Tire Market Size, Share, Trends and Forecast by Design, End-Use, Vehicle Type, Distribution Channel, Season, and Region, 2026-2034

Tire Market Size and Share:

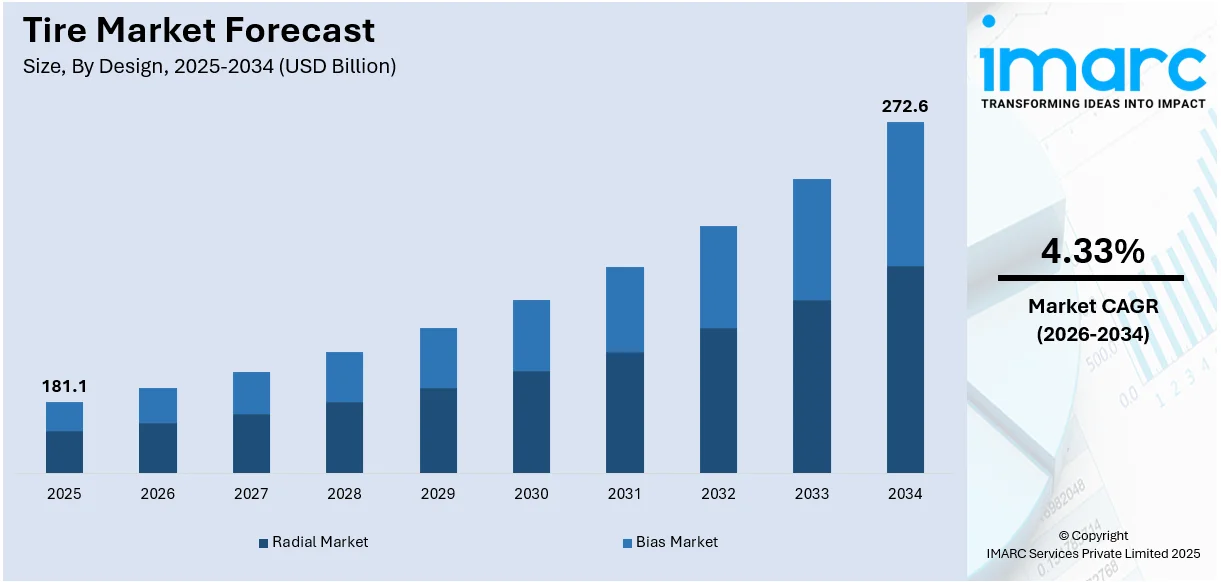

The global tire market size reached USD 181.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 272.6 Billion by 2034, exhibiting a growth rate (CAGR) of 4.33% during 2026-2034. Continuous technological advancements in the manufacturing of tires, along with the rising demand among individuals for eco-friendly and specialized tires, owing to the increasing environmental consciousness, are primarily bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 181.1 Billion |

|

Market Forecast in 2034

|

USD 272.6 Billion |

| Market Growth Rate 2026-2034 | 4.33% |

Global Tire Market Analysis:

- Major Market Drivers: The rising vehicle sales and the increasing demand for tires among emerging economies are providing a positive outlook in the tire market. Additionally, the implementation of stringent regulations by government bodies is also acting as another significant growth-inducing factor.

- Key Market Trends: The emerging popularity of high-performance and specialized tires is one of the emerging trends catalyzing the tire market demand. Besides this, the development of tires that are specifically designed for electric vehicles (EVs), reflecting the shift towards electrification in the automotive industry, is anticipated to fuel the tire market revenue in the foreseeable future.

- Geographical Trends: According to the tire market report, Asia Pacific accounted for the largest market share, owing to the increasing number of automobiles. Moreover, the expanding economic growth is further bolstering the tire market growth.

- Competitive Landscape: Some of the leading tire market companies include Apollo Tyres Ltd., Bridgestone Corporation, Continental AG, Hankook Tire & Technology Co., Ltd., Kumho Tire Co., Inc., Michelin, MRF Tyres, Pirelli Tyre C. S.p.A, Sumitomo Rubber Industries, Ltd., The Goodyear Tire & Rubber Company, The Yokohama Rubber Co., Ltd., and Toyo Tire Corporation, among many others.

