UAE Glamping Market Size, Share, Trends and Forecast by Age Group, Accommodation Type, Booking Mode, and Region, 2025-2033

UAE Glamping Market Overview:

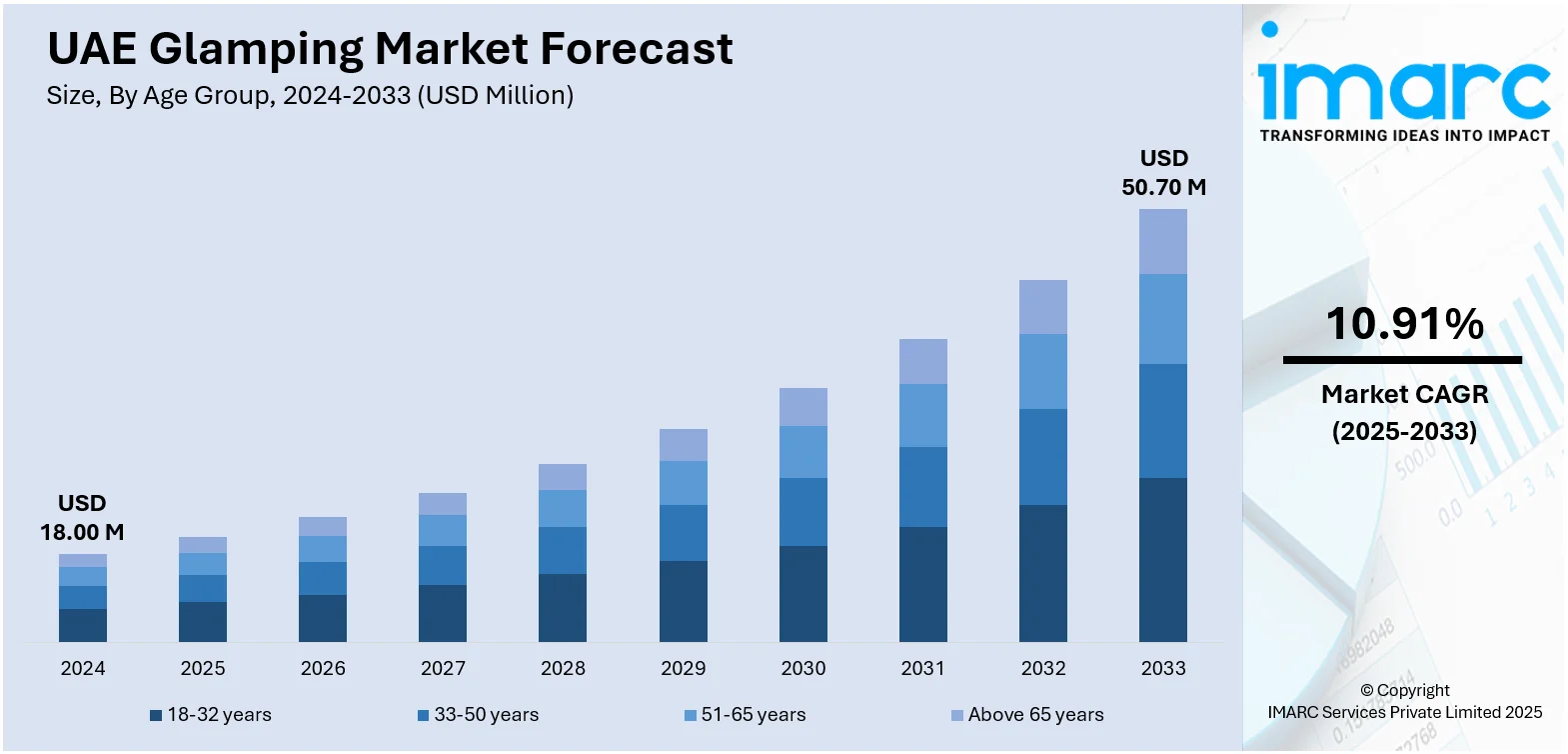

The UAE glamping market size reached USD 18.00 Million in 2024. The market is projected to reach USD 50.70 Million by 2033, exhibiting a growth rate (CAGR) of 10.91% during 2025-2033. The market is driven by rising domestic tourism, supported by government initiatives promoting sustainable and luxury outdoor experiences. Apart from this, the growing demand for unique travel accommodations among high-income consumers, coupled with the increasing popularity of eco-tourism, has led to a surge in luxury camping developments across desert and coastal regions. Moreover, strategic investments in hospitality infrastructure are further augmenting the UAE glamping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.00 Million |

| Market Forecast in 2033 | USD 50.70 Million |

| Market Growth Rate 2025-2033 | 10.91% |

UAE Glamping Market Trends:

Rise in Eco-Conscious and Sustainable Tourism Offerings

A prominent trend shaping the UAE glamping market is the increasing emphasis on eco-conscious and sustainable tourism experiences. Consumers are progressively seeking travel options that minimize environmental impact while still offering comfort and luxury. In response, operators are developing eco-friendly glamping sites that incorporate solar power, wastewater recycling systems, and low impact building materials. These accommodations are often set in nature reserves or remote desert areas, designed to blend with the landscape and conserve biodiversity. Notably, on May 17, 2025, a prominent Indian luxury glamping brand, LuxeGlamp Eco-Resorts, launched its first international eco-tourism project, LuxeGlamp UAQ, in Umm Al Quwain, UAE. Situated within a 50-acre mangrove reserve, the resort features ten glass-domed luxury suites with private plunge pools and sustainable, solar-powered infrastructure. The development aligns with the emirate's broader strategy to promote environmentally responsible tourism and diversify its hospitality offerings. Also, government policies encouraging sustainable tourism further support this trend by offering incentives for green infrastructure. Additionