Turkey Higher Education Market Size, Share, Trends and Forecast by Component, Deployment Mode, Course Type, Learning Type, End User, and Region, 2025-2033

Turkey Higher Education Market Overview:

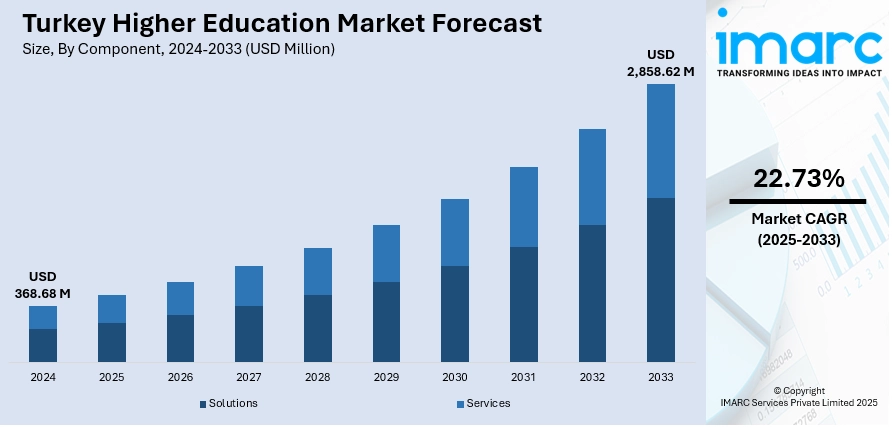

The Turkey higher education market size reached USD 368.68 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,858.62 Million by 2033, exhibiting a growth rate (CAGR) of 22.73% during 2025-2033. The market is driven by Turkey’s strategic push for internationalization, attracting global students through scholarships and bilateral academic partnerships. The integration of advanced digital infrastructure and hybrid learning systems is modernizing academic delivery and accessibility. Furthermore, the increasing focus on industry-relevant academic programs is aligning graduate capabilities with labor market demands, further augmenting the Turkey higher education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 368.68 Million |

| Market Forecast in 2033 | USD 2,858.62 Million |

| Market Growth Rate 2025-2033 | 22.73% |

Turkey Higher Education Market Trends:

Growing Emphasis on Internationalization and Academic Partnerships

The Turkish higher education sector is increasingly oriented towards fostering internationalization, aligning with national strategies to transform the country into a regional academic hub. Turkish universities are expanding partnerships with global institutions, leading to increased student mobility, joint research programs, and dual-degree offerings. Scholarships specifically targeting foreign students, including Türkiye Scholarships, are designed to attract talent from Asia, Africa, and Eastern Europe. On May 9, 2025, Türkiye announced its goal to host 500,000 international students by 2028, up from the current 340,000, as stated by Turkish Education Federation (TEF) President Mert Şener. Highlighting Türkiye’s emergence as a global higher education hub, Şener noted that students from 200 countries are already enrolled, placing Türkiye among the world’s top 10 destinations for international students. This initiative aligns with Türkiye’s strategy to strengthen its global educational influence, expand cultural ties, and enhance academic excellence. The expansion of English-medium programs facilitates broader international enrollment, while participation in global university rankings incentivizes quality improvements. Simultaneously, Turkish universities are establishing overseas campuses and branch collaborations to enhance global recognition. Faculty exchange programs and academic mobility schemes are supported by agreements with European and Middle Eastern universities, strengthening academic diversity. Accreditation efforts by Turkish universities for international recognition help secure the credibility of degrees abroad. These international strategies support both institutional growth and Turkey’s cultural diplomacy objectives. As these trends continue shaping university policies and strategic investments, they directly contribute to Turkey higher education market growth.

