Turkey ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2025-2033

Turkey ATM Market Overview:

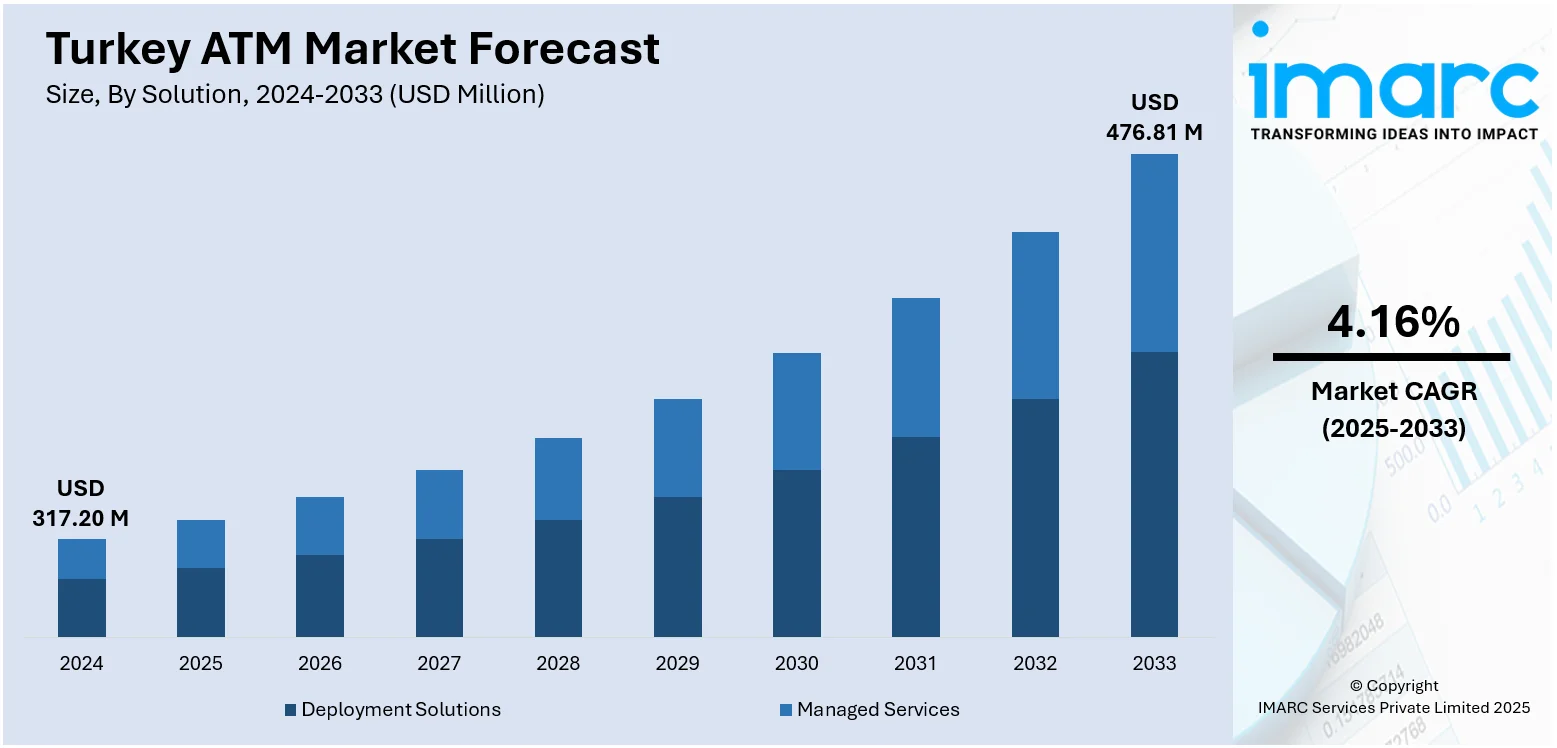

The Turkey ATM market size reached USD 317.20 Million in 2024. Looking forward, the market is expected to reach USD 476.81 Million by 2033, exhibiting a growth rate (CAGR) of 4.16% during 2025-2033. The market is driven by increased demand for financial inclusion, the growing adoption of digital payment systems, and the expansion of contactless payment technology. These factors contribute to the modernization of ATM infrastructure, facilitating seamless transactions. Consequently, they play a significant role in expanding Turkey ATM market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 317.20 Million |

| Market Forecast in 2033 | USD 476.81 Million |

| Market Growth Rate 2025-2033 | 4.16% |

Turkey ATM Market Trends:

Expansion of Contactless Payment Options

The increase in contactless payment options is a trend that is on the rise in the Turkey ATM market. With contactless cards and mobile wallets picking up pace, Turkish banks are upgrading their ATM network to accommodate these technologies. ATMs are increasingly fitted with contactless card readers, allowing customers to conduct transactions in a hurry without inserting a physical card. This comes on the back of the demand for speedier, more secure means of payment. Moreover, certain ATMs are now also enabling direct mobile wallet transfers, again lessening dependence on physical cards. In response to hyperinflation, Turkish banks are refilling ATMs up to three times a day with 100 and 200-lira banknotes due to the dominance of the 200-lira note in circulation. This operational strain highlights the need for more efficient payment methods. Upgrading ATMs to support contactless payments aligns with these needs, offering a solution to ease the pressure on ATM systems while enhancing transaction speed and security.

