UAE Certified Pre-Owned Car Market Size, Share, Trends and Forecast by Car Type, Car Age, Fuel Type, Vendor Type, Distribution Channel, and Emirates, 2026-2034

UAE Certified Pre-Owned Car Market Summary:

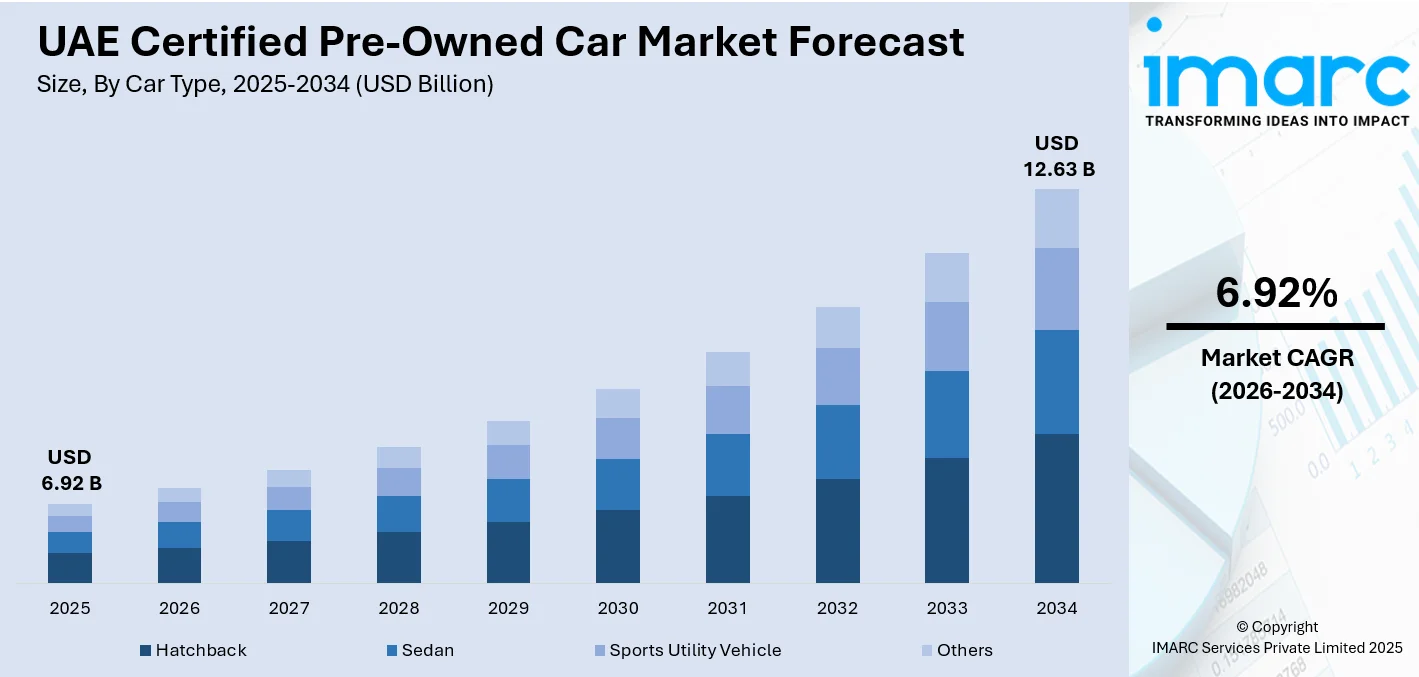

The UAE certified pre-owned car market size was valued at USD 6.92 Billion in 2025 and is projected to reach USD 12.63 Billion by 2034, growing at a compound annual growth rate of 6.92% from 2026-2034.

The market's growth is fueled by growing consumer preference for value-driven purchases, accelerated by the UAE's large expatriate population seeking flexible mobility solutions without long-term commitments. Certified programs offering comprehensive multi-point inspections, extended warranties, and verified service histories have transformed pre-owned vehicles into trusted alternatives to new cars, attracting budget-conscious buyers and young families alike while maintaining quality standards through rigorous inspection protocols, thereby expanding the UAE certified pre-owned car market share.