To get more information on this market, Request Sample

Rising Demand for Industry-Relevant and Skill-Oriented Programs

The rising emphasis on employability in Turkey’s academic ecosystem has driven universities to restructure curricula around industry needs. Strong collaboration between universities and private sector organizations is facilitating the creation of skill-focused programs, internships, and job placement services. Sectors such as information technology, engineering, and renewable energy now influence academic program design, ensuring that graduates meet evolving labor market expectations. Universities are increasingly incorporating competency-based learning and micro-credential programs tailored to specific job profiles. On July 11, 2024, Türkiye’s Higher Education Council (YÖK) unveiled major reforms aimed at strengthening the nation’s higher education sector, including the integration of the Turkish Qualifications Framework (TYÇ) logo in program guides to accelerate international diploma recognition. With over 1 million university admissions and 898 programs authorized to use the TYÇ logo, the reforms also include discontinuation of evening programs at state universities and realignment of quotas toward employment-oriented fields. Career centers at Turkish universities actively coordinate with businesses to align student skills with market demands, while entrepreneurship and innovation hubs within campuses foster start-up incubation programs. Additionally, the Higher Education Council (YÖK) has encouraged the formalization of university-industry advisory boards to guide curriculum development. Vocational and applied sciences programs are witnessing higher enrollment rates, reflecting the shifting priorities of students who favor practical skills acquisition. As Turkey’s economic diversification strategies intensify, universities play a key role in producing graduates prepared for contemporary workforce challenges.

Turkey Higher Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, course type, learning type, and end user.

Component Insights:

- Solutions

- Student Information Management System

- Content Collaboration

- Data Security and Compliance

- Campus Management

- Others

- Services

- Managed Services

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (student information management system, content collaboration, data security and compliance, campus management, and others) and services (managed services and professional services).

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Course Type Insights:

- Arts

- Economics

- Engineering

- Law

- Science

- Others

The report has provided a detailed breakup and analysis of the market based on the course type. This includes arts, economics, engineering, law, science, and others.

Learning Type Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the learning type. This includes online and offline.

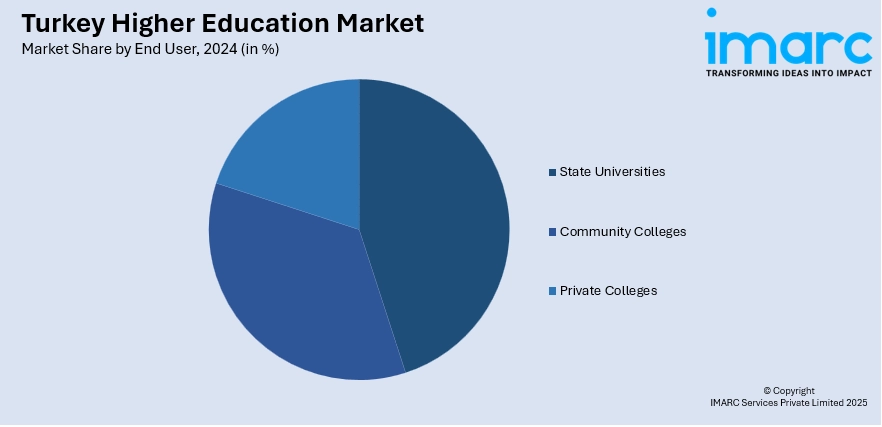

End User Insights:

- State Universities

- Community Colleges

- Private Colleges

The report has provided a detailed breakup and analysis of the market based on the end user. This includes state universities, community colleges, and private colleges.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all major regional markets. This includes Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Higher Education Market News:

- On August 8, 2024, the Higher Education Quality Council (HEQC) of Turkey granted AACSB International formal recognition for five years, reinforcing AACSB’s role in Turkish higher education. This recognition affirms that AACSB’s accreditation aligns with European Standards and Guidelines (ESG), emphasizing strategic management, innovation, and active engagement of students and faculty. The move is expected to enhance global collaboration and elevate business education quality within Turkey’s expanding higher education market.

Turkey Higher Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Course Types Covered | Arts, Economics, Engineering, Law, Science, Others |

| Learning Types Covered | Online, Offline |

| End Users Covered | State Universities, Community Colleges, Private Colleges |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey higher education market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey higher education market on the basis of component?

- What is the breakup of the Turkey higher education market on the basis of deployment mode?

- What is the breakup of the Turkey higher education market on the basis of course type?

- What is the breakup of the Turkey higher education market on the basis of learning type?

- What is the breakup of the Turkey higher education market on the basis of end user?

- What is the breakup of the Turkey higher education market on the basis of region?

- What are the various stages in the value chain of the Turkey higher education market?

- What are the key driving factors and challenges in the Turkey higher education market?

- What is the structure of the Turkey higher education market and who are the key players?

- What is the degree of competition in the Turkey higher education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey higher education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey higher education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey higher education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)