- Challenges and Opportunities: The price fluctuations of raw materials, including synthetic rubber, natural rubber, plasticizers, carbon black, etc., that are utilized in the manufacturing of tires are one of the key challenges hampering the tire market share. However, the shifting preferences from petroleum-based oils towards bio-based oils in the production of tire rubbers, as various companies are focusing on cutting down materials that can negatively impact the environment, are among the recent tire market developments.

To get more information on this market Request Sample

Global Tire Market Trends:

Rapid Technological Advancements in Tire Manufacturing

The increasing enhancements in tire fuel efficiency, longevity, and performance represent primary factors bolstering the tire market's recent opportunities. Apart from this, various key players across the globe are widely investing in R&D activities to launch novel tire variants. For example, Pirelli introduced a new all-season tire, called the P Zero AS Plus 3, designed for high-performance cars. Similarly, in June 2023, Michelin developed the Air X SkyLight tire for commercial aviation. The tire is lighter as compared to previous generations, with a weight reduction of 10-20% leading to over 15-20% long-term lifespan and performance. Moreover, in March 2023, Sumitomo Rubber Industries Ltd. launched FALKEN "e. ZIEX," the replacement tires for electric vehicles. FALKEN aimed to offer optimal fuel efficiency. Apart from this, the emerging popularity of adopting sustainable materials in the manufacturing of tires is projected to propel the global market over the forecasted period. For instance, Continental is the first manufacturer to introduce tires with both maximum EU tire-label performance and sustainable materials in volume production. Furthermore, in May 2023, Kumho Petrochemical Co., Ltd. (KKPC) and Hankook Tire & Technology signed a Memorandum of Understanding (MOU) to launch eco-friendly tires. They aim to adopt solution-polymerized styrene-butadiene rubber (Eco-SSBR) as an eco-friendly initiative.

Expansion in the Automotive Industry

According to the tire market overview, the rising production of commercial and passenger vehicles, owing to the growing expenditure capacities of individuals, is acting as a significant growth-inducing factor. For example, the sales of passenger vehicles in India improved after the third quarter of the year, reaching 3,10,294 units in October 2020 as compared to 2,71,737 units in the same month last year, which indicated a 14.19% growth. Similarly, major players in the Asia-Pacific region are introducing new tires to gain an advantage over their competitors. For instance, in March 2021, Apollo Tires developed the Apterra Cross tires for the compact SUV segment in India. Apterra Cross tires are an outcome of the company's R&D activities to understand the exact usage patterns of CSUV. Furthermore, automotive tire vendors that compete for original equipment fitments are enhancing the Corporate Average Fuel Economy (CAFE). In line with this, they are trying to achieve the federally mandated target of 54.5 miles per gallon by 2025.

Implementation of Regulatory Policies and Safety Standards

The rising need for minimizing carbon emissions levels and improving fuel efficiency is encouraging government bodies to implement stringent rules to enhance the development of sustainable production and address the elevating environmental concerns associated with tire disposal. This, in turn, is propelling the tire market’s recent price. For instance, the Ministry of Road Transport and Highways (MoRTH) in India announced the regulatory changes in June 2022. The amendment to India’s Central Motor Vehicles Rules covered wet grip, rolling resistance, and rolling sound emissions for C1 (passenger vehicle), C2 (light commercial vehicle), and C3 (truck and bus) tires. In addition to this, MoRTH also announced the central motor vehicle rules in June 2023. The amendments aim to enhance safety and implement environmental standards by regulating the performance and quality of tires for motor vehicles. Moreover, the European Union’s new proposed framework became the first worldwide standard to move beyond exhaust emissions. The Euro 7 rules set out additional limits for particulate emissions generated by brakes. The rising trend of green mobility, leading to stricter emissions standards by government bodies, is projected to fuel the global market over the forecasted period.

Growing Urbanization and Infrastructure Development

The elevating number of infrastructure development activities in developing economies, especially China and India, is catalyzing the sales of construction vehicles and commercial vehicles. The replacement and aftermarket tire market presents a huge opportunity for producers to generate revenue. Furthermore, individuals prefer high-performance tires over traditional rubber tires, as they are subjected to wear and tear. For example, the increasing demand for high-performance tires in Europe, owing to the wide presence of a large number of OEMs, including Ferrari, Daimler, BMW, Volkswagen, Renault, etc. These OEMs regularly participate in motorsports events to showcase their new line of innovative product variants that cater to the need for cleaner, cost-effective, and safer vehicles and components. For example, in March 2021, Bridgestone EMIA and Versalis, Eni's chemical company, signed a joint development agreement for the production, research, and supply of new elastomer grades, including styrene-butadiene rubber (SBR), and synthetic rubber in the manufacturing of high-performance tires.

