UAE Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2025-2033

UAE Air Freight Market Overview:

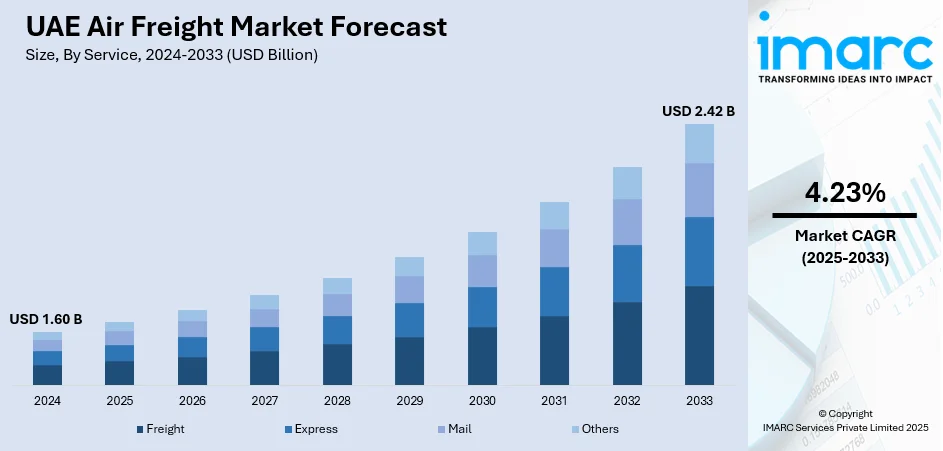

The UAE air freight market size reached USD 1.60 Billion in 2024. The market is projected to reach USD 2.42 Billion by 2033, exhibiting a growth rate (CAGR) of 4.23% during 2025-2033. The market is driven by the UAE’s strategic location as a global transit hub connecting Asia, Europe, and Africa, facilitating efficient cargo movement. Along with this, growth in e-commerce and demand for time-sensitive shipments have led to expanded capacity and infrastructure investments at major airports like Dubai and Abu Dhabi. Additionally, government initiatives supporting trade and logistics, including free zones and customs modernization, attract international freight operators, further augmenting UAE air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.60 Billion |

| Market Forecast in 2033 | USD 2.42 Billion |

| Market Growth Rate 2025-2033 | 4.23% |

UAE Air Freight Market Trends:

Expansion of E-Commerce and Demand for Express Logistics

E-commerce growth in the UAE has created a sustained increase in air freight volumes, particularly for time-sensitive goods. According to industry reports, the e-commerce market in UAE reached USD 125.0 Billion in 2024. The market is expected to reach USD 776.2 Billion by 2033, exhibiting a growth rate (CAGR) of 21.4% during 2025-2033. With consumers expecting shorter delivery timelines and international brands scaling direct-to-consumer operations, express logistics has become essential. Dubai and Abu Dhabi airports have responded by expanding dedicated cargo facilities, investing in automation, and optimizing customs processes to speed up last-mile operations. Major carriers are increasingly focusing on e-commerce-specific services, offering tailored solutions that integrate warehousing, customs clearance, and express delivery. Cross-border purchases, especially from China, Europe, and the United States, have surged, further reinforcing air freight’s role in supporting omnichannel retail. Additionally, third-party logistics providers have expanded their UAE presence, leveraging the country’s air network to serve both GCC and East African markets. The combination of robust payment systems, smartphone penetration, and regulatory clarity in digital trade contributes to the continued expansion of e-commerce air cargo, especially in electronics, fashion, health products, and luxury goods.

To get more information on this market, Request Sample

Strategic Investments in Airport Infrastructure and Cargo Capacity

The UAE government and private stakeholders have continued to allocate significant resources toward expanding air cargo infrastructure. This is positively impacting the UAE air freight market growth. Dubai World Central (DWC) and Abu Dhabi Airport’s Midfield Cargo Complex are central to this strategy. Notably, in April 2024, the Dubai Government announced the commencement of Phase Two of Dubai World Central’s (DWC) expansion. The plan outlines the development of what is set to become the world’s highest-capacity airport. Over the next ten years, DWC will be equipped with five runways and the infrastructure to handle 150 million passengers annually, with long-term capacity expected to reach 260 million passengers and 12 million tonnes of cargo each year. In parallel, Emirates and Etihad have invested in expanding their freighter fleets and building larger temperature-controlled facilities to meet pharmaceutical and food shipment requirements. These upgrades are accompanied by improved ground handling systems and customs modernization, enabling faster clearance and higher efficiency. The development of integrated logistics zones around airport perimeters, particularly in Jebel Ali and Khalifa Industrial Zone, has also improved multimodal connectivity, linking air freight with sea and land transport. These zones attract global freight players seeking to base regional operations in the UAE. The focus on scalability and resilience ensures that the country remains prepared for peak demand cycles, such as during pandemics or major global supply chain disruptions.

UAE Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, destination, and end user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes domestic and international.

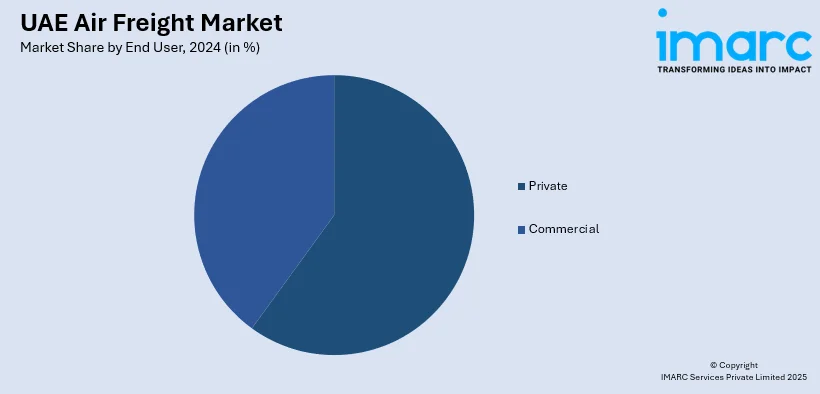

End User Insights:

- Private

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes private and commercial.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Air Freight Market News:

- On April 16, 2025, Emirates SkyCargo and Teleport (AirAsia’s exclusive cargo partner) entered into a strategic Memorandum of Understanding (MoU). The collaboration enables Emirates to utilize AirAsia’s belly‑hold capacity across more than 100 Southeast Asian destinations, while Teleport gains access to Emirates’ extensive global network of over 145 destinations. Together, the partners will broaden interline arrangements and establish additional block space agreements to strengthen network connectivity for ASEAN businesses and capitalize on growing e‑commerce demand.

UAE Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End Users Covered | Private, Commercial |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE air freight market on the basis of service?

- What is the breakup of the UAE air freight market on the basis of destination?

- What is the breakup of the UAE air freight market on the basis of end user?

- What is the breakup of the UAE air freight market on the basis of region?

- What are the various stages in the value chain of the UAE air freight market?

- What are the key driving factors and challenges in the UAE air freight market?

- What is the structure of the UAE air freight market and who are the key players?

- What is the degree of competition in the UAE air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE air freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)