Turkey Retail Market Report by Product (Food and Beverages, Personal and Household Care, Apparel, Footwear and Accessories, Furniture, Toys and Hobby, Electronic and Household Appliances, and Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, and Others), and Region 2025-2033

Turkey Retail Market Overview:

The Turkey retail market size reached USD 391.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 868.3 Billion by 2033, exhibiting a growth rate (CAGR) of 8.30% during 2025-2033. Some of the key factors driving the market include urbanization, rising disposable incomes, increasing consumer spending, expanding e-commerce, growing tourism, modern retail infrastructure development, and the adoption of advanced technologies enhancing shopping experiences and operational efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 391.2 Billion |

|

Market Forecast in 2033

|

USD 868.3 Billion |

| Market Growth Rate 2025-2033 | 8.30% |

Turkey Retail Market Trends:

Rapid Expansion of E-Commerce

The increasing digital transformation in Turkey, with more consumers turning to online shopping due to its convenience and a broader range of products is bolstering the market growth. This trend was highly enhanced by the COVID-19 pandemic, as social distancing and lockdowns resulted in a rise in online shopping. In Türkiye, eCommerce transactions surged by 22%, and values soared by 130% from 2022 to 2023. Credit, debit, and prepaid cards dominate online payments, comprising around 80% of total transaction value. This evident rise in preference for online shopping and payment is contributing to the market growth. Moreover, e-commerce platforms have also enhanced their logistics and delivery networks, improving user interfaces, and offering diverse payment options to attract and retain customers. This combined with, the increasing penetration of smartphones and internet access is supporting the market growth. The rise of e-commerce is also supported by the growing trend of social commerce, where retailers leverage social media platforms to reach consumers is propelling the market forward.

Modernization of Retail Infrastructure

Turkey's retail market is enduring a transformation driven by the modernization of retail infrastructure. The emergence of contemporary shopping malls, retail parks, and commercial centers is reshaping the retail landscape, offering diversified shopping, entertainment, and dining experiences to consumers. This evolution attracts international brands to establish flagship stores within these modern retail environments, enhancing overall shopping experiences. In order to effectively compete, domestic retailers are also modernizing their physical stores and incorporating cutting-edge technologies, superior customer service, and modern design elements. This is helping to drive market growth. Moreover, extensive investments in retail infrastructure development are creating a positive outlook for market expansion. In 2023, the European Bank for Reconstruction and Development (EBRD) bolstered its investment in Türkiye, reaching a historic €2.48 billion. This surge was fueled by the Bank's swift response to support the nation's recovery and rebuilding efforts post-earthquake, spurring investments in retail infrastructure development.

Rise in Consumer Spending Fueled by Increasing Disposable Incomes

Economic growth and improved employment rates have elevated the disposable incomes of many Turkish consumers, leading to higher spending on a variety of products, from essentials to luxury items. In February, Turkey's retail sales surged 25.1% annually, up from 13.7% in January. This is the fastest growth since July 2023's 31.9% rise. Non-food sales, excluding automotive fuels, grew 36.5%, food and drink sales rose 13%, and sales of computers, books, and telecom equipment soared 56.1%. Consequently, the increase in retail sales is aiding in market expansion. Moreover, the burgeoning middle class, seeking higher-quality products and willing to spend more on premium brands is impelling the market growth. Furthermore, heightened consumer assurance regarding the economy is augmenting retail sales, thereby broadening their product assortments and launching novel brands to cater to the changing inclinations of Turkish consumers, thereby aiding the market's expansion.

Turkey Retail Market News:

- In January 2022, Trendyol enhanced its strategic alliance with Couchbase to gain the performance and scalability required for its applications, such as online shopping carts, delivery tracking, product catalogs, coupons, claims, inventory management, pre-orders, and customer services, by utilizing Couchbase as its database foundation.

Turkey Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product and distribution channel.

Product Insights:

To get more information on this market, Request Sample

- Food and Beverages

- Personal and Household Care

- Apparel, Footwear and Accessories

- Furniture, Toys and Hobby

- Electronic and Household Appliances

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes food and beverages, personal and household care, apparel, footwear and accessories, furniture, toys and hobby, electronic and household appliances, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

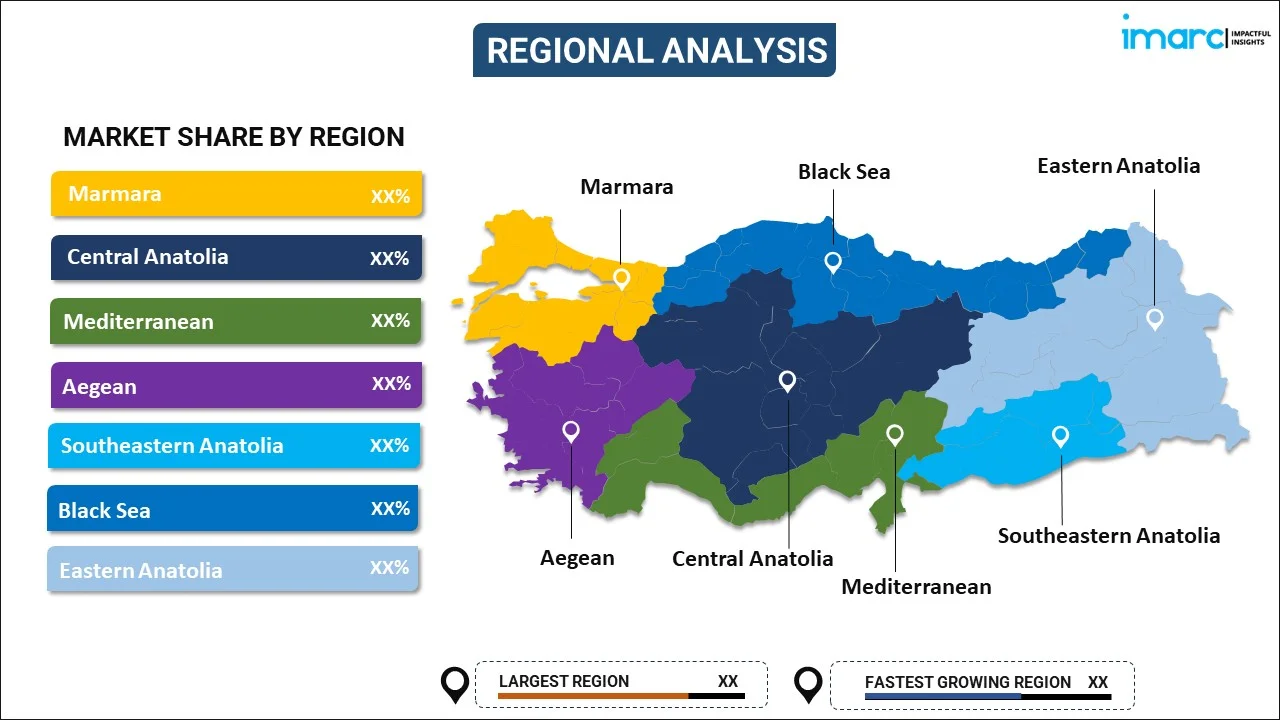

Region Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Food and Beverages, Personal and Household Care, Apparel, Footwear and Accessories, Furniture, Toys and Hobby, Electronic and Household Appliances, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey retail market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey retail market on the basis of product?

- What is the breakup of the Turkey retail market on the basis of distribution channel?

- What are the various stages in the value chain of the Turkey retail market?

- What are the key driving factors and challenges in the Turkey retail?

- What is the structure of the Turkey retail market and who are the key players?

- What is the degree of competition in the Turkey retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)