UAE Edtech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Region, 2025-2033

UAE Edtech Market Overview:

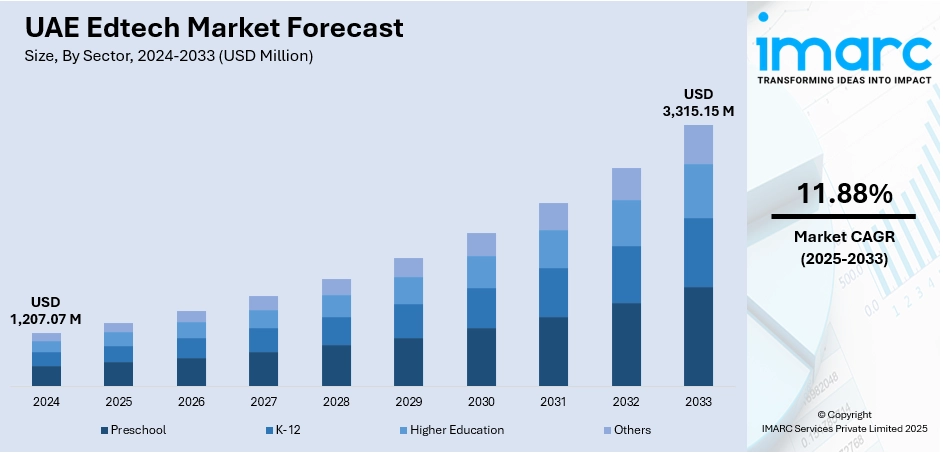

The UAE edtech market size reached USD 1,207.07 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,315.15 Million by 2033, exhibiting a growth rate (CAGR) of 11.88% during 2025-2033. The market is driven by the rising demand for AI-powered personalized learning, fueled by government initiatives such as the Smart Learning Initiative and the shift toward hybrid education models. Corporate e-learning is expanding rapidly, supported by Vision 2030’s focus on a knowledge-based economy and the need for upskilling in competitive sectors such as tech and leadership. Additionally, the growing adoption of gamification and on-demand training solutions enhances engagement and efficiency, further augmenting the UAE EdTech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,207.07 Million |

| Market Forecast in 2033 | USD 3,315.15 Million |

| Market Growth Rate 2025-2033 | 11.88% |

UAE Edtech Market Trends:

Increasing Demand for Personalized Learning Solutions

The market is witnessing a rise in demand for personalized learning solutions, driven by the need for tailored educational experiences. As the focus on student-centered education increases, educational institutions are implementing AI-driven platforms that cater to unique learning preferences and speeds. These innovations utilize data analysis to pinpoint individual strengths and weaknesses, providing tailored content and evaluations. The UAE government’s focus on smart education, such as the "Smart Learning Initiative," further accelerates this trend. The UAE's federal budget for 2025 reached AED 71.5 Billion (approximately 19.47 Billion), marking the largest budget in its history. The budget allots AED 25.57 Billion (approximately USD 6.96 Billion), or 35.7%, to government matters, encompassing smart government infrastructure, digital services, and cybersecurity. A further AED 10.91 Billion (approximately USD 2.97 Billion), or 15.3%, goes to public and higher education. This budget is in line with 2023 allocations of AED 63.07 Billion (approximately USD 17.17 Billion) and 2024 allocations of AED 64.06 Billion (approximately USD 17.45 Billion), continuing to have double-digit funding for EdTech-related industries consistently. This puts the UAE at the forefront of digital education transformation as part of 2022–2026. Additionally, the rise of hybrid learning post-pandemic has increased the adoption of adaptive learning tools, ensuring continuity and efficiency. EdTech startups are also leveraging gamification and interactive content to enhance engagement, particularly in K-12 and higher education sectors. As competition in the job market intensifies, parents and institutions are increasingly investing in platforms that provide personalized skill development, making this a key trend shaping the UAE’s EdTech landscape.

