UAE Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and Region, 2025-2033

UAE Gaming Market Overview:

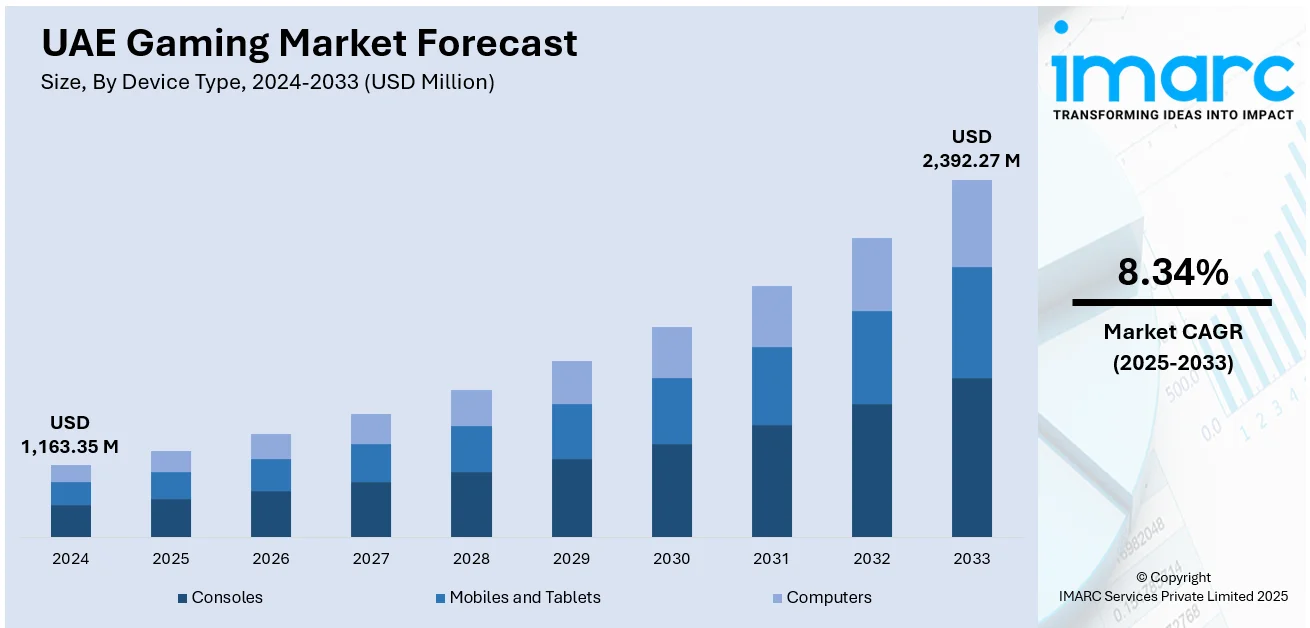

The UAE gaming market size reached USD 1,163.35 Million in 2024. Looking forward, the market is projected to reach USD 2,392.27 Million by 2033, exhibiting a growth rate (CAGR) of 8.34% during 2025-2033. The market is driven by sustained government initiatives supporting game development, digital content creation, and esports professionalization. Expanding infrastructure for competitive gaming, combined with international partnerships and growing local participation, is fostering a thriving esports ecosystem. Additionally, the widespread adoption of mobile and cloud gaming, supported by 5G networks and regional data centers, is further augmenting the UAE gaming market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,163.35 Million |

| Market Forecast in 2033 | USD 2,392.27 Million |

| Market Growth Rate 2025-2033 | 8.34% |

UAE Gaming Market Trends:

Rising Government Support and National Digital Strategies

The UAE government has identified gaming and digital entertainment as priority sectors in its broader strategy for economic diversification and technological leadership. Initiatives like the Dubai Program for Gaming 2033 and the Abu Dhabi Gaming initiative are structured to position the UAE as a regional hub for game development, esports, and digital entertainment. These programs provide funding, infrastructure, and talent development platforms, attracting global and regional developers to set up operations in the Emirates. The revenue in the overall United Arab Emirates games market will reach USD 751.97 Million in 2025, with an anticipated annual growth rate of 4.67% through 2030, reaching USD 944.72 Million. By 2030, the UAE gaming industry is expected to serve around 2.2 Million users, with an average revenue per user (ARPU) of USD 1.85 thousand. This robust expansion highlights the UAE’s growing contribution to immersive and culturally tailored gaming experiences. Free zones such as twofour54 in Abu Dhabi and Dubai Internet City offer tailored incentives for tech and gaming startups, including 100% foreign ownership and tax exemptions. Furthermore, partnerships with global gaming firms have resulted in localized content development aimed at Arabic-speaking gamers, increasing regional engagement. Esports tournaments, supported by local municipalities, are elevating the profile of the industry and creating vibrant gaming communities. The UAE’s alignment of gaming with its broader digital economy vision, supported by long-term government investment and policy commitment, forms the foundation for the UAE gaming market growth, establishing it as a central pillar of the nation’s future creative economy.

To get more information on this market, Request Sample

Rise in Mobile Gaming and Cloud Gaming Adoption

The proliferation of smartphones, combined with high-speed internet connectivity and significant cloud infrastructure development, has positioned mobile gaming as a dominant segment in the UAE’s gaming landscape. In 2023, 34% of gamers in the UAE reported spending between 1 to 5 hours per week playing video games. The data reflects gaming habits among 1,048 respondents aged 18 to 64. Titles tailored to mobile platforms are achieving mass adoption, with genres such as multiplayer online battle arenas (MOBAs), first-person shooters (FPS), and casual puzzle games leading downloads across app stores. Telecom providers in the UAE are enhancing gaming-specific services through high-bandwidth data packages, low-latency 5G networks, and partnerships with international mobile game publishers. On June 9, 2025, Dubai announced that its gaming ecosystem has expanded to over 350 companies, including 260 specialized game developers, under the Dubai Program for Gaming 2033 (DPG33). The initiative targets a USD 1 Billion contribution to Dubai’s GDP by 2033, with the creation of 30,000 new jobs, supported by a 16.6% growth in the number of gaming companies since its launch in November 2023. The integration of mobile payment systems with in-game purchases has streamlined monetization, supporting the growth of free-to-play models with optional microtransactions. Moreover, global cloud gaming platforms are actively expanding in the UAE, allowing players to access high-end titles on mobile devices without expensive gaming hardware. Collaborations between telecom providers and global tech firms, including investments in regional data centers, are accelerating the adoption of these services. Influencer-driven marketing and localized game content tailored to Arabic-speaking users are also contributing to market engagement. The strong alignment between digital infrastructure development and consumer gaming habits reinforces the growing importance of mobile and cloud platforms in the UAE.

UAE Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device type, platform, revenue type, type, and age group.

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computers

The report has provided a detailed breakup and analysis of the market based on the device type. This includes consoles, mobiles and tablets, and computers.

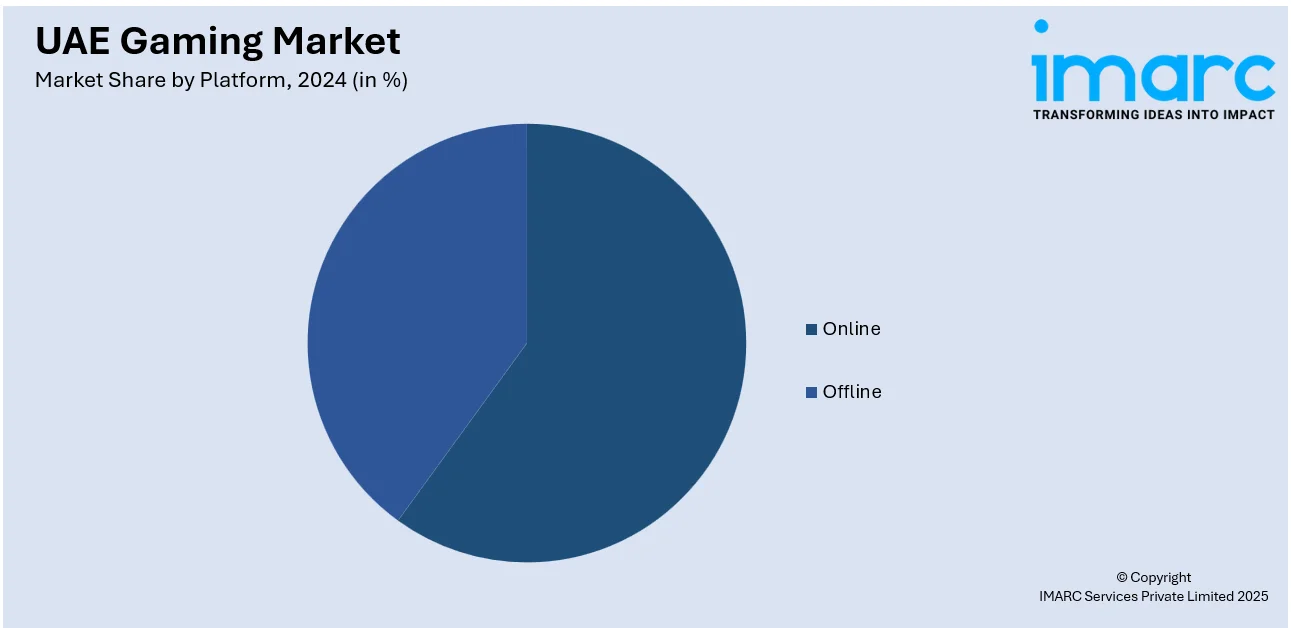

Platform Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the platform. This includes online and offline.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

The report has provided a detailed breakup and analysis of the market based on the revenue type. This includes in-game purchase, game purchase, and advertising.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Stimulation

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes adventure/role playing games, puzzles, social games, strategy, stimulation, and others.

Age Group Insights:

- Adults

- Children

The report has provided a detailed breakup and analysis of the market based on the age group. This includes adults and children.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Gaming Market News:

- On May 29, 2025, Phygital International confirmed Abu Dhabi as the official host city for the Games of the Future 2025, scheduled from December 18 to 23, at the Abu Dhabi National Exhibition Center (ADNEC). The event will feature groundbreaking phygital sports, blending physical athleticism with immersive digital gaming, and expects participation from thousands of athletes and over 300,000 spectators globally. This major global tournament complements the UAE’s rising prominence in the gaming sector, underscoring the nation’s commitment to innovation and interactive entertainment experiences.

- On September 30, 2024, the Emirates E-Sports Federation and ITW Universe announced the launch of the E-Gaming League (EGL), scheduled to commence in March 2025 in the UAE. The EGL will introduce a first-of-its-kind franchise-based draft system in esports, featuring six teams competing across MOBA, FPS, Sports, and Racing genres. Positioned to strengthen the UAE’s role as a global esports hub, the EGL aims to blend competitive gaming with mainstream entertainment experiences.

UAE Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Stimulation, Others |

| Age Groups Covered | Adults, Children |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE gaming market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE gaming market on the basis of device type?

- What is the breakup of the UAE gaming market on the basis of platform?

- What is the breakup of the UAE gaming market on the basis of revenue type?

- What is the breakup of the UAE gaming market on the basis of type?

- What is the breakup of the UAE gaming market on the basis of age group?

- What is the breakup of the UAE gaming market on the basis of region?

- What are the various stages in the value chain of the UAE gaming market?

- What are the key driving factors and challenges in the UAE gaming market?

- What is the structure of the UAE gaming market and who are the key players?

- What is the degree of competition in the UAE gaming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE gaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)