Increased Vehicle Production

Global car manufacturing has witnessed a sharp increase over the past few years, owing to growing demand for personal transportation, economic expansion, and innovation in electric vehicle (EV) technology. Auto manufacturers globally are increasing production volumes, particularly in the Asia-Pacific and European regions, to address the EV adoption surge and meet sustainability targets. The trend is paced by favorable government regulations, technology advances such as autonomous driving, and emerging markets' rising middle-class demographics. Nonetheless, the sector also experiences challenges including supply chain disturbances and increased raw material prices. In spite of all these challenges, the move towards green power and intelligent cars is defining the future of car manufacturing, rendering greater production a vital determinant of sector advancement as well as global transport demand.

Global Tire Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on design, end-use, vehicle type, distribution channel, and season.

Breakup by Design:

- Radial Market

- Bias Market

The radial market accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the design. This includes radial market and bias market. According to the report, the radial market accounted for the largest market share.

Based on the tire market outlook, the rising usage of golf carts represents one of the primary factors propelling the growth of the market in this segmentation. Furthermore, the introduction of tweels, which refers to an automotive airless tire held together by rubber spokes, is also acting as another significant growth-inducing factor. For example, Michelin Group has been developing a range of tweel model airless tires for numerous vehicles, such as light-tactical vehicles and skid steer loaders used by military special operators. Furthermore, the company provides tweels for ATVs, golf carts, zero-turn mowers, light construction vehicles, etc.

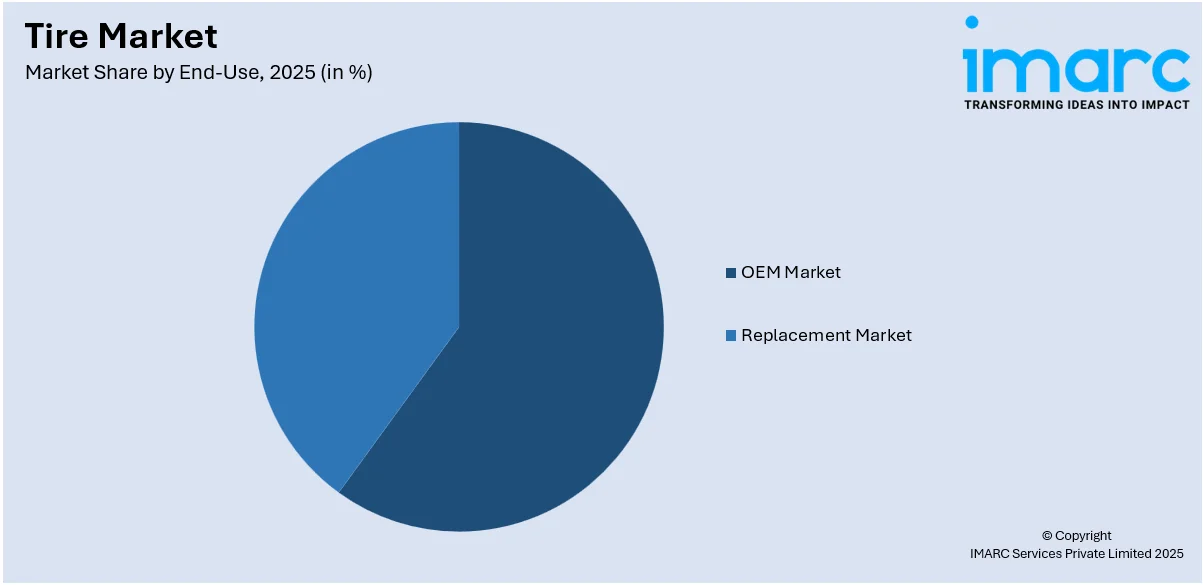

Breakup by End-Use:

Access the comprehensive market breakdown Request Sample

- OEM Market

- Replacement Market

The replacement market holds the largest share in the industry

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes OEM market and replacement market. According to the report, the replacement market accounted for the largest market share.