Key Takeaways and Insights:

- By Car Type: Sedan dominates the market with a share of 34% in 2025, representing the largest category driven by strong demand for practical family vehicles offering fuel efficiency and comfortable daily commuting across urban centers.

- By Car Age: 0-4 years lead the market with a share of 40% in 2025, accounting for the highest revenue share as buyers prioritize modern features combined with manageable pricing and remaining manufacturer warranty coverage.

- By Fuel Type: Petrol represents the largest segment with a market share of 58% in 2025, reflecting the UAE's affordable fuel infrastructure and established buyer preference for internal combustion performance across all vehicle categories.

- By Vendor Type: Organized leads the market with a share of 53% in 2025, with established dealerships offering comprehensive certification programs, quality assurance, and after-sales support that build buyer confidence and trust.

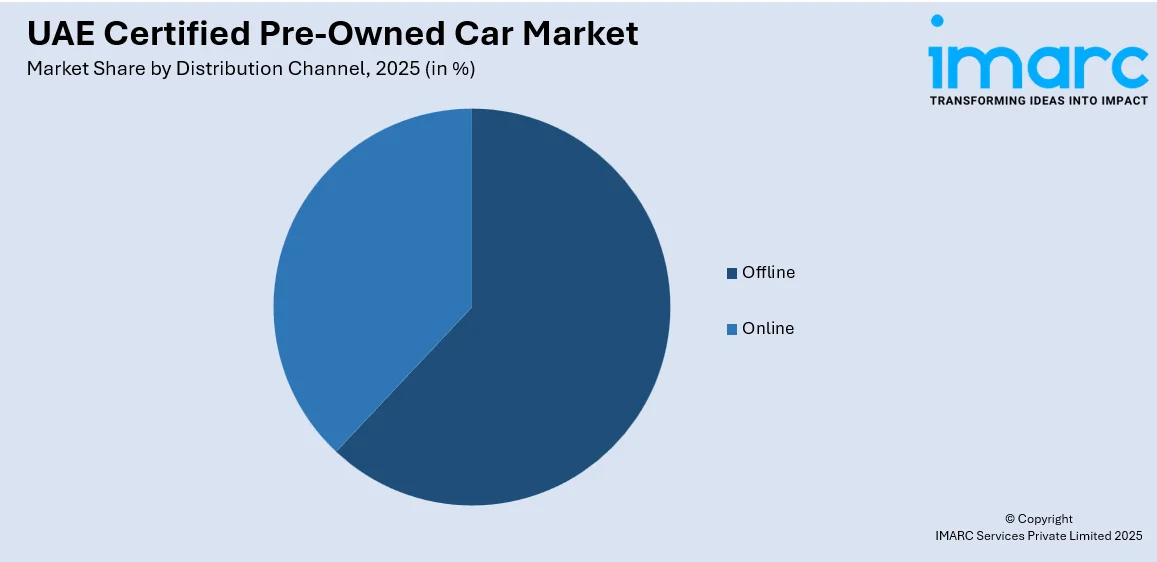

- By Distribution Channel: Offline represents the largest segment with a market share of 62% in 2025, as traditional dealerships provide hands-on vehicle inspection, test drives, and personalized customer service that enhance purchasing decisions.

- By Emirates: Dubai leads the market with a share of 42% in 2025, driven by its position as the UAE's primary commercial hub with high purchasing power and advanced automotive infrastructure.

- Key Players: The certified pre-owned car market in the UAE showcases fierce competition among leading automotive companies, international platforms, and specialized pre-owned retailers across premium and volume segments. Some of the key players include AlbaCars, Al-Futtaim, Al Naboodah Group (Saeed & Mohammed Al Naboodah Holding LLC), AL Tayer Group, AW Rostamani Group, Car Switch Dubai, Dubicars International FZ-LLC, Dubizzle Middle East FZ-LLC, and The Elite Car.

