Turkey Diaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Turkey Diaper Market Summary:

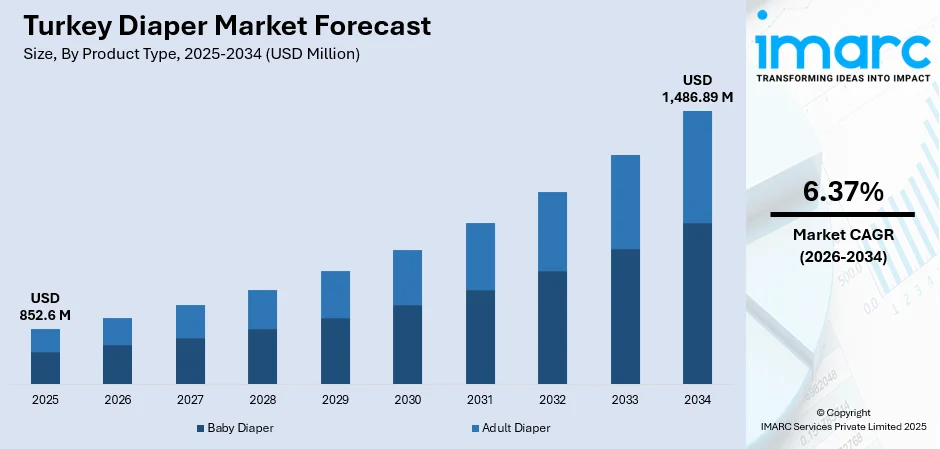

The Turkey diaper market size was valued at USD 852.6 Million in 2025 and is projected to reach USD 1,486.89 Million by 2034, growing at a compound annual growth rate of 6.37% from 2026-2034.

The Turkey diaper market is undergoing steady growth due to the changing lifestyles of consumers, rapid urbanization, and the growing knowledge about hygiene standards among Turkish families. Increasing disposable income is giving consumers the ability to focus on the quality and comfort of the baby and adult care products, which are causing more people to embrace the high-end diaper products. Increased involvement of women in the labor force has increased the pressure on easy-to-use, time-saving diapers. Additionally, the expansion of modern retail infrastructure and e-commerce platforms is enhancing product accessibility across urban and semi-urban regions, supporting sustained growth in the Turkey diaper market share.

Key Takeaways and Insights:

- By Product Type: Baby Diaper dominates the market with a share of 88% in 2025, driven by Turkey's family-oriented culture and the widespread adoption of disposable products among modern urban households seeking convenience and superior hygiene.

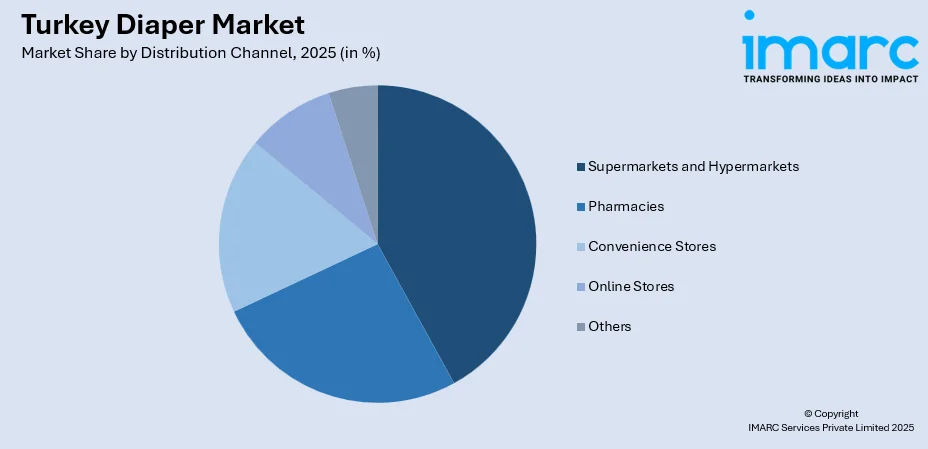

- By Distribution Channel: Supermarkets and Hypermarkets lead the market with a share of 42% in 2025, supported by extensive product variety, competitive pricing strategies, and the convenience of one-stop shopping experiences for Turkish consumers.

- Key Players: The Turkey diaper market features a competitive landscape with domestic manufacturers leveraging local production capabilities alongside multinational corporations introducing innovative products, resulting in diverse pricing tiers and quality options for consumers across all segments.

To get more information on this market Request Sample

The Turkey diaper market is positioned for robust growth as manufacturers respond to shifting consumer preferences and demographic dynamics. Technological advancements in absorbent materials and skin-friendly formulations are enhancing product performance while addressing health-conscious consumer demands. The retail landscape is transforming with major e-commerce platforms expanding their baby care offerings and providing exclusive discounts that drive online adoption. The Turkey retail market size reached USD 391.2 Billion in 2024. Looking forward, the market is expected to reach USD 868.3 Billion by 2033, exhibiting a growth rate (CAGR) of 8.30% during 2025-2033. Furthermore, increasing environmental awareness is stimulating demand for biodegradable and eco-friendly diaper alternatives, with manufacturers investing in sustainable product development to capture emerging market opportunities across urban and rural markets.

Turkey Diaper Market Trends:

E-commerce Expansion and Digital Retail Growth

Online retail channels are experiencing accelerated growth in Turkey's diaper sector as digital platforms enhance product accessibility and convenience. Major e-commerce marketplaces are expanding their baby care product portfolios while offering exclusive promotions and subscription services. The proliferation of mobile shopping applications is enabling parents to compare prices and access diverse brand options seamlessly. The Turkey e-commerce market size reached USD 235.1 Billion in 2024. Looking forward, the market is expected to reach USD 1,774.5 Billion by 2033, exhibiting a growth rate (CAGR) of 25.18% during 2025-2033, strengthening integrated payment solutions and buy-now-pay-later options that enhance consumer purchasing flexibility across the Turkey diaper market growth.

Rising Demand for Eco-Friendly and Sustainable Products

Environmental consciousness is shaping purchasing decisions among Turkish parents who increasingly seek biodegradable and organic diaper alternatives. Manufacturers are responding by developing plant-based materials, chlorine-free processing methods, and recyclable packaging solutions. Sustainability certifications and eco-labels are becoming influential factors in brand selection as consumers prioritize reduced environmental impact. In February 2025, Ontex launched its Dreamshields diaper technology featuring advanced leakage protection while reducing carbon dioxide emissions, reflecting the industry's commitment to combining innovation with environmental responsibility.

Premiumization and Advanced Product Features

Turkish consumers are demonstrating growing preference for premium diapers offering superior absorption, breathable materials, and dermatologically tested formulations. Rising disposable incomes are enabling families to prioritize comfort and skin health over price considerations. Manufacturers are introducing wetness indicators, hypoallergenic materials, and enhanced leak protection technologies to address evolving expectations. In May 2025, Ontex Group introduced its 360-degree anti-leak barrier technology featuring channeled absorbent cores, cloud-soft materials, and navel cutouts for newborns, demonstrating the industry trend toward specialized comfort-focused innovations.

Market Outlook 2026-2034:

The Turkey diaper market outlook remains positive as urbanization accelerates and modern retail infrastructure expands across metropolitan and secondary cities. Government initiatives promoting family welfare and child health awareness are expected to sustain demand fundamentals. Manufacturers are strategically investing in production capacity upgrades and distribution network optimization to capture emerging market opportunities. The adult diaper segment is anticipated to experience accelerated growth as Turkey's population aged 65 and above has exceeded 10.6 percent, creating new demand dynamics. The market generated a revenue of USD 852.6 Million in 2025 and is projected to reach a revenue of USD 1,486.89 Million by 2034, growing at a compound annual growth rate of 6.37% from 2026-2034.

Turkey Diaper Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Baby Diaper | 88% |

| Distribution Channel | Supermarkets and Hypermarkets | 42% |

Product Type Insights:

- Baby Diaper

- Disposable Diaper

- Training Diaper

- Cloth Diaper

- Swim Pants

- Biodegradable Diaper

- Adult Diaper

- Pad Type

- Flat Type

- Pant Type

The Baby Diaper segment dominates with a market share of 88% of the total Turkey diaper market in 2025.

The baby diaper segment maintains commanding market presence driven by Turkey's family-centric cultural values and consistent demand from households with infants and toddlers. Urbanization has transformed parenting practices as working parents increasingly rely on disposable diapers for convenience and time efficiency. Modern Turkish families prioritize hygiene and comfort, driving preference for high-quality absorbent products. Turkish manufacturer Hayat Kimya, ranked as the world's fifth largest branded baby diaper producer, operates several production sites across multiple countries and exports its Molfix brand to numerous nations, demonstrating the strength of local manufacturing capabilities.

Product innovation remains central to competitive positioning within the baby diaper category. Manufacturers are introducing advanced features, including wetness indicators, breathable outer layers, and dermatologically tested materials to differentiate offerings. The growing demand for training diapers reflects evolving consumer needs as parents seek transitional products supporting developmental milestones. Biodegradable baby diapers are gaining traction among environmentally conscious consumers, with manufacturers investing in plant-based materials and sustainable production processes to capture this emerging demand segment.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

The Supermarkets and Hypermarkets segment leads with a share of 42% of the total Turkey diaper market in 2025.

