Turkey EdTech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Region, 2026-2034

Turkey EdTech Market Overview:

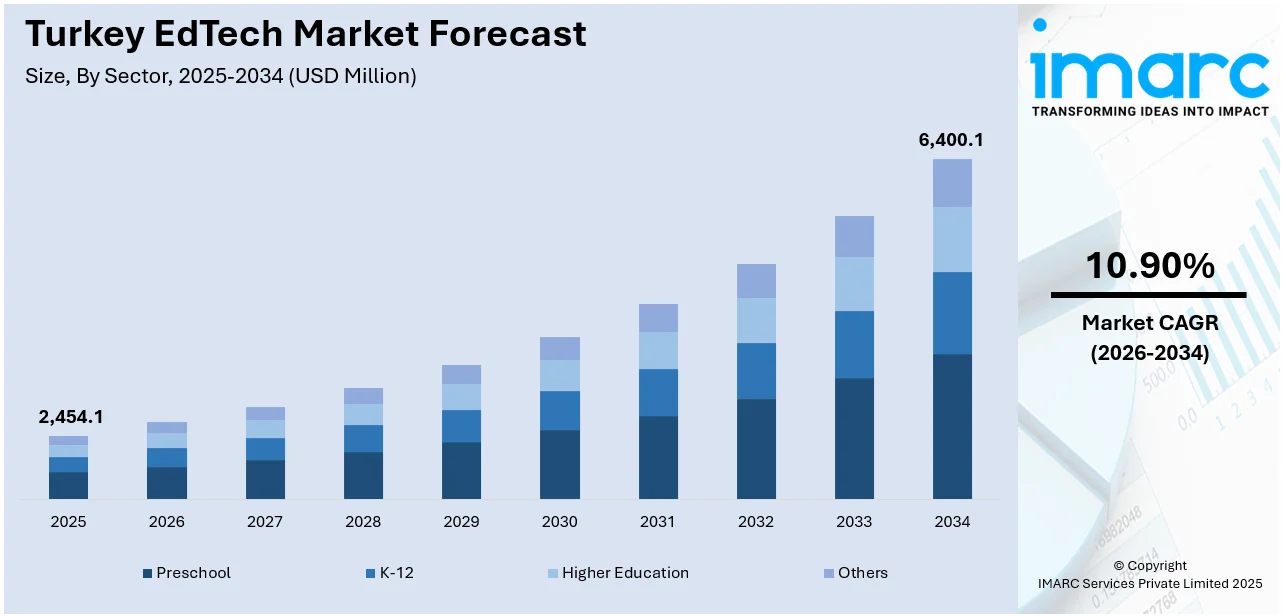

The Turkey EdTech market size reached USD 2,454.1 Million in 2025. The market is projected to reach USD 6,400.1 Million by 2034, exhibiting a growth rate (CAGR) of 10.90% during 2026-2034. The demand is fueled by an expanding need for online education, government support for the uptake of technology, and deepening internet penetration. The advancement of e-learning platforms and AI inclusion in learning is playing a great role in contributing to Turkey EdTech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,454.1 Million |

| Market Forecast in 2034 | USD 6,400.1 Million |

| Market Growth Rate 2026-2034 | 10.90% |

Turkey EdTech Market Trends:

Increasing Adoption of Online Learning Platforms

Online learning platforms are becoming increasingly popular in Turkey, stimulated by flexibility in accessibility and affordability. Such platforms are used by a vast array of consumers, ranging from K-12 students to college students and professionals. Consequently, both private and public education institutions are becoming more inclined to adopt online tools in conventional learning environments using hybrid models. Turkish EdTech firms are taking advantage of this trend by providing strong learning management systems (LMS), content delivery networks, and virtual classrooms that promote engaging, real-time learning experiences and drive the expansion of the Turkey EdTech market. For instance, in April 2024, Udemy was ranked 78th on TIME’s inaugural list of the World’s Top EdTech Companies for 2024. Recognized for its innovative online skills marketplace, Udemy serves over 69 million learners globally with a wide array of up-to-date courses. The platform also supports 16,000 companies with customized corporate learning solutions via Udemy Business. Additionally, Udemy is operational in Turkey, offering a diverse range of courses in multiple languages, including Turkish, to cater to local learners in fields such as technology, business, and personal development.

