UAE Animal Feed Market Size, Share, Trends and Forecast by Form, Animal Type, Ingredient, and Region, 2025-2033

UAE Animal Feed Market Overview:

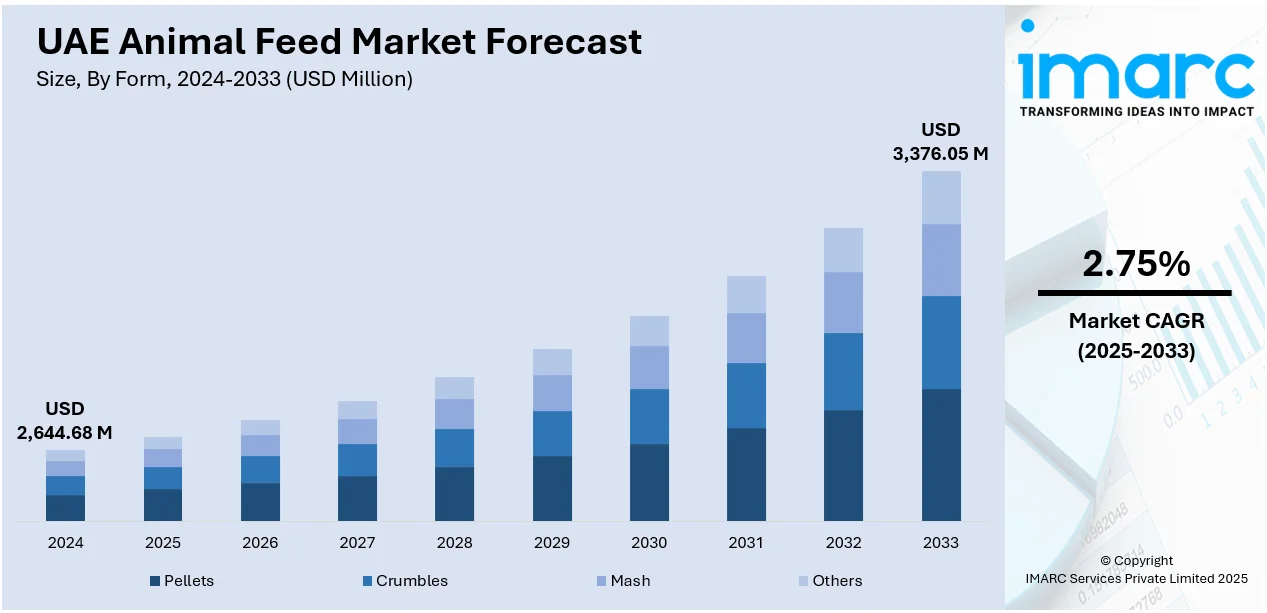

The UAE animal feed market size reached USD 2,644.68 Million in 2024. The market is projected to reach USD 3,376.05 Million by 2033, exhibiting a growth rate (CAGR) of 2.75% during 2025-2033. The market is expanding due to rising demand for sustainable, locally produced feed solutions. Innovations like using surplus bread waste for livestock feed and consolidating local production capabilities continue to support the UAE animal feed market share, driving food security and reducing import dependency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,644.68 Million |

| Market Forecast in 2033 | USD 3,376.05 Million |

| Market Growth Rate 2025-2033 | 2.75% |

UAE Animal Feed Market Trends:

Push for Sustainability and Local Production

The UAE has been increasingly focusing on sustainability and enhancing local food production capabilities in response to growing food security concerns and environmental challenges. The need for efficient and sustainable feed solutions has increased as the region deals with rising food and energy prices. Moreover, reducing dependency on imports and preserving food security are increasingly dependent on a move toward more inventive and local methods. As a result, companies are adopting effective feed systems that minimize waste and their impact on the environment, leading to a push for more sustainable agricultural practices. núaFEEDs opened a factory in the United Arab Emirates in July 2025, turning leftover bread scraps into premium animal feed. This move contributed directly to the UAE animal feed market growth by offering a cost-effective and sustainable alternative to traditional feed ingredients. This program uses food waste to maintain a steady and locally produced feed source while simultaneously addressing environmental issues by reducing landfill waste. It directly supports the UAE's objectives for sustainability and a circular economy. Food security is improved by the project since it increases domestic production capacity and lessens reliance on imported feed. The action fits into a larger trend in which agricultural waste is being utilized to create sustainable, nutrient-dense feed that satisfies consumer desires and environmental objectives.

To get more information on this market, Request Sample

Focus on Self-Sufficiency and Innovation

As part of its strategic goals, the UAE has been shifting its focus towards increasing self-sufficiency in food production, especially in the animal feed sector. This shift is driven by the necessity to ensure food security, reduce reliance on imports, and foster local production. The UAE’s growing focus on innovation and operational efficiency has played a significant role in driving this transformation. Efforts to enhance local feed production, alongside improving quality, have become essential for supporting the broader agricultural landscape. For instance, in May 2025, Al Ain Farms Group (AAFG) consolidated some of the UAE's leading food brands, such as Al Ain Farms and Marmum Dairy, under a single entity. This strategic move allowed the group to optimize operations and strengthen local protein and poultry production. By consolidating resources, AAFG aims to improve the UAE Animal Feed market by creating a more resilient, self-sufficient feed production system. The consolidation not only provides a more efficient supply chain but also enhances food security by reducing dependency on imported feed ingredients. With AAFG’s focus on sustainable practices like recyclable packaging and water conservation, the company is contributing to the UAE’s broader sustainability goals. The shift toward self-sufficiency and innovation in the UAE’s food sector is helping to lay the foundation for long-term growth and resilience in animal feed production.