The rising emphasis on fuel economy and the escalating demand for convenience are positively influencing the growth in the replacement market. Moreover, another significant driver is the inflating usage of cutting-edge manufacturing technology by OEMs to provide product differentiation via durability, affordability, sustainability, etc. Besides this, the replacement market is further bolstered, owing to the growing inclination among key producers towards green energy, as they are working to achieve carbon neutrality by 2050. Consequently, these players are widely investing in zero-carbon technologies. For example, in February 2021, Michelin Group announced that it is working towards making its tires 100% sustainable by 2050. For this, Michelin partnered with numerous organizations, such as Pyrowave, Axens, IFP Energies Nouvelles, Carbios, Enviro, and BlackCycle.

Breakup by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Two Wheelers

- Three Wheelers

- Off-The-Road (OTR)

Passenger cars represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, medium and heavy commercial vehicles, two wheelers, three wheelers, and off-the-road (OTR). According to the report, passenger cars accounted for the largest market share.

According to the tire market statistics, passenger cars account for the largest share, on account of the rising number of passenger vehicles on roads across countries. For instance, the sales of passenger vehicles in India reached up to 3,10,294 units in October 2020, when compared to 2,71,737 units in the same month last year, which indicated a 14.19% growth. Moreover, as per the Federation of Automobile Dealers Associations (FADA), passenger vehicle sales in November 2020 were 2,91,001 units compared to 2,79,365 units in November 2019, with a 4.17% growth. These automobiles include luxury sedans, compact models, sports utility vehicles (SUVs), etc., necessitating the need for a wide array of tire types to suit different vehicle specifications.

Breakup by Distribution Channel:

- Offline

- Online

Offline exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online. According to the report, offline accounted for the largest market share.

The offline distribution channel holds the largest segment, as it includes a wide array of retail formats, including automotive dealerships, specialty tire shops, big-box retailers, etc. Apart from this, the escalating demand for professional advice, direct inspection, and immediate installation services offered by offline channels is also acting as another significant growth-inducing factor. Moreover, specialty tire dealerships and shops further provide value-added services, such as wheel alignment, balancing, and rotation, which are crucial for tire maintenance. Besides this, the widespread adoption of established brick-and-mortar stores, as individuals prefer hands-on experience before making a purchase, will continue to bolster the growth in this segmentation over the forecasted period.

Breakup by Season:

- All Season Tires

- Winter Tires

- Summer Tires

Summer tires dominate the market

The report has provided a detailed breakup and analysis of the market based on the season. This includes all season tires, winter tires, and summer tires. According to the report, summer tires accounted for the largest market share.

Summer tires hold the largest segment across the global market, as they cater to various regions with dry, warm, or wet climates. They are specifically designed to offer optimal performance in humid temperatures. In addition to this, summer tires also provide special tread compounds that improve grip and handling on dry and wet terrains. Moreover, summer tires allow for greater contact with the road, thereby resulting in better stability and traction. They find widespread applications in performance vehicles, owing to their ability to provide responsive handling and handle high speed.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

Asia Pacific leads the market, accounting for the largest tire market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others); and the Middle East and Africa (Turkey, Saudi Arabia, Iran, United Arab Emirates, and others). According to the report, Asia Pacific accounted for the largest market share.

The Asia Pacific region represents the largest market share, on account of the elevating number of passenger and commercial vehicles, in countries, including China. Furthermore, there is a wide presence of major players in the region who are extensively investing in R&D activities related to tire pressure management systems and entering into strategic partnerships to produce tire pressure monitoring systems (TPMS) with the latest technologies to meet international and domestic demands. For example, in November 2019, in partnership with X-FAB Silicon Foundries SE, an automotive electronics chip design company in China, called AutoChips Inc., announced it initiated the production of an advanced TPMS chipset. Apart from this, the emerging popularity of two-wheeler tires is projected to fuel the regional market in the coming years.

Competitive Landscape:

Key players are engaging in various strategic initiatives to maintain and enhance their market positions. They are investing in research and development (R&D) activities to innovate and improve tire technology, such as the development of eco-friendly tires using sustainable materials and advanced manufacturing processes. Moreover, some companies are focusing on producing tires designed for electric vehicles (EVs), which require different performance characteristics compared to traditional vehicles. Additionally, the leading manufacturers are expanding their global footprint through strategic partnerships, acquisitions, and opening new manufacturing facilities in emerging markets. Furthermore, they are also embracing digital transformation by enhancing their online presence and improving distribution channels to cater to evolving consumer buying behaviors.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Apollo Tyres Ltd.

- Bridgestone Corporation

- Continental AG

- Hankook Tire & Technology Co., Ltd.

