Turkey Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2025-2033

Turkey Vegetable Oil Market Overview:

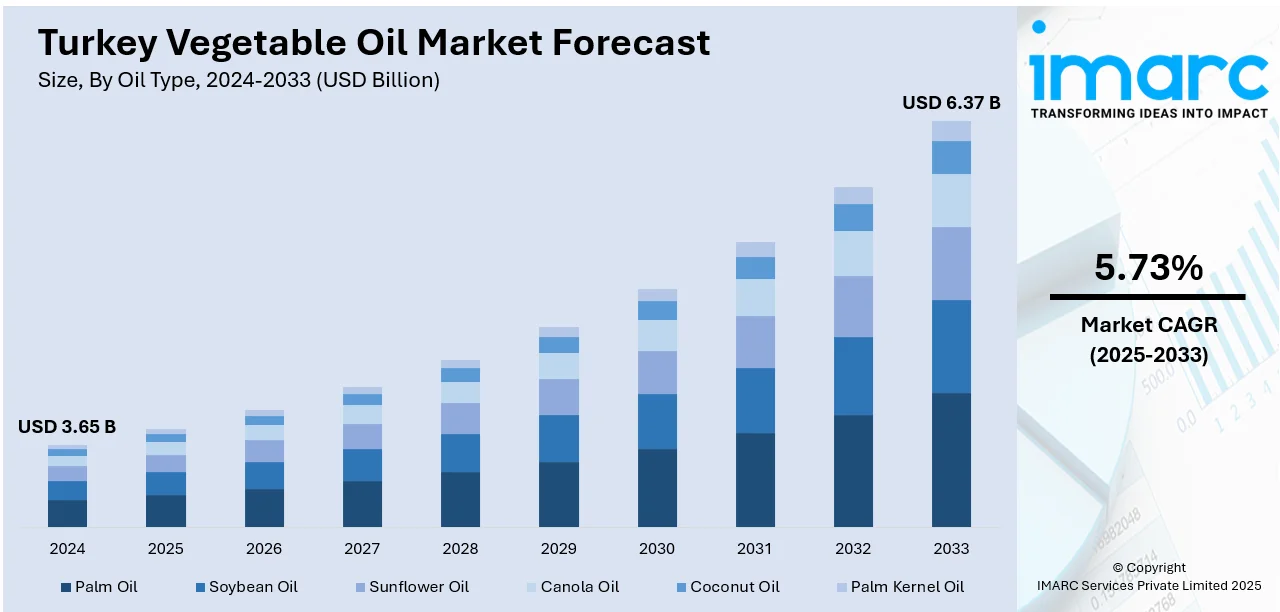

The Turkey vegetable oil market size reached USD 3.65 Billion in 2024. Looking forward, the market is projected to reach USD 6.37 Billion by 2033, exhibiting a growth rate (CAGR) of 5.73% during 2025-2033. The market is driven by Turkey’s strong domestic oilseed production and integrated refining capacity supporting staple household consumption. Strategic export positioning across Europe, MENA, and Central Asia fuels industrial scale and trade resilience. Rising consumer demand for fortified and health-oriented oils is further augmenting the Turkey vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.65 Billion |

| Market Forecast in 2033 | USD 6.37 Billion |

| Market Growth Rate 2025-2033 | 5.73% |

Turkey Vegetable Oil Market Trends:

Strong Agricultural Backbone and Domestic Oilseed Production

Turkey’s vegetable oil sector is supported by a robust agricultural base, particularly for sunflower and cottonseed cultivation. The Thrace region and Central Anatolia are major producers of oilseeds, supplying raw materials for both domestic refining and value-added product development. Government programs, including input subsidies and price supports, encourage farmers to prioritize oilseed crops, reducing dependence on imports. Processing capacity is well developed, with local refineries operating at efficient scales to meet national consumption. Turkish cuisine heavily relies on vegetable oil, which is used for deep-frying, dressings, and hot dishes across all regions. Cottonseed and corn oils also play a role in certain regional recipes, while olive oil remains dominant in Mediterranean and Aegean diets. On July 20, 2023, Edremit olive oil from Turkey was officially granted Protected Designation of Origin (PDO) certification by the European Union under the name “Edremit Zeytinyağı.” The PDO region, located in Balikesir province, encompasses 9.8 million olive trees, approximately 6.2% of Turkey’s total, highlighting the area’s historic and agricultural importance to the vegetable oil industry. This recognition reinforces Turkey’s position in the global vegetable oil market, making Edremit the second Turkish olive oil to obtain EU GI status after Milas extra virgin olive oil in 2020. As oilseed acreage expands and domestic processing modernizes, Turkey is building resilience against external market fluctuations. Local brands are widely trusted by consumers, particularly in small and medium-sized cities where national distribution networks ensure availability. This synergy between farming, processing, and consumer habits secures a reliable supply chain. The country’s ability to meet internal demand through domestic production underpins Turkey vegetable oil market growth across retail, foodservice, and industrial channels.

