Turkey Online Travel Market Size, Share, Trends and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Region, 2025-2033

Turkey Online Travel Market Overview:

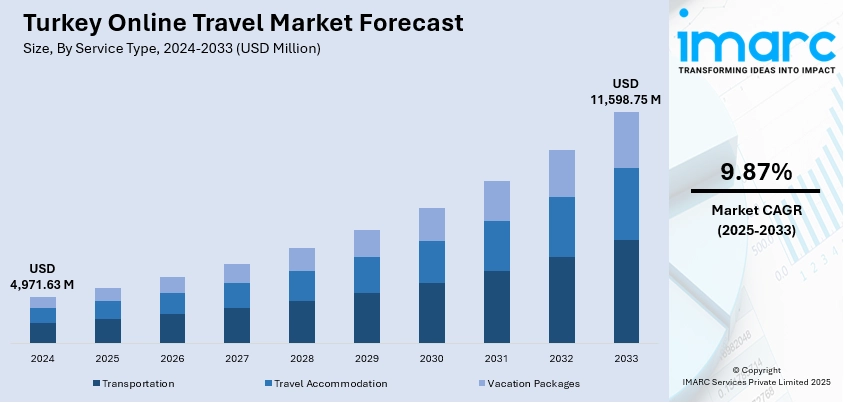

The Turkey online travel market size reached USD 4,971.63 Million in 2024. The market is projected to reach USD 11,598.75 Million by 2033, exhibiting a growth rate (CAGR) of 9.87% during 2025-2033. The market is expanding due to rising smartphone penetration, widespread internet access, and growing preference for mobile-first bookings. Government-backed tourism campaigns, improved digital payment infrastructure, and increased adoption of AI for personalized trip planning further support growth. Integration of local experiences, real-time booking, and customer-friendly platforms is attracting both domestic and international travelers. These advancements continue to drive the growth of Turkey online travel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,971.63 Million |

| Market Forecast in 2033 | USD 11,598.75 Million |

| Market Growth Rate 2025-2033 | 9.87% |

Turkey Online Travel Market Trends:

Surge in Online Travel Bookings Accelerates Digital Shift

Turkey's travel sector is experiencing a fast-paced digital revolution and online is now the leading platform for travel bookings. Online travel platforms accounted for around 70 percent of tourism revenues globally in 2024, and this represents a global phenomenon that is particularly pronounced in Turkey. Convenience and ease offered by websites and mobile apps to compare offers appeal to travelers, particularly younger travelers, more than the traditional travel agency. Online travel agencies and virtual tours have simplified travel planning, increasing accessibility across diverse demographics. This trend is also supported by growing internet penetration and smartphone use across Turkey, enabling more people to research and book trips online. The Turkish Tourism Investors Association highlights that the proportion of online travel sales will further increase, with projections suggesting digital bookings may come to rule the market even more by the close of the decade. The digital expansion boosts Turkey's competitiveness as a travel destination by refining user experience and optimizing booking methods. The market is transforming at a fast pace, and digital channels are a driving force behind its continued Turkey online travel growth.

To get more information on this market, Request Sample

The Rise of Domestic Tourism Platforms in Turkey

The growing demand for domestic tourism inside Turkey is propelling expansion in niche web-based platforms dealing with local destinations. Ever since the early months of 2025, several digital platforms have introduced with packaged deals to culturally beautiful and naturally picturesque places such as Cappadocia, the Black Sea coastline, and the Aegean coast. Such platforms combine transportation, stay, and guided tours into seamless booking processes, serving the tastes of tourists for real and sustainable tourism. Sources of March 2025 indicate a consistent rise in domestic tours booked through these websites, reflecting their increasing clout. This growth is complemented by government efforts to promote local tourism to enhance regional economies and lower reliance on foreign tourists. By easing travel to lesser-known locations, these websites are assisting in diversifying Turkey's tourist industry as well as community development. The growth of local tourism services via online platforms is increasingly becoming a major driver in Turkey online travel market trends.

