Turkey Soft Skills Training Market Size, Share, Trends and Forecast by Soft Skill Type, Channel Provider, Sourcing, Delivery Mode, End Use Industry, and Region, 2026-2034

Turkey Soft Skills Training Market Summary:

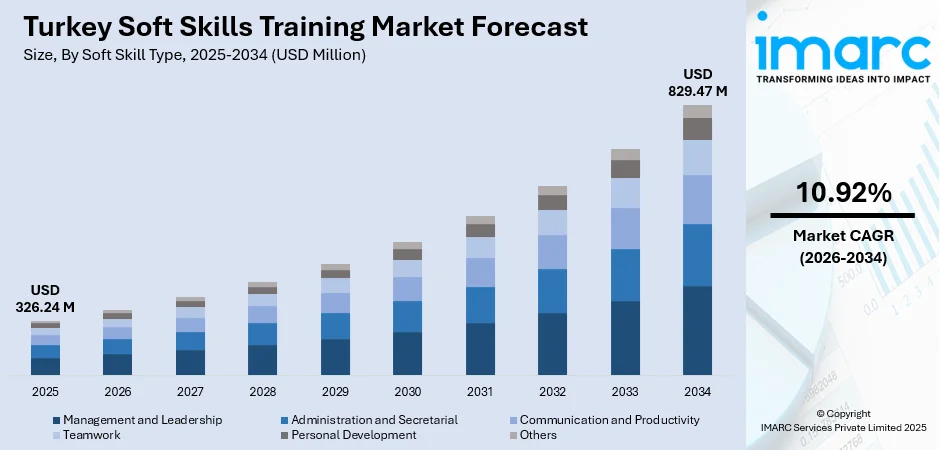

The Turkey soft skills training market size was valued at USD 326.24 Million in 2025 and is projected to reach USD 829.47 Million by 2034, growing at a compound annual growth rate of 10.92% from 2026-2034.

The market is experiencing robust growth driven by organizations increasingly recognizing the critical role of interpersonal competencies in developing motivated and productive workforces. The convergence of digital transformation initiatives, rising demand for leadership development, and expanding corporate training investments creates favorable conditions for market expansion. Turkish companies are prioritizing employee skills enhancement to improve workplace performance, foster collaboration, and maintain competitive advantage in rapidly evolving business environments, strengthening the Turkey soft skills training market share.

Key Takeaways and Insights:

- By Soft Skill Type: Communication and Productivity dominates the market with a share of 35% in 2025, driven by the fundamental importance of effective communication and productivity enhancement in improving workplace performance, teamwork, and organizational efficiency across all industries.

- By Channel Provider: Corporate/Enterprise leads the market with a share of 58% in 2025, attributed to the growing emphasis on workforce transformation, compliance training, leadership development, and talent retention strategies within Turkish corporations and multinational enterprises.

- By Sourcing: Outsourced represents the largest segment with a market share of 66% in 2025, owing to the preference for specialized external training providers offering expertise, scalability, and cost-effective access to high-quality soft skills programs and certified trainers.

- By Delivery Mode: Offline holds the largest share of 55% in 2025, reflecting the continued importance of traditional classroom-based instruction, in-person workshops, and face-to-face training interactions in developing interpersonal competencies and practical skills.

