Turkey Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2026-2034

Turkey Luxury Fashion Market Summary:

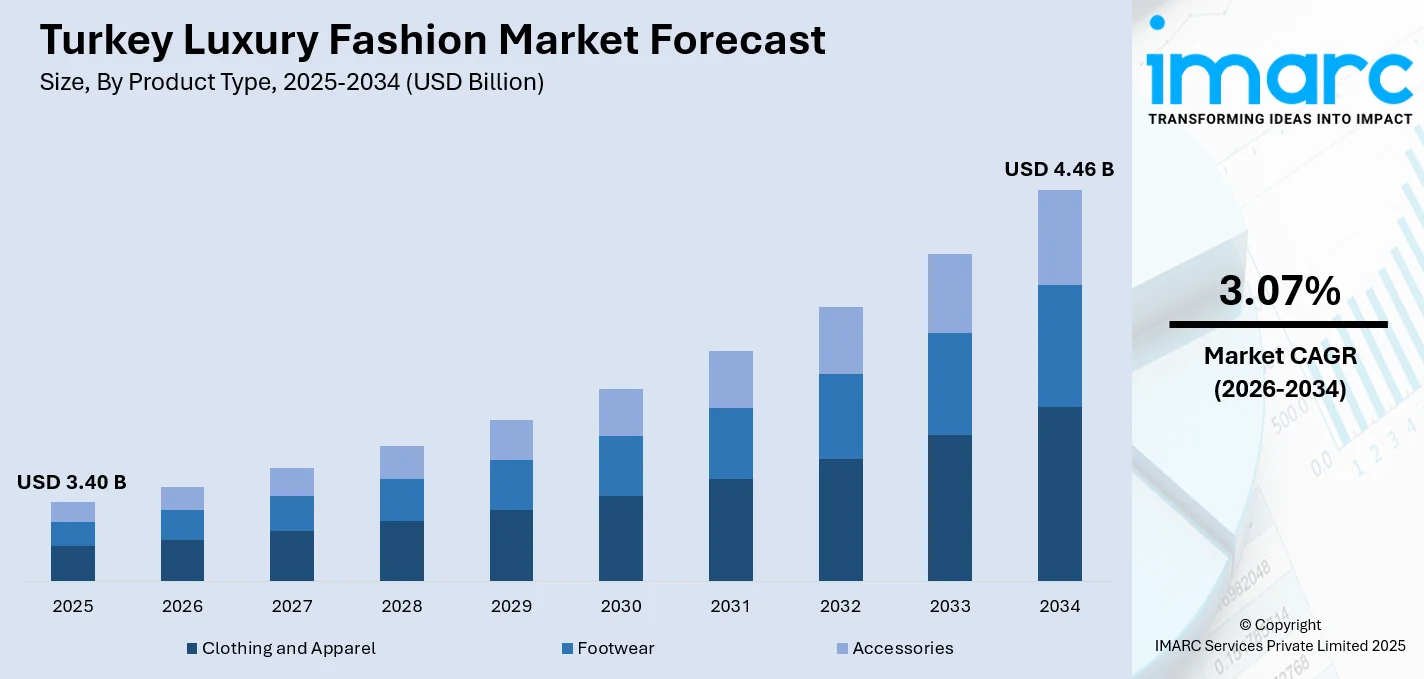

The Turkey luxury fashion market size was valued at USD 3.40 Billion in 2025 and is projected to reach USD 4.46 Billion by 2034, growing at a compound annual growth rate of 3.07% from 2026-2034.

Turkey has turned out to be a lively luxury fashion destination, situated between Europe and Asia. It is driven by a young, fashion-loving generation, a rising middle class of luxury consumers, and a thriving tourism industry that draws in high-spending travelers from the Middle East, Central Asia, and Europe. World-class shopping venues in the Turkish city of Istanbul create unparalleled luxury fashion avenues, making Turkey a lively destination for luxury shopping and the entry point for luxury brands around the globe.

Key Takeaways and Insights:

-

By Product Type: Clothing and apparel dominate the market with a share of 54% in 2025, driven by strong consumer demand for designer garments, the influence of international fashion trends, and the growing preference for premium ready-to-wear collections among Turkish consumers.

