UAE Footwear Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End User, and Region, 2025-2033

UAE Footwear Market Overview:

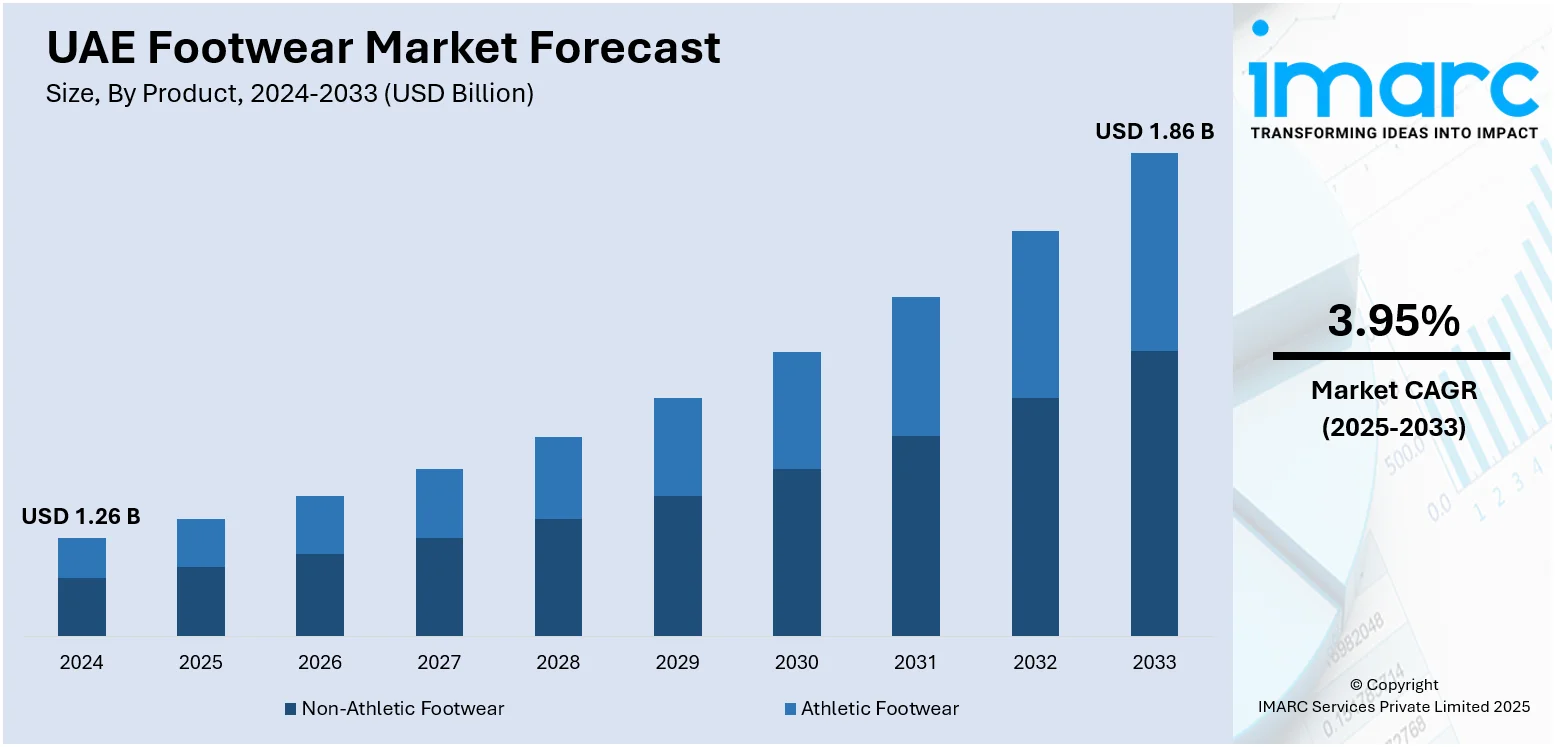

The UAE footwear market size reached USD 1.26 Billion in 2024. The market is projected to reach USD 1.86 Billion by 2033, exhibiting a growth rate (CAGR) of 3.95% during 2025-2033. The industry is fueled by growing fashion awareness among young, wealthy consumers looking for on-trend, high-end brands with social media and international trends playing a role. E-commerce growth accelerates, with online platforms providing ease, assortment, and technology trends such as virtual try-ons, powering sales online. Growing emphasis on health and fitness driven by government wellness programs also powers demand for athletic and athleisure footwear. These conditions together dictate consumer choice, encouraging companies to provide fashionable, functional, and technologically improved shoe products thereby contributing to the UAE footwear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.26 Billion |

| Market Forecast in 2033 | USD 1.86 Billion |

| Market Growth Rate 2025-2033 | 3.95% |

UAE Footwear Market Trends:

Expansion of E-commerce and Digital Platforms

E-commerce has emerged as a key growth driver in the UAE footwear market, supported by the country’s booming digital retail sector valued at approximately US $8.8 billion (AED 32.3 billion) in 2024, with apparel and footwear among its top-performing segments. Consumers increasingly favor online shopping for its convenience, variety, and competitive pricing, turning to platforms like Amazon.ae, Namshi, and Noon. Retailers enhance these experiences with innovations such as virtual try-ons, AI-driven recommendations, and secure payment solutions, fostering trust and repeat purchases. Mobile commerce and social platforms like Instagram and TikTok are also shaping purchasing behavior, especially among young, fashion-conscious shoppers. Post-pandemic digital adoption trends have firmly established online channels as essential for market expansion, encouraging brands to invest in direct-to-consumer websites and seamless delivery services to meet the evolving expectations of the UAE’s tech-savvy consumer base.

To get more information on this market, Request Sample

Growing Fashion Consciousness and Lifestyle Changes

Another significant UAE footwear market trend is the rapidly urbanizing population, with a young, affluent demographic, is increasingly adopting global fashion trends, fueling demand for branded and stylish footwear. Consumers, particularly millennials and Gen Z, view footwear not merely as functional items but as fashion statements reflecting personal style and status. Social media platforms, celebrity endorsements, and influencer marketing significantly shape purchasing decisions, prompting brands to release limited editions and exclusive collaborations. Additionally, the rise of fitness culture and athleisure wear is boosting demand for casual and sports shoes alongside formal and luxury segments. UAE residents prioritize quality, brand reputation, and design innovation, pushing companies to consistently launch trendy and premium offerings. The region’s multicultural environment also influences diverse footwear preferences, allowing global brands to experiment with varied styles catering to this fashion-forward market.

Increasing Focus on Sports and Wellness Activities

The UAE government’s strong push for health and fitness through initiatives like the Dubai Fitness Challenge has significantly boosted demand for sports and athletic footwear. Growing participation in activities such as running, hiking, and gym workouts drives interest in performance-oriented, durable, and comfortable shoes. Reflecting this trend, the UAE’s active footwear e-commerce segment including sneakers and running shoes is projected to reach US $205 million in online sales by 2025, accounting for 42.2% of total footwear e-commerce sales. Global brands like Nike, Adidas, and Puma are responding with technologically advanced designs offering superior cushioning, breathability, and ergonomic support tailored to various sports. Meanwhile, the rise of athleisure combining casual and athletic fashion has expanded the appeal of sports footwear beyond fitness, making it a key lifestyle choice. Sponsorship of local sports events and influencer collaborations further fuel the UAE footwear market growth.

UAE Footwear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, material, distribution channel, pricing, and end user.

Product Insights:

- Non-Athletic Footwear

- Athletic Footwear

The report has provided a detailed breakup and analysis of the market based on the product. This includes non-athletic footwear and athletic footwear.

Material Insights:

- Rubber

- Leather

- Plastic

- Fabric

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes rubber, leather, plastic, fabric, and others.