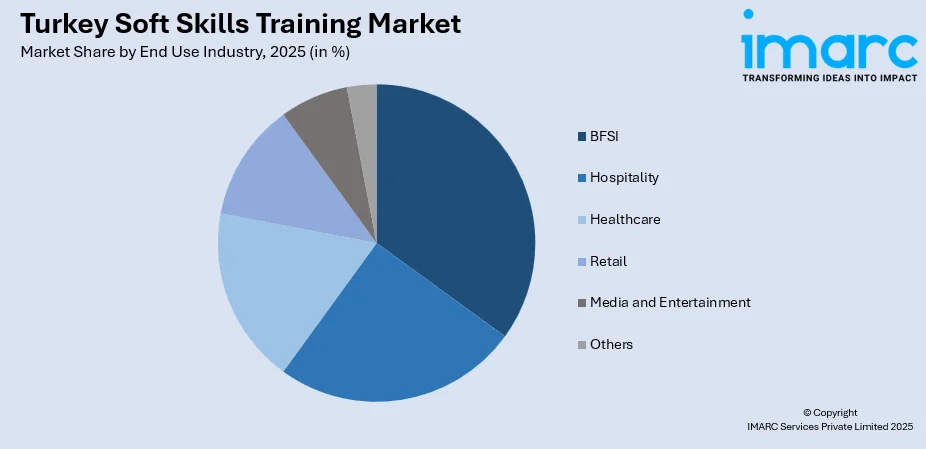

- By End Use Industry: BFSI dominated the market with a share of 25% in 2025, driven by the banking, financial services, and insurance sector's significant investments in customer service excellence, compliance training, leadership development, and communication skills enhancement.

- Key Players: The Turkey soft skills training market features a dynamic mix of regional universities, international training providers, and corporate education institutions competing through program innovation and digital learning integration.

To get more information on this market, Request Sample

Turkey has emerged as a dynamic hub for professional development, with organizations increasingly emphasizing the importance of soft skills training to complement technical expertise. Soft skills such as communication, teamwork, leadership, emotional intelligence, and problem-solving are becoming essential for career growth in a competitive business environment. In Turkey, both multinational corporations and local enterprises are investing in structured training programs to enhance employee effectiveness, workplace collaboration, and customer engagement. In August 2024, Türkiye launched the Workforce Adaptation Program to enhance citizens’ skills, expand employment opportunities, and align job seekers’ qualifications with labor market needs. By fostering these competencies, professionals can navigate complex workplace challenges, build stronger relationships, and drive organizational success. Soft skills training is shaping Turkey’s modern workforce for growth and innovation.

Turkey Soft Skills Training Market Trends:

Digital Learning Platform Expansion

The rise of digital learning platforms is significantly contributing to market growth as organizations and training providers utilize online platforms to offer flexible, scalable, and accessible soft skills training programs. In April 2025, Kliksoft joined the global Moodle Certified Partner network, supporting over 500,000 end users daily in Türkiye across education, corporate, and public sectors. Moreover, the shift toward remote work and hybrid models accelerates e-learning adoption, with companies providing continuous skill development opportunities through webinars, online courses, and virtual workshops focused on communication, time management, and leadership capabilities.

Leadership Development Focus

The escalating demand for effective organizational leadership is supporting market growth as Turkish companies face leadership shortages particularly among mid-management and senior management levels. Organizations increasingly recognize that technical proficiency alone is insufficient for leading diverse teams, driving emphasis on training programs building emotional intelligence, conflict resolution, and decision-making skills essential for adaptive leadership during digital transformation and market uncertainty.

Employee Development and Retention Strategies

Turkish organizations acknowledge the role of soft skills in developing motivated, productive workforces, driving investment in ongoing learning and development programs. Companies integrate soft skills training into comprehensive talent development initiatives, linking programs to organizational objectives to enhance competitiveness and support innovation. With high turnover rates challenging businesses, firms focus on soft skills training as a key employee retention strategy.

Market Outlook 2026-2034:

The Turkey soft skills training market is positioned for substantial growth over the forecast period, supported by accelerating digitalization, evolving workforce requirements, and increasing corporate investment in human capital development. The convergence of government support for employment initiatives, expanding corporate training budgets, and growing recognition of soft skills' importance in hybrid work environments creates favorable conditions for market expansion. Continued advancement in e-learning technologies, personalized training solutions, and AI-powered learning platforms will drive adoption across industries. The market generated a revenue of USD 326.24 Million in 2025 and is projected to reach a revenue of USD 829.47 Million by 2034, growing at a compound annual growth rate of 10.92% from 2026-2034.

Turkey Soft Skills Training Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Soft Skill Type | Communication and Productivity | 35% |

| Channel Provider | Corporate/Enterprise | 58% |

| Sourcing | Outsourced | 66% |

| Delivery Mode | Offline | 55% |

| End Use Industry | BFSI | 25% |

Soft Skill Type Insights:

- Management and Leadership

- Administration and Secretarial

- Communication and Productivity

- Teamwork

- Personal Development

- Others

The communication and productivity dominate with a market share of 35% of the total Turkey soft skills training market in 2025.

The communication and productivity segment leads the Turkish market, reflecting the fundamental importance of these competencies across all industries and job functions. Effective communication skills are essential for workplace collaboration, customer interactions, and organizational efficiency. In 2025, Astera İnsan Kaynakları rolled out customised corporate‑workshop offerings designed to strengthen communication, team collaboration, and leadership capabilities across Turkish firms. Turkish companies prioritize training programs enhancing verbal and written communication, presentation skills, time management, and productivity optimization to improve employee performance and business outcomes.

The increasing demand for remote and hybrid work arrangements has further accelerated the need for communication and productivity training in Turkey. Organizations are investing in digital tools and virtual workshops to ensure employees can collaborate effectively, manage tasks efficiently, and maintain high performance regardless of their work environment.

Channel Provider Insights:

- Corporate/ Enterprise

- Academic/ Education

- Government

The corporate/enterprise leads with a share of 58% of the total Turkey soft skills training market in 2025.

The corporate and enterprise segment dominates the Turkish soft skills training market, driven by the growing trend of workforce transformation, compliance training, and leadership development within the corporate sector. Companies invest significantly in executive education to enhance leadership capabilities, support digital transformation, and improve workforce productivity. In 2024, Akçansa — part of the Sabancı Group — deployed a broad training and development programme via its “Akçansa Digital Academy,” offering nearly 600 modules covering personal development, leadership, and soft‑skills training to employees at all levels. Moreover, major corporations in Istanbul, Ankara, and Izmir lead training investments, with multinational enterprises establishing comprehensive learning and development programs.

The strong focus on employee retention and engagement further propels corporate investment in soft skills training. By equipping teams with advanced interpersonal, problem-solving, and decision-making skills, organizations aim to foster a resilient and adaptable workforce, enhancing overall business performance and maintaining a competitive edge in Turkey’s evolving corporate landscape.

Sourcing Insights:

- In-house

- Outsourced

The outsourced dominate with a market share of 66% of the total Turkey soft skills training market in 2025.

The outsourced segment leads the Turkish market as organizations prefer specialized external training providers offering expertise, scalability, and access to certified trainers and established methodologies. In 2025, under the İŞKUR‑UNDP Skills Development for Improved Employability Project, soft‑skills training was rolled out nationwide through external providers, supporting workforce development for vulnerable populations. Further, external providers deliver cost-effective solutions, particularly for small and medium enterprises lacking internal training infrastructure. Leading universities including Koç University, Sabancı University, and Boğaziçi University offer executive education programs serving corporate clients.

The rising adoption of blended and digital learning solutions further strengthens the outsourced segment. Companies increasingly rely on external providers to deliver flexible online courses, virtual workshops, and customized training modules, enabling employees across locations to acquire essential soft skills efficiently while ensuring consistent quality and measurable outcomes.

Delivery Mode Insights:

- Online

- Offline

The offline leads with a share of 55% of the total Turkey soft skills training market in 2025.

The offline segment leads the Turkish market, reflecting the continued importance of traditional classroom‑based instruction and face‑to‑face training interactions in developing interpersonal competencies. Approximately 65% of Turkish companies still rely on traditional classroom‑based training, valuing in‑person engagement for soft skills development where practical exercises, role‑playing, and direct feedback are essential learning components. In 2025, NobleProg Türkiye confirmed that many of its corporate soft‑skills courses continue to be delivered onsite (onsite live training), offering in‑person communication, leadership, and teamwork workshops to companies preferring classroom‑based formats.

The integration of experiential learning techniques further reinforces the offline segment’s popularity. Turkish organizations emphasize interactive workshops, team exercises, and live simulations to enhance collaboration, problem‑solving, and communication skills, ensuring employees gain practical experience and immediate feedback that strengthens overall skill retention and workplace application.

End Use Industry Insights:

Access the Comprehensive Market Breakdown, Request Sample

- BFSI

- Hospitality

- Healthcare

- Retail

- Media and Entertainment

- Others

The BFSI dominate with a market share of 25% of the total Turkey soft skills training market in 2025.