-

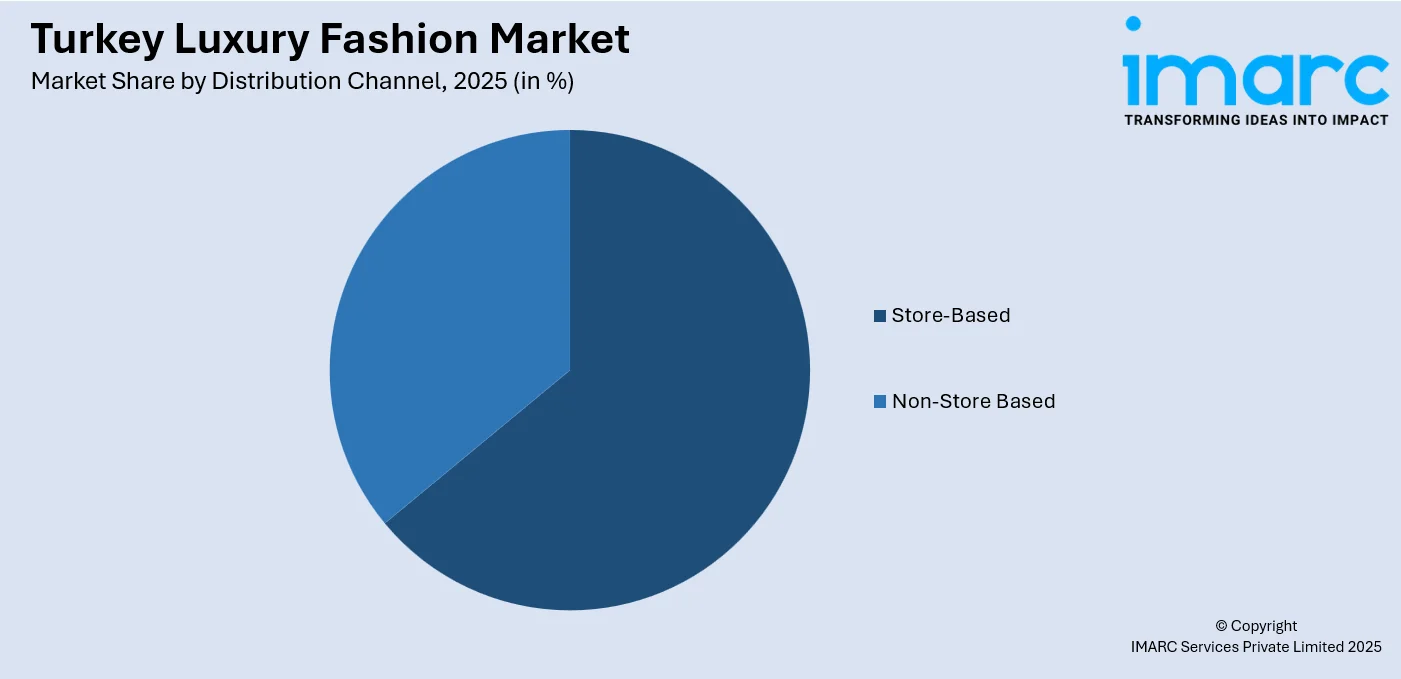

By Distribution Channel: Store-based leads the market with a share of 64% in 2025, fueled by the expansion of luxury shopping malls, flagship boutiques in prestigious districts, and the Turkish consumer preference for tactile, personalized in-store shopping experiences.

-

By End User: Women dominate the market with a share of 55% in 2025, owing to the strong inclination toward high-end apparel and accessories, growing female workforce participation, and increasing social occasions demanding premium fashion choices.

-

By Region: Marmara leads the market with a share of 36% in 2025, attributed to Istanbul's position as Turkey's economic and fashion capital, concentration of luxury retail infrastructure, high-income demographics, and status as a major international tourism hub.