Supermarkets and hypermarkets remain key distribution channels for diaper products in Turkey, giving consumers broad product choices and attractive pricing through bulk-buying formats. Large retail chains offer convenient one-stop shopping, allowing parents to purchase diapers along with other household essentials. Frequent promotions and loyalty programs strengthen customer engagement and encourage repeat purchases. Many retailers are also enhancing their omnichannel capabilities by integrating physical store networks with online ordering and home delivery to meet changing consumer preferences.

Online stores represent the fastest-growing distribution channel as digital commerce penetration accelerates across Turkey. E-commerce platforms are leveraging technology to provide personalized recommendations, subscription services, and competitive pricing that attract digitally savvy parents. The convenience of home delivery and access to extensive brand portfolios unavailable in local stores is driving online adoption. Turkey's young population, with half under 30 years old, demonstrates strong preference for mobile shopping, with 91% of online transactions completed via mobile devices in 2023.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

Marmara’s dense population, high urbanization, and greater household purchasing power strongly support diaper demand. The region’s well-developed retail ecosystem, including supermarkets, pharmacies, and e-commerce distribution hubs, ensures broad product availability. Parents increasingly prefer premium, dermatologically tested diapers, boosting sales of advanced and eco-friendly options. The presence of major hospitals and maternity clinics further drives newborn diaper consumption across the region.

Central Anatolia benefits from a growing young population, expanding middle-income households, and improving maternal healthcare services. Ankara’s strong retail presence and access to modern baby care products help increase diaper adoption. Rising awareness of hygiene and skin-friendly formulations encourages parents to shift toward higher-quality diaper brands. The region also sees growing online purchasing behavior, strengthening demand for both newborn and toddler diaper categories.

The Mediterranean Region’s expanding family population, coupled with rising urban migration, fuels consistent diaper demand. Widespread retail penetration and active e-commerce usage make diapers easily accessible for households. The region’s warm climate also increases the preference for breathable, lightweight diaper varieties. Growing health and hygiene awareness among parents supports demand for hypoallergenic and natural-material diapers, sustaining steady market growth across major cities and coastal areas.

In the Aegean Region, diaper demand is driven by a young demographic base, rising disposable incomes, and strong access to maternity and pediatric healthcare services. Urban centers like Izmir see increasing preference for premium and eco-conscious diaper products. Retail chains and online marketplaces expand consumer reach, while heightened awareness of baby skincare encourages parents to choose gentle, high-absorbency diaper solutions for everyday use.

Southeastern Anatolia’s diaper market is supported by a high birth rate, growing household incomes, and greater availability of baby care products through expanding retail networks. Government initiatives promoting maternal and child health increase awareness around hygiene practices, boosting diaper usage. As lifestyle patterns modernize, parents increasingly adopt disposable diapers over traditional alternatives. Demand for affordable yet reliable diaper options remains strong across both urban and semi-urban areas.

The Black Sea Region experiences steady diaper demand driven by a family-oriented population structure and improving access to retail and healthcare facilities. Consumers show growing preference for gentle, absorbent diaper varieties suited to the region’s humid climate. Expansion of local supermarkets and online delivery services enhances product accessibility. Increased health awareness among new parents continues to support demand for dermatologically safe diaper options.

Eastern Anatolia’s diaper market is shaped by improving maternal healthcare access, rising awareness of modern childcare practices, and expanding retail availability. As urbanization increases, more families shift from cloth-based solutions to disposable diapers. Affordability remains a key factor, driving sales of value-focused diaper brands. Educational campaigns promoting hygiene and infant well-being further encourage consistent use of diapers across both cities and smaller towns.

Market Dynamics:

Growth Drivers:

Why is the Turkey Diaper Market Growing?

Urbanization and Modern Lifestyle Adoption

Rapid urbanization across Turkey is fundamentally transforming childcare practices and household consumption patterns. Metropolitan expansion has created time-constrained lifestyles where working parents increasingly depend on convenient disposable diaper solutions. Urban families exhibit greater exposure to modern shopping environments and international product standards, elevating expectations for quality and innovation. Nuclear family structures prevalent in cities amplify reliance on commercial baby care products as traditional extended family support diminishes. Infrastructure development in secondary cities is extending urban consumption patterns to previously underserved markets. In 2024, Turkey recorded approximately 937,559 live births, with urbanized provinces demonstrating higher per capita diaper consumption as modern retail access and purchasing power converge to drive market penetration.

