Turkey Citric Acid Market Size, Share, Trends and Forecast by Application, Form, and Region, 2026-2034

Turkey Citric Acid Market Summary:

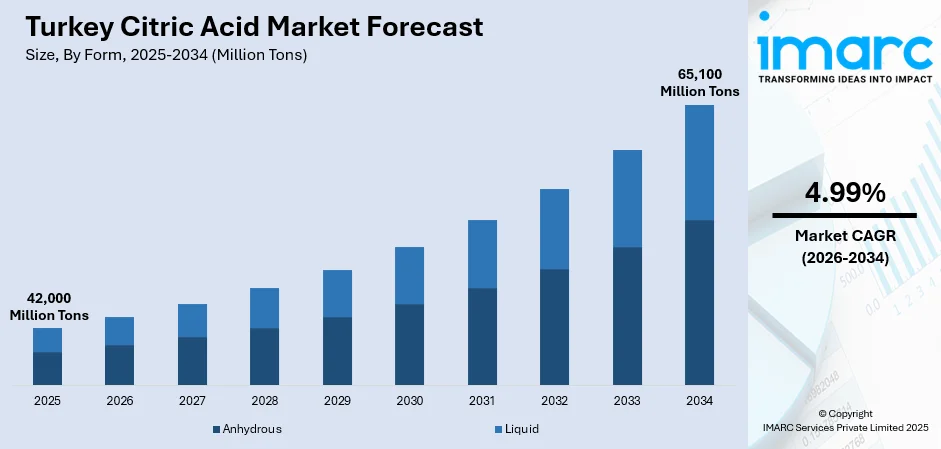

The Turkey citric acid market size reached 42,000 Million Tons in 2025 and is projected to reach 65,100 Million Tons by 2034, growing at a compound annual growth rate of 4.99% from 2026-2034.

The Turkey citric acid market is experiencing sustained growth, driven by expanding applications across food and beverage (F&B) manufacturing, pharmaceutical formulations, and household cleaning products. Rising consumer demand for natural preservatives and clean-label ingredients is encouraging food processors to adopt citric acid as a preferred acidulant and flavor enhancer. Additionally, increasing urbanization and changing dietary patterns towards convenience foods are supporting market expansion. The pharmaceutical sector's reliance on citric acid for effervescent tablets and drug stabilization further strengthens demand.

Key Takeaways and Insights:

-

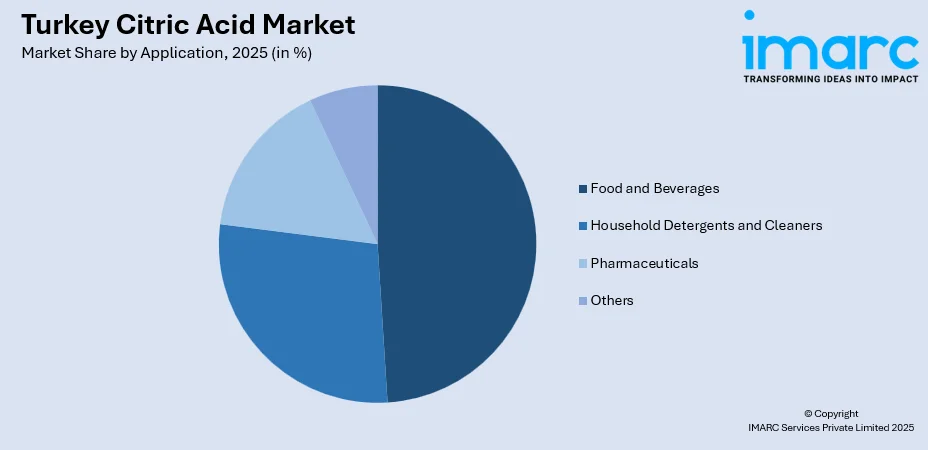

By Application: Food and beverages dominate the market with a share of 49% in 2025, owing to extensive utilization as a natural acidulant and preservative in processed food items, carbonated drinks, and confectionery products. Growing consumer preferences for natural flavor enhancers over synthetic alternatives are fueling segment expansion.

-

By Form: Liquid exhibits a clear dominance in the market with 61% share in 2025, reflecting superior handling characteristics and seamless integration into beverage manufacturing processes. Enhanced storage stability and reduced contamination risks compared to powder forms drive adoption across food processing facilities.

-

By Region: Marmara represents the largest region with 28% share in 2025, driven by concentration of food processing industries in Istanbul, Bursa, and Kocaeli metropolitan areas. Established manufacturing infrastructure and proximity to major export ports strengthen regional market leadership.