To get more information on this market Request Sample

The UAE's certified pre-owned car market benefits from its strategic position as a regional automotive hub, supported by stringent vehicle maintenance standards and advanced inspection infrastructure that ensure quality and reliability across all Emirates. Digital transformation through AI-powered pricing tools and blockchain verification systems has revolutionized transparency, enabling buyers to make informed decisions with unprecedented confidence levels. The country's unique demographic structure, with 89% expatriate population on temporary assignments, creates consistent demand for flexible, short-term mobility solutions that avoid long-term financial commitments associated with new vehicle ownership. For instance, July 2025 witnessed over 42,000 drivers utilizing AI-verified digital reports for safer vehicle purchases, representing a transformative shift in buyer behavior as technology-enabled transparency reduced traditional fraud concerns and compressed average selling periods from 55 days to just 40 days. This rapid adoption of technology-driven solutions demonstrates how digital innovation enhances buyer confidence, streamlines transaction processes, and attracts younger demographics across all price segments throughout the market.

UAE Certified Pre-Owned Car Market Trends:

Digital Transformation Through AI and Blockchain Integration

The market is experiencing a fundamental shift toward technology-enabled transparency, with artificial intelligence powering real-time vehicle valuations and risk assessments that help buyers make informed decisions. Digital platforms now incorporate blockchain-based mileage verification, 200-plus-point digital inspection protocols, and artificial intelligence (AI)-driven chatbot support that provide instant vehicle recommendations and 24/7 customer service. These innovations reduce fraud risks, accelerate sales cycles, and build consumer trust by offering verified vehicle histories and ownership records integrated with official insurance and inspection databases, fundamentally changing how buyers research and purchase certified pre-owned vehicles across the Emirates. In 2025, the United Arab Emirates cemented its status as a global center for digital infrastructure, achieving a remarkable 97 percent adoption rate of artificial intelligence tools among government agencies, with the programmer count in the nation surpassing 450,000. The UAE utilized AI for global development, pledging $1 billion to the "AI for Development" initiative at the G20 summit to back projects in Africa, and collaborating with the Gates Foundation on a $200 million AI ecosystem for worldwide agricultural advancement.

Accelerating Adoption of Electric and Hybrid CPO Vehicles

Environmental consciousness and government sustainability initiatives are driving unprecedented growth in certified pre-owned electric and hybrid vehicle segments, with dealerships expanding green model offerings to meet rising demand. The UAE's expanding charging infrastructure, unified EV tariffs, and improved driving ranges have strengthened consumer confidence in pre-owned electric mobility, while government policies supporting clean transport create favorable conditions for second-hand EV adoption. Major dealerships are responding by curating specialized EV showrooms, offering extended battery warranties, and providing comprehensive charging solutions that address range anxiety, positioning certified pre-owned electric vehicles as practical alternatives for environmentally conscious buyers seeking cost-effective sustainable transportation. Information from Dubizzle's Annual Pre-Owned Electric Car Market Report 2025 reveals that listings for used EVs on the platform increased by 41 percent compared to the previous year, highlighting rising consumer confidence and indicating that EV ownership in the UAE has expanded beyond early adopters and high-end buyers

Expansion of Premium CPO Programs with Enhanced Warranties

Luxury and premium segments are witnessing strategic growth through dedicated certified pre-owned showrooms offering factory-grade inspection protocols and manufacturer-backed warranty programs that rival new vehicle coverage. Dealerships are investing in state-of-the-art facilities featuring advanced diagnostic equipment, comprehensive reconditioning processes, and extended service packages that provide aspirational buyers with premium brand access at significantly reduced prices. These programs emphasize transparency through detailed vehicle documentation, multi-year warranty options, and complimentary maintenance packages, creating value propositions that attract discerning customers seeking luxury vehicle ownership without the steep depreciation associated with new car purchases. Dourado Luxury Car, Dubai's top hub for high-end automotive quality, proudly reports an impressive increase in interest for pre-owned luxury cars during the initial quarter of 2025.

Market Outlook 2026-2034:

The UAE certified pre-owned car market is poised for sustained expansion throughout the forecast period, with revenue growth driven by evolving consumer preferences, technological innovations, and supportive government policies that enhance market accessibility. Digital transformation will continue revolutionizing the buying experience through sophisticated AI-driven platforms offering seamless vehicle discovery, instant financing approvals, and virtual inspection capabilities that attract tech-savvy buyers across age groups. The market generated a revenue of USD 6.92 Billion in 2025 and is projected to reach a revenue of USD 12.63 Billion by 2034, growing at a compound annual growth rate of 6.92% from 2026-2034. Established dealerships that embrace digitalization, expand premium CPO programs, and offer personalized customer experiences will capture significant market share, positioning the UAE as a leading certified pre-owned vehicle hub.

UAE Certified Pre-Owned Car Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Car Type |

Sedan |

34% |

|

Car Age |

0-4 Years |

40% |

|

Fuel Type |

Petrol |

58% |

|

Vendor Type |

Organized |

53% |

|

Distribution Channel |

Offline |

62% |

|

Emirate |

Dubai |

42% |

Car Type Insights:

- Hatchback

- Sedan

- Sports Utility Vehicle

- Others

Sedan dominates with a market share of 34% of the total UAE certified pre-owned car market in 2025.

The sedan segment maintains market leadership through its optimal balance of practicality, fuel efficiency, and affordability that appeals to families and professionals across the UAE. Popular models dominate certified pre-owned listings, offering buyers proven reliability, lower maintenance costs, and strong resale values that minimize ownership risks. Sedans provide comfortable daily commuting for urban professionals while accommodating family transportation needs at price points significantly below luxury SUV alternatives. The segment benefits from abundant inventory as corporate fleets and rental companies regularly release well-maintained units, creating steady supply that meets diverse buyer budgets from entry-level to premium luxury sedans across all Emirates.

Certified pre-owned sedans attract budget-conscious expatriates and young families seeking dependable transportation without the steep depreciation associated with new car purchases. The segment demonstrates resilience through economic cycles as buyers prioritize fuel economy and lower insurance premiums when household budgets tighten, making sedans practical choices during periods of economic uncertainty. Premium sedans from German manufacturers enter the certified market after three to four years, offering aspirational buyers access to luxury features, advanced safety systems, and prestigious brand ownership at prices comparable to new mainstream vehicles.

Car Age Insights:

- 0-4 Years

- 4-8 Years

- More than 8 Years

0-4 years lead with a share of 40% of the total UAE certified pre-owned car market in 2025.

The 0-4 year age segment represents the optimal value proposition in certified pre-owned markets, offering buyers near-new vehicles with modern technology, safety features, and remaining manufacturer warranty coverage at significantly reduced prices. These vehicles typically originate from corporate lease returns, executive fleet rotations, and rental company upgrades, ensuring well-maintained inventory with comprehensive service documentation that satisfies buyer quality expectations. The segment commands premium pricing within the used car market as vehicles retain most technological features found in current model years while avoiding the steep first-year depreciation that impacts new car buyers. Certified programs add value through extended warranty packages, roadside assistance, and complimentary maintenance that effectively extend factory coverage, creating confidence among buyers who prioritize modern connectivity, advanced driver assistance systems, and contemporary design aesthetics without new vehicle price tags.

Corporate fleet upgrades and rental company refresh cycles drive consistent inventory supply in this age bracket, with vehicles entering certified programs after completing initial lease terms or reaching predetermined mileage thresholds. The segment attracts diverse buyer demographics from young professionals seeking their first luxury vehicle to growing families requiring larger models with latest safety technologies like automatic emergency brakes and lane departure warning systems. Dubai's stringent RTA inspection standards ensure mechanical integrity for vehicles in this age range, while manufacturers maintain extensive service records through connected vehicle systems that verify maintenance compliance and identify potential issues before certification. Premium brands dominate the luxury subsegment, offering three-year-old models with advanced infotainment systems, premium audio packages, and driver assistance features at prices substantially below new equivalents, making luxury vehicle ownership accessible to middle-income buyers previously excluded from premium segments.

