Turkey Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and Region, 2025-2033

Turkey Gaming Market Overview:

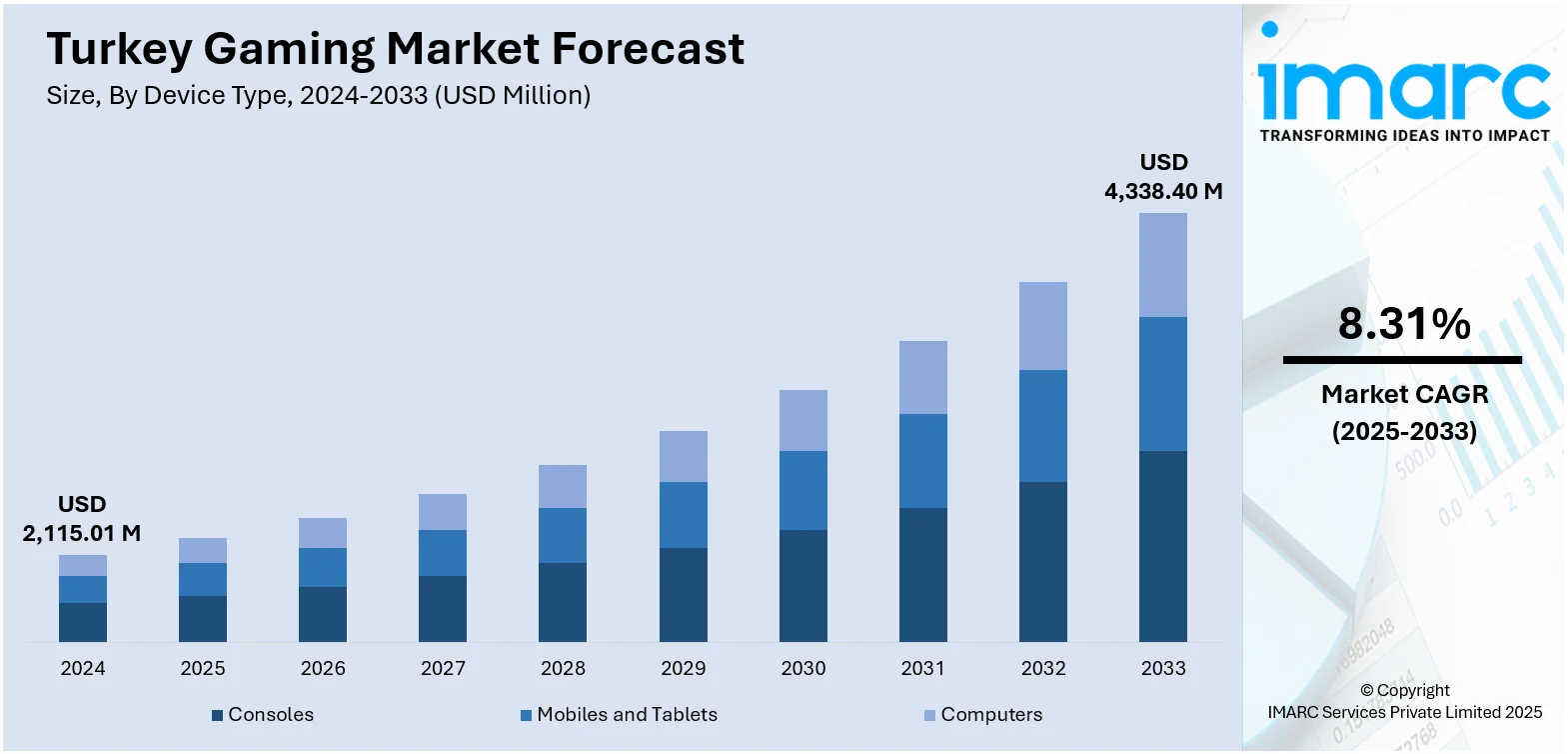

The Turkey gaming market size reached USD 2,115.01 Million in 2024. Looking forward, the market is projected to reach USD 4,338.40 Million by 2033, exhibiting a growth rate (CAGR) of 8.31%during 2025-2033. The market is driven by Turkey’s structured government incentives, developer incubation programs, and strong international investment in game studios. The mobile gaming segment benefits from deep smartphone penetration, digital payment adoption, and growing regional exports. Additionally, the increasing professionalization of esports and cross-sector collaborations are further augmenting the Turkey gaming market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,115.01 Million |

| Market Forecast in 2033 | USD 4,338.40 Million |

| Market Growth Rate 2025-2033 | 8.31% |

Turkey Gaming Market Trends:

Government Incentives and Growing Developer Ecosystem

Turkey’s gaming industry is supported by proactive government initiatives aimed at transforming the country into a regional technology and creative hub. As per recent industry reports, revenue in Turkey’s games market is projected to reach USD 3.33 Billion in 2025, with an expected annual growth rate (CAGR 2025–2030) of 7.38%, resulting in a projected market volume of USD 4.76 Billion by 2030. User penetration is anticipated to be 16.2% in 2025, increasing to 17.7% by 2030, with the number of users expected to reach 15.7 Million by the end of the forecast period. Additionally, the average revenue per user (ARPU) is estimated at USD 1,600, driven by Turkey’s rising demand for culturally relevant mobile games and esports experiences. The Turkish Technology Development Foundation (TTGV) and TÜBİTAK provide grants, tax incentives, and R&D subsidies specifically for game developers. Additionally, the Turkish Investment Office promotes foreign direct investment in the gaming sector, attracting international publishers and encouraging global studios to establish local operations. Game developer clusters in Istanbul, Ankara, and Izmir foster collaboration among studios, universities, and incubators, creating a structured development ecosystem. Educational institutions are increasingly introducing specialized programs in game design, programming, and animation to build a sustainable talent pipeline. Turkey’s game exports have gained traction, particularly in mobile and casual gaming markets across Europe and the Middle East. Local success stories, such as Peak Games and Dream Games, have inspired entrepreneurial growth and attracted significant global investment. These factors—combined with a strong digital services infrastructure—are positioning Turkey as a major content creation hub for global audiences, directly contributing to Turkey gaming market growth and increasing its international influence in interactive entertainment.

To get more information on this market, Request Sample

Rapid Expansion of Mobile Gaming Among Diverse Demographics

The rise of mobile gaming in Turkey reflects widespread smartphone adoption, improving internet connectivity, and a tech-savvy, youthful population. Turkish players demonstrate strong engagement with multiplayer online battle arenas (MOBAs), first-person shooters (FPS), and mobile strategy games, leading to consistently high download and play rates for both domestic and international titles. As of 2024, Turkey’s gaming market comprises 45 million PC gamers, 21 million mobile gamers, and 11 million console gamers. Local telecom operators support this growth through competitive data plans, game-specific bundles, and cloud gaming initiatives that make advanced gameplay accessible on mobile platforms. Payment integration through mobile wallets and digital banking services enables frictionless microtransactions, supporting the monetization of free-to-play titles. Influencer-driven marketing through YouTube and TikTok channels has fueled viral trends around popular mobile games, expanding audience reach beyond traditional gamer demographics. Turkish mobile game developers have achieved significant commercial success globally, capitalizing on user acquisition expertise and data-driven monetization models. Turkey hosts 844 active game studios, with 517 located in Istanbul, making it the second-largest game development hub in Europe after London. The country also has 13 dedicated gaming venture capital funds, accelerators, and incubators supporting a vibrant startup landscape. Additionally, government-led digital literacy programs have expanded technology access across urban and rural communities, driving broader market participation. The convergence of consumer demand, telecom innovation, and entrepreneurial expertise solidifies mobile gaming’s role as a primary growth engine within Turkey’s evolving gaming landscape.

Turkey Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device type, platform, revenue type, type, and age group.

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computers

The report has provided a detailed breakup and analysis of the market based on the device type. This includes consoles, mobiles and tablets, and computers.

