmental sustainability. Companies are focusing on developing oils with superior insulating, cooling, and biodegradable properties to meet strict regulatory and environmental standards. Technological advancements such as the introduction of bio-based and high-flash-point oils are shaping market dynamics. Market participants also compete by offering customized solutions suited to modern energy systems like renewable energy grids and smart transformers. Price competitiveness, product differentiation, and regional expansion remain key strategies. Additionally, strategic partnerships, R&D investment, and efforts to meet evolving safety standards influence positioning in this evolving market space.

The report provides a comprehensive analysis of the competitive landscape in the transformer oil market with detailed profiles of all major companies, including:

- Calumet Specialty Products Partners L.P.

- Cargill, Incorporated

- Engen Petroleum Limited

- Ergon Inc.

- Edens Garden, Inc.

- Hydrodec Group plc

- Nynas AB

- PetroChina Company Limited

- San Joaquin Refining Co. Inc.

- China Petroleum & Chemical Corporation (SINOPEC)

- Valvoline Inc.

Latest News and Developments:

- May 2025: Redox Ltd. successfully acquired Molekulis Ply Ltd. and Molekulis Limited, a manufacturer of transformer oils. This acquisition will expand the company's clientele in Australia and New Zealand, broadening the selection of products that Redox's loyal clients can choose from while also establishing beneficial supplier relationships with important specialty oil manufacturers.

- May 2024: Together with SCGC and QTC, BBGI reported that their bio-based transformer oil successfully completed a trial, fulfilling international requirements and guaranteeing safe usage. The company plans to expand its commercial production, which will help lower carbon dioxide emissions and imports from other nations while advancing Thailand's transition to the BCG (Bio-Circular-Green Economy) agenda for sustainable development.

- May 2024: Nynas’ circular transformer oil, which is developed using used oil from transformers as a raw material, secured the ISCC Plus certification. By ensuring that raw materials can be tracked along the whole value chain, the standard guarantees that Nynas' product is made of 100% recycled raw materials.

- March 2024: Nynas, a prominent manufacturer of transformer oils, established a collaborative alliance with Stena Recycling to Gather and re-refine transformer oils at the end of their lives. As part of this partnership, Stena will provide Nynas with discarded mineral-insulating oils from electrical transformers across Europe. Nynas will then utilize these oils as feedstock for its circular transformer oils.

- January 2024: Shell Lubricants successfully acquired MIDEL and MIVOLT from M&I Materials Ltd. By acquiring MIDEL, Shell will strengthen its distinctive standing in transformer oils used by traction power systems, utility firms, offshore wind parks, and power distribution. Shell Lubricants intends to provide its clients with enhanced fire protection and biodegradability by expanding its line of transformer oils and services to include both natural and synthetic ester-based products.

Transformer Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Napthenic Oil, Paraffinic Oil, Silicone-Based, Bio-Based, Others |

| Functions Covered | Insulator, Cooling Agent, Lubricant, Chemical Stabilizer |

| End-Uses Covered | Small Transformers, Large Transformers, Utility, Others |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Calumet Specialty Products Partners L.P., Cargill, Incorporated, Engen Petroleum Limited, Ergon Inc., Edens Garden, Inc., Hydrodec Group plc, Nynas AB, PetroChina Company Limited, San Joaquin Refining Co. Inc., China Petroleum & Chemical Corporation (SINOPEC), Valvoline Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the transformer oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global transformer oil market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the transformer oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The transformer oil market was valued at USD 2.65 Billion in 2024.

The transformer oil market is projected to exhibit a CAGR of 5.9% during 2025-2033, reaching a value of USD 4.4 Billion by 2033.

Key factors driving the transformer oil market include rising electricity demand, grid modernization, renewable energy integration, and replacement of aging transformers. Additionally, increasing focus on energy efficiency, safety standards, and the development of biodegradable, eco-friendly transformer oils further fuels market growth worldwide.

Asia Pacific currently dominates the transformer oil market, accounting for a share of 55.8% due to rapid industrialization, urbanization, and significant investments in power infrastructure. Growing electricity demand, expansion of renewable energy projects, and grid modernization efforts in countries like China and India drive the region’s leading market share and continued growth potential.

Calumet Specialty Products Partners L.P., Cargill, Incorporated, Engen Petroleum Limited, Ergon Inc., Edens Garden, Inc., Hydrodec Group plc, Nynas AB, PetroChina Company Limited, San Joaquin Refining Co. Inc., China Petroleum & Chemical Corporation (SINOPEC), Valvoline Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)