Fuel Type Insights:

- Diesel

- Petrol

- Others

Petrol exhibits a clear dominance with a 58% share of the total UAE certified pre-owned car market in 2025.

Petrol vehicles maintain commanding market leadership driven by the UAE's affordable fuel prices, extensive infrastructure, and consumer familiarity with internal combustion engine performance and maintenance. The segment offers widest model availability across all price ranges and vehicle categories, from economical sedans to high-performance luxury cars, providing buyers maximum choice flexibility when selecting certified pre-owned vehicles. Petrol engines deliver proven reliability with established maintenance networks, transparent service costs, and abundant parts availability that reduce ownership uncertainties compared to alternative fuel technologies. The segment benefits from consistent demand across both individual and corporate buyers who prioritize vehicle performance, acceleration responsiveness, and refueling convenience through the UAE's comprehensive petrol station network, while certified programs ensure engine integrity through detailed diagnostics and comprehensive mechanical inspections.

The petrol segment demonstrates remarkable inventory depth spanning entry-level compact cars, accommodating diverse buyer budgets and preferences. Japanese petrol vehicles lead volume sales through reputation for durability, with models routinely surpassing 200,000 kilometers without major mechanical issues when properly maintained. European petrol engines dominate the premium segment, offering sophisticated powertrains with turbocharging technology that delivers impressive performance while maintaining reasonable fuel consumption for daily driving. Certified programs address buyer concerns about hidden engine wear through comprehensive compression testing, oil analysis, and emissions compliance verification that identify potential issues before vehicle certification, while extended powertrain warranties provide financial protection against unexpected mechanical failures that might otherwise deter buyers from purchasing higher-mileage petrol vehicles in this mature segment.

Vendor Type Insights:

- Organized

- Unorganized

Organized leads with a share of 53% of the total UAE certified pre-owned car market in 2025.

Organized vendors maintain market leadership through professional certification programs offering multi-point vehicle inspections, verified service histories, and manufacturer-backed warranties that build buyer confidence and justify premium pricing. Established dealership groups operate dedicated certified pre-owned facilities featuring advanced diagnostic equipment, comprehensive reconditioning processes, and standardized quality protocols that ensure consistent vehicle standards across inventory. These vendors provide end-to-end solutions including financing arrangements, trade-in evaluations, and after-sales support that simplify purchasing processes while reducing transaction risks through transparent documentation and legal compliance. The organized segment attracts quality-conscious buyers willing to pay moderate premiums for peace of mind, professional customer service, and recourse mechanisms unavailable through private sales, particularly appealing to expatriate buyers unfamiliar with local automotive markets.

Major dealership groups leverage parent manufacturer relationships to access off-lease vehicles, executive fleet returns, and trade-ins before they reach open markets, securing prime inventory that meets certification standards. Organized vendors invest heavily in customer experience through modern showroom facilities, dedicated finance departments offering competitive interest rates, and digital platforms enabling online browsing, virtual inspections, and home delivery services that compete effectively against emerging online-only marketplaces. The segment benefits from brand reputation accumulated over decades, with buyers trusting established names over unknown entities, while warranty fulfillment networks spanning all Emirates provide convenient service access that enhances long-term ownership satisfaction and drives repeat customer business through positive experiences.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline exhibits a clear dominance with a 62% share of the total UAE certified pre-owned car market in 2025.

Offline channels sustain market leadership by offering comprehensive customer experiences including physical vehicle inspections, extended test drives, and face-to-face consultations with sales professionals who provide personalized guidance throughout purchasing processes. Traditional dealerships maintain extensive showroom facilities displaying diverse certified pre-owned inventory, enabling buyers to compare multiple vehicles, assess condition directly, and experience vehicle features hands-on before committing to purchases. These channels excel in building trust through professional presentation, transparent documentation review, and immediate financing arrangement capabilities that facilitate same-day vehicle acquisition for qualified buyers. The offline segment benefits from established reputations, physical locations providing accountability, and comprehensive after-sales service networks that enhance long-term ownership satisfaction, particularly appealing to older demographics and first-time buyers preferring human interaction over digital transactions.