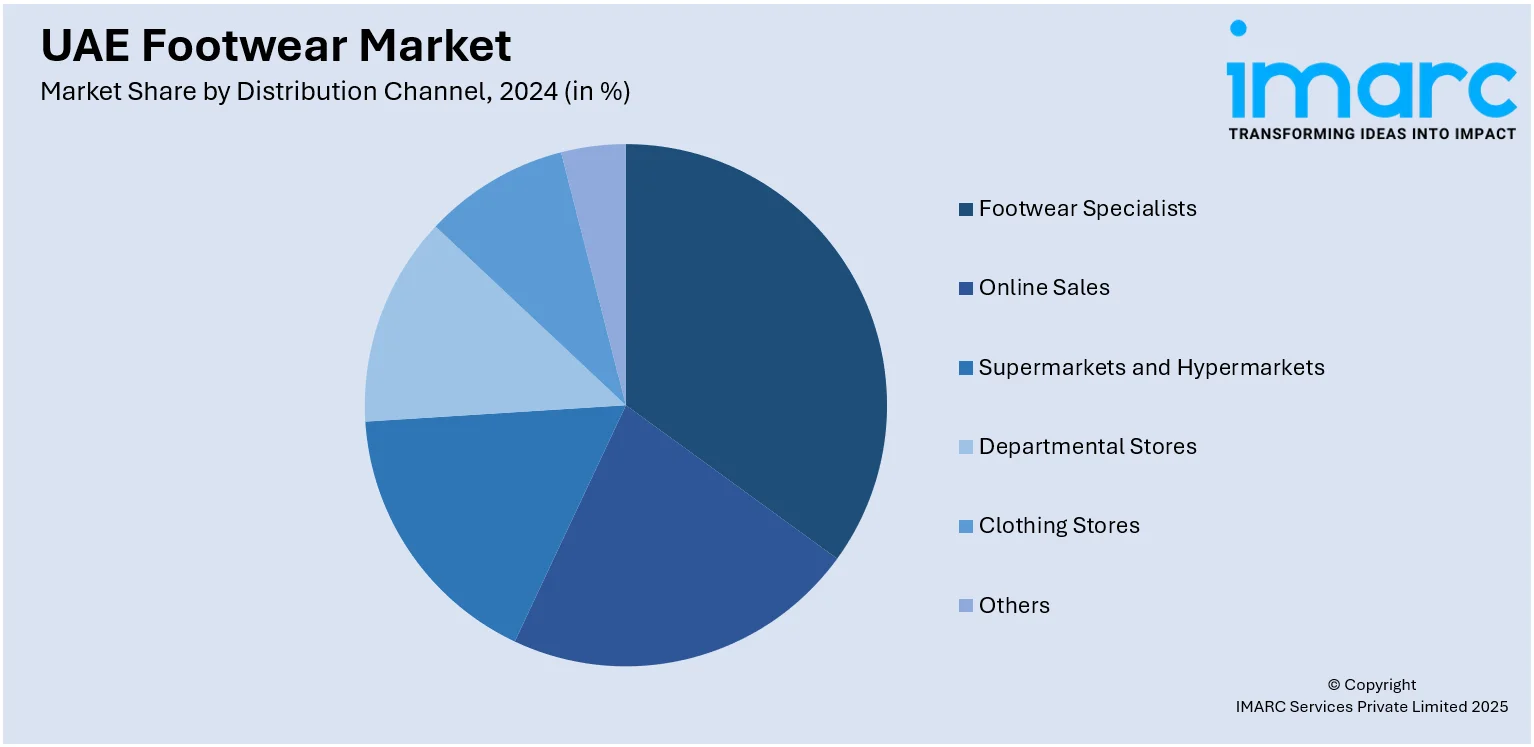

Distribution Channel Insights:

- Footwear Specialists

- Online Sales

- Supermarkets and Hypermarkets

- Departmental Stores

- Clothing Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes footwear specialists, online sales, supermarkets and hypermarkets, departmental stores, clothing stores, and others.

Pricing Insights:

- Premium

- Mass

A detailed breakup and analysis of the market based on the pricing have also been provided in the report. This includes premium and mass.

End User Insights:

- Men

- Women

- Kids

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and kids.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Footwear Market News:

- In June 2025, Brands4U is set to open a new store at Al Ghurair Centre in Deira, Dubai, offering a wide range of fashion, footwear, bags, perfumes, cosmetics, and sunglasses for men, women, and children. The modern retail space combines luxury aesthetics with affordability, aiming to attract both loyal customers and new, style-conscious shoppers. Founder Vijey Samyani emphasizes making premium fashion accessible without the high-end price tag.

- In April 2025, The EU and UAE agreed to launch Free Trade Agreement (FTA) talks, aiming to boost trade in goods, services, and investments, with focus areas like renewable energy and critical raw materials. The European Confederation of the Footwear Industry (CEC) welcomed the move, noting that EU footwear exports to the UAE exceeded €563 million in 2024. Both sides aim for swift, ambitious negotiations to deepen economic ties.

UAE Footwear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Non-Athletic Footwear, Athletic Footwear |

| Materials Covered | Rubber, Leather, Plastic, Fabric, Others |

| Distribution Channels Covered | Footwear Specialists, Online Sales, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Others |

| Pricings Covered | Premium, Mass |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE footwear market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE footwear market on the basis of product?

- What is the breakup of the UAE footwear market on the basis of material?

- What is the breakup of the UAE footwear market on the basis of distribution channel?

- What is the breakup of the UAE footwear market on the basis of pricing?

- What is the breakup of the UAE footwear market on the basis of end user?

- What is the breakup of the UAE footwear market on the basis of region?

- What are the various stages in the value chain of the UAE footwear market?

- What are the key driving factors and challenges in the UAE footwear market?

- What is the structure of the UAE footwear market and who are the key players?

- What is the degree of competition in the UAE footwear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE footwear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE footwear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE footwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)