UAE ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2025-2033

UAE ATM Market Overview:

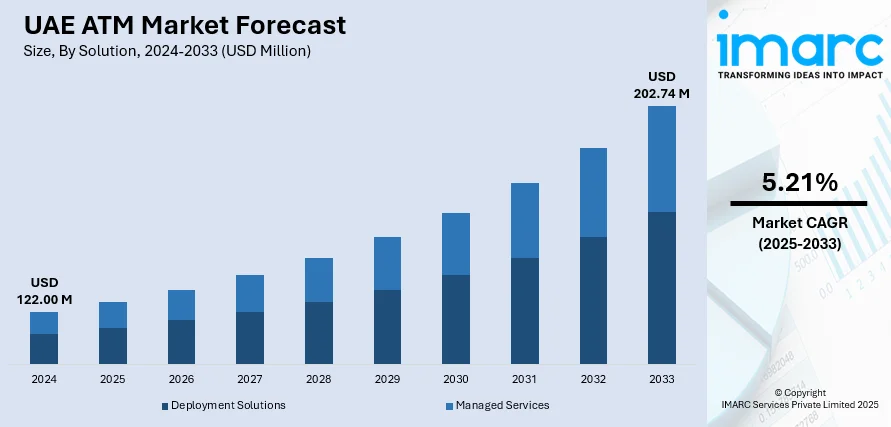

The UAE ATM market size reached USD 122.00 Million in 2024. The market is expected to reach USD 202.74 Million by 2033, exhibiting a growth rate (CAGR) of 5.21% during 2025-2033. The market is powered by technological innovation, financial inclusion, and strong tourism and retail industries. With consumers requiring faster, secure, and convenient banking services, banks are installing intelligent ATMs with features such as biometric authentication, multi-lingual support, and contactless payments. Governmental encouragement of digitalization and the spread of banking infrastructure in urban and rural regions also makes its contribution to this expansion. Increased expectations from consumers for 24/7 banking and cash availability further contribute to the UAE ATM market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 122.00 Million |

| Market Forecast in 2033 | USD 202.74 Million |

| Market Growth Rate 2025-2033 | 5.21% |

UAE ATM Market Trends:

Rising Demand for Cash Access

Although digital banking and mobile wallets are gaining popularity, the demand for physical cash access remains strong in the UAE, supporting the ATM market growth. Many users, particularly expatriates, rely on ATMs for cash withdrawals to manage day-to-day expenses, remittances, and bill payments. Retail transactions, smaller-scale purchases, and informal payments are heavily cash-driven, which ensures steady ATM utilization. Banks and financial institutions are responding by expanding ATM networks and integrating multifunctional capabilities, such as deposits and account inquiries, to meet customer expectations. According to the latest information from the Central Bank of the UAE (CBUAE), the overall number of ATMs from banks in the UAE increased by 15, reaching 4,669 ATMs by the end of Q1 2024. The sustained reliance on cash alongside rising electronic transactions is creating a balanced financial ecosystem, where ATMs remain a critical component, ensuring continued relevance and long-term growth of the market.

To get more information on this market, Request Sample

Financial Inclusion Initiatives by the Government

Government-driven financial inclusion policies are positively influencing the market in the UAE by ensuring that banking services are accessible to all citizens and expatriates. Initiatives to integrate unbanked and underbanked groups into the financial system require expanded ATM networks in both major cities and less-served regions. According to industry reports, as of May 2025, in the United Arab Emirates, approximately 32% of the population lacked access to banking services or were underbanked, underscoring the necessity for creative approaches to address the financial inclusion gap. ATMs play a critical role in supporting this inclusion, as they provide easy access to cash, deposits, and utility payments without requiring direct interaction with bank branches. In rural or semi-urban areas, ATMs serve as the primary link between individuals and formal banking systems, driving greater financial participation.

Growth of Expatriate Population and Remittance Needs

The UAE’s large expatriate population is bolstering the market growth, as these individuals rely heavily on ATMs for remittance-related transactions and everyday cash withdrawals. As per industry reports, in 2024, expats accounted for approximately 88.5% of the total population in the UAE. This amounted to 11.06 Million individuals. Expatriates, who make up the majority of the UAE’s population, often use ATMs to access salaries, send funds abroad, and pay local bills. Banks have responded by deploying ATMs in residential areas, malls, and near worker accommodations to meet this demand conveniently. Additionally, remittance-focused features, such as international transfers and multilingual interfaces, have been incorporated into ATMs to cater to diverse communities. As remittance inflows continue to be a major aspect of the UAE’s financial ecosystem, ATMs remain indispensable.