Physical dealerships address buyer anxieties through tangible reassurance that online platforms struggle to replicate, including mechanic-guided vehicle walkarounds, demonstration of features like advanced driver assistance systems, and test drives on varied road conditions that reveal handling characteristics and comfort levels. Sales professionals provide expert advice on financing options, insurance requirements, and registration procedures that simplify complex processes for buyers unfamiliar with UAE automotive regulations, particularly valuable for newly arrived expatriates navigating vehicle ownership for the first time. Dealerships invest in premium locations with high visibility, modern architecture, and customer amenities like comfortable waiting areas, complimentary refreshments, and children's play zones that transform vehicle shopping into pleasant experiences rather than stressful transactions. The offline segment maintains competitive advantages through immediate vehicle availability, same-day delivery capabilities, and on-site service departments offering convenient maintenance scheduling that strengthen customer relationships and generate recurring revenue through long-term service contracts bundled with certified pre-owned purchases.

Emirates Insights:

- Abu Dhabi

- Dubai

- Sharjah

- Ajman

- Others

Dubai exhibits a clear dominance with a 42% share of the total UAE certified pre-owned car market in 2025.

Dubai dominates the certified pre-owned car market through its concentration of high-income residents, extensive automotive infrastructure, and position as the region's business center attracting multinational corporations with large vehicle fleets. Dubai's Roads and Transport Authority maintains stringent inspection standards ensuring vehicle quality, while the emirate's competitive dealership landscape drives innovation in certified programs, customer service, and digital platform development. The market benefits from continuous expatriate turnover as professionals relocate, creating steady supply of well-maintained vehicles from departing residents, while Dubai's affluent customer base supports premium certified pre-owned segments with strong demand for luxury brands and high-specification vehicles that maintain robust pricing despite pre-owned status.

Dubai's strategic location as a regional automotive trading hub attracts premium inventory from across the GCC, with dealers sourcing low-mileage European imports and exclusive limited-edition models unavailable in other Emirates. The emirate's advanced digital infrastructure supports sophisticated online marketplaces, AI-powered valuation platforms, and blockchain verification systems that enhance transaction transparency and attract tech-savvy younger buyers comfortable with digital commerce. Dubai hosts the UAE's largest concentration of authorized brand dealerships, providing buyers access to manufacturer-certified programs from Toyota, BMW, Mercedes-Benz, and other premium brands that offer factory-backed warranties and quality guarantees. The emirate's tourism industry generates unique demand as visitors explore vehicle purchases during extended stays, while tax-free shopping environment and competitive pricing compared to European and Asian markets attract international buyers seeking quality certified pre-owned vehicles for export to home countries, further supporting market liquidity and price stability across all segments.

Market Dynamics:

Growth Drivers:

Why is the UAE Certified Pre-Owned Car Market Growing?

Quality Assurance and Value Proposition Through Comprehensive Certification Programs

Certified pre-owned programs have fundamentally transformed buyer perceptions by offering vehicle quality assurance comparable to new cars at substantially reduced acquisition costs, creating compelling value propositions that drive market expansion. These programs implement rigorous multi-point inspection protocols examining mechanical systems, electrical components, body condition, and interior quality, ensuring vehicles meet stringent standards before certification approval. Comprehensive reconditioning processes address identified deficiencies through professional repairs, replacing worn components with genuine parts, and conducting detailed cleaning to present vehicles in near-new condition that justifies premium pricing over non-certified alternatives. Extended warranty packages often include powertrain coverage, roadside assistance, and complimentary maintenance services that effectively extend manufacturer protection, eliminating major ownership risks that traditionally deterred pre-owned vehicle purchases. In 2025, Chery UAE, in partnership with AW Rostamani Group, has launched AWR Approved, a new certified pre-owned vehicle initiative aimed at enhancing transparency and trust in the used-car purchasing process in the UAE. The program provides a thoughtfully selected assortment of quality-checked pre-owned Chery cars, accessible solely through authorized Chery dealerships and the brand’s official site.