-

Key Players: Key players drive the Turkey citric acid market by expanding distribution networks, enhancing product quality standards, and establishing strategic partnerships with end-user industries. Their investments in logistics infrastructure, regulatory compliance, and technical support services strengthen market penetration across diverse application segments.

To get more information on this market Request Sample

The Turkey citric acid market is characterized by robust demand from multiple end-use sectors seeking versatile organic acid solutions for preservation, acidification, and chelation applications. F&B manufacturers represent the main consumer base, employing citric acid widely in soft drinks, fruit juices, sweets, and dairy items for flavor improvement and prolonging shelf life. The thriving pharmaceutical industry represents another significant demand driver, employing citric acid in effervescent formulations, oral solutions, and as an anticoagulant in blood preservation applications. As per IMARC Group, the Turkey pharmaceutical market size reached USD 21.4 Billion in 2024. Household detergent manufacturers are increasingly incorporating citric acid as an environment-friendly alternative to phosphate-based compounds, responding to regulatory pressures and consumer preferences for sustainable cleaning products. The market benefits from Turkey's strategic geographic position bridging European and Asian markets, well-developed food processing infrastructure, and growing domestic pharmaceutical manufacturing capabilities that collectively support sustained citric acid demand.

Turkey Citric Acid Market Trends:

Rising Adoption of Clean-Label and Natural Preservatives

Turkish food manufacturers are increasingly reformulating products to meet growing consumer demand for clean-label ingredients free from synthetic additives, as more emphasis is being placed on health and wellness. As per IMARC Group, the Turkey health and wellness market size reached USD 49.48 Billion in 2024. Citric acid, derived through natural fermentation processes, is gaining preference as a transparent preservative solution. Its multifunctional role as an acidulant, flavor enhancer, and chelating agent makes it highly suitable for clean-label F&B formulations. Additionally, its compatibility with organic and minimally processed products supports wider adoption across sauces, beverages, dairy, and packaged food segments in Turkey.

Expanding Pharmaceutical and Nutraceutical Sector

Turkey’s growing pharmaceutical and nutraceutical industries are contributing to rising citric acid demand. It is widely used as an excipient, buffering agent, and flavor enhancer in syrups, effervescent tablets, and dietary supplements. Increasing healthcare awareness and demand for vitamins and mineral supplements support consistent consumption. Citric acid’s compatibility with active ingredients and its safety profile make it essential for manufacturers focusing on quality, stability, and regulatory compliance in medicinal and wellness products.

Growing Use in Cleaning and Industrial Applications

Citric acid is increasingly employed in household and industrial cleaning products across Turkey due to its natural descaling and chelating properties. Growing preferences for eco-friendly and biodegradable cleaning solutions are encouraging manufacturers to replace harsh chemicals with citric acid. It is widely used in detergents, surface cleaners, and industrial sanitation products. Rising environmental awareness and stringent regulations on chemical cleaners further support the adoption of citric acid in sustainable cleaning formulations.

Market Outlook 2026-2034:

The Turkey citric acid market demonstrates promising growth prospects supported by expanding food processing capabilities, pharmaceutical sector development, and increasing adoption of eco-friendly cleaning products. Domestic manufacturers are strengthening production capacities and distribution networks to meet rising demand across diverse application segments. The market size was estimated at 42,000 Million Tons in 2025 and is expected to reach 65,100 Million Tons by 2034, reflecting a compound annual growth rate of 4.99% over the forecast period 2026-2034. Government initiatives supporting domestic manufacturing and healthcare infrastructure development are expected to stimulate pharmaceutical-grade citric acid demand. Additionally, Turkey's strategic position as a regional food processing hub and growing export activities to Middle Eastern and European markets will contribute to sustained market expansion throughout the forecast period.

Turkey Citric Acid Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Application | Food and Beverages | 49% |

| Form | Liquid | 61% |

| Region | Marmara | 28% |

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Household Detergents and Cleaners

- Pharmaceuticals

- Others

Food and beverages dominate with a market share of 49% of the total Turkey citric acid market in 2025.

The food and beverages segment maintains market leadership, driven by citric acid's multifunctional properties as a natural acidulant, preservative, and flavor enhancer. Turkish food processors extensively utilize citric acid in carbonated soft drinks, fruit juices, confectionery products, and dairy items to achieve optimal taste profiles and extend product shelf life. The compound's ability to regulate pH levels and prevent enzymatic browning makes it indispensable in canned goods and processed fruit preparations. Rising domestic consumption of convenience foods and packaged beverages continues to strengthen segment demand across urban and rural markets.