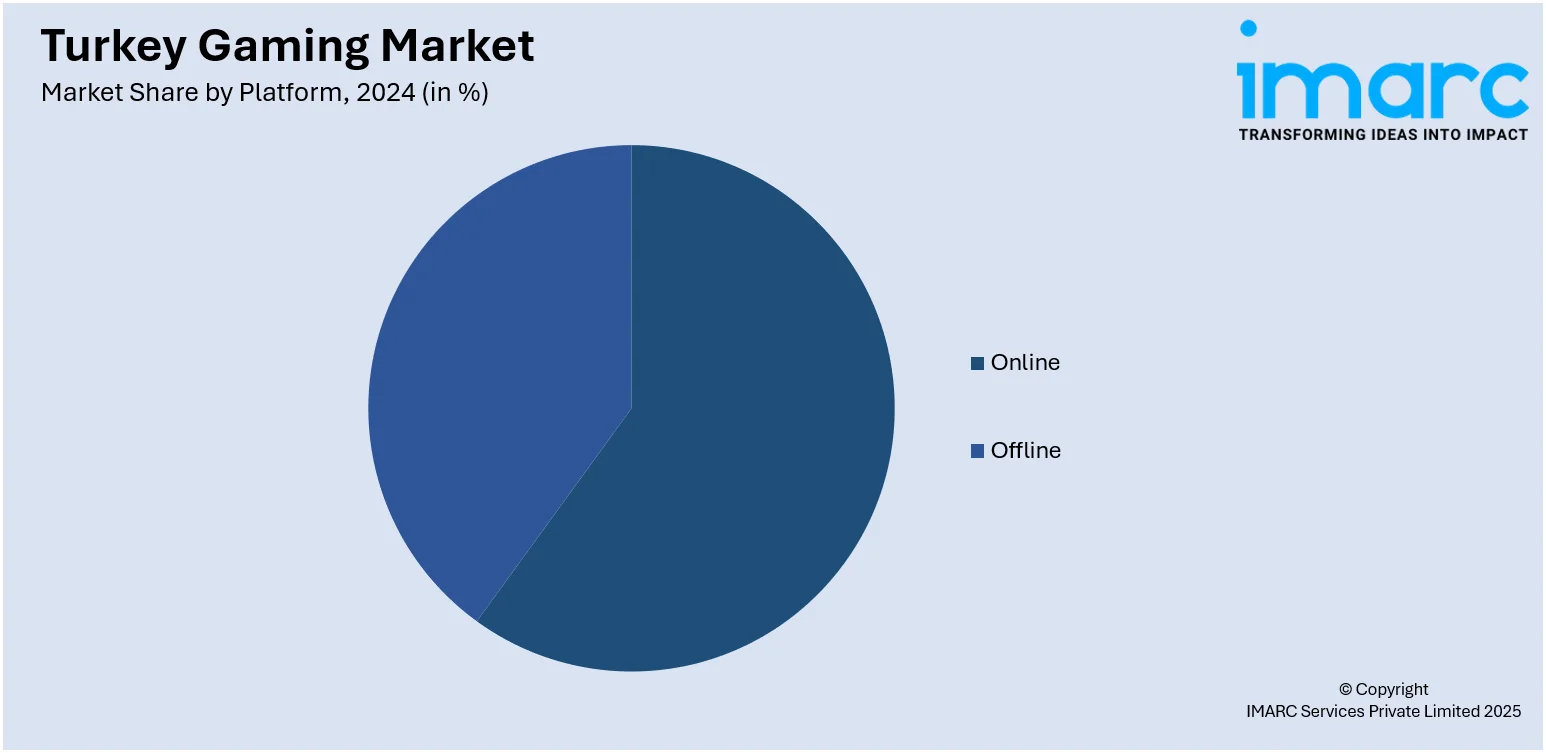

Platform Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the platform. This includes online and offline.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

The report has provided a detailed breakup and analysis of the market based on the revenue type. This includes in-game purchase, game purchase, and advertising.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Simulation

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes adventure/role playing games, puzzles, social games, strategy, simulation, and others.

Age Group Insights:

- Adults

- Children

The report has provided a detailed breakup and analysis of the market based on the age group. This includes adults and children.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all major regional markets. This includes Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Gaming Market News:

- On March 26, 2025, Turkish gaming studio Paxie Games was acquired by South Korea’s DoubleU Games in a deal worth USD 29.9 Million for a 60% stake, with the remainder structured as an earnout over three years. Paxie’s popular title Merge Studio: Fashion Makeover surpassed 28 million downloads and earned USD 34 Million in revenue by February 2025.

- On May 2, 2025, Turkish mobile gaming startup Dream Games secured USD 2.5 Billion through a combined debt and equity deal, elevating its total valuation to USD 5 Billion. The financing round, led by CVC Capital Partners with debt provided by Blackstone Inc., reflects Dream Games’ success with Royal Match, which generated approximately USD 1.4 Billion in revenue last year. This milestone underscores Turkey’s emergence as a global mobile gaming powerhouse, backed by repeatable success patterns and maturing investment ecosystems.

Turkey Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Stimulation, Others |

| Age Groups Covered | Adults, Children |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey gaming market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey gaming market on the basis of device type?

- What is the breakup of the Turkey gaming market on the basis of platform?

- What is the breakup of the Turkey gaming market on the basis of revenue type?

- What is the breakup of the Turkey gaming market on the basis of type?

- What is the breakup of the Turkey gaming market on the basis of age group?

- What is the breakup of the Turkey gaming market on the basis of region?

- What are the various stages in the value chain of the Turkey gaming market?

- What are the key driving factors and challenges in the Turkey gaming market?

- What is the structure of the Turkey gaming market and who are the key players?

- What is the degree of competition in the Turkey gaming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey gaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)