UAE Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033

UAE Cement Market Overview:

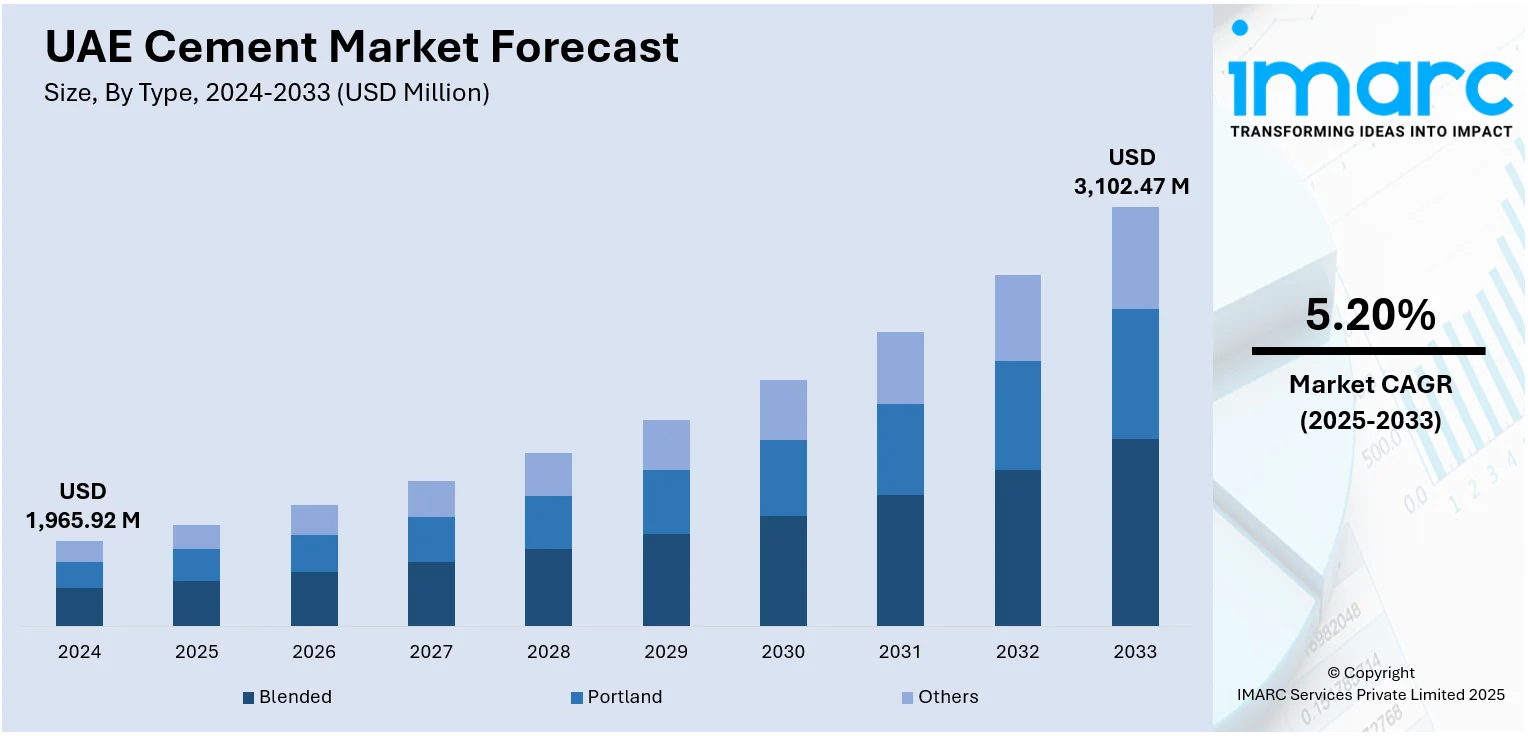

The UAE cement market size reached USD 1,965.92 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,102.47 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is driven by large-scale infrastructure and urban expansion initiatives requiring structural-grade cement in transport, real estate, and utilities. Growth in industrial zones and energy projects continues to bolster demand for specialist cement types. Residential market recovery and villa developments, combined with sustainability requirements, reinforce consumption and further augment the UAE cement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,965.92 Million |

| Market Forecast in 2033 | USD 3,102.47 Million |

| Market Growth Rate 2025-2033 | 5.20% |

UAE Cement Market Trends:

Massive Infrastructure Development and Urban Expansion

The United Arab Emirates continues to invest heavily in large-scale infrastructure projects that require robust quantities of cement. Iconic developments such as Expo Dubai legacy projects, expanded metro systems in Abu Dhabi and Dubai, and new airport terminals reinforce cement demand for structural foundations, tunnels, and elevated roadways. Additionally, mixed-use urban districts like Aljada in Sharjah and Mina Rashid redevelopments in Dubai rely on high-grade cement grades to achieve durability and seismic resilience. The surge in residential construction, driven by population growth and rising expatriate settlements, is bolstering high-rise developments across free zones and new suburbs. Real estate developers are increasingly incorporating sustainable construction practices, including low-carbon cement blends and supplementary cementitious materials, in compliance with Estidama and Al Sa’fat green building systems. On May 29, 2025, EMSTEEL signed a strategic partnership with Finnish company Magsort to produce decarbonized cement using steel slag from its own operations. The company successfully completed a 10,000-tonne pilot at its Al Ain facility, marking the first industrial-scale use of such cement in the region. This initiative aligns with EMSTEEL’s goal of cutting cement-related emissions by 30% by 2030. The availability of clinker import channels from Oman, Iran, and Turkey has supported local capacity augmentation in cement plants, ensuring supply stability. As demand for resilient, long-life structures increases, cement consumption continues to play a central role in supporting the UAE’s urban expansion strategy, directly underpinning UAE cement market growth.

To get more information on this market, Request Sample

Growth in Industrial and Infrastructure Sectors

Cement usage within the UAE’s industrial, utility, and energy infrastructure segments is expanding in response to national diversification initiatives. The development of industrial zones like Khalifa Industrial Zone Abu Dhabi (KIZAD), along with growth in petrochemical hubs in Ruwais and Fujairah, requires heavy civil construction using specialized, high-performance cement grades. Projects related to water treatment, waste management, and power generation—such as the Hassyan and Mohammed bin Rashid Al Maktoum Solar Parks—depend on low-heat cements and sulfate-resistant mixtures. The demand for ports and logistic terminals across Khor Fakkan, Hamriyah, and Jebel Ali is also increasing, requiring durable cement blends for quay walls, refineries, and heavy-duty pavements. The integration of cement with precast and modular construction techniques is becoming prevalent in industrial manufacturing facilities, reducing construction timelines and improving quality assurance. Local contractors and multinational engineering firms collaborate on EPC frameworks that demand standardized cement specifications. Cement manufacturers have responded by investing in research to develop low-carbon formulations and by modernizing grinding systems. Sharjah Cement and Industrial Development reported a 12% year-on-year increase in revenue, reaching USD 92 million in the first half of 2024. The company achieved a net profit of USD 2.61 million, reversing a USD 1.58 million loss from H1 2023. This marks a notable turnaround in financial performance within a year. As the UAE positions itself as a regional industrial hub, cement volumes are rising in both traditional and energy-related projects aligning with diversification objectives.

UAE Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end-use.

Type Insights:

- Blended

- Portland

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, Portland, and others.