UAE Animal Feed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on form, animal type, and ingredient.

Form Insights:

- Pellets

- Crumbles

- Mash

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes pellets, crumbles, mash, and others.

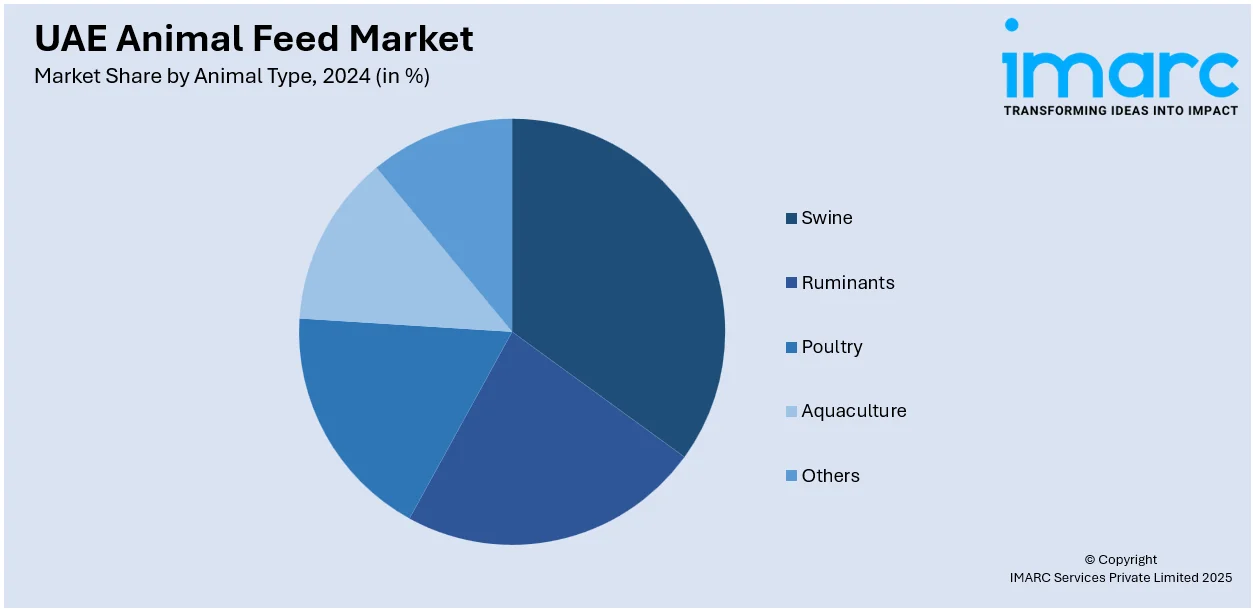

Animal Type Insights:

- Swine

- Starter

- Finisher

- Grower

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Turkeys

- Others

- Aquaculture

- Carps

- Crustaceans

- Mackeral

- Milkfish

- Mollusks

- Salmon

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes swine (starter, finisher, and grower), ruminants (calves, dairy cattle, beef cattle, and others), poultry (broilers, layers, turkeys, and others), aquaculture (carps, crustaceans, mackeral, milkfish, mollusks, salmon, and others), and others.

Ingredient Insights:

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient. This includes cereals, oilseed meal, molasses, fish oil and fish meal, additives (antibiotics, vitamins, antioxidants, amino acids, feed enzymes, feed acidifiers, and others), and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Animal Feed Market News:

- May 2025: SugaRich strengthened its position in the UAE animal feed market through the acquisition of McGuinness Feeds Ltd. This move enhanced SugaRich's market presence, leveraging McGuinness's expertise and infrastructure. The acquisition solidified SugaRich’s role in sustainable feed solutions and boosted industry growth.

- February 2025: England and Wales launched a consultation on livestock feed regulations, proposing the inclusion of non-ruminant Processed Animal Protein (PAP) in poultry and pig feed. This move aimed to improve animal nutrition, welfare, and sustainability while aligning the UAE with European standards.

UAE Animal Feed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Pellets, Crumbles, Mash, Others |

| Animal Types Covered |

|

| Ingredients Covered |

|

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE animal feed market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE animal feed market on the basis of form?

- What is the breakup of the UAE animal feed market on the basis of animal type?

- What is the breakup of the UAE animal feed market on the basis of ingredient?

- What is the breakup of the UAE animal feed market on the basis of region?

- What are the various stages in the value chain of the UAE animal feed market?

- What are the key driving factors and challenges in the UAE animal feed market?

- What is the structure of the UAE animal feed market and who are the key players?

- What is the degree of competition in the UAE animal feed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE animal feed market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE animal feed market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE animal feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)