The BFSI sector leads soft skills training adoption in Turkey due to its strong focus on customer interaction, regulatory sensitivity, and service excellence. Banks, insurance firms, and financial institutions invest in programs covering communication, problem-solving, emotional intelligence, and customer handling to strengthen service quality. In 2025, the Banks Association of Türkiye reported training nearly 8,000 bankers each term, offering year-round classroom sessions, seminars, and online modules that strengthen sector-wide soft-skills and professional capabilities. Moreover, large employee bases further drive continuous development to ensure consistent client-facing professionalism.

Digital banking expansion and rising demand for relationship-based financial services heighten the need for well-trained frontline and managerial staff. BFSI organizations emphasize conflict resolution, consultation skills, and persuasive communication to improve customer trust and satisfaction. With increasing competition and evolving consumer expectations, BFSI remains the top industry investing in structured soft skills development across Turkey.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

Marmara is a major center for professional development in Turkey, supported by strong corporate activity and a diverse workforce. The region’s businesses prioritize communication, leadership, and customer-facing skills to strengthen service delivery. Its competitive environment encourages continuous skill-building as organizations refine workforce capabilities to improve collaboration and operational efficiency.

Central Anatolia shows increasing emphasis on structured training as companies seek to improve workplace communication and productivity. Organizations focus on developing interpersonal skills, teamwork, and managerial capabilities to support growing industries. With expanding commercial activity, employers encourage consistent capability development to help employees adapt to evolving operational requirements.

The Mediterranean region benefits from a service-oriented economy that values professional behavior and customer interaction. Companies encourage training programs aimed at improving communication, problem-solving, and client engagement. As tourism and service enterprises grow, organizations prioritize interpersonal competence to maintain service quality and strengthen staff-customer relationships.

The Aegean region demonstrates consistent demand for professional skills development driven by its diverse business landscape. Companies rely on training to build team coordination, strengthen internal communication, and support employee performance. Growing commercial activity encourages organizations to invest in workforce competencies that contribute to smoother operations and improved service outcomes.

Southeastern Anatolia is witnessing increasing interest in professional development as businesses expand and modernize. Organizations focus on strengthening communication, adaptability, and team-oriented skills to support evolving business structures. Professional training encourages employees to perform effectively in dynamic environments and contributes to improved organizational functioning across sectors.

The Black Sea region values training programs that boost communication effectiveness and teamwork in diverse industries. Companies support initiatives that help employees improve interpersonal interactions and workplace collaboration. With gradual economic development, organizations view skill enhancement as a means to improve operational consistency and service quality.

Eastern Anatolia continues to develop its focus on strengthening workplace professionalism through targeted training. Companies encourage improvement in communication, coordination, and problem-resolution abilities to support organizational stability. As regional industries evolve, employers recognize the need for capable staff who can manage responsibilities with confidence and efficiency.

Market Dynamics:

Growth Drivers:

Why is the Turkey Soft Skills Training Market Growing?

Growing Demand for Staff Development and Retention

Turkish organizations are acknowledging the role of soft skills in developing motivated and productive workforces, driving the need for training programs. For example, in early 2025 SAP Türkiye announced that its HR software platform, enhanced with AI analytics, will be used by many firms to identify gaps in employees’ soft skills such as communication, leadership, and adaptability and then recommend personalized training plans. Companies concentrate on employee interpersonal skills, emotional intelligence, and communication skills to improve workplace performance and teamwork. The growing emphasis on people oriented corporate culture convinces organizations to invest in ongoing learning and development. With high turnover rates challenging businesses, firms focus on soft skills training as a key employee retention strategy.

Integration of Soft Skills in Workforce Digital Transformation

The accelerated adoption of digital technologies in Turkish organizations is creating a pressing need for employees who can effectively combine technical expertise with strong interpersonal abilities. As companies implement new digital tools, collaborative platforms, and automated processes, workers must possess adaptability, communication, problem-solving, and teamwork skills to leverage technology efficiently. Organizations increasingly recognize that technological proficiency alone is insufficient; employees must navigate complex workflows, interact across virtual teams, and respond to evolving business challenges.