To get more information on this market, Request Sample

Growth of Corporate E-Learning and Upskilling Platforms

The rapid expansion of corporate e-learning and professional upskilling platforms is also supporting the UAE edtech market growth. With Dubai and Abu Dhabi positioning themselves as global business hubs, companies are prioritizing continuous employee development to maintain a competitive edge. Online learning platforms, including Coursera, LinkedIn Learning, and locally developed solutions are gaining traction, offering courses in digital transformation, leadership, and technical skills. The UAE’s Vision 2030 agenda, which emphasizes a knowledge-based economy, further fuels this demand. Moreover, government initiatives such as the National Program for Coders encourage upskilling in tech-related fields. With its largest and most diverse cohort yet, 120 students from 26 countries have graduated from the Samsung Innovation Campus 2024, a three-month hybrid program under the UAE's National Program for Coders for individuals aged between 18 and 29 with basic coding abilities. The UAE is the only Gulf country partnering with Samsung on this project, thus further cementing its AI Strategy 2031; the highest achievers developed projects such as an emotional recognition system through the use of facial AI. A Memorandum of Understanding sealed in June 2024 by Samsung Gulf and the UAE AI Office also strengthens the national EdTech and AI capabilities. Businesses are also partnering with EdTech providers to deliver customized training programs, reducing costs associated with traditional workshops. As remote work becomes more prevalent, flexible, on-demand learning solutions are becoming essential, making corporate e-learning a dominant trend in the UAE’s changing market.

UAE Edtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on sector, type, deployment mode, and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

Type Insights:

- Hardware

- Software

- Content

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes hardware, software, and content.

Deployment Mode Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises.

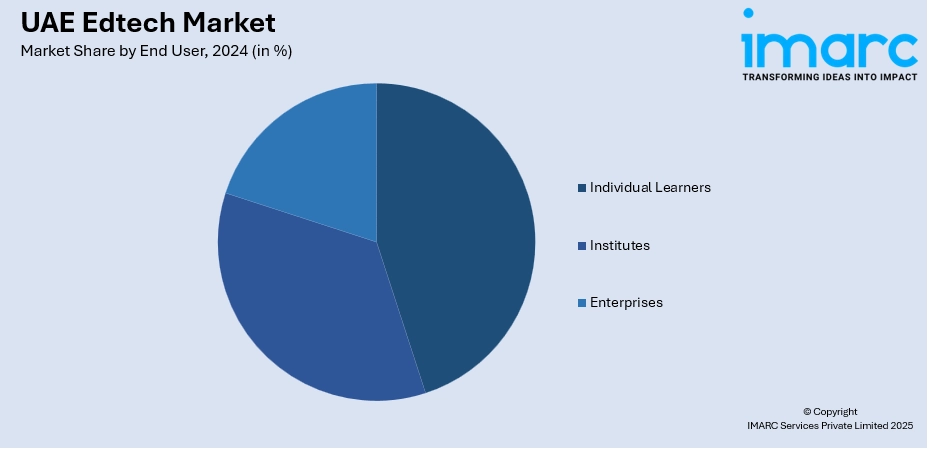

End User Insights:

- Individual Learners

- Institutes

- Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual learners, institutes, and enterprises.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Edtech Market News:

- April 08, 2025: The UAE EdTech startup Classadia launched its AI-powered childcare and school management platform. The platform offers automation of billing, attendance, staff scheduling, and instant communication with parents, tailored specifically for nursery and primary schools. The platform enhances the development of children by using adaptive tools, predictive analytics, and customized insights. It also includes free access to nonprofit organizations as part of its special launch program. Classadia aims to relieve administrative responsibilities and improve the interaction among teachers and parents across the UAE early education landscape.

UAE Edtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE edtech market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE edtech market on the basis of sector?

- What is the breakup of the UAE edtech market on the basis of type?

- What is the breakup of the UAE edtech market on the basis of deployment mode?

- What is the breakup of the UAE edtech market on the basis of end user?

- What is the breakup of the UAE edtech market on the basis of region?

- What are the various stages in the value chain of the UAE edtech market?

- What are the key driving factors and challenges in the UAE edtech market?

- What is the structure of the UAE edtech market and who are the key players?

- What is the degree of competition in the UAE edtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE edtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE edtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE edtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)