UAE Cheese Market Size, Share, Trends and Forecast by Source, Type, Product, Format, Distribution Channel, and Region, 2025-2033

UAE Cheese Market Overview:

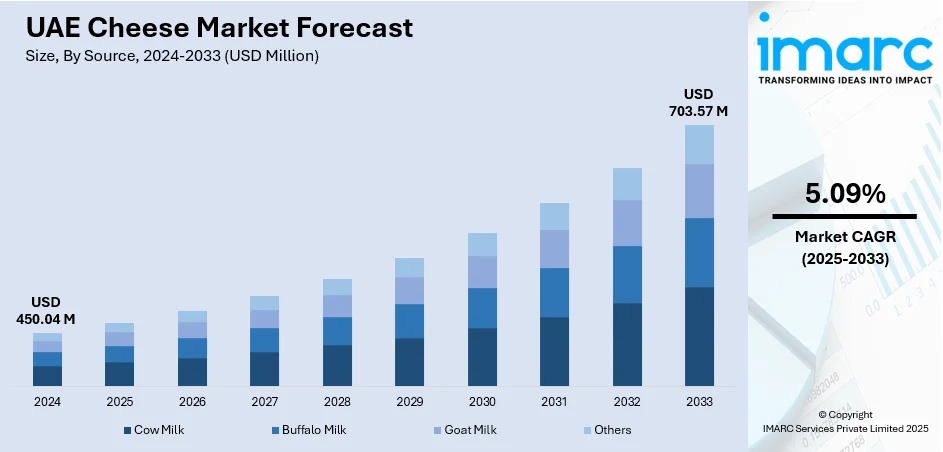

The UAE cheese market size reached USD 450.04 Million in 2024. The market is projected to reach USD 703.57 Million by 2033, exhibiting a growth rate (CAGR) of 5.09% during 2025-2033. The market is fueled by changing eating habits, growing health consciousness, and expanding demand in both retail and foodservice channels. Cheeses, ranging from premium to functional to plant-based, are being increasingly adopted by consumers from around the world, demonstrating global dining trends. Population growth, urbanization, and a thriving hospitality industry further fuel the growth in consumption. Ongoing innovation in product range and packaging is also boosting market penetration, enabling the accelerating UAE cheese market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 450.04 Million |

| Market Forecast in 2033 | USD 703.57 Million |

| Market Growth Rate 2025-2033 | 5.09% |

UAE Cheese Market Trends:

Increased Demand for Specialty and Premium Cheese

The UAE market for cheese is going through a radical change with an amplifying demand for specialty and premium cheese types among customers. The demand is influenced by escalating disposable incomes, increased expatriate communities, and changing dietary habits brought about by Western-style diets. With heightening health awareness and information among UAE consumers, the demand is shifting toward artisanal cheeses produced from goat, sheep, or buffalo milk, and imported specialty cheeses renowned for unique textures and flavors. Shoppers are boosting shelf space for these types in hypermarkets and gourmet food stores, reflecting a positive market response. Additionally, domestic manufacture is slowly evolving to satisfy the high quality of specialty products, guaranteeing freshness and supply chain continuity. According to the reports, in May 2024, ZHO, Ma'an, and SLB opened an inclusive cheese factory in Abu Dhabi run by People of Determination to enhance economic empowerment, local dairy industry, and sustainable development through strategic partnership. Furthermore, UAE cheese market growth is facilitated by such changing consumer aspirations and the general direction in the UAE toward premiumization of the food and beverages business, indicative of a matured market with varied tastes.

To get more information on this market, Request Sample

Impact of Healthy and Functional Diets

With the health movement gaining popularity throughout the UAE, cheese eating habits are being redirected towards healthier, low-fat, and high-protein choices. Shoppers are becoming more interested in purchasing products bearing additional nutritional benefits, such as calcium-enriched, probiotic, or low-sodium cheeses. As per the sources, in November 2024, Lifeway Foods broadened its UAE footprint by introducing kefir, lactose-free versions, ProBugs for children, and farmer cheese in response to increasing demand for functional and fermented dairy products. Moreover, this trend is seen especially among young working professionals and sports enthusiasts who view cheese as a functional food or ingredient to be used as part of their fitness objectives. Secondly, plant-based and lactose-free cheese substitutes are gaining traction among health-conscious groups such as those with dietary restrictions or ethical motivations. Urban eateries in cities like Dubai and Abu Dhabi also include such types on health-focused menus. These shifts in consumption patterns mirror the overall UAE cheese market trends, which are occasioned by an intersection of wellness, innovation, and functional food demand. Consequently, the market is quickly diversifying and meeting changing nutritional requirements without sacrificing flavor or culinary experience.