-

Key Players: The Turkey luxury fashion market is highly competitive, with international luxury houses and established domestic brands vying across diverse product categories and distribution channels, driving innovation and catering to evolving consumer preferences.

To get more information on this market Request Sample

The Turkey luxury fashion market continues to demonstrate strong growth potential, supported by demographic advantages including a large young population with evolving fashion consciousness and aspirational purchasing behavior. In 2025, US‑based luxury label AMIRI and Lebanese designer Elie Saab opened their first retail stores in Istanbul’s key luxury destinations such as Emaar Square and Zorlu Center, highlighting increasing global brand investment into the Turkish luxury segment. The market is characterized by a unique blend of Western fashion influences and traditional cultural aesthetics, creating opportunities for both international luxury brands and emerging Turkish designers. Istanbul has established itself as a premier shopping destination, with upscale districts and modern shopping centers attracting both domestic consumers and international visitors seeking luxury fashion experiences. The growing emphasis on experiential retail, personalized customer service, and omnichannel integration is reshaping the competitive dynamics of the Turkish luxury fashion landscape.

Turkey Luxury Fashion Market Trends:

Digital Transformation and Omnichannel Retail Evolution

Turkey’s luxury fashion sector is rapidly embracing digital transformation. In May 2025, menswear leader Kiğılı teamed up with Centric Software to implement a unified digital planning platform, enhancing both e‑commerce and in-store operations. Driven by high smartphone penetration and a tech-savvy young population, Turkish consumers increasingly demand virtual try-ons, personalized recommendations, and seamless delivery. Luxury brands are investing in digital storefronts and social commerce while preserving premium physical shopping experiences.

Rise of Sustainable and Heritage-Inspired Luxury

Turkish consumers are increasingly embracing sustainable fashion and culturally authentic designs that blend modern aesthetics with traditional Anatolian craftsmanship. In December 2025, the Global Fashion Agenda launched the Circular Fashion Partnership: Türkiye, engaging manufacturers and over 100 global partners to promote textile recycling and circular practices. Luxury brands are responding by adopting eco-friendly materials, ethical production methods, and transparent supply chains, while reviving heritage textiles and artisanal techniques to offer distinctive, culturally grounded collections that balance sustainability with modern appeal.

Tourism-Driven Luxury Retail Expansion

Turkey’s status as a premier tourism destination continues to drive its luxury fashion market, with international visitors making substantial contributions to premium retail sales. Istanbul attracts affluent travelers from the Middle East, Central Asia, Russia, and Europe seeking high-end shopping experiences. In 2024, foreign tourists spent an estimated $6.2 billion on clothing and footwear. Luxury retailers are enhancing services such as multilingual staff, tax-free shopping, and premium amenities to capitalize on this valuable segment.

Market Outlook 2026-2034:

The Turkey luxury fashion market is poised for sustained growth throughout the forecast period, driven by rising disposable incomes among the expanding upper-middle class, increasing brand awareness among younger demographics, and continued investment in retail infrastructure. The market will benefit from growing tourism flows, expansion of e-commerce capabilities, and the emergence of Turkish luxury designers gaining international recognition. Strategic positioning between European and Asian markets presents opportunities for brands to leverage Turkey as a regional hub for luxury fashion distribution and experiential retail. The market generated a revenue of USD 3.40 Billion in 2025 and is projected to reach a revenue of USD 4.46 Billion by 2034, growing at a compound annual growth rate of 3.07% from 2026-2034.

Turkey Luxury Fashion Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Clothing and Apparel |

54% |

|

Distribution Channel |

Store-Based |

64% |

|

End User |

Women |

55% |

|

Region |

Marmara |

36% |

Product Type Insights:

- Clothing and Apparel

- Jackets and Coats

- Skirts

- Shirts and T-Shirts

- Dresses

- Trousers and Shorts

- Denim

- Underwear and Lingerie

- Others

- Footwear

- Accessories

- Gems and Jewellery

- Belts

- Bags

- Watches

The clothing and apparel dominate with a market share of 54% of the total Turkey luxury fashion market in 2025.