Large Expatriate Population Driving Flexible Mobility Solutions

The UAE's unique demographic composition with expatriates comprising 89% of the total population creates exceptional demand for certified pre-owned vehicles as transient residents seek practical transportation without long-term financial commitments associated with new car ownership. By 2025, expatriates represent a substantial majority of the UAE's population, reaching around 10.04 million individuals, or 88.5%. Expatriate professionals arriving on limited-term employment contracts require reliable vehicles for daily commuting but avoid new car purchases recognizing they will likely sell upon contract completion or relocation to new assignments. Certified pre-owned programs address these needs perfectly through quality-assured vehicles at accessible price points that minimize capital outlay, slower depreciation rates that preserve resale values, and established remarketing channels through dealership trade-in programs that simplify eventual vehicle disposal. The consistent expatriate turnover, estimated at thousands monthly across major emirates, creates continuous supply of well-maintained vehicles from departing residents while simultaneously generating fresh demand from newly arriving professionals establishing households and transportation needs.

Digital Platform Innovation Enhancing Transparency and Transaction Efficiency

Technology-driven transformation through AI-powered platforms, blockchain verification systems, and digital marketplace innovations has revolutionized certified pre-owned transactions by dramatically improving transparency, reducing fraud risks, and streamlining purchasing processes that previously deterred potential buyers. Advanced AI algorithms now provide real-time vehicle valuations based on market data, condition assessments, and demand trends, enabling buyers to confidently negotiate fair prices supported by objective data rather than subjective dealer assessments. Blockchain technology ensures mileage authenticity, ownership history verification, and service record validation by creating tamper-proof digital ledgers that eliminate odometer fraud, hidden accident histories, and maintenance documentation disputes that historically plagued used car markets. Digital platforms offer comprehensive vehicle listings featuring multiple high-resolution photographs, detailed specifications, independently verified inspection reports, and transparent pricing that enable informed decision-making from mobile devices without physical dealership visits. In 2024, Carabia, an innovative online platform, announced the opening of its waitlist for a marketplace focused solely on high-quality used cars for private buyers and sellers in the UAE. The platform seeks to transform the UAE's used car industry by providing a clear, reliable, and streamlined method for purchasing and selling quality pre-owned automobiles.

Market Restraints:

What Challenges the UAE Certified Pre-Owned Car Market is Facing?

Price Volatility and Depreciation Inconsistency Across Vehicle Categories

Market participants face significant challenges from unpredictable depreciation patterns that vary substantially across manufacturers, model years, and vehicle conditions, creating pricing uncertainties that complicate both buyer decisions and seller valuations. Identical vehicles can exhibit dramatic price variations depending on mileage accumulation, service history completeness, and overall maintenance quality, making standardized valuation difficult and creating negotiation friction between buyers and sellers. European luxury brands experience steeper depreciation curves compared to Japanese mainstream vehicles, while early-generation electric vehicles depreciate faster than petrol equivalents due to battery technology concerns, forcing dealers to implement conservative pricing strategies that may discourage inventory turnover and reduce profit margins across certified programs.

Competition from New Car Sales and Aggressive Manufacturer Incentives

Certified pre-owned markets face intensifying competition as automotive manufacturers deploy aggressive new vehicle incentives including zero-percent financing, substantial cash rebates, and comprehensive warranty packages that narrow price gaps between new and certified pre-owned alternatives. Manufacturer-backed promotional campaigns during peak sales periods create attractive value propositions for new cars, diverting potential certified pre-owned buyers toward new vehicle showrooms particularly when monthly payment differences become marginal through extended financing terms. This competitive pressure forces certified pre-owned dealers to enhance value propositions through extended warranties, complimentary maintenance packages, and flexible financing arrangements that compress profit margins while simultaneously requiring increased marketing expenditures to maintain brand visibility and customer consideration.

