Turkey Lingerie Market Size, Share, Trends and Forecast by Product Type, Material, Price Range, Distribution Channel, and Region, 2025-2033

Turkey Lingerie Market Overview:

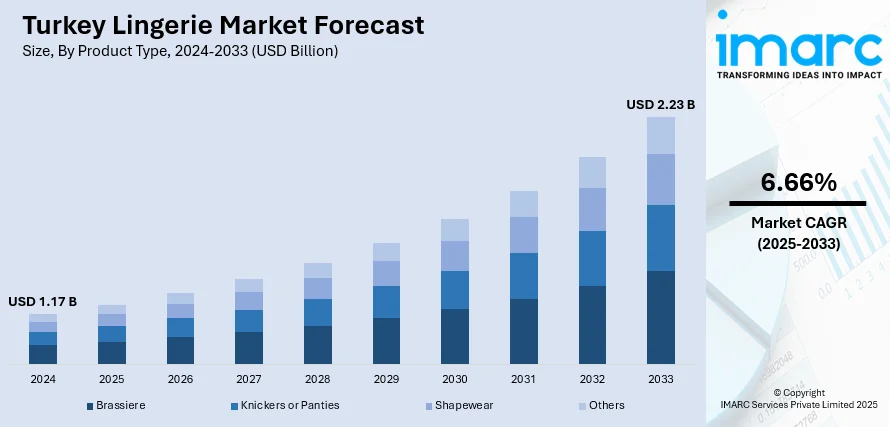

The Turkey lingerie market size reached USD 1.17 Billion in 2024. Looking forward, the market is projected to reach USD 2.23 Billion by 2033, exhibiting a growth rate (CAGR) of 6.66% during 2025-2033. The market is driven by Turkey’s textile manufacturing advantage and rising global demand for competitively priced, certified lingerie exports. A cultural shift toward comfort and functional innerwear is redefining local preferences. Digital retail innovations, omnichannel expansion, and influencer-driven e-commerce are further augmenting the Turkey lingerie market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.17 Billion |

| Market Forecast in 2033 | USD 2.23 Billion |

| Market Growth Rate 2025-2033 | 6.66% |

Turkey Lingerie Market Trends:

Domestic Manufacturing Strength and Export Competitiveness

Turkey’s lingerie industry benefits from its strong position as a global textile and apparel hub, with vertically integrated supply chains, skilled labor, and access to high-quality fabrics. Major lingerie producers in Istanbul, Izmir, and Bursa serve both domestic demand and international markets, including Europe and the Middle East. These manufacturers offer competitive pricing and fast fashion turnaround, making Turkey a preferred sourcing destination for global private-label and branded innerwear. The country's extensive textile clusters support rapid prototyping, fabric innovation, and small-batch flexibility, key for trend-sensitive products like lingerie. Turkish lingerie exporters meet stringent EU quality standards, and many factories hold certifications such as OEKO-TEX and GOTS, which boost appeal among environmentally and socially conscious buyers. Beyond contract manufacturing, several Turkish lingerie brands are expanding internationally through multi-brand outlets and digital commerce platforms. This strong manufacturing base supports not only exports but also enhances the quality and affordability of products within the domestic market. As a result, Turkey lingerie market growth is being driven by the convergence of local production excellence and global sourcing relevance, creating resilient opportunities across retail, wholesale, and online channels.

To get more information on this market, Request Sample

Shifting Cultural Norms and Rise of Functional Innerwear

Cultural perspectives on lingerie in Turkey are shifting, particularly among urban millennials and Gen Z consumers. Younger women are prioritizing comfort, body positivity, and personal expression over traditional aesthetics. Wireless bras, bralettes, and seamless designs are gaining popularity, especially among women in metropolitan areas such as Istanbul, Ankara, and Izmir. Retailers are responding with modernized designs that reflect global fashion trends while catering to local preferences in modesty and versatility. This shift is supported by the rise of social media influencers, lifestyle bloggers, and online campaigns that normalize lingerie as part of everyday comfort rather than purely intimate or aesthetic wear. Additionally, consumers are showing a growing interest in multipurpose lingerie, pieces that can transition from innerwear to outerwear or be worn as loungewear. Turkish brands are launching collections with moisture-wicking fabrics, stretchable silhouettes, and breathable linings, addressing both climate and lifestyle needs. As women increasingly seek lingerie that aligns with functionality, comfort, and evolving identity, domestic retailers are well-positioned to lead this transformation, capturing a larger share of the mid-market and premium segments.

