Turkey Craft Beer Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, and Region, 2025-2033

Turkey Craft Beer Market Overview:

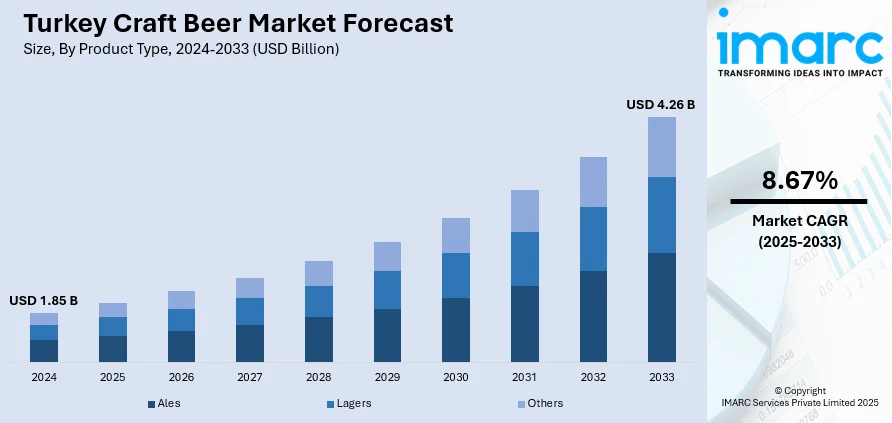

The Turkey Craft Beer market size reached USD 1.85 Billion in 2024. The market is projected to reach USD 4.26 Billion by 2033, exhibiting a growth rate (CAGR) of 8.67% during 2025-2033. The market is experiencing slow growth, fueled by rising interest in premiums and locally produced beers. Younger adults and urban dwellers are leading demand for alternative flavors and artisan brewing methods. Though classic distribution via bars and restaurants continues, e-tail and specialty retail channels are broadening visibility and accessibility. The market is also fostered by changing taste trends and cultural acceptability towards international beverage influences. These advancements are continuously improving the Turkey craft beer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 4.26 Billion |

| Market Growth Rate 2025-2033 | 8.67% |

Turkey Craft Beer Market Trends:

Flavor Innovation Reflects Local Heritage

Turkey’s craft beer scene is experiencing a surge in flavor experimentation rooted in regional traditions and local ingredients. Brewers are integrating Turkish staples such as pomegranate, cherry, and locally harvested honey into lagers, sours, and pale ales to create unique brews with cultural resonance. Throughout 2024, events like regional tastings and festivals have highlighted these heritage-driven beers, offering consumers deeper insight into flavor origins and artisanal brewing techniques. Breweries in cities like Istanbul and Izmir are actively promoting these locally inspired blends through curated pairing sessions and community-led tastings. This movement showcases how cultural authenticity and culinary innovation are defining modern craft brewing in Turkey. These efforts align closely with evolving Turkey craft beer market trends, emphasizing differentiation, storytelling, and regional identity. As this approach gains momentum, local producers are strengthening their market presence amid increasing domestic and international competition while also appealing to domestic consumers and international visitors. The fusion of traditional ingredients with contemporary brewing methods establishes a strong foundation for long-term market growth and resilience.

To get more information on this market, Request Sample

Festival Expansion Accelerates Growth

The Turkish craft beer sector witnessed notable expansion in 2024, marked by an uptick in beer festivals and new taproom openings across the country. High-traffic events in Istanbul and Ankara drew large, enthusiastic crowds eager to explore unique small-batch brews and experimental lagers. These gatherings foster community engagement and promoting the artisanal movement by creating direct feedback loops between brewers and consumers. Meanwhile, the rise of taprooms especially in emerging markets like Izmir and Antalya has improved access to fresh, innovative craft beer and reinforced experiential consumption. This environment supports increasing Turkey craft beer market growth, as visibility and public interest in the category continue to climb. Beyond urban centers, regional penetration is gaining pace, adding geographic diversity and expanding reach. Enhanced consumer loyalty, strengthened distribution, and vibrant event culture are shaping a robust platform for sustained development. These factors indicate a structurally evolving landscape where demand is being met with both cultural relevance and consistent innovation.