Key Growth Drivers of UAE ATM Market:

Technological Advancements in ATM Services

Technological innovations are offering a favorable market outlook. Modern ATMs go beyond cash withdrawal, offering features like biometric authentication, contactless card usage, and digital account management. These innovations improve security, user convenience, and transaction speed, aligning with consumer expectations for advanced services. In addition, ATMs equipped with artificial intelligence (AI) and data analytics help banks analyze customer behavior and improve personalized offerings. The integration of cash recycling machines also reduces operational costs while enhancing efficiency. These advanced features attract both banks and customers, creating a competitive environment that enables continuous adoption of modern ATMs. With the UAE striving to become a global leader in financial technology, investments in innovative ATM solutions ensure sustained growth, keeping the machines relevant and valuable.

Increasing Retail and Commercial Infrastructure

The UAE’s growing retail and commercial landscape is fueling the market growth by creating the need for widespread cash access points. Shopping malls, supermarkets, and entertainment venues attract large numbers of residents and tourists, catalyzing constant demand for ATMs in such locations. Businesses prefer having ATMs nearby as they encourage higher cash-based transactions, which remain common in the UAE’s retail sector. Moreover, as new commercial projects and business hubs emerge, banks are strategically expanding ATM installations to cater to employees, shoppers, and visitors. This growth is also complemented by tourism-driven demand, where visitors often rely on ATMs for currency exchange and withdrawals. By linking ATM availability with the rapid development of retail and commercial infrastructure, the UAE is ensuring that financial convenience becomes an integrated part of user experiences.

Rising Tourism and International Events

Tourism is a vital driver of the UAE ATM market, with millions of visitors arriving annually for leisure, business, and major sports tournaments. Tourists often rely on ATMs for local currency withdrawals, balance checks, and payment services, catalyzing the demand for widespread ATM networks across airports, hotels, and shopping centers. ATMs with multilingual support and currency exchange features further enhance convenience for international travelers, ensuring smooth financial transactions. Tourism is also driving the demand for ATMs in entertainment venues, theme parks, and cultural destinations. With the UAE continuing to invest in positioning itself as a global tourism hub, ATM infrastructure is becoming a critical enabler of visitor satisfaction and spending. This steady influx of international travelers guarantees sustained ATM usage.

UAE ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size:

- 15" and Below

- Above 15"

A detailed breakup and analysis of the market based on the screen size has also been provided in the report. This includes 15” and below and above 15”.

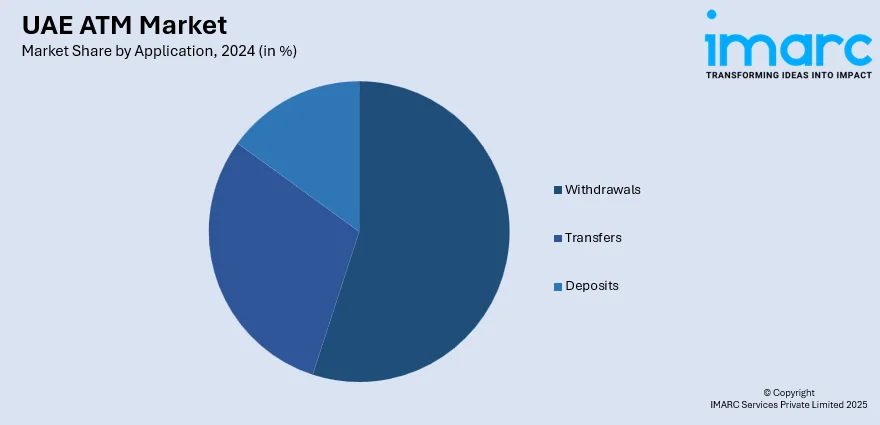

Application Insights:

- Withdrawals

- Transfers

- Deposits

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

The report has provided a detailed breakup and analysis of the market based on the ATM type. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE ATM Market News:

- June 2025: Meedaf, a licensed entity by ADGM, announced a strategic partnership with Brink’s to revolutionize the cash management and ATM service industry in the UAE, ushering in a new era of efficiency, safety, and creativity. The new initiative, serving as the first strategic alliance on the Meedaf platform, would strengthen financial institutions by leveraging Brink’s global technology, infrastructure, and operational expertise to establish better standards in cash management and ATM managed services throughout the UAE.

- February 2025: Al Etihad Payments (AEP), a branch of the Central Bank of the UAE (CBUAE), unveiled Jaywan, the first domestic card program in the nation. It would provide various card options, such as debit, prepaid, and credit cards, for online transactions, and ATM withdrawals.

UAE ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE ATM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ATM market in the UAE was valued at USD 122.00 Million in 2024.

The UAE ATM market is projected to exhibit a CAGR of 5.21% during 2025-2033, reaching a value of USD 202.74 Million by 2033.

The UAE ATM market is being driven by expanding banking penetration, increasing cash withdrawal needs, and the integration of advanced ATM technologies. Banks are upgrading machines with biometric authentication, multi-currency dispensing, and value-added services to improve customer convenience. The rise in tourism and expatriate populations is also supporting higher usage.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)