To get more information on this market Request Sample

Integration of Artificial Intelligence and Data Analytics in Education

Data analytics and Artificial Intelligence (AI) are revolutionizing the mode of education in Turkey. AI-based tools, including learning apps personalized for students, grading software, and student support chatbots, are optimizing learning experiences and making them more personalized. Data analytics is also assisting institutions in monitoring student progress, detecting learning gaps, and offering focused interventions. In the Turkey EdTech industry, this intertwinement of AI makes learning more efficient through adaptive and responsive processes for individual students. Additionally, AI benefits educators by streamlining their administrative responsibilities and enabling them to dedicate more time to teaching. As technologies continue to advance in AI, their widespread application will continue to propel the Turkey EdTech market growth, further improving educational outcomes. For instance, in April 2025, Seesaw, a global leader in PreK-12 learning experiences, acquired Little Thinking Minds, a MENA-based edtech startup specializing in Arabic literacy. This acquisition strengthens Seesaw's presence in the MENA region, adding culturally relevant content in Arabic and English. Seesaw plans to launch its first Arabic-language platform in 2026, expanding its multilingual offerings. The partnership aims to provide interactive learning tools, AI-driven assessments, and data insights, enhancing educational experiences for students, teachers, and ministries across the region.

Turkey EdTech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on sector, type, deployment mode, and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

Type Insights:

- Hardware

- Software

- Content

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes hardware, software, and content.

Deployment Mode Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises.

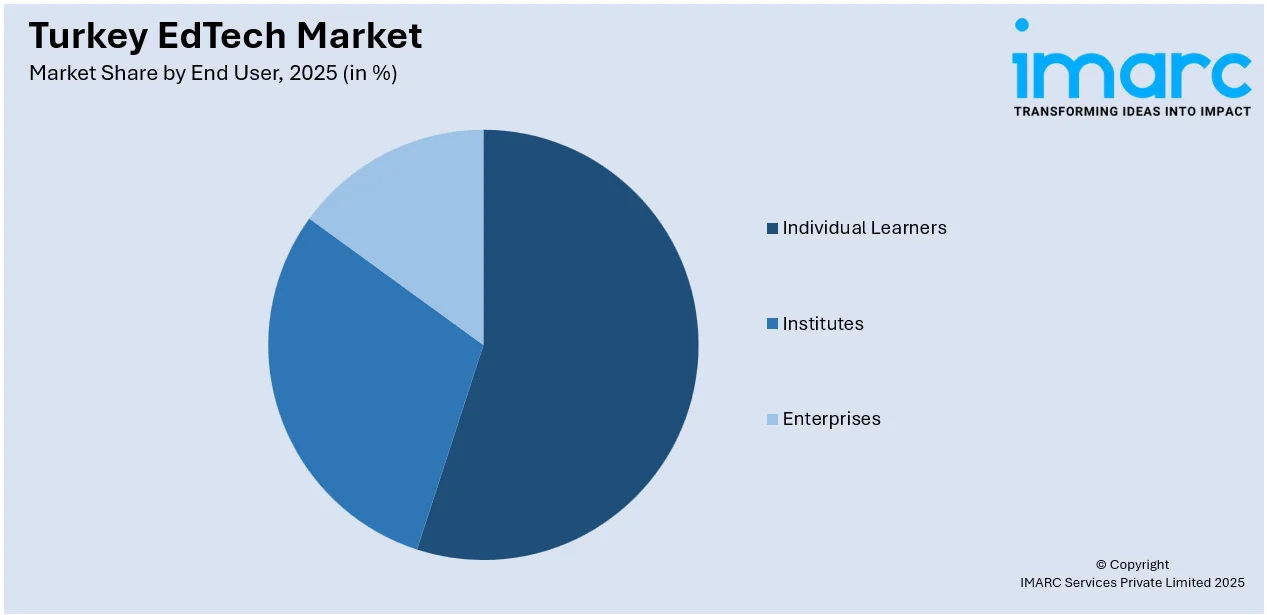

End User Insights:

Access the comprehensive market breakdown Request Sample

- Individual Learners

- Institutes

- Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual learners, institutes, and enterprises.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey EdTech Market News:

- In February 2025, Leverage Edu expanded its services to Turkey with the launch of LeverageTürkiye. The platform offers AI tools for counselors, a consumer app for students, and exclusive products designed to support Turkish students pursuing higher education abroad. With over 50,000 Turkish students studying abroad, the move capitalizes on Turkey's youthful population and increasing global mobility. Leverage Edu is also rolling out additional services like Fly Finance and Fly Homes in the region to cater to growing demand.

Turkey EdTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey EdTech market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey EdTech market on the basis of sector?

- What is the breakup of the Turkey EdTech market on the basis of type?

- What is the breakup of the Turkey EdTech market on the basis of deployment mode?

- What is the breakup of the Turkey EdTech market on the basis of end user?

- What is the breakup of the Turkey EdTech market on the basis of region?

- What are the various stages in the value chain of the Turkey EdTech market?

- What are the key driving factors and challenges in the Turkey EdTech market?

- What is the structure of the Turkey EdTech market and who are the key players?

- What is the degree of competition in the Turkey EdTech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey EdTech market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey EdTech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey EdTech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)