The luxury clothing and apparel segment remains a top performer in Turkey, driven by strong demand for designer ready-to-wear, formal attire, and premium casual wear. Turkish consumers favor sophisticated European-influenced styles while valuing high-quality, elegant garments, supported by international fashion houses and local designers blending contemporary aesthetics with cultural refinement, resulting in consistently growing market interest and brand loyalty.

The demand for luxury apparel is further supported by Turkey's vibrant social calendar, including weddings, corporate events, and cultural celebrations that drive purchases of premium evening wear, tailored suits, and sophisticated daytime ensembles. Seasonal collections featuring high-quality fabrics, impeccable craftsmanship, and exclusive designs continue to attract discerning consumers seeking investment pieces that reflect their personal style and social status within Turkish society.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Store-Based

- Non-Store Based

The store-based leads with a share of 64% of the total Turkey luxury fashion market in 2025.

Concerning distribution channels, the physical retail channels continue to be dominant in the luxury fashion market of Turkey. This is associated with the ongoing desire of consumers to experience a shopping environment where they can easily engage with the product. Key shopping districts within Istanbul such as Nişantaşı, as well as high-end shopping centers such as Zorlu Center, İstinyePark, and Emaar Square Mall, remain the focal point of luxury fashion shopping within this market.

Luxury brands are also investing in their flagship stores and brand boutiques that provide an excellent customer experience in terms of their elegant designs, qualified sales force, and product offerings. The traditional channel is also fueled by the culture of Turkey in terms of its relationship-based purchasing habit, where people are fond of physically touching the product before purchasing in the luxury segment.

End User Insights:

- Men

- Women

- Unisex

The women dominate with a market share of 55% of the total Turkey luxury fashion market in 2025.

Women are the primary consumers in Turkey’s luxury fashion market, exhibiting strong purchasing power and refined fashion awareness across all ages. According to reports, the 25–34 age group dominates luxury shopping, with young women driving significant demand. Increasing participation in professional and social spheres prompts investments in designer apparel, accessories, and footwear. Rising female economic empowerment enables working women to allocate substantial income toward luxury fashion that reflects both professional success and personal style.

The women's luxury fashion segment encompasses diverse product categories including elegant evening wear, professional attire, casual luxury pieces, designer handbags, fine jewelry, and premium footwear. Turkish women demonstrate particular interest in brands that offer versatility, quality craftsmanship, and designs suitable for both traditional occasions and contemporary lifestyle requirements, creating sustained demand across multiple luxury fashion categories.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

Marmara exhibits a clear dominance with a 36% share of the total Turkey luxury fashion market in 2025.

The Marmara region, anchored by Istanbul, maintains its position as Turkey's undisputed luxury fashion capital, concentrating the majority of high-end retail infrastructure, brand headquarters, and affluent consumer populations. Istanbul serves as the gateway for international luxury brands entering the Turkish market, with its prestigious shopping districts offering world-class retail environments that attract both domestic consumers and international visitors. The city's diverse consumer base spans all income levels and fashion preferences, with significant concentration of high-net-worth individuals driving premium segment growth.

The Marmara region benefits from superior transportation connectivity, international airport facilities, and tourism infrastructure that facilitate luxury retail activities. Istanbul's cosmopolitan character, rich cultural heritage, and modern lifestyle appeal create an environment where luxury fashion consumption is deeply embedded in social and professional contexts, supporting sustained market development and attracting continued investment from global luxury brands seeking Turkish market presence.

Market Dynamics:

Growth Drivers:

Why is the Turkey Luxury Fashion Market Growing?

Expanding Affluent Consumer Base and Rising Disposable Incomes

Turkey’s expanding upper-middle class is a key driver of luxury fashion market growth, as more consumers reach income levels that support premium purchases. According to reports, individuals earning $75,000–$500,000 annually, many of whom are entrepreneurs, executives, and professionals, now account for around half of the country’s luxury sales. A large young population entering peak earning years, combined with rising household wealth in urban centers, fuels sustained demand for high-end apparel, accessories, and footwear, allowing consumers to showcase professional success and social aspirations through luxury fashion.

