UAE Ghee Market Size, Share, Trends and Forecast by Source, Distribution Channel, End-User, and Region, 2025-2033

UAE Ghee Market Overview:

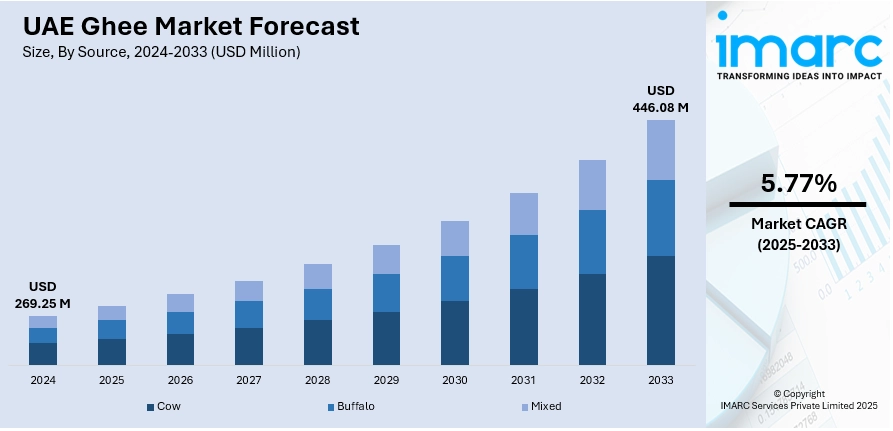

The UAE ghee market size reached USD 269.25 Million in 2024. The market is projected to reach USD 446.08 Million by 2033, exhibiting a growth rate (CAGR) of 5.77% during 2025-2033. The market is driven by rising health awareness among consumers, prompting a shift from hydrogenated fats to healthier fat alternatives like ghee. Along with this, increasing demand from the food service sector, coupled with the growing popularity of ethnic and traditional foods, supports consistent market growth. Moreover, rapid urbanization and rising disposable incomes contribute to premium ghee consumption, which is significantly augmenting the UAE ghee market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 269.25 Million |

| Market Forecast in 2033 | USD 446.08 Million |

| Market Growth Rate 2025-2033 | 5.77% |

UAE Ghee Market Trends:

Health-Oriented Reformulations and Premium Positioning

The market is undergoing a shift toward health-centric product development. With increasing consumer awareness around dietary habits and lifestyle diseases, brands are reformulating ghee to highlight functional health benefits. This includes the incorporation of fortified variants with vitamins A, D, and E and clarified butter options with reduced trans-fat. Moreover, organic and grass-fed ghee has gained traction among health-conscious buyers, especially expatriates familiar with Western wellness trends. Apart from this, positioning these products as clean-label and additive-free appeals to younger and more affluent demographics who view ghee not just as a traditional cooking fat but as a nutritional supplement. Many local and international brands are also leveraging packaging innovations to enhance shelf appeal and encourage trial purchases among urban professionals. Price elasticity remains relatively high in this segment, allowing manufacturers to introduce premium products with higher margins. The trend has also driven collaborations with dieticians and fitness influencers to reinforce the health narrative through digital marketing channels.

To get more information on this market, Request Sample

Influence of Regional Cuisine and Ethnic Consumption Patterns

Cultural preferences continue to play a defining role in shaping ghee demand in the UAE. According to industry reports, the expatriate population in the UAE is estimated to be 11.06 million as of 2024. This represents a significant portion of the total UAE population, which stands at 12.50 million. As a country with a large expatriate population, particularly from South Asia, demand for ghee remains rooted in traditional cooking habits. Indian, Pakistani, Bangladeshi, and Nepali households use ghee not only for cooking but also for ceremonial and religious purposes, driving consistent retail sales across major supermarket chains and local grocery outlets. The preference for branded ghee among these communities has also encouraged the growth of ethnic-focused SKUs, often positioned on regional familiarities, such as "Punjabi Desi Ghee" or "Awadhi Cow Ghee." Moreover, demand spikes during religious festivals such as Eid, Diwali, and Navratri result in seasonal promotions and bundling strategies. Parallel to household consumption, many ethnic restaurants and sweet shops use ghee extensively for authenticity in cooking. This has led to increased B2B activity from manufacturers offering bulk packs, which is contributing to the UAE ghee market growth.

Modern Trade Expansion and Private Label Penetration

Modern retail formats in the UAE, including hypermarkets and online grocery platforms, have significantly expanded the visibility and availability of ghee products. Retailers are dedicating shelf space for multiple ghee brands, including both regional imports and global players. Within this retail environment, private label products have started capturing meaningful share, driven by competitive pricing and perceived quality parity with national brands. Besides, the shift toward e-commerce has further accelerated product experimentation, as online platforms enable a broader range of products, including imported specialty ghee from Australia, New Zealand, and Europe. Also, subscription-based delivery models for ghee are tested in high-income residential areas. In addition to this, retail data analytics have allowed retailers to tailor stock-keeping units (SKUs) and adjust pricing strategies based on geographic and demographic trends, enabling more agile demand matching.

UAE Ghee Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, distribution channel, and end-user.

Source Insights:

- Cow

- Buffalo

- Mixed

The report has provided a detailed breakup and analysis of the market based on the source. This includes cow, buffalo, and mixed.

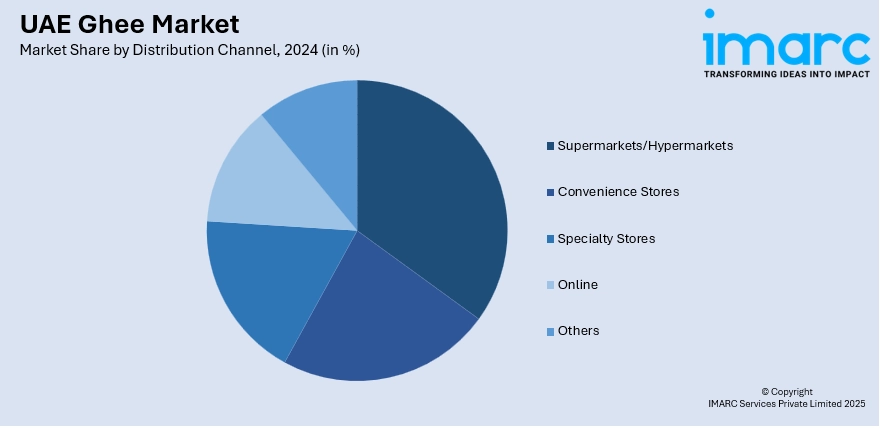

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, specialty stores, online, and others.

End-User Insights:

- Retail

- Institutional

The report has provided a detailed breakup and analysis of the market based on the end user. This includes retail and institutional.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Ghee Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Cow, Buffalo, Mixed |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| End-Users Covered | Retail, Institutional |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE ghee market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE ghee market on the basis of source?

- What is the breakup of the UAE ghee market on the basis of distribution channel?

- What is the breakup of the UAE ghee market on the basis of end-user?

- What is the breakup of the UAE ghee market on the basis of region?

- What are the various stages in the value chain of the UAE ghee market?

- What are the key driving factors and challenges in the UAE ghee market?

- What is the structure of the UAE ghee market and who are the key players?

- What is the degree of competition in the UAE ghee market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE ghee market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE ghee market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE ghee industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)