Increased Consumption of Cheese in Foodservice Sector

The foodservice segment is leading the growth in cheese consumption and is a key driver in the UAE. With a booming hospitality sector, with international restaurant chains, luxury hotels, and a thriving café culture, demand for cheese as a fundamental ingredient of Western and fusion food is growing steadily. All popular dishes like pizzas, burgers, baked goods, and salads are adding to the demand, and chefs are consistently experimenting with cheese-based foods to add to menu attractions. Furthermore, increasing popularity of quick-service restaurants and gourmet food trucks in urban areas has further opened up cheese consumption. Coupled with the nation's tourism-led economy, where varied culinary expectations of foreign tourists dictate menu structures, menu compositions become a resultant function. Against the backdrop of UAE cheese market trends, the foodservice industry is an active platform for innovation in bringing new types of cheese and formats. This guarantees ongoing interaction with consumers and sustains constant demand outside of family consumption.

UAE Cheese Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, type, product, format, and distribution channel.

Source Insights:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes cow milk, buffalo milk, goat milk, and others.

Type Insights:

- Natural

- Processed

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes natural and processed.

Product Insights:

- Mozzarella

- Cheddar

- Feta

- Parmesan

- Roquefort

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes mozzarella, cheddar, feta, parmesan, roquefort, and others.

Format Insights:

- Slices

- Diced/Cubes

- Shredded

- Blocks

- Spreads

- Liquid

- Others

A detailed breakup and analysis of the market based on the format have also been provided in the report. This includes slices, diced/cubes, shredded, blocks, spreads, liquid, and others.

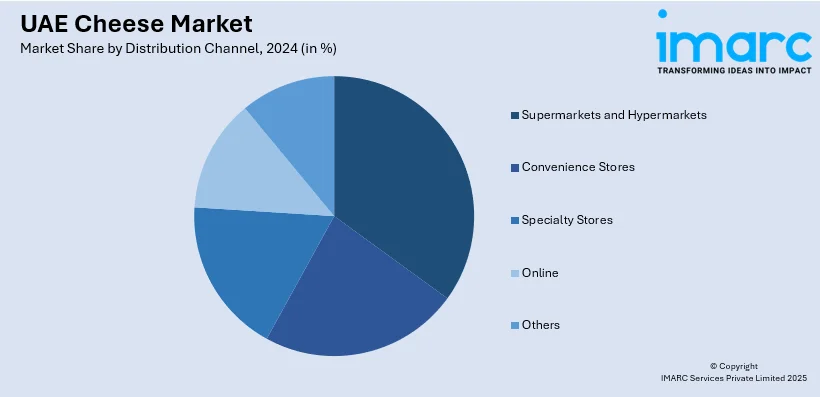

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Cheese Market News:

- In July 2024, Puck launched its very first limited-time flavor, Zaatar Cream Cheese, in certain retailers in the UAE, Saudi Arabia, Oman, Kuwait, Bahrain, and Lebanon. The product, packaged in a 450g jar using 100% milk, combines the rich, creamy feel of conventional cheese with the characteristic zest of zaatar to meet regional tastes.

- In December 2024, Swiss raclette maker Seiler Käserei released a limited-edition Dubai raclette cheese with pistachio filling inspired by the viral trend of the Dubai chocolate bar. The cheese was developed in partnership with Eberle Spezialitäten, where the raclette wheels were drilled meticulously and filled with pistachio paste, resulting in a decadent, rich blend of flavors.

UAE Cheese Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Cow Milk, Buffalo Milk, Goat Milk, Others |

| Types Covered | Natural, Processed |

| Products Covered | Mozzarella, Cheddar, Feta, Parmesan, Roquefort, Others |

| Formats Covered | Slices, Diced/Cubes, Shredded, Blocks, Spreads, Liquid, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE cheese market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE cheese market on the basis of source?

- What is the breakup of the UAE cheese market on the basis of type?

- What is the breakup of the UAE cheese market on the basis of product?

- What is the breakup of the UAE cheese market on the basis of format?

- What is the breakup of the UAE cheese market on the basis of distribution channel?

- What is the breakup of the UAE cheese market on the basis of region?

- What are the various stages in the value chain of the UAE cheese market?

- What are the key driving factors and challenges in the UAE cheese?

- What is the structure of the UAE cheese market and who are the key players?

- What is the degree of competition in the UAE cheese market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE cheese market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE cheese market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE cheese industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)