Turkey Alternative Data Market Size, Share, Trends and Forecast by Data Type, Industry, End User, and Region, 2025-2033

Turkey Alternative Data Market Overview:

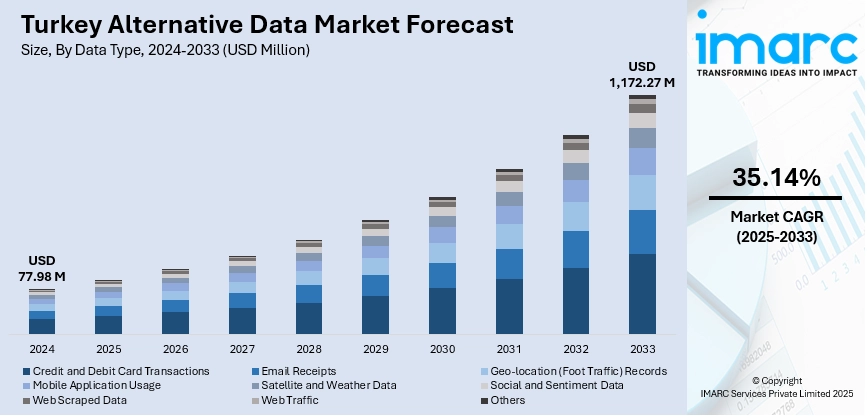

The Turkey alternative data market size reached USD 77.98 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,172.27 Million by 2033, exhibiting a growth rate (CAGR) of 35.14% during 2025-2033. Rapid fintech expansion, soaring digital payments and e‑commerce activity, government-driven digital infrastructure, and growing demand from BFSI and healthcare sectors for real-time analytics are key drivers enhancing data monetization efforts and expanding the Turkey alternative data market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 77.98 Million |

| Market Forecast in 2033 | USD 1,172.27 Million |

| Market Growth Rate 2025-2033 | 35.14% |

Turkey Alternative Data Market Trends:

Data Monetization Across Industries

Turkey alternative data market growth is propelled by increasing recognition of data’s commercial potential. Sectors such as BFSI, retail, telecommunications, manufacturing, healthcare, and energy actively leverage data monetization. Recent industry reports project a compound annual growth rate of 25.8% for Turkey’s data monetization market from 2025–2031. Companies now routinely convert digital wallets, consumer behavior, IoT, and telemetry into actionable insights. These methods enable firms to optimize operations, tailor products, and generate new revenue streams, establishing a solid foundation for broader adoption of alternative datasets.

To get more information on this market, Request Sample

Digital Payments & E‑commerce Data Aggregation

As of January 2025, Turkey recorded around 80.7 million cellular mobile connections, accounting for 92.1% of its total population. The rise in smartphone usage, coupled with the widespread adoption of digital wallets and payment platforms such as Papara and iyzico, has driven a notable increase in cashless transactions across the country. This expanded digital footprint, covering payments, mobile usage, and online shopping, supplies a rich reservoir of alternative data. Financial platforms are leveraging this data for credit scoring, fraud detection, and personalized lending. As peer-to-peer lending also gains regulatory traction, non-traditional data is increasingly vital to support underbanked customers. This trend underscores how transactional and behavioral data is central to Turkey alternative data market growth.

Turkey Alternative Data Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2025-2033. Our report has categorized the market based on data type, industry, and end user.

Data Type Insights:

- Credit and Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite and Weather Data

- Social and Sentiment Data

- Web Scraped Data

- Web Traffic

- Others

The report has provided a detailed breakup and analysis of the market based on the data type. This includes credit and debit card transactions, email receipts, geo-location (foot traffic) records, mobile application usage, satellite and weather data, social and sentiment data, web scraped data, web traffic, and others.

Industry Insights:

- Automotive

- BFSI

- Energy

- Industrial

- IT and Telecommunications

- Media and Entertainment

- Real Estate and Construction

- Retail

- Transportation and Logistics

- Others

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes automotive, BFSI, energy, industrial, IT and telecommunications, media and entertainment, real estate and construction, retail, transportation and logistics, and others.

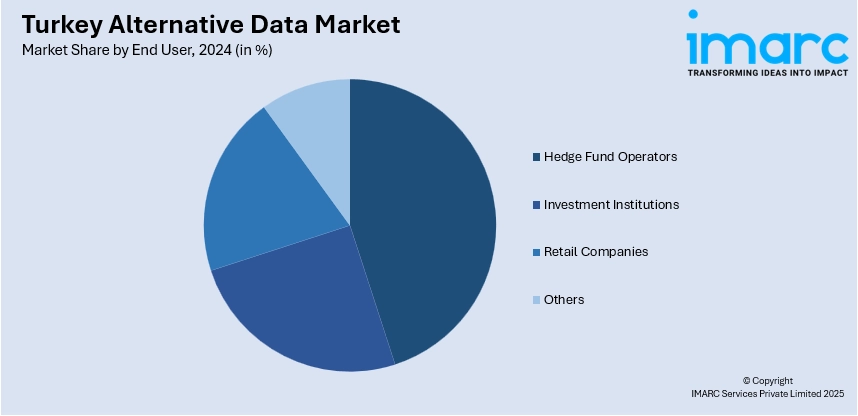

End User Insights:

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hedge fund operators, investment institutions, retail companies, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Alternative Data Market News:

- In June 2025, Bloomberg expanded its alternative data offerings by integrating Similarweb’s web traffic data into the Bloomberg Terminal through the {ALTD<GO>} function. This enhancement extends alternative data coverage to over 3,000 companies worldwide, providing investors with near real-time digital insights across industries such as SaaS, e-commerce, and healthcare. The partnership enables users to monitor key performance indicators and emerging trends more effectively, supporting improved investment decision-making.

- In November 2024, Goldman Sachs started leveraging alternative data such as satellite imagery and credit card transaction records to enhance its retail trend predictions. By examining these datasets, the firm aims to provide more accurate insights into consumer behavior and spending patterns, enabling clients to make more informed investment decisions in the retail sector.

Turkey Alternative Data Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Types Covered | Credit and Debit Card Transactions, Email Receipts, Geo-location (Foot Traffic) Records, Mobile Application Usage, Satellite and Weather Data, Social and Sentiment Data, Web Scraped Data, Web Traffic, Others |

| Industries Covered | Automotive, BFSI, Energy, Industrial, IT and Telecommunications, Media and Entertainment, Real Estate and Construction, Retail, Transportation and Logistics, Others |

| End Users Covered | Hedge Fund Operators, Investment Institutions, Retail Companies, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey alternative data market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey alternative data market on the basis of data type?

- What is the breakup of the Turkey alternative data market on the basis of industry?

- What is the breakup of the Turkey alternative data market on the basis of end user?

- What is the breakup of the Turkey alternative data market on the basis of region?

- What are the various stages in the value chain of the Turkey alternative data market?

- What are the key driving factors and challenges in the Turkey alternative data market?

- What is the structure of the Turkey alternative data market and who are the key players?

- What is the degree of competition in the Turkey alternative data market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey alternative data market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey alternative data market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey alternative data industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)