Economic Uncertainties Impacting Consumer Purchasing Power and Confidence

Global economic volatility, regional geopolitical tensions, and fluctuating oil prices create purchasing power uncertainties that affect consumer confidence in major expenditure decisions including vehicle acquisitions, causing potential buyers to delay purchases or opt for lower-priced alternatives. Currency fluctuations impact expatriate communities whose salaries may be denominated in foreign currencies, creating affordability challenges particularly for European and American expatriates when local currency strengthens against home currencies. Economic downturns trigger conservative financial behaviors including reduced discretionary spending, extended vehicle ownership periods, and preference shifts toward public transportation alternatives, collectively dampening certified pre-owned demand during periods when economic outlook remains uncertain or deteriorating across regional markets.

Competitive Landscape:

The UAE certified pre-owned car market exhibits intense competition characterized by established automotive groups operating comprehensive certification programs, international digital platforms expanding regional presence, and specialized pre-owned retailers focusing on niche segments across luxury and volume categories. Major dealership groups leverage parent manufacturer relationships, extensive service networks, and brand reputation to dominate organized vendor segments through factory-backed certification programs offering extended warranties and comprehensive vehicle reconditioning. International platforms bring sophisticated digital technologies including AI-powered pricing algorithms, blockchain verification systems, and seamless user experiences that attract tech-savvy buyers seeking transparency and convenience in vehicle transactions. The market demonstrates moderate consolidation as leading players expand through acquisition strategies, multi-brand showroom developments, and vertical integration of financing, insurance, and after-sales services, while independent dealers maintain presence through competitive pricing, personalized service, and specialization in specific vehicle categories or price segments that larger operators may underserve. Some of the key players include:

- AlbaCars

- Al-Futtaim

- Al Naboodah Group (Saeed & Mohammed Al Naboodah Holding LLC)

- AL Tayer Group

- AW Rostamani Group

- Car Switch Dubai

- Dubicars International FZ-LLC

- Dubizzle Middle East FZ-LLC

- The Elite Car

Recent Developments:

- In June 2025, CARS24, the top e-commerce platform in the UAE, has reached another milestone with the debut of its brand-new Super App. With this new enhancement, the brand intends to offer an all-inclusive app that delivers ease and convenience for everything automotive to its customers, consolidating buying, selling, financing, servicing, and chauffeur assistance into a unified digital experience.

UAE Certified Pre-Owned Car Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Car Types Covered | Hatchback, Sedan, Sports Utility Vehicle, Others |

| Car Ages Covered | 0-4 Years, 4-8 Years, More than 8 Years |

| Fuel Types Covered | Diesel, Petrol, Others |

| Vendor Types Covered | Organized, Unorganized |

| Distribution Channels Covered | Online, Offline |

| Emirates Covered | Abu Dhabi, Dubai, Sharjah, Ajman, Others |

| Companies Covered | AlbaCars, Al-Futtaim, Al Naboodah Group (Saeed & Mohammed Al Naboodah Holding LLC), AL Tayer Group, AW Rostamani Group, Car Switch Dubai, Dubicars International FZ-LLC, Dubizzle Middle East FZ-LLC and The Elite Car. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UAE certified pre-owned car market size was valued at USD 6.92 Billion in 2025.

The UAE certified pre-owned car market is expected to grow at a compound annual growth rate of 6.92% from 2026-2034 to reach USD 12.63 Billion by 2034.

Sedan dominated the market with 34% share, driven by their optimal balance of fuel efficiency, practicality, and affordability that appeals to families and professionals across urban centers, with popular models leading certified pre-owned listings through proven reliability and strong resale values.

Key factors driving the UAE Certified Pre-Owned Car market include comprehensive certification programs offering quality assurance through multi-point inspections and extended warranties, the large expatriate population seeking flexible mobility solutions without long-term commitments, and digital platform innovations leveraging AI-powered pricing and blockchain verification that enhance transparency, reduce fraud, and streamline purchasing processes for tech-savvy buyers.

Major challenges include price volatility and depreciation inconsistency across different vehicle categories and manufacturers creating valuation uncertainties, intense competition from new car sales with aggressive manufacturer incentives narrowing price gaps, economic uncertainties impacting consumer purchasing power and confidence in major expenditure decisions, and regulatory compliance requirements increasing operational costs for certified pre-owned program operators.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)