Smart City Innovations Enhance Urban Tourism

Turkey’s major urban destinations namely Istanbul, İzmir, and Antalya are actively deploying smart city technologies to upgrade the visitor experience and manage tourism sustainably. These initiatives encompass IoT‑enabled infrastructure, such as intelligent transportation systems, real-time crowd monitoring, and public information kiosks, all delivering seamless data directly to travelers. In Antalya, for example, the municipal smart-city platform integrates free Wi‑Fi in public zones, smart lighting, and traffic monitoring, while offering tourist‑friendly features like digital city guides and emergency alerts. In May 2025, Antalya’s smart city management was hailed for improving efficiency in transport, energy consumption, and public services all critical in managing visitor flows and reducing overcrowding at key heritage and leisure sites. Contactless payment systems have also been incorporated into public transit and entry gates, further streamlining travel. These technologies not only elevate tourist convenience but also support environmental goals by optimizing resource use. As smart-city solutions become established across Turkey’s urban hubs, they are embedding digital innovation into the heart of travel experiences. This evolution reinforces both visitor satisfaction and broader.

Turkey Online Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, platform, mode of booking, and age group.

Service Type Insights:

- Transportation

- Travel Accommodation

- Vacation Packages

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation, and vacation packages.

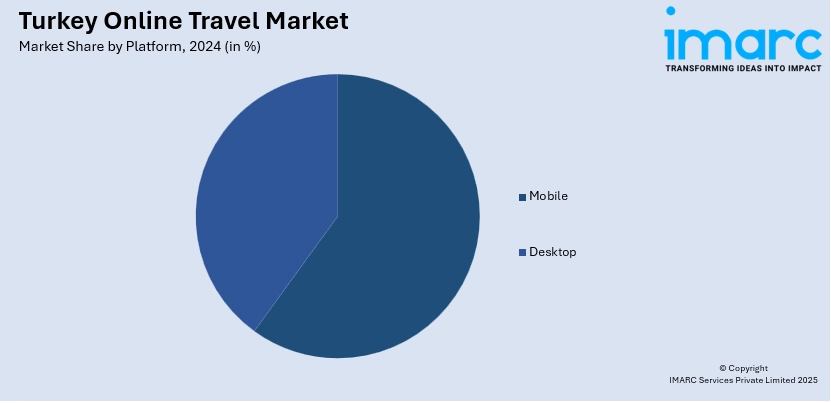

Platform Insights:

- Mobile

- Desktop

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile and desktop.

Mode of Booking Insights:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

The report has provided a detailed breakup and analysis of the market based on the mode of booking. This includes online travel agencies (OTAs) and direct travel suppliers.

Age Group Insights:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 22-31 years, 32-43 years, 44-56 years, and above 56 years.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Online Travel Market News:

- July 2025: Turkish Airlines, honored as Europe’s Best Airline, is set to launch direct flights between Istanbul and London Stansted starting March 2026. Operating 14 weekly services with Airbus A321s, this marks the carrier’s sixth UK gateway, complementing Heathrow, Gatwick, Manchester, Birmingham, Edinburgh, and Dublin operations. The route expansion underscores Turkey’s commitment to strengthening UK connectivity and reflects Turkish Airlines’ strategic ambition to diversify access to its global network.

- May 2025: Turkish Airlines has introduced its online vacation booking facility, Turkish Airlines Holidays, in Canada to make and improve the vacation planning process easier. The website enables tourists to plan flights, hotels, car hire, and activities in one simple procedure. The move is part of the airline's overall digital expansion and focuses on global service innovation. The step also comes as Turkey increases its focus on marketing its tourism industry overseas, strengthening its foothold in the changing world of global tourism.

Turkey Online Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages |

| Platforms Covered | Mobile, Desktop |

| Mode of Bookings Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22-31 Years, 32-43 Years, 44-56 Years, Above 56 Years |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey online travel market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey online travel market on the basis of service type?

- What is the breakup of the Turkey online travel market on the basis of platform?

- What is the breakup of the Turkey online travel market on the basis of the mode of booking?

- What is the breakup of the Turkey online travel market on the basis of age group?

- What is the breakup of the Turkey online travel market on the basis of the region?

- What are the various stages in the value chain of the Turkey online travel market?

- What are the key driving factors and challenges in the Turkey online travel market?

- What is the structure of the Turkey online travel market and who are the key players?

- What is the degree of competition in the Turkey online travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey online travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey online travel market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)