Turkey Glamping Market Size, Share, Trends and Forecast by Age Group, Accommodation Type, Booking Mode, and Region, 2026-2034

Turkey Glamping Market Summary:

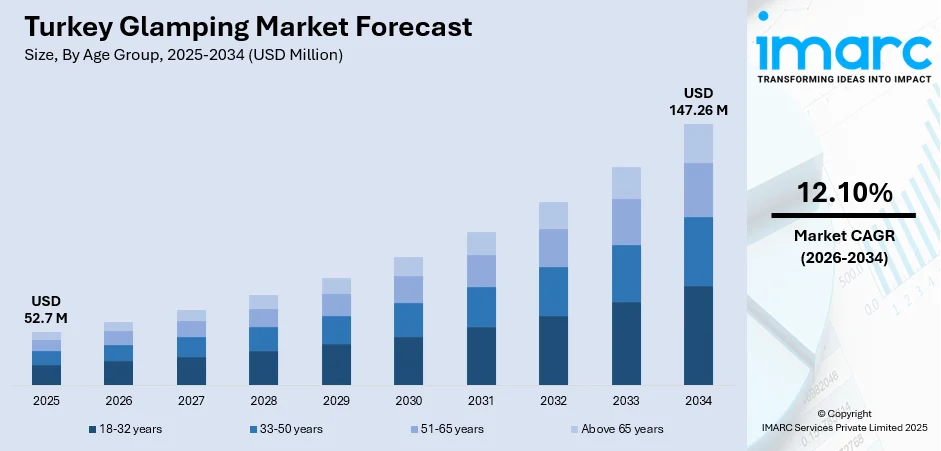

The Turkey glamping market size was valued at USD 52.7 Million in 2025 and is projected to reach USD 147.26 Million by 2034, growing at a compound annual growth rate of 12.10% from 2026-2034.

The market is experiencing robust expansion, driven by increasing consumer preferences for experiential outdoor travel that blends luxury with nature immersion. The growing environmental consciousness among travelers, particularly millennials and younger demographics, is accelerating the demand for eco-friendly accommodations across Turkey's diverse geographic regions. The country's strategic positioning at the crossroads of Europe and Asia, combined with its rich cultural heritage and varied natural landscapes, spanning Mediterranean coastlines to Cappadocian highlands, supports sustained growth of the market.

Key Takeaways and Insights:

- By Age Group: 18-32 years dominate the market with a share of 40% in 2025, driven by millennials and Gen Z travelers prioritizing experience-based travel over traditional accommodations and seeking social media-worthy destinations.

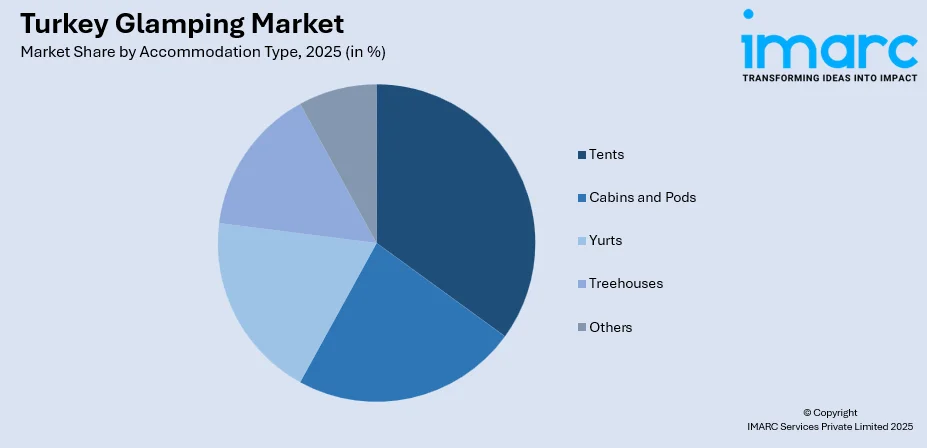

- By Accommodation Type: Tents lead the market with a share of 35% in 2025, owing to their versatility in deployment across Turkey's diverse terrain and alignment with authentic outdoor camping experiences enhanced by luxury amenities.

- By Booking Mode: Online travel agencies represent the largest segment with a market share of 50% in 2025, reflecting the digital-first behavior of younger travelers and the convenience of comparing diverse glamping options across multiple regions.

- Key Players: The Turkey glamping market exhibits moderate fragmentation with domestic operators competing alongside international hospitality brands, expanding their outdoor accommodation portfolios.

