UAE Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

UAE Duty-Free and Travel Retail Market Overview:

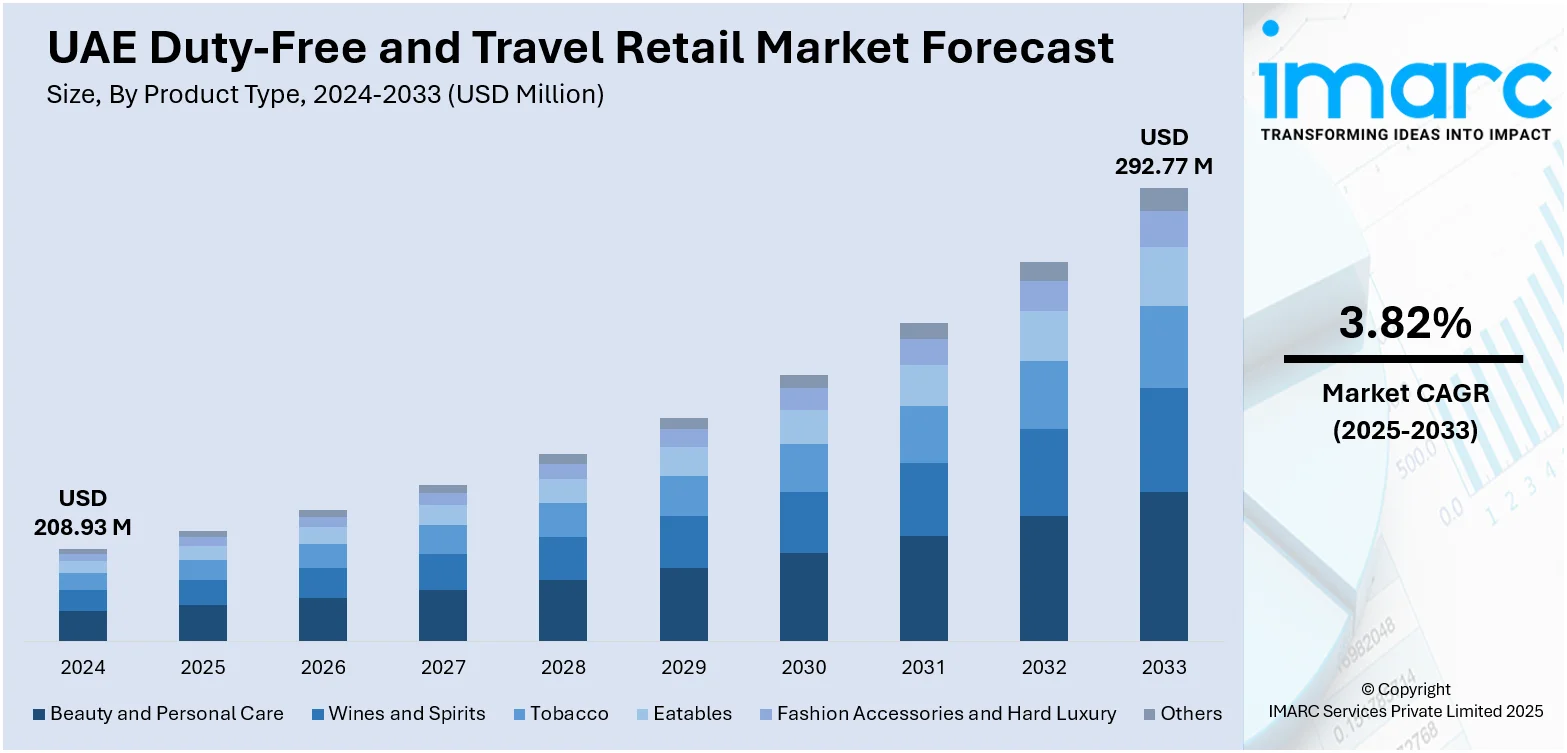

The UAE duty-free and travel retail market size reached USD 208.93 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 292.77 Million by 2033, exhibiting a growth rate (CAGR) of 3.82% during 2025-2033. Rising international passenger traffic, airport expansions (notably in Dubai and Abu Dhabi), high consumer spending power, increasing tourism, luxury brand presence, promotional pricing strategies, and digitalization of retail experiences within terminals are some of the factors contributing to the UAE duty-free and travel retail market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 208.93 Million |

| Market Forecast in 2033 | USD 292.77 Million |

| Market Growth Rate 2025-2033 | 3.82% |

UAE Duty-Free and Travel Retail Market Trends:

Sales Momentum Accelerating at Airport Retail

Retail activity in UAE airports has shown steady improvement, with recent months bringing strong performance across major categories. Shopper engagement is high, supported by consistent passenger traffic and elevated spending patterns. Activity typically peaks during holiday periods, but current momentum is extending beyond the usual seasonal surges. The steady rise in purchases points to growing confidence among travelers and a willingness to spend on premium and everyday items alike. Retailers are benefitting from refreshed store formats, curated product mixes, and favorable travel flows. This performance reflects broader shifts in consumer behavior within travel environments. The sustained pace seen so far this year suggests a healthy outlook and positions the sector for further gains through the remainder of the year. These factors are intensifying the UAE duty-free and travel retail market growth. For example, Dubai Duty Free recorded its best month of 2025 in May, hitting AED 724.7 Million (USD 198.5 Million) in sales, i.e., a 12.5% year-on-year rise. This follows April’s record of AED713 Million. May ranks as the second-highest sales month outside December in the retailer's 41-year history. Year-to-date revenue crossed AED 3.5 billion (USD 1 Billion), reflecting 6.5% growth, with strong performance across major product categories.