To get more information on this market, Request Sample

Focus on Enhanced Security Features

As a result of rising cybercrime and ATM fraud, Turkish banking institutions are focusing more on improving security in their ATMs. Banks are making increased use of enhanced security features, such as biometric authentication, encryption systems, and real-time anti-fraud systems, to secure customers' financial data. Biometric characteristics like fingerprint and facial recognition are becoming more widespread, providing an added level of secure user authentication compared to PINs. They not only increase security, but they also improve the customer experience by reducing the likelihood of fraud. With these security concerns being addressed, banks are building confidence and driving the growth of the Turkey ATM market, making self-service banking options long-term stable. For instance, in February 2025, a new regulation in Turkey mandates that ATM users must have their faces clearly visible to the ATM camera in order to complete transactions. Individuals with masks or concealed faces will be unable to use the ATMs. Additionally, ATM camera footage will be stored for two years for security purposes.

Turkey ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size Insights:

- 15" and Below

- Above 15"

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes 15" and below and above 15".

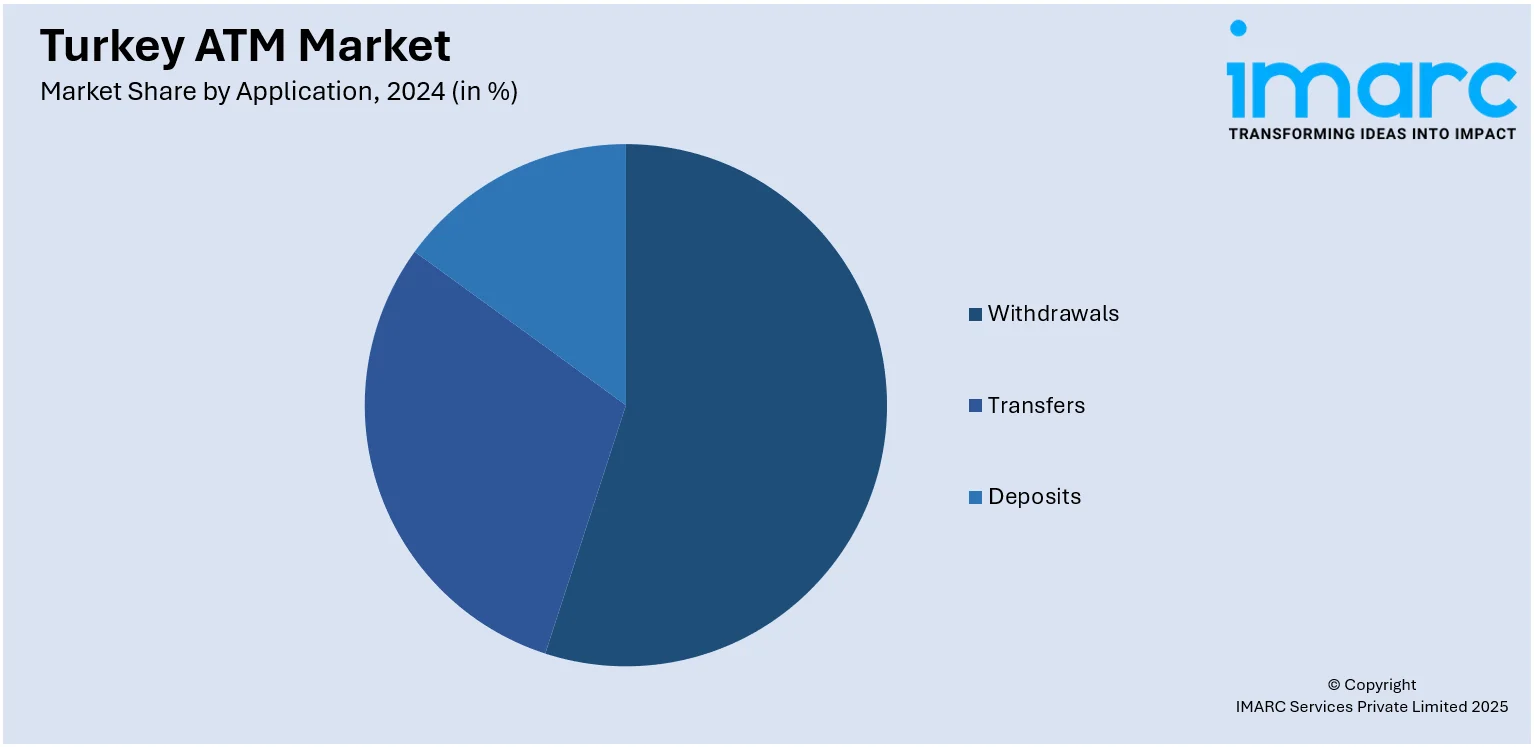

Application Insights:

- Withdrawals

- Transfers

- Deposits

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

A detailed breakup and analysis of the market based on the ATM type have also been provided in the report. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey ATM market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey ATM market on the basis of solution?

- What is the breakup of the Turkey ATM market on the basis of screen size?

- What is the breakup of the Turkey ATM market on the basis of application?

- What is the breakup of the Turkey ATM market on the basis of ATM type?

- What is the breakup of the Turkey ATM market on the basis of region?

- What are the various stages in the value chain of the Turkey ATM market?

- What are the key driving factors and challenges in the Turkey ATM market?

- What is the structure of the Turkey ATM market and who are the key players?

- What is the degree of competition in the Turkey ATM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey ATM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)