To get more information on this market, Request Sample

The Turkey glamping market benefits from the nation's established tourism infrastructure that continues to attract record-breaking visitor numbers. As per industry reports, in 2024, Turkey's tourism revenue reached a record high of USD 61.1 Billion, reflecting an 8.3% growth from 2023, with package tour spending increasing by 22.7%. Tourists are showing strong interest in eco-friendly stays, scenic locations, and wellness-focused travel, which supports glamping demand across coastal, forest, and mountainous regions. Domestic tourism and demand for short, experiential holidays are also rising, encouraging investments in luxury tents, cabins, and themed accommodations. Social media exposure is further increasing curiosity for distinctive stays. The growing awareness and changing travel preferences position glamping as a promising niche within the broader tourism industry in Turkey.

Turkey Glamping Market Trends:

Rising Demand for Eco-Conscious Outdoor Accommodations

Turkish travelers and international visitors increasingly seek sustainable lodging options that minimize environmental impact while providing comfortable nature immersion experiences. The Turkish tourism industry underwent comprehensive restructuring through a 3-year agreement with the Global Sustainable Tourism Council (GSTC), with 15,178 of Turkey's hotels being verified or certified as sustainable establishments, as of January 2024. Glamping sites across regions from the Black Sea to the Mediterranean coast are implementing renewable energy systems, waste reduction programs, and locally sourced materials to appeal to environmentally conscious consumers seeking responsible travel alternatives.

Integration of Wellness and Digital Detox Experiences

The integration of wellness and digital detox experiences is strongly driving the growth of the market in Turkey by attracting travelers who seek relaxation, mental balance, and escape from busy urban lifestyles. Glamping sites are increasingly offering yoga sessions, meditation spaces, spa treatments, and natural therapies that enhance physical and emotional wellbeing. Limited internet access or designated ‘no-screen zones’ encourage visitors to disconnect from devices and reconnect with nature. This appeals especially to working professionals and wellness-focused travelers. Rising youth population also prefers experience-based travel, wellness escapes, and digital detox holidays. According to industry reports, as of March 2024, approximately 50% of the Turkish population was under 30 years old.

Expansion of Digital Booking Platforms and Social Media Influence

The proliferation of online booking platforms and social media channels is transforming how travelers discover and book glamping experiences across Turkey. As per the DataReportal, in January 2025, Turkey had 58.5 Million social media user accounts, representing 66.7% of its entire population. Travelers can easily discover unique glamping stays, compare prices, read reviews, and book instantly. Social media showcases scenic locations and luxury tents, creating travel inspiration and influencing purchase decisions. Influencer content and real traveler posts build trust and excitement. Online promotions and mobile booking convenience further increase customer engagement.

Market Outlook 2026-2034:

The Turkey glamping market is positioned for sustained revenue expansion throughout the forecast period, supported by favorable tourism policies and infrastructure investments. As per the Republic of Türkiye Ministry of Culture and Tourism, the nation established an ambitious goal of attracting 65 Million international tourists and generating USD 64 Billion in tourism revenue by 2025. Government initiatives aimed at promoting sustainable tourism certification, coupled with the growing international hotel brand interest in outdoor hospitality concepts, are set to accelerate market development. The market generated a revenue of USD 52.7 Million in 2025 and is projected to reach a revenue of USD 147.26 Million by 2034, growing at a compound annual growth rate of 12.10% from 2026-2034.

Turkey Glamping Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Age Group | 18-32 years | 40% |

| Accommodation Type | Tents | 35% |

| Booking Mode | Online Travel Agencies | 50% |

Age Group Insights:

- 18-32 years

- 33-50 years

- 51-65 years

- Above 65 years

18-32 years dominate with a market share of 40% of the total Turkey glamping market in 2025.

The 18–32 age group holds prominence because it actively seeks travel that blends adventure, comfort, and social sharing. This segment values unique stays over traditional hotels and prefers destinations that offer scenic settings, digital connectivity, and memorable, experience-led getaways.

Young travelers are more responsive to visual storytelling on social media, where stylish tents, domes, and nature retreats create strong travel desire. They favor short breaks, group trips, and budget-friendly luxury, which glamping delivers efficiently. Turkey’s diverse landscapes enhance this appeal by offering beaches, mountains, and heritage sites within accessible distances. This age group also shows higher openness to sustainability-focused accommodations, aligning with eco-friendly glamping models. Easy online booking, influencer promotions, and peer recommendations further encourage trial and repeat visits among younger tourists.

Accommodation Type Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Cabins and Pods

- Tents

- Yurts

- Treehouses

- Others

Tents lead with a share of 35% of the total Turkey glamping market in 2025.

Tents dominate the market because they offer the strongest balance between outdoor experience and basic comfort. They allow travelers to stay close to nature without high costs, making them attractive to both operators and guests seeking affordable yet immersive luxury stays.

Canvas tents are flexible to install across beaches, forests, and mountain regions, enabling faster site development compared to cabins or domes. Their lower setup and maintenance costs help operators scale quickly and offer competitive pricing. For guests, tents create an authentic ‘under the stars’ feeling while still providing beds, lighting, and stylish interiors. Turkey’s climate in many tourist regions supports tent-based stays for extended seasons. Their aesthetic appeal also performs well on social media, increasing demand and occupancy rates.

Booking Mode Insights:

- Direct Booking

- Travel Agents

- Online Travel Agencies

Online travel agencies exhibit a clear dominance with a 50% share of the total Turkey glamping market in 2025.

Online travel agencies offer easy comparison, instant booking, and wide property visibility on a single platform. Travelers prefer online travel agencies for transparent pricing, real guest reviews, and flexible cancellation options, which reduce uncertainty when booking unfamiliar outdoor-style accommodations.

Online travel agencies also invest heavily in digital marketing, pushing glamping options through targeted ads and curated travel suggestions that influence younger audiences. Operators benefit from ready access to international tourists without building complex booking systems. Last-minute deals and bundled packages further attract price-sensitive travelers. In a market where glamping sites are often in remote locations, online travel agencies act as trusted discovery tools. In April 2025, Trippido, catering to Thailand, Turkey, Malaysia, Singapore, and additional locations, officially introduced its online platform, providing a simplified method for travel bookings for both individual travelers and travel agents. The platform offered a wide range of services, such as event and activity tickets, visa processing, lodging, transportation, and holiday rentals, enhancing the convenience and efficiency of trip planning.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

Marmara drives glamping demand due to high urban population and weekend travel culture. Proximity to major cities increases short-stay bookings, while lakesides and forests attract eco-tourists seeking luxury nature experiences within easy reach.

In Central Anatolia, glamping benefits from cultural tourism and scenic landscapes. Desert-style camps, cave-style stays, and wellness retreats attract travelers seeking calm surroundings and unique lodging experiences in historically rich and visually striking environments.

The Mediterranean region leads in beachside and resort-style glamping. Tourists prefer luxury tents near coastal areas offering sea views, outdoor activities, and wellness services, making it ideal for leisure travelers seeking comfort with an adventurous touch.

The Aegean region attracts glamping tourists with its natural beauty, olive groves, and tranquil coastlines. Visitors seek peaceful stays, eco-tourism, and boutique travel experiences, supporting strong glamping demand among both domestic and international travelers.

The Southeastern Anatolia region shows emerging glamping demand, driven by cultural tourism and heritage exploration. Visitors prefer traditional-style glamping experiences that reflect local culture. Infrastructure development and rising tourism awareness are gradually improving market potential.

The Black Sea region appeals to nature lovers with its forests, rivers, and mountain scenery. Rainforest-style glamping and wooden cabins attract tourists seeking cool weather, greenery, and quiet stays away from busy tourist routes.

Eastern Anatolia supports adventure-based glamping due to the presence of mountains and natural landscapes. Tourists interested in hiking, winter experiences, and remote destinations prefer insulated luxury camps offering comfort in cold and rugged environments.

Market Dynamics:

Growth Drivers:

Why is the Turkey Glamping Market Growing?

Expanding Tourism Infrastructure and International Visitor Growth

The Turkey tourism sector continues to attract substantial international investments supporting glamping market expansion across diverse regions. As per industry reports, Marriott International revealed plans to expand its portfolio by adding 20 Turkish properties to the approximately 50 properties it owns by the end of 2025. Radisson Hotel Group incorporated seven Turkish hotels, which included six signings and one new opening in early 2024, advancing towards its goal of 100 hotels in Turkey by 2030. Major hospitality brands recognize outdoor accommodation potential, with strategic partnerships and development initiatives expanding capacity beyond traditional hotel segments. This institutional investment signals confidence in Turkey's long-term tourism trajectory and creates favorable conditions for glamping operators seeking capital and operational partnerships.

Rising Millennial and Gen Z Preference for Experiential Travel

Rising Millennial and Gen Z interest in experiential travel is strongly driving the growth of the market. These younger travelers prioritize unique memories over traditional sightseeing and prefer stays that offer immersion in nature, culture, and wellness. Glamping perfectly fits this mindset by combining outdoor adventure with comfort and aesthetics. Social sharing also plays an important role, as visually appealing glamping locations encourage online posting and influence peers. According to industry reports, as of October 2024, in Turkey, 76% of the Gen Z population participated in social media every day. Sustainability awareness among these generations is further boosting the demand for eco-friendly accommodations. They also prefer flexible, short getaways and customized experiences, which glamping providers offer through themed stays, activities, and wellness programs. As their spending power is increasing, the demand for experience-focused travel options like glamping is expected to rise steadily in Turkey.

Development of Themed and Customized Stays

The development of themed and customized stays is strongly driving the market growth by meeting travelers’ growing desire for personalized and immersive experiences. Instead of standard accommodations, tourists look for stays that reflect specific interests, such as wellness retreats, romantic escapes, adventure camps, cultural experiences, or family-focused resorts. Glamping operators design unique concepts that combine luxury with storytelling, making each stay emotionally engaging and memorable. Customized packages including guided activities, local cuisine, wellness sessions, and nature experiences increase perceived value and guest satisfaction. Travelers are willing to pay more for tailored experiences, improving profitability for operators. Themed stays also encourage repeat visits, as guests return to try different concepts. This strategy helps destinations stand out in a competitive market and attracts niche audiences, supporting sustained growth of glamping across Turkey.

Market Restraints:

What Challenges the Turkey Glamping Market is Facing?

High Inflation Impacting Operating Costs and Pricing Competitiveness

Inflation surged in Turkey, rocketing to 75.4% in May 2024, driven mainly by increases in hotel, café, and restaurant prices, leading to overvaluation of the Turkish lira in this inflationary environment. Rising operational costs are forcing glamping operators to increase prices, potentially deterring price-sensitive domestic travelers and creating competitive disadvantage against neighboring Mediterranean destinations offering similar experiences at lower costs.

Seasonal Demand Concentration and Weather Dependency

Turkey's glamping sector is experiencing pronounced seasonality with peak demand concentrated during summer months while shoulder seasons remain underutilized. There has been a trend of placing bookings during shoulder periods, as domestic travelers shorten their trips and look to benefit from discounts. Weather-dependent outdoor accommodations face operational challenges during winter months, limiting year-round revenue potential and requiring operators to generate sufficient returns during compressed peak periods.

Limited Consumer Awareness in Emerging Glamping Regions

While established tourism destinations like Cappadocia and Mediterranean coastal areas demonstrate strong glamping awareness, emerging regions, including Black Sea, Southeastern Anatolia, and Eastern Anatolia, face challenges building consumer recognition. Marketing infrastructure and digital presence remain underdeveloped in these areas, limiting their ability to attract glamping visitors despite possessing unique natural attractions and cultural heritage suitable for outdoor hospitality development.

Competitive Landscape:

The Turkey glamping market features diverse competitive dynamics with domestic boutique operators, regional hospitality groups, and international brands establishing presence across key tourist destinations. Market participants range from family-operated glamping sites offering authentic local experiences to professionally managed properties affiliated with larger tourism networks. Competition centers on location selection, accommodation quality, amenity offerings, and digital marketing effectiveness in reaching target demographics. Operators increasingly differentiate through wellness programming, sustainability certifications, and unique experiential offerings that leverage Turkey's distinctive natural and cultural assets. Strategic partnerships with online travel agencies and direct-to-consumer (D2C) digital platforms remain critical competitive factors, as market participants are seeking to capture growing demand from digitally-native travelers.

Turkey Glamping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Age Groups Covered | 18-32 years, 33-50 years, 51-65 years, Above 65 years |

| Accommodation Types Covered | Cabins and Pods, Tents, Yurts, Treehouses, Others |

| Booking Modes Covered | Direct Booking, Travel Agents, Online Travel Agencies |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey glamping market size was valued at USD 52.7 Million in 2025.

The Turkey glamping market is expected to grow at a compound annual growth rate of 12.10% from 2026-2034 to reach USD 147.26 Million by 2034.

18-32 years dominate the market share of 40%, driven by millennial and Gen Z travelers prioritizing experiential outdoor accommodations and seeking unique, social media-worthy destinations.

Key factors driving the Turkey glamping market include expanding tourism infrastructure, rising millennial and Gen Z preference for experiential travel, and government sustainability initiatives creating favorable regulatory environments for eco-conscious glamping development.

Major challenges include high inflation impacting operating costs and pricing competitiveness, seasonal demand concentration limiting year-round revenue potential, limited consumer awareness in emerging glamping regions, infrastructure development needs in remote locations, and competition from neighboring Mediterranean destinations offering similar experiences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)