Increasing Demand for Leadership Development

The escalating demand for successful organizational leadership supports market growth as Turkish companies face leadership shortages particularly among mid-management and senior management levels. Organizations recognize that technical proficiency alone is insufficient for leading diverse teams and managing complex work environments. Companies increasingly invest in training initiatives building emotional intelligence, conflict resolution, and decision-making skills essential for navigating digital transformation and market uncertainty.

Market Restraints:

What Challenges the Turkey Soft Skills Training Market is Facing?

Resistance to Change in Traditional Training Methods

Despite the growth of innovative training solutions, many Turkish organizations remain resistant to adopting new methodologies. Approximately 65% of companies still rely on traditional classroom-based training, limiting the effectiveness of executive education and hindering development of essential skills in the workforce. This reluctance to embrace modern learning techniques presents challenges for market expansion.

Skills Mismatch and Education-Employment Gap

Turkey faces an acute disconnect between education outcomes and labor market needs. Unemployment rates remain elevated across all education levels, with approximately one-third of young people neither in school nor employed. Skills mismatch represents a major labor market challenge, requiring significant investment in bridging educational curricula with employer requirements.

Regional Economic Disparities

Employment opportunities remain concentrated in major cities including Istanbul, Ankara, and Izmir, leaving some regions struggling with limited access to quality training programs. Regional disparities in employment rates reaching 26 percentage points between regions create uneven market development and accessibility challenges for training providers serving geographically dispersed populations.

Competitive Landscape:

The competitive landscape of the Turkey soft skills training market is dynamic and increasingly crowded. Demand is driven by organizations recognizing the importance of communication, leadership, emotional intelligence, and adaptability for employee performance and career growth. Providers range from professional training firms to digital learning platforms and niche consultancies, creating strong competition across delivery modes, including in-person, online, and blended programs. Success in this market relies on offering high-quality, flexible training tailored to organizational needs, while differentiation is achieved through specialized programs, innovative delivery methods, and the ability to address evolving workforce challenges.

Recent Developments:

- In November 2025, Helsinki-based edtech startup Sopu Academy, founded by Turkish entrepreneurs, launched a flagship soft-skills training programme for innovation and knowledge-transfer professionals in Türkiye. Part of the EU-funded KTSS project, the training focuses on communication, collaboration, negotiation, and feedback skills to convert research into real-world results. The initiative aims to benefit Türkiye’s innovation ecosystem.

- In November 2025, Samsung Türkiye and UNDP Türkiye are expanding the Samsung Innovation Campus through the “Sector on Campus” program, part of the National Technology Move. The initiative offers AI, IoT, and coding training to students while emphasizing soft skills alongside digital competencies, aiming to equip youth to drive Türkiye’s digital transformation and innovation-led growth.

Turkey Soft Skills Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Soft Skill Types Covered | Management and Leadership, Administration and Secretarial, Communication and Productivity, Teamwork, Personal Development, Others |

| Channel Providers Covered | Corporate/ Enterprise, Academic/ Education, Government |

| Sourcings Covered | In-house, Outsourced |

| Delivery Modes Covered | Online, Offline |

| End Use Industries Covered | BFSI, Hospitality, Healthcare, Retail, Media and Entertainment, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey soft skills training market size was valued at USD 326.24 Million in 2025.

The Turkey soft skills training market is expected to grow at a compound annual growth rate of 10.92% from 2026-2034 to reach USD 829.47 Million by 2034.

Communication and productivity held the largest market share of 35%, driven by the fundamental importance of effective communication and productivity enhancement in improving workplace performance, teamwork, and organizational efficiency.

Key factors driving the Turkey soft skills training market include growing demand for staff development and retention, emergence of digital learning platforms, increasing demand for leadership development, government support for workforce training initiatives, and corporate emphasis on people-oriented culture.

Major challenges include resistance to change in traditional training methods of companies still relying on classroom-based training, skills mismatch between education outcomes and labor market needs, and regional economic disparities limiting training accessibility in areas outside major cities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)