Turkey Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Region, 2025-2033

Turkey Air Freight Market Overview:

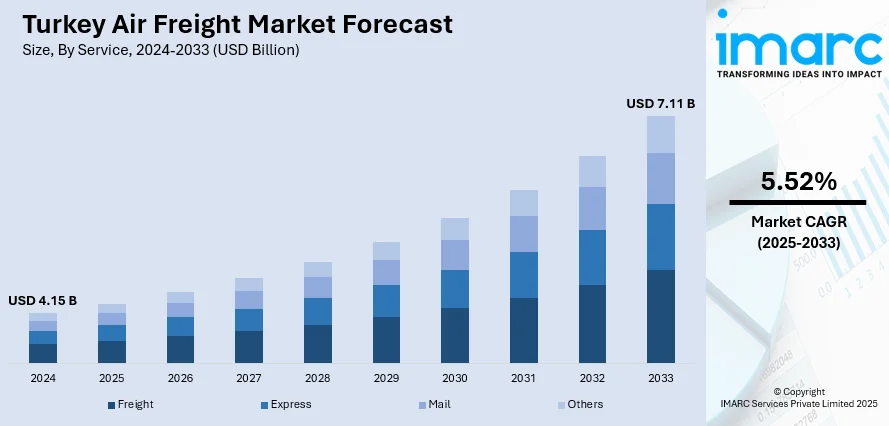

The Turkey air freight market size reached USD 4.15 Billion in 2024. The market is projected to reach USD 7.11 Billion by 2033, exhibiting a growth rate (CAGR) of 5.52% during 2025-2033. The market is propelled by its strategic Istanbul hub positioning, state-backed logistics infrastructure investments, and the rise of e-commerce. Fleet expansion and multimodal integration further boost efficiency. These combined elements enhance Turkey air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.15 Billion |

| Market Forecast in 2033 | USD 7.11 Billion |

| Market Growth Rate 2025-2033 | 5.52% |

Turkey Air Freight Market Trends:

Strategic Geographic & Infrastructure Advantage

Turkey’s advantageous geographic location at the crossroads of Europe, Asia, and the Middle East positions it as a critical air freight transit hub. This strategic placement facilitates efficient cargo connections across continents, making it a preferred route for global logistics operations. The country has consistently invested in expanding and modernizing its airport infrastructure, with major developments enhancing cargo handling capacity and operational efficiency. Istanbul, in particular, serves as a central point for freight consolidation and distribution. Additionally, the integration of air freight operations with road and rail networks supports multimodal logistics solutions, streamlining end-to-end cargo movement. These infrastructural enhancements, combined with its geographical leverage, significantly contribute to Turkey air freight market growth by attracting both regional and international logistics providers. For instance, Turkish Cargo has been named "Fastest‑Growing International Cargo Airline of the Year" by STAT Trade Times during the Air Cargo Africa event in Nairobi (Feb 19–21, 2025). The accolade recognizes its expanding global network, operational efficiency, SMARTIST facility at Istanbul Airport, and innovative logistics. Turkish Cargo plans to reach 150 destinations, operate 44 freighters, and increase SMARTIST capacity to 4.5 million tons—targeting 3.9 million tons of cargo by 2033.

To get more information on this market, Request Sample

Fleet Expansion & High-Value Cargo Specialization

The expansion of air cargo fleets and specialization in high-value cargo are key drivers shaping the growth of Turkey's air freight market. Turkish carriers, particularly Turkish Cargo, are actively increasing their fleet capabilities to meet growing global demand and improve route flexibility. This fleet diversification enables them to handle a wider range of cargo types, including sensitive and high-value goods such as pharmaceuticals, electronics, and perishables. Additionally, dedicated cargo aircraft and tailored handling protocols ensure better temperature control, security, and compliance with international standards. This specialization not only enhances service quality and reliability but also strengthens Turkey’s competitive position in premium freight categories. As global trade increasingly relies on speed and precision, these capabilities offer a strategic advantage. For instance, in June 2024, Turkish Airlines ordered four additional Boeing 777 Freighters, bringing its total fleet to 12, as part of its strategy to strengthen its position in the global air cargo market. The move supports growing demand driven by e-commerce and the need for efficient logistics. The Boeing 777 Freighter’s high payload and range make it ideal for long-haul operations. This expansion enhances Turkish Airlines' cargo capabilities and reflects its commitment to operational efficiency and leadership in the international air freight sector.

Turkey Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, destination, and end user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes domestic and international.

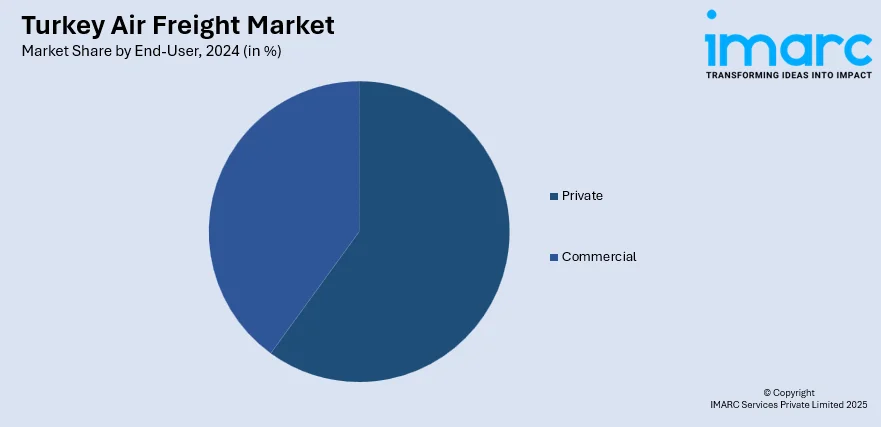

End-User Insights:

- Private

- Commercial

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes private ad commercial.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Air Freight Market News:

- In May 2025, Turkish Cargo entered a long-term partnership with Atlas Air Worldwide to enhance its global network and operational efficiency. Under the agreement, Atlas Air will operate a Boeing 747-400F freighter for Turkish Cargo, serving major destinations across the Middle East, Asia, Europe, and the Americas. This collaboration supports Turkish Cargo’s capacity expansion and strategic growth, reinforcing Istanbul’s role as a key international cargo hub.

- In May 2025, Hong Kong Air Cargo signed a Memorandum of Understanding (MoU) with Turkish Cargo to strengthen collaboration in global air cargo operations. The agreement outlines plans for joint operational initiatives, such as codeshare arrangements, freighter aircraft cooperation, and enhanced connectivity across major global routes. By combining their network reach and operational expertise, both carriers aim to deliver more efficient and customer-centric logistics solutions. This partnership supports Hong Kong Air Cargo’s strategic expansion and Turkish Cargo’s growing presence in Asia’s key logistics corridors.

- In March 2025, Turkey-based ULS Airlines Cargo received its first Airbus A330-300 freighter from ATSG, marking a fleet upgrade from its current A310 freighters. This delivery is part of ATSG’s broader shift to diversify its cargo fleet beyond the Boeing 767.

Turkey Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End Users Covered | Private, Commercial |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey air freight market on the basis of service?

- What is the breakup of the Turkey air freight market on the basis of destinations?

- What is the breakup of the Turkey air freight market on the basis of end user?

- What is the breakup of the Turkey air freight market on the basis of region?

- What are the various stages in the value chain of the Turkey air freight market?

- What are the key driving factors and challenges in the Turkey air freight?

- What is the structure of the Turkey air freight market and who are the key players?

- What is the degree of competition in the Turkey air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey air freight market and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)