Strategic Geographic Position and Tourism-Driven Demand

Turkey’s strategic position bridging Europe and Asia creates strong opportunities for luxury fashion retail, attracting visitors seeking premium shopping experiences. Its robust tourism infrastructure, cultural attractions, and competitive shopping environment draw affluent travelers from the Middle East, Central Asia, Russia, and nearby regions. In August 2025, foreign tourists spent around $3.74 billion on clothing and footwear, highlighting the impact of international visitor spending. Duty-free shopping and favorable exchange rates further boost Turkey’s appeal as a luxury fashion destination.

Retail Infrastructure Development and Brand Expansion

Continued investment in premium retail infrastructure is driving growth in Turkey’s luxury fashion market through world-class shopping centers, flagship stores, and enhanced retail environments. In 2025, the country announced its first luxury designer outlet, Florentia Village Istanbul, near Istanbul Airport, supported by 160 million euros in international financing and set to host global brands, reflecting strong confidence in Turkish retail. Modernized facilities, digital integration, and improved customer service attract global luxury brands and elevate the shopping experience across product categories.

Market Restraints:

What Challenges the Turkey Luxury Fashion Market is Facing?

Economic Volatility and Currency Fluctuations

Turkey's macroeconomic environment presents ongoing challenges for the luxury fashion sector, with currency depreciation and inflationary pressures affecting consumer purchasing power and import costs. Economic uncertainty influences consumer confidence and discretionary spending patterns, potentially delaying major fashion purchases as consumers prioritize essential expenditures during periods of financial instability.

Price Competitiveness Challenges Against International Markets

Luxury fashion pricing in Turkey often exceeds equivalent products available in European shopping destinations, encouraging affluent Turkish consumers to make purchases during international travel. Import duties, taxes, and operational costs contribute to price premiums that reduce competitiveness against established luxury markets, potentially limiting domestic sales among price-sensitive luxury consumers.

Counterfeit Products and Brand Protection Concerns

The presence of counterfeit luxury goods in Turkish markets poses challenges for authentic brand positioning and consumer trust. Market participants must invest in anti-counterfeiting measures, consumer education, and brand protection strategies to maintain premium positioning and ensure consumers can confidently distinguish genuine luxury products from imitations.

Competitive Landscape:

The Turkey luxury fashion market exhibits a dynamic competitive landscape featuring international luxury conglomerates, European fashion houses, and established Turkish fashion brands competing across multiple product categories and distribution channels. The market structure reflects a blend of global brand presence through flagship stores and authorized retailers alongside domestic luxury brands that have developed strong brand equity among Turkish consumers. Competition intensifies around prime retail locations, customer experience differentiation, and digital engagement capabilities as brands seek to capture market share in this growing luxury market. Strategic partnerships, localized marketing approaches, and investments in omnichannel capabilities characterize competitive strategies as participants position for long-term market development.

Recent Developments:

-

In June 2025, Premium fashion brand YARGICI has partnered with Centric Software to implement a Product Lifecycle Management (PLM) platform, enhancing operational efficiency by ~10% and supporting global expansion. The move underscores how Turkish luxury brands are adopting digital tools to optimize design-to-market processes.

Turkey Luxury Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Store-Based, Non-Store Based |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey luxury fashion market size was valued at USD 3.40 Billion in 2025.

The Turkey luxury fashion market is expected to grow at a compound annual growth rate of 3.07% from 2026-2034 to reach USD 4.46 Billion by 2034.

The clothing and apparel segment dominated the product type category with a market share of 54%, driven by strong consumer demand for designer ready-to-wear collections, formal attire, and premium casual wear across diverse demographic segments.

Key factors driving the Turkey luxury fashion market include expanding affluent consumer base with rising disposable incomes, strategic geographic positioning attracting tourism-driven demand, retail infrastructure development and international brand expansion, growing fashion consciousness among young demographics, and digital transformation enabling omnichannel retail experiences.

Major challenges include economic volatility and currency fluctuations affecting consumer purchasing power, price competitiveness challenges compared to international markets, counterfeit product concerns requiring brand protection investments, and the need to balance traditional retail preferences with growing digital commerce expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)