Consumer preferences shifting towards natural and functional ingredients over synthetic alternatives are reinforcing citric acid adoption in food manufacturing. As per IMARC Group, the Turkey functional beverages market size reached USD 1,258.83 Million in 2024 and is set to reach USD 2,073.20 Million by 2033. Clean-label product reformulations incorporating citric acid as a transparent preservative solution align with evolving dietary preferences among health-conscious Turkish consumers seeking minimally processed food options with recognizable ingredient lists.

Form Insights:

- Anhydrous

- Liquid

Liquid leads with a share of 61% of the total Turkey citric acid market in 2025.

The liquid citric acid segment commands dominant market position, owing to superior operational characteristics in industrial manufacturing environments. Beverage producers particularly favor liquid formulations for seamless integration with syrup preparation and mixing processes, enabling precise concentration control and uniform product quality. Liquid citric acid eliminates dust generation concerns associated with powder handling, reducing workplace safety risks and contamination potential in food-grade production facilities. Storage and transportation improvements have enhanced product stability, expanding viable shelf-life periods for liquid formulations.

Manufacturing efficiency gains achieved through liquid citric acid utilization contribute to segment growth across Turkish food processing operations. Automated dosing systems integrated with liquid supply lines enable consistent product formulation while minimizing material waste and labor requirements. The segment also benefits from faster dissolution rates compared to solid alternatives, which shortens production cycles and supports high-throughput manufacturing operations. Additionally, liquid citric acid aligns well with hygienic design standards, helping processors comply with stringent food safety and quality regulations across large-scale facilities.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

Marmara represents the leading segment with a 28% share of the total Turkey citric acid market in 2025.

Marmara leads the Turkey citric acid market due to its strong concentration of food, beverage, and pharmaceutical manufacturing facilities that represent the largest consumption base for acidulants and preservatives. The region hosts major beverage bottlers, confectionery producers, dairy processors, and processed food companies that rely heavily on citric acid for flavor enhancement, preservation, and pH control. High population density and strong consumer demand further stimulate large-scale production, creating consistent, high-volume citric acid consumption across industrial applications. As of December 2024, the West Marmara region had a total population of 3,832,502, constituting around 4.5% of Turkey's overall population.

The region’s logistical advantages also reinforce Marmara’s leadership in the citric acid market. Proximity to major ports, advanced transportation networks, and export-oriented industrial zones enables efficient raw material sourcing and product distribution. Marmara’s developed infrastructure supports just-in-time manufacturing and cost-efficient supply chains. Additionally, the presence of multinational food and pharmaceutical companies encourages adoption of standardized, high-quality citric acid inputs. Strong industrial clustering, skilled labor availability, and investment-friendly conditions continue to position Marmara as Turkey’s primary citric acid demand hub.

Market Dynamics:

Growth Drivers:

Why is the Turkey Citric Acid Market Growing?

Expanding Foodservice Industry

The thriving foodservice industry in Turkey is a key driver of citric acid demand, as restaurants, cafés, bakeries, and quick-service outlets increasingly rely on standardized ingredients to maintain consistent taste, quality, and shelf life. As per USDA, in Turkey, consumer spending in the foodservice industry increased to USD 18.6 Billion in 2023. In sauces, drinks, marinades, sweets, and processed meals served in a variety of foodservice settings, citric acid is frequently utilized as an acidulant and taste enhancer. The continuous usage of citric acid is supported by the increased bulk procurement of food ingredients brought about by the rapid rise of cloud kitchens and chain restaurants. The need for ready-to-use food preparations that require efficient pH control and preservation is further enhanced by growing tourism and urban dining culture. By preventing microbial growth in high-volume kitchens, citric acid also promotes adherence to food safety regulations. Citric acid adoption is also strengthened by the trend of consuming clean-label, fresh-tasting meals that promote the use of naturally sourced additives. Turkey's dynamic foodservice ecosystem continues to drive demand through the expansion of catering services, institutional dining, and takeout platforms.

Increasing Use in Cosmetics and Personal Care Products

The cosmetics and personal care industry in Turkey is emerging as an important driver for citric acid consumption. Citric acid is widely used in skincare, haircare, and personal hygiene products as a pH adjuster, chelating agent, and mild exfoliant. Rising consumer preference for dermatologically safe and naturally derived ingredients is encouraging manufacturers to replace harsher synthetic chemicals with citric acid. Growth in premium skincare, organic cosmetics, and multifunctional beauty products further supports demand. Citric acid helps enhance product stability, improve texture, and boost the effectiveness of active ingredients, making it valuable in modern cosmetic formulations. The expansion of local cosmetic brands and increasing export activities to Europe and the Middle East also stimulate ingredient demand. Additionally, heightened focus on hygiene and personal grooming has increased consumption of soaps, shampoos, and cleansers, which commonly incorporate citric acid. These trends collectively strengthen the market outlook.