To get more information on this market, Request Sample

Expanding Payment Access through Digital Wallet Integration

Airport retailers in the UAE are embracing more flexible payment options to match evolving traveler preferences. A recent collaboration links retail operations with a vast network of global digital wallets, allowing visitors to pay using familiar apps from their home countries. This shift supports smoother transactions and reduces reliance on traditional cards or currency exchanges. As digital wallets gain ground in cross-border payments, retailers are positioning themselves to cater to a tech-savvy audience seeking speed and convenience. The integration reflects a broader move toward inclusive payment ecosystems that align with international consumer habits. It also reinforces the importance of seamless checkout experiences in enhancing overall customer satisfaction in busy, high-volume travel hubs. For instance, in February 2025, Dubai Duty Free partnered with TerraPay to allow travelers to pay using their home-country digital wallets. This move connects DDF to TerraPay’s network of 3.7 Billion wallets, enhancing payment flexibility across its retail operations. As digital wallets are set to account for 35% of global cross-border payments in 2025, the collaboration positions DDF to meet the growing demand for faster, more accessible digital payment options.

UAE Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

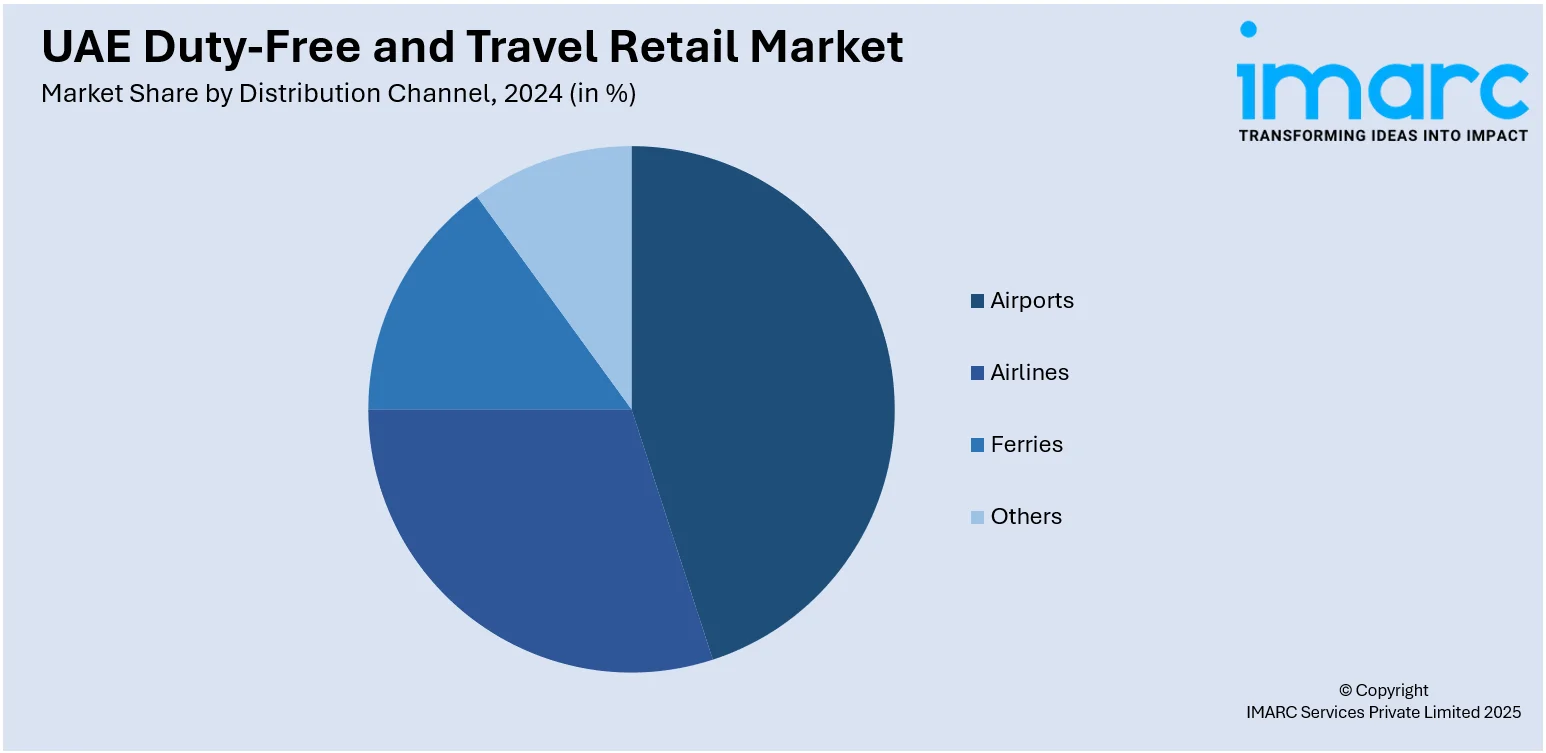

Distribution Channel Insights:

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Duty-Free and Travel Retail Market News:

- In May 2025, JTI launched its Ploom X Advanced heated tobacco device at Dubai International Airport, marking the product’s debut in the UAE. Partnering with Dubai Duty Free, Dubai Airports, and JCDecaux, the campaign includes high-impact digital displays and promotional zones across the airport. The rollout would expand to a flagship store. JTI aims to create a strong retail presence and immersive experience for travelers.

UAE Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE duty-free and travel retail market on the basis of product type?

- What is the breakup of the UAE duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the UAE duty-free and travel retail market on the basis of region?

- What are the various stages in the value chain of the UAE duty-free and travel retail market?

- What are the key driving factors and challenges in the UAE duty-free and travel retail market?

- What is the structure of the UAE duty-free and travel retail market and who are the key players?

- What is the degree of competition in the UAE duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE duty-free and travel retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)