- Kumho Tire Co., Inc.

- Michelin

- MRF Tyres

- Pirelli Tyre C. S.p.A

- Sumitomo Rubber Industries, Ltd.

- The Goodyear Tire & Rubber Company

- The Yokohama Rubber Co., Ltd.

- Toyo Tire Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Global Tire Market News:

- In June 2025, Bridgestone launched the all-new Turanza EverDrive touring tire, designed for sedans, CUVs, and minivans. Backed by an 80,000-mile limited warranty, its longest yet, the tire features a next-generation compound that resists irregular wear and ensures long-lasting performance. It offers excellent control in wet, dry, and light snow conditions with reduced road noise for a comfortable ride. The tire is available in 36 fitments for popular vehicle models.

- In March 2025, CEAT launched its new SportDrive range of tyres in India, featuring three advanced innovations designed for ultra-luxury and high-performance cars and SUVs. The range includes ultra-high performance and run-flat tyres, rigorously tested in Germany. The run-flat technology allows vehicles to continue driving temporarily even after a puncture, enhancing safety and convenience. These premium tyres are priced between ₹15,000 to ₹20,000 each and cater to high-end sedans and SUVs.

- In February 2025, Eurogrip introduced two new variants in its Trailhound tyre range in India — the SCR and STR. The SCR is designed for modern classic motorcycles, offering improved road control with a radial structure and steel belt. The STR targets medium and large adventure bikes, delivering better lateral stiffness and bump resistance. Both variants feature a knobby tread pattern for excellent on-road grip and light off-road traction. Prices will be announced soon.

- February 2024: Cabot Corp.'s engineered elastomer composites (E2C) have gained extensive traction in the off-road tire segment, marking four years since their introduction to the market.

- December 2023: Sailun Group expanded its investment plan for the construction of a tire manufacturing plant in León, located in the central Mexican state of Guanajuato, via a joint venture (JV) with Mexico's TD International Holding.

- October 2023: TVS Srichakra acquired Super Grip, a Tennessee-based company, to launch an off-highway tire business.

Tire Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Units |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Designs Covered | Radial Market, Bias Market |

| End-Uses Covered | OEM Market, Replacement Market |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two Wheelers, Three Wheelers, Off-The-Road (OTR) |

| Distribution Channels Covered | Offline, Online |

| Seasons Covered | All Season Tires, Winter Tires, Summer Tires |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Apollo Tyres Ltd., Bridgestone Corporation, Continental AG, Hankook Tire & Technology Co., Ltd., Kumho Tire Co., Inc., Michelin, MRF Tyres, Pirelli Tyre C. S.p.A, Sumitomo Rubber Industries, Ltd., The Goodyear Tire & Rubber Company, The Yokohama Rubber Co., Ltd., Toyo Tire Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the tire market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global tire market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the tire industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global tire market was valued at USD 181.1 Billion in 2025 and is expected to reach a USD 272.6 Billion by 2034 exhibiting a CAGR of 4.33% during 2026-2034.

The growing adoption of sport utility vehicles (SUVs), along with rising popularity of automobile tires with a high safety quotient, is currently driving the global tire market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of numerous manufacturing units for vehicles, thereby limiting the overall demand for tires.

Based on the design, the global tire market can be segregated into radial and bias, where radial tires currently account for the majority of the global market share.

Based on the end-use, the global tire market has been divided into OEM market and replacement market. Currently, replacement market exhibits a clear dominance in the market.

Based on the vehicle type, the global tire market can be categorized into passenger cars, light commercial vehicles, medium and heavy commercial vehicles, two wheelers, three wheelers, Off- The-Road (OTR). Among these, passenger cars currently hold the majority of the total market share.

Based on the distribution channel, the global tire market has been segmented into offline and online. Currently, offline channel represents the largest market share.

Based on the season, the global tire market can be bifurcated into all season tires, winter tires, and summer tires. Among these, summer tires currently account for the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where Asia Pacific currently dominates the global market.

Some of the major players in the global tire market include Apollo Tyres Ltd., Bridgestone Corporation, Continental AG, Hankook Tire & Technology Co., Ltd., Kumho Tire Co., Inc., Michelin, MRF Tyres, Pirelli Tyre C. S.p.A, Sumitomo Rubber Industries, Ltd., The Goodyear Tire & Rubber Company, The Yokohama Rubber Co., Ltd., and Toyo Tire Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)