Broadening Industrial and Household Cleaning Applications

Citric acid’s growing adoption in industrial and household cleaning products is a key factor fueling the market growth in Turkey. Its effectiveness as a natural descaling, chelating, and antimicrobial agent makes it a preferred alternative to harsh chemical cleaners. Rising environmental awareness and stricter regulations on hazardous cleaning chemicals are pushing manufacturers towards biodegradable and eco-friendly formulations. Citric acid is extensively used in detergents, surface cleaners, dishwashing products, and industrial cleaning solutions for food processing and hospitality sectors. Households increasingly favor natural cleaning products perceived as safer for health and the environment. Growth in hospitality and commercial facilities further boosts demand for effective yet sustainable cleaning agents. Citric acid’s versatility, cost efficiency, and regulatory acceptance make it suitable for both consumer and industrial applications. As sustainability-focused consumption continues to grow, citric acid remains a critical ingredient supporting greener cleaning solutions across Turkey.

Market Restraints:

What Challenges the Turkey Citric Acid Market is Facing?

Raw Material Price Volatility and Supply Chain Dependencies

The market for citric acid in Turkey is hampered by its dependence on foreign suppliers and the volatility of raw material prices. Consistent carbohydrate feedstocks, whose prices are influenced by fluctuations in the agricultural commodity market, are necessary for the manufacturing of citric acid. Due to Turkey's substantial imports of citric acid, the market is vulnerable to changes in global prices and supply interruptions. Depreciation of currency increases import expenses and puts pressure on domestic distributors and end users looking for competitive procurement options.

Competition from Alternative Acidulants and Preservatives

The citric acid market faces competitive threats from alternative organic acids and preservation methods. For certain food applications, lactic acid, tartaric acid, and malic acid provide similar acidulation qualities, which can restrict the use of citric acid in some product categories. Other options include natural antibacterial chemicals and high-pressure processing, two emerging preservation approaches. When formulation flexibility allows, cost-conscious food makers may replace citric acid with less expensive acidulants.

Regulatory Compliance and Quality Certification Requirements

Stringent regulatory requirements governing food-grade and pharmaceutical-grade citric acid specifications create compliance burdens for market participants. Manufacturers and distributors must maintain rigorous quality control systems and certification documentation to serve regulated end use applications. Meeting international quality standards requires substantial investment in testing capabilities and documentation systems. Evolving regulatory frameworks across different application sectors necessitate continuous compliance monitoring and adaptation.

Competitive Landscape:

The Turkey citric acid market exhibits a moderately consolidated competitive structure, characterized by the presence of international chemical distributors and domestic trading companies serving diverse end-user industries. Market participants compete through product quality differentiation, technical service capabilities, and logistics efficiency to secure customer relationships. Leading distributors maintain strategic partnerships with global citric acid manufacturers to ensure consistent supply availability and competitive pricing. Companies are investing in expanded warehousing facilities, application development laboratories, and technical support teams to enhance value-added service offerings. Distribution network optimization and digital ordering platforms are becoming increasingly important for maintaining competitive positions in the evolving market landscape.

Turkey Citric Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Food and Beverages, Household Detergents and Cleaners, Pharmaceuticals, Others |

| Forms Covered | Anhydrous, Liquid |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey citric acid market reached a volume of 42,000 Million Tons in 2025.

The Turkey citric acid market is expected to grow at a compound annual growth rate of 4.99% from 2026-2034 to reach 65,100 Million Tons by 2034.

Food and beverages dominated the market with a share of 49%, driven by extensive utilization as a natural acidulant and preservative in processed foods, carbonated drinks, and confectionery products.

Key factors driving the Turkey citric acid market include expanding F&B processing industry, growing pharmaceutical sector demand, and rising adoption of eco-friendly cleaning products. Additionally, increasing use of citric acid in cosmetics and personal care formulations as a natural pH regulator is supporting market growth.

Major challenges include raw material price volatility and supply chain dependencies, competition from alternative acidulants and preservatives, and stringent regulatory compliance and quality certification requirements. Additionally, fluctuations in export demand and currency exchange rates create uncertainty for long-term production planning and investment decisions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)