UAE E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Region, 2025-2033

UAE E-Invoicing Market Overview:

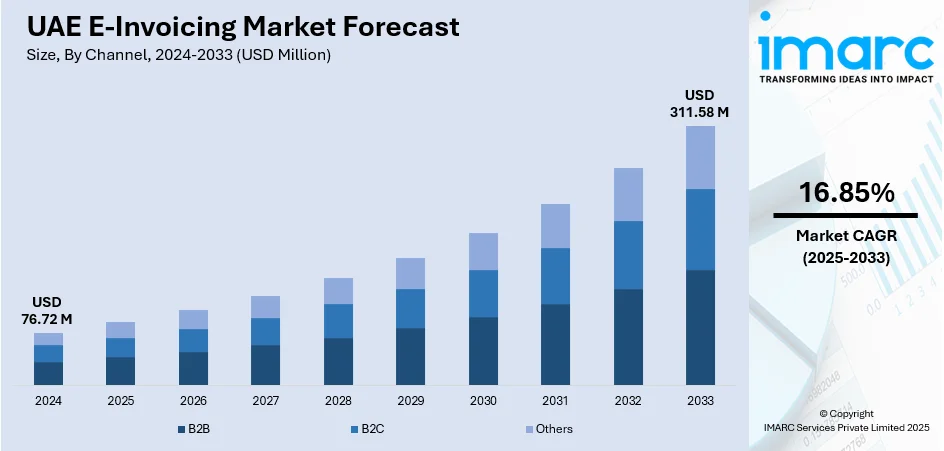

The UAE e-invoicing market size reached USD 76.72 Million in 2024. Looking forward, the market is expected to reach USD 311.58 Million by 2033, exhibiting a growth rate (CAGR) of 16.85% during 2025-2033. The market is being propelled by a country-wide movement for digitalization and regulatory updates and changes to VAT and tax procedure legislation. Accredited Service Providers (ASPs) are also at the center of confirming invoice validation, standardization, and safe transmission. Companies are further reacting to the advantages of increased tax compliance, fraud reduction, and business efficiency. With increasing implementation across industries, these advances are further adding to the growth of the UAE e-invoicing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 76.72 Million |

| Market Forecast in 2033 | USD 311.58 Million |

| Market Growth Rate 2025-2033 | 16.85% |

UAE E-Invoicing Market Trends:

Phased Rollout & Regulatory Framework

The UAE's e-invoicing program is framed through a sequence of government-driven reforms under new tax legislations. The reforms have established a transparent legal framework for the deployment of structured digital invoicing and regulating compliance for all industries. An explicit implementation schedule involves accreditation of service providers, publishing technical standards, and mandatory take-up for B2B and B2G transactions. This phased implementation facilitates businesses to migrate their systems and processes in phases as per new mandates. Proactive government initiatives ensure readiness of digital infrastructure and provide a solid platform for real-time tax compliance, positioning the UAE among early regional adopters of contemporary e-invoicing solutions.

To get more information on this market, Request Sample

DCTCE Model & Peppol Integration

The UAE has embraced a decentralized continuous transaction control and exchange model (DCTCE) based on the Peppol five-corner network. It has an architecture that provides safe, real-time exchange of invoices through Accredited Service Providers as intermediaries between companies and the tax agency. It provides for on-time validation, transformation to the needed invoice format, and automatic reporting of invoice metadata to the government. Through adoption of a global standard such as Peppol, the UAE facilitates both local efficiency and global compatibility, simplifying cross-border trade. This approach enables secure data exchanges and the promotion of compliance through automation, positioning the UAE as a progressive digital economy, which further contributes to the UAE e-invoicing market growth.

Business Impact & SME Adaptation

The shift to e-invoicing in the UAE has various advantages, particularly for SMEs. Firms need to adapt their accounting software, conform to formatted schemes, use digital signatures, and work with approved service providers. Although the upfront cost might appear burdensome, the long-term advantage is realized through better cash flow, reduced errors, and easy VAT reporting. SMEs are being helped by a combination of technical advice, staged deadlines, and lessons from the initial experiences of larger enterprises. Hence, the digital transformation is likely to enhance fiscal transparency and provide a more streamlined, automated billing climate throughout the UAE economy.

UAE E-Invoicing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on channel, deployment type, and application.

Channel Insights:

- B2B

- B2C

- Others

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes cloud-based and on-premises.

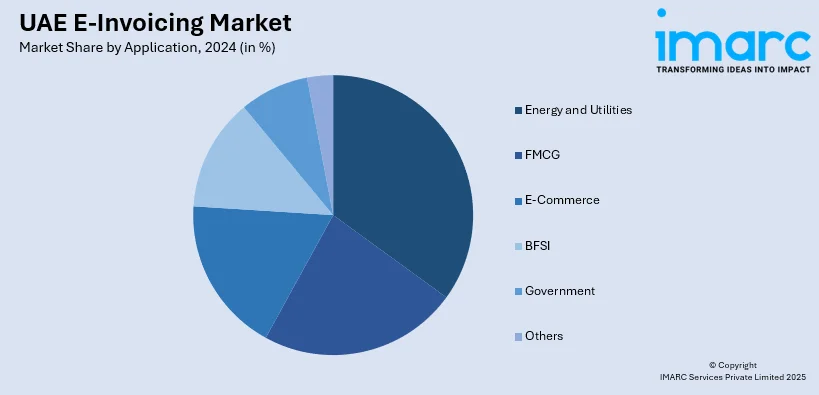

Application Insights:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes energy and utilities, FMCG, e-commerce, BFSI, government, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE E-Invoicing Market News:

- In March 2025, the United Arab Emirates Ministry of Finance released the formal requirements for accreditation of service providers. Only individuals who receive this accreditation will be permitted to provide electronic invoicing services within the country. In the 5-corner model, accredited providers are essential since they handle the validation, exchange, and reporting of invoice data to the tax authority. EDICOM, as a Peppol Access Point, is currently engaged in securing this accreditation to offer electronic invoicing services following the Peppol model in the UAE.

UAE E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE e-invoicing market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE e-invoicing market on the basis of channel?

- What is the breakup of the UAE e-invoicing market on the basis of deployment type?

- What is the breakup of the UAE e-invoicing market on the basis of application?

- What is the breakup of the UAE e-invoicing market on the basis of region?

- What are the various stages in the value chain of the UAE e-invoicing market?

- What are the key driving factors and challenges in the UAE e-invoicing market?

- What is the structure of the UAE e-invoicing market and who are the key players?

- What is the degree of competition in the UAE e-invoicing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE e-invoicing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)