Sustainability & Digital Traceability Shape Future

In 2025, Turkish craft breweries are actively incorporating sustainability initiatives and digital engagement into their long-term strategies. Breweries are investing in environmentally friendly practices ranging from energy-efficient brewing systems and recyclable cans to waste reduction and water-saving technologies. Many also emphasize transparency, with QR-code labeling, digital storytelling, and virtual tasting sessions allowing customers to trace ingredients and learn about eco-friendly practices. This intersection of innovation and accountability aligns with changing expectations among modern consumers, particularly younger demographics who prioritize ethical consumption and sustainability. The combination of mindful production methods with real-time consumer engagement is redefining brand loyalty and authenticity in the sector. These priorities underscore emerging market, as values-driven consumers seek brands that align with environmental stewardship and quality craftsmanship. By embracing traceability and green brewing processes, Turkey’s craft beer industry is creating a future-ready model that resonates with evolving market needs and regulatory focus. This positions the sector for enduring competitiveness, built on both social trust and innovative agility.

Turkey Craft Beer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, and distribution channel.

Product Type Insights:

- Ales

- Lagers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ales, lagers, and others.

Age Group Insights:

- 21–35 Years Old

- 40–54 Years Old

- 55 Years and Above

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 21–35 years old, 40–54 years old, and 55 years and above.

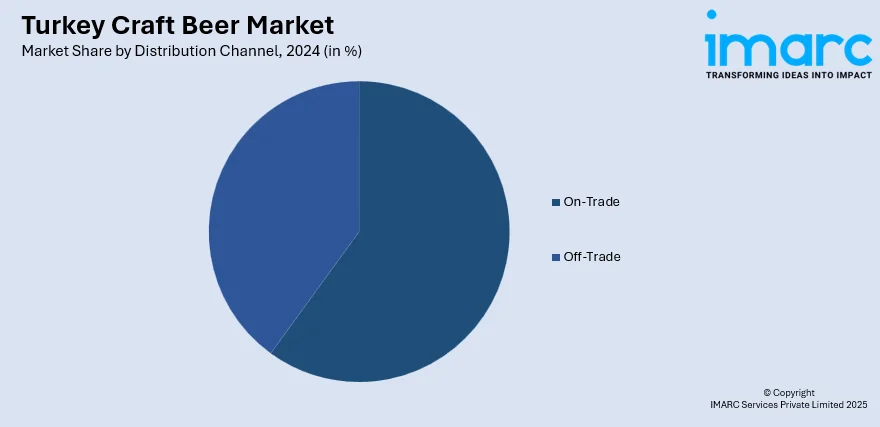

Distribution Channel Insights:

- On-Trade

- Off-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes on-trade and off-trade.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Craft Beer Market News:

- October 2024: Big Ditch Brewing has unveiled Turkey Trotter, a blonde ale crafted as the official beer for Buffalo’s iconic Turkey Trot race. The brew, featuring crackery malt and light fruity hops, was launched at the brewery and will be available at the YMCA post‑race celebration. Now in its third year, the collaboration honors a cherished local Thanksgiving tradition by offering runners and attendees a refreshing finish‑line pint. The partnership continues to support community spirit in Western New York

Turkey Craft Beer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ales, Lagers, Others |

| Age Groups Covered | 21–35 Years Old, 40–54 Years Old, 55 Years and Above |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey craft beer market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey craft beer market on the basis of product type?

- What is the breakup of the Turkey craft beer market on the basis of age group?

- What is the breakup of the Turkey craft beer market on the basis of distribution channel?

- What is the breakup of the Turkey craft beer market on the basis of region?

- What are the various stages in the value chain of the Turkey craft beer market?

- What are the key driving factors and challenges in the Turkey craft beer?

- What is the structure of the Turkey craft beer market and who are the key players?

- What is the degree of competition in the Turkey craft beer market?

key benefits for stakeholders:

- Imarc’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey craft beer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey craft beer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. it helps stakeholders to analyze the level of competition within the Turkey craft beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)