To get more information on this market, Request Sample

Shifting Consumer Preferences and Fortified Oil Demand

Consumer preferences in Turkey are gradually shifting toward fortified, functional, and health-oriented oils, driven by rising health awareness and evolving dietary habits. Urban families, particularly in Istanbul, Ankara, and Izmir, are seeking oils enriched with vitamins A and D, as well as low-cholesterol and low-saturated fat variants. Brands are responding with innovative products, including cold-pressed options, omega-enriched blends, and organically certified oils that meet EU-aligned health standards. On January 11, 2024, Oliveoilsland, a leading Turkish olive oil producer, launched its premium extra virgin olive oil line for international markets. The product is made from hand-picked olives cold-pressed within 24 hours, preserving rich flavor and nutrients, and is certified organic. This launch highlights the rising global appeal of Turkish vegetable oil, reinforcing Turkey’s role as a key exporter in the premium segment. Marketing campaigns led by nutritionists and wellness influencers further drive demand by emphasizing the role of vegetable oil in preventing lifestyle-related diseases. Turkish supermarkets are dedicating more shelf space to premium and health-oriented oil varieties, including high-oleic sunflower and canola oils. Educational initiatives by the Ministry of Health and food industry associations also promote responsible oil use, especially in schools and hospitals. These shifting preferences are expanding the retail category beyond price-driven mass consumption, encouraging brand diversification and product innovation. Consumer interest in label transparency, natural ingredients, and added nutritional benefits is not only transforming purchase behavior but also elevating product standards across the industry. This evolution in health-driven consumption continues to refine and expand the country’s vegetable oil landscape.

Turkey Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

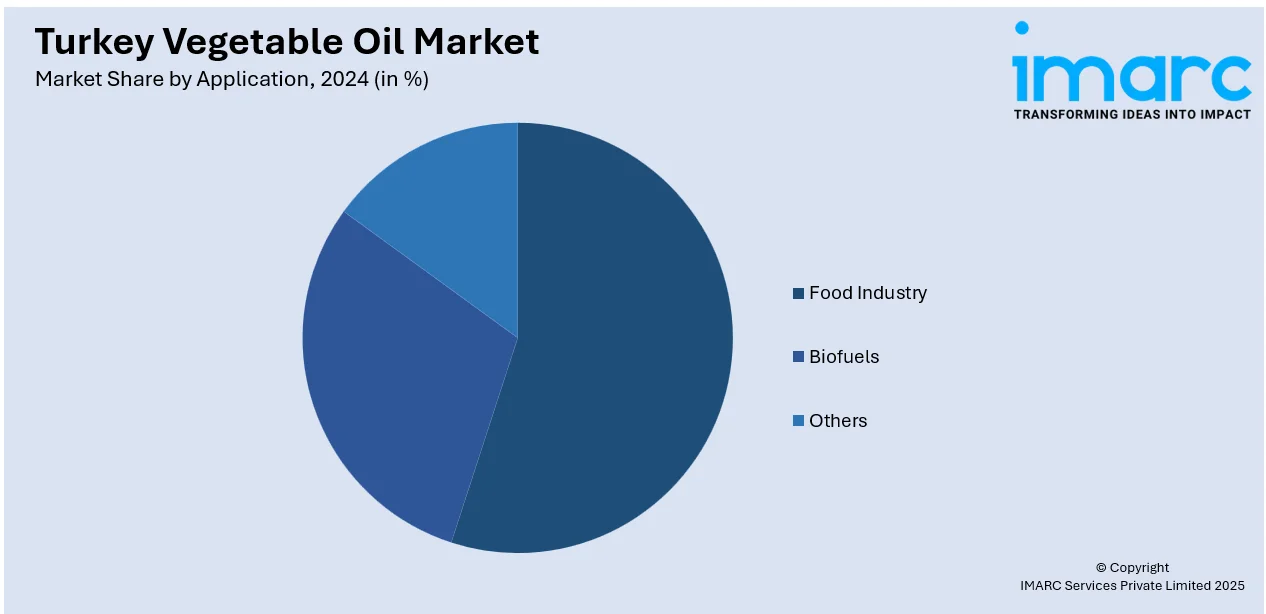

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Vegetable Oil Market News:

- On July 1, 2025, Turkish olive oil brand Oleavia received its seventh international award, a Silver Award at the NYIOOC World Olive Oil Competition, for its “South Aegean Special” extra virgin olive oil, produced from Memecik and Avail olives grown in Turkey’s Aydın region.

- On June 2025, Bunge announced it has signed a definitive agreement to acquire Ana Gıda, a prominent Turkish producer of olive and seed oils and the owner of Komili, Turkey’s leading olive oil brand. This strategic acquisition is aimed at expanding Bunge’s product portfolio and deepening its market presence across Turkey. The move underscores increasing consolidation and international investment activity in the Turkish vegetable oil market.

Turkey Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey vegetable oil market on the basis of oil type?

- What is the breakup of the Turkey vegetable oil market on the basis of application?

- What is the breakup of the Turkey vegetable oil market on the basis of region?

- What are the various stages in the value chain of the Turkey vegetable oil market?

- What are the key driving factors and challenges in the Turkey vegetable oil market?

- What is the structure of the Turkey vegetable oil market and who are the key players?

- What is the degree of competition in the Turkey vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)