E-commerce Growth and Retail Modernization

Digital transformation is accelerating the evolution of lingerie retail in Turkey. Online lingerie sales are surging due to broader internet penetration, mobile-first purchasing behavior, and enhanced payment infrastructure. E-commerce platforms now offer discreet packaging, virtual fitting guides, and localized language support, increasing consumer confidence in buying lingerie online, an item traditionally seen as high-touch. Meanwhile, omnichannel strategies are becoming common among Turkish brands, with flagship stores doubling as fulfillment hubs for click-and-collect or same-day delivery services. Lingerie startups are also leveraging Instagram shops, influencer marketing, and data-driven customization to attract niche audiences. Major Turkish retailers are investing in experiential stores with curated fitting zones, digital sizing tools, and loyalty integrations, aiming to modernize how lingerie is purchased and perceived. Furthermore, the COVID-19 pandemic catalyzed lasting changes in consumer behavior, with greater demand for home-friendly, soft lingerie as remote work normalized casual dressing. These retail innovations are expanding access to both urban and regional consumers, while streamlining the path to purchase. As Turkey’s digital retail ecosystem matures, lingerie brands are capitalizing on new channels to deliver value, style, and comfort at scale.

Turkey Lingerie Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material, price range, and distribution channel.

Product Type Insights:

- Brassiere

- Knickers or Panties

- Shapewear

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes brassiere, knickers or panties, shapewear, and others.

Material Insights:

- Cotton

- Silk

- Satin

- Nylon

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes cotton, silk, satin, nylon, and others.

Price Range Insights:

- Economy

- Premium

The report has provided a detailed breakup and analysis of the market based on the price range. This includes economy and premium.

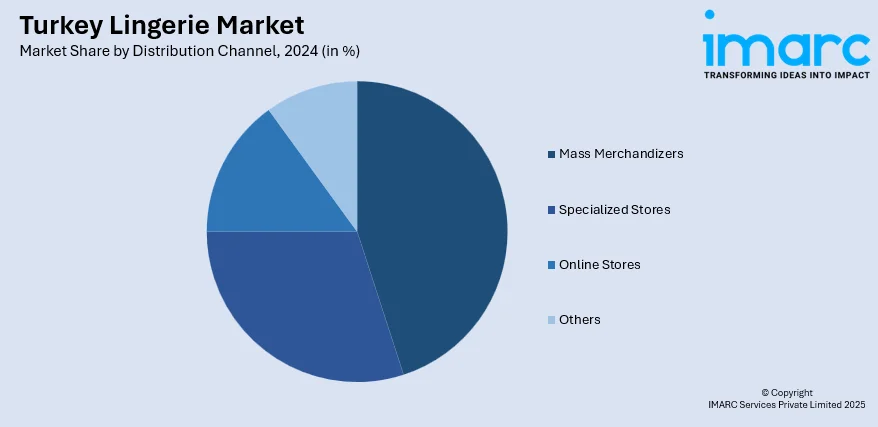

Distribution Channel Insights:

- Mass Merchandizers

- Specialized Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes mass merchandizers, specialized stores, online stores, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Lingerie Market News:

- On April 2, 2025, Spain-based fashion brand Women’secret re-entered the Turkish market after 13 years by opening its first store in Istanbul’s Emaar Square Mall, the country’s largest shopping center. This relaunch adds to the brand’s global footprint of 692 physical stores across 80 countries, backed by parent company Tendam. The move reflects intensifying competition in Turkey’s women’s lingerie and fashion segment.

Turkey Lingerie Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Brassiere, Knickers or Panties, Shapewear, Others |

| Materials Covered | Cotton, Silk, Satin, Nylon, Others |

| Price Ranges Covered | Economy, Premium |

| Distribution Channels Covered | Mass Merchandizers, Specialized Stores, Online Stores, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey lingerie market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey lingerie market on the basis of product type?

- What is the breakup of the Turkey lingerie market on the basis of material?

- What is the breakup of the Turkey lingerie market on the basis of price range?

- What is the breakup of the Turkey lingerie market on the basis of distribution channel?

- What is the breakup of the Turkey lingerie market on the basis of region?

- What are the various stages in the value chain of the Turkey lingerie market?

- What are the key driving factors and challenges in the Turkey lingerie market?

- What is the structure of the Turkey lingerie market and who are the key players?

- What is the degree of competition in the Turkey lingerie market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey lingerie market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey lingerie market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey lingerie industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)