Rising Disposable Incomes and Consumer Premiumization

Economic advancement in Turkey is enabling consumers to prioritize product quality and performance over price considerations when selecting baby and adult care products. Growing middle-class populations demonstrate a willingness to invest in premium diapers offering superior absorption, skin-friendly materials, and advanced features. Health and wellness consciousness is driving demand for dermatologically tested and hypoallergenic products that minimize irritation risks. Brand awareness has increased substantially as parents conduct research and compare product specifications before making purchase decisions. The premiumization trend is also shaping the adult diaper segment, as aging consumers increasingly look for comfortable, discreet, and high-quality options. Expanding e-commerce adoption is giving shoppers greater access to a wider range of premium and international brands that were previously harder to find in traditional retail stores, further supporting the shift toward upgraded product preferences.

Expanding Adult Diaper Demand from Demographic Shifts

Turkey’s ongoing demographic shift is fueling rising demand for adult diapers as the share of older adults continues to grow. Longer life expectancy and a higher incidence of age-related conditions are prompting greater reliance on incontinence care products. Increasing health awareness and educational efforts are helping reduce the stigma around adult diaper use, supporting wider acceptance among consumers. Hospitals, clinics, and home-care providers are integrating these products into regular care routines. At the same time, advancements that improve discretion, comfort, and mobility are resonating with active seniors who value independence and dignity. As a result, the adult diaper segment is expanding at a faster pace than the baby diaper market, supported by evolving consumer needs, better product design, and a more open attitude toward modern incontinence solutions.

Market Restraints:

What Challenges the Turkey Diaper Market is Facing?

Declining Birth Rates and Fertility Challenges

Turkey is experiencing a significant drop in birth rates, which is expected to affect long-term demand for baby diapers. Economic pressures and higher living costs are prompting many young adults to reconsider or delay parenthood. In addition, variations in fertility across different regions are creating uneven market demand, pushing manufacturers to tailor their distribution and supply strategies.

Economic Pressures and Inflationary Impact

Persistent inflation and currency fluctuations affect consumer purchasing power and influence price sensitivity in diaper purchasing decisions. Economic pressures compel some households to seek lower-cost alternatives or reduce consumption frequency. Raw material cost increases challenge manufacturers' ability to maintain competitive pricing while preserving product quality and profit margins.

Intense Competitive Market Dynamics

The Turkey diaper market features intense competition between established domestic manufacturers and multinational corporations with significant marketing resources. Price competition in mass-market segments constrains profit margins for smaller producers lacking economies of scale. Brand loyalty and distribution network strength create barriers for new market entrants seeking to establish competitive positioning.

Competitive Landscape:

The Turkey diaper market exhibits dynamic competitive characteristics with domestic manufacturers holding substantial market presence alongside multinational personal care corporations. Turkish producers leverage local manufacturing advantages, established distribution networks, and regional brand recognition to maintain competitive positioning. International players compete through product innovation, premium brand positioning, and marketing investments targeting urban consumer segments. Competition extends across price tiers from economy to premium categories, with manufacturers differentiating through technological features, sustainability credentials, and product performance. Strategic partnerships, production capacity expansions, and e-commerce channel development represent key competitive initiatives as companies seek to capture evolving market opportunities.

Recent Developments:

- In November 2025, Pampers launched its smallest diaper to date, the Swaddlers “Preemie Extra Extra Small” (Pxxs), crafted specifically for the delicate skin of extremely premature infants. Made from ultra-soft, high-quality materials, this carefully designed product supports NICU teams in delivering exceptional comfort and care to the tiniest newborns. In a separate development, Ontex Group NV finalized the sale of its operations in Turkey to Dilek Grup.

Turkey Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey diaper market size was valued at USD 852.6 Million in 2025.

The Turkey diaper market is expected to grow at a compound annual growth rate of 6.37% from 2026-2034 to reach USD 1,486.89 Million by 2034.

Baby Diaper held the largest market share at 88% in 2025, driven by Turkey's family-oriented culture, urbanization trends, and growing preference for convenient disposable hygiene products among modern households.

Key factors driving the Turkey diaper market include rapid urbanization and lifestyle modernization, rising disposable incomes enabling premium product adoption, expanding e-commerce channels, growing adult diaper demand from aging demographics, and increasing environmental awareness driving sustainable product development.

Major challenges include declining birth rates affecting baby diaper demand growth, economic pressures and inflation impacting consumer purchasing power, intense competition between domestic and international manufacturers, and raw material cost fluctuations affecting production economics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)