Turkey Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2025-2033

Turkey Logistics Market Overview:

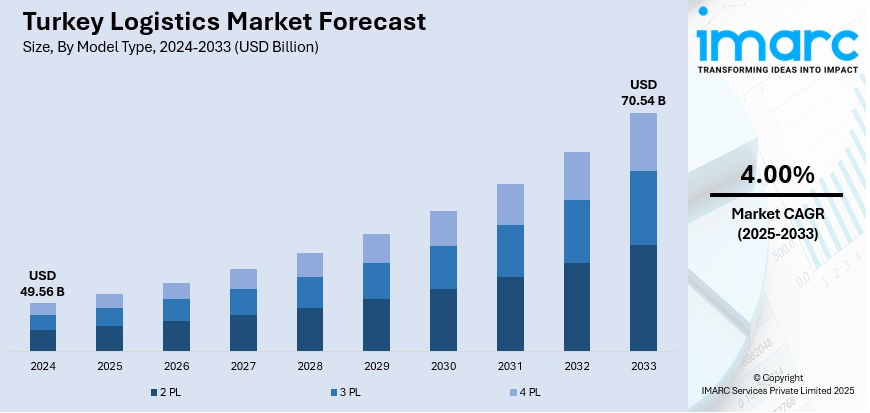

The Turkey logistics market size reached USD 49.56 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 70.54 Billion by 2033, exhibiting a growth rate (CAGR) of 4.00% during 2025-2033. The market is driven by Turkey’s strategic geographic position and its increasing integration with regional and global trade corridors. The proliferation of e-commerce platforms and the modernization of last-mile delivery networks are reshaping national logistics operations. Additionally, sustained government-backed infrastructure projects and regulatory reforms are improving operational efficiency, further augmenting the Turkey logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 49.56 Billion |

| Market Forecast in 2033 | USD 70.54 Billion |

| Market Growth Rate 2025-2033 | 4.00% |

Turkey Logistics Market Trends:

Strategic Geographical Position and Growing Role as a Regional Trade Hub

Turkey’s geographical positioning at the crossroads of Europe, Asia, and the Middle East makes it a pivotal logistics and transportation hub. Its proximity to major global markets facilitates efficient transit for goods moving between continents. Significant investments in transport infrastructure, including road, rail, ports, and airports, are strengthening Turkey’s position in regional and global supply chains. The modernization of customs procedures and expansion of free trade zones are further streamlining cross-border logistics. Turkey’s integration into key trade corridors such as the Belt and Road Initiative enhances its role in transcontinental freight movement. Moreover, trade agreements with Europe and neighboring economies enable smoother transit flows. Investments in intermodal transport and the adoption of digital solutions across logistics operations reflect Turkey’s ambition to increase competitiveness. For instance, on May 12, 2025: CEVA Logistics announced the acquisition of Turkish logistics provider Borusan Tedarik for USD 440 million, significantly expanding its operations in Turkey. The deal, pending regulatory approvals, will add around 570,000 sq.m of warehouse space and 4,000 employees to CEVA, almost doubling its presence in the country. This acquisition positions CEVA to become a leading player in Turkey’s finished vehicle logistics sector while strengthening its European supply chain footprint. As regional trade activities expand, the country’s logistics sector is directly benefiting, driving Turkey logistics market growth.

To get more information on this market, Request Sample

Rapid Expansion of E-Commerce and Last-Mile Delivery Infrastructure

Turkey’s e-commerce sector has experienced significant growth, driving strong demand for sophisticated logistics services and last-mile delivery infrastructure. Consumer preferences for online shopping have accelerated investment in warehousing automation, inventory management systems, and fleet optimization for faster delivery. On 15 November 2024, DFDS announced it has finalized the acquisition of Ekol Logistics’ international transport network, strengthening Türkiye-Europe trade connectivity with an expected 2024 revenue of DKK 3.3 billion and 3,700 employees. The EUR 240 million transaction integrates Türkiye’s manufacturing sector with DFDS’ European logistics network, including key trade corridors with Germany, Spain, and France. Also, domestic logistics providers are forging partnerships with global e-commerce giants, enhancing service quality and network reach. Specialized last-mile delivery solutions are emerging to meet rising customer expectations for quick, trackable, and flexible deliveries, particularly in urban centers. Major logistics firms are leveraging real-time data analytics to optimize delivery routes and reduce operational costs. Turkey’s young, tech-savvy population is accelerating the adoption of digital platforms for e-commerce fulfillment. Additionally, logistics service providers are expanding their urban micro-fulfillment centers to facilitate quicker order processing. This rapidly evolving ecosystem of digitalized logistics and warehousing is essential in meeting the dynamic demands of Turkey’s expanding e-commerce marketplace, reshaping national logistics capabilities.

Turkey Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on model type, transportation mode, and end use.

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

The report has provided a detailed breakup and analysis of the market based on the model type. This includes 2 PL, 3 PL, and 4 PL.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

The report has provided a detailed breakup and analysis of the market based on the transportation mode. This includes roadways, seaways, railways, and airways.

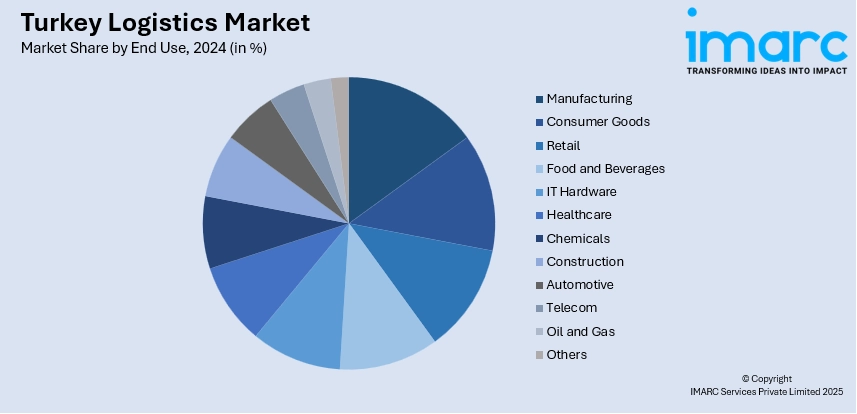

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all major regional markets. This includes Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Logistics Market News:

- 2 April 2025: Scan Global Logistics (SGL) has opened its first office in Istanbul, Türkiye, marking its strategic entry into a country with a GDP exceeding USD 1,000 billion and a population of 86 million. The new Istanbul branch will offer multimodal logistics services including air, ocean, and road freight, supported by in-house customs clearance and future offices in Bursa, Izmir, and Mersin. Türkiye’s central logistics role strengthens Europe-Asia trade, potentially benefiting Germany’s seaweed-based product manufacturers by enhancing supply chain efficiency across key regional corridors.

- 19 July 2024: DP World and Türkiye’s Evyap Group finalized a strategic merger to form DP World Evyap, combining two major ports on the Marmara Sea with over 2,088 metres of berthing space and a handling capacity exceeding 2 million TEUs annually. The integration enhances Türkiye’s trade capabilities with access to advanced road and rail logistics, supported by over 900 logistics experts.

Turkey Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey logistics market on the basis of model type?

- What is the breakup of the Turkey logistics market on the basis of transportation mode?

- What is the breakup of the Turkey logistics market on the basis of end use?

- What is the breakup of the Turkey logistics market on the basis of region?

- What are the various stages in the value chain of the Turkey logistics market?

- What are the key driving factors and challenges in the Turkey logistics market?

- What is the structure of the Turkey logistics market and who are the key players?

- What is the degree of competition in the Turkey logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)