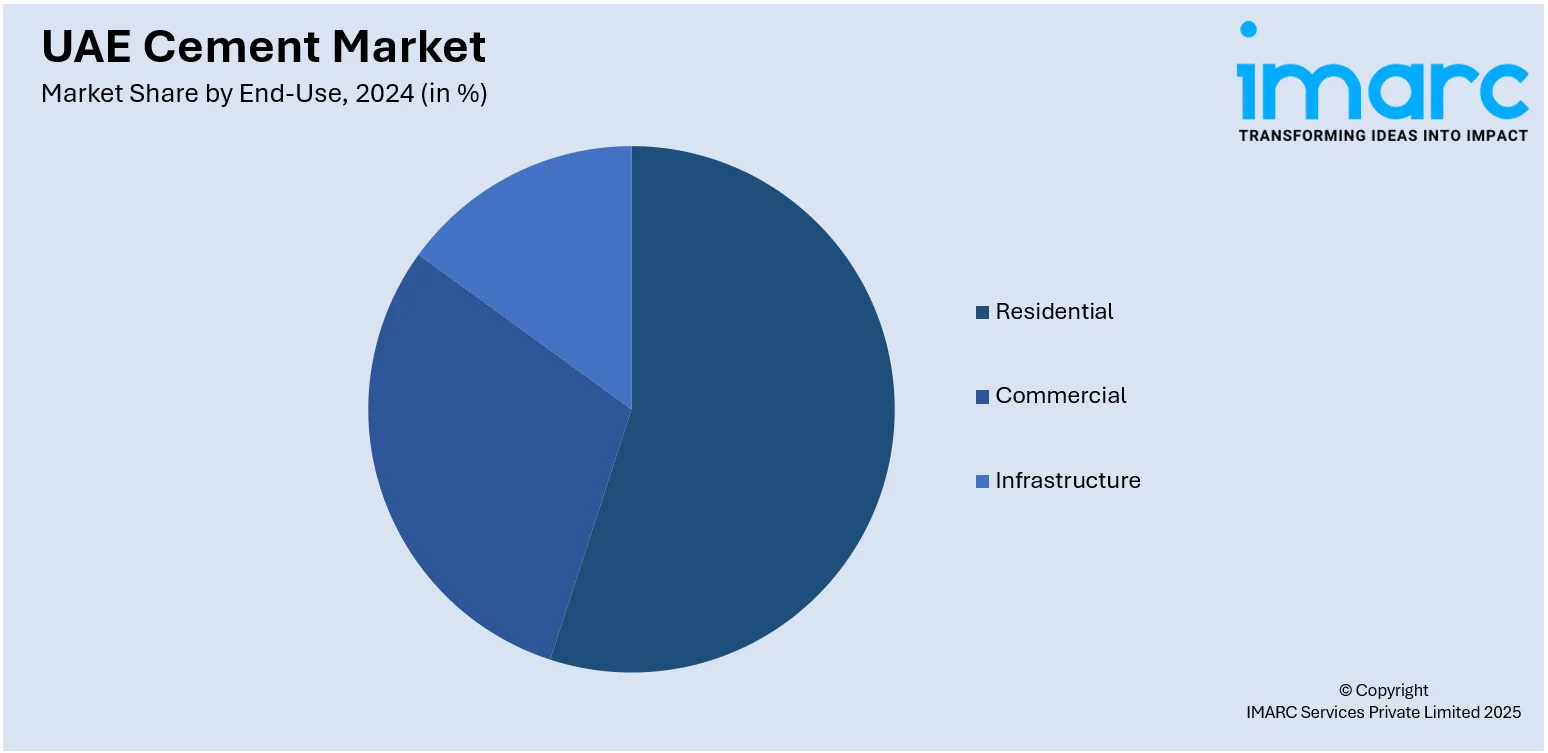

End-Use Insights:

- Residential

- Commercial

- Infrastructure

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes residential, commercial, and infrastructure.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Dubai, Abu Dhabi, Sharjah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Cement Market News:

- On May 20, 2025, Exeed Industries signed an MoU with Partanna Oasis to explore the development of carbon-negative cement technologies in the UAE. The partnership plans to establish production facilities in Abu Dhabi for manufacturing traditional cement alternatives that actively remove CO₂, addressing emissions from traditional Portland cement, which contributes 9% of global CO₂ emissions. This collaboration directly aligns with the UAE’s industrial decarbonization targets and advances sustainability within the UAE cement market.

UAE Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE cement market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE cement market on the basis of type?

- What is the breakup of the UAE cement market on the basis of end-use?

- What is the breakup of the UAE cement market on the basis of region?

- What are the various stages in the value chain of the UAE cement market?

- What are the key driving factors and challenges in the UAE cement market?

- What is the structure of the UAE cement market and who are the key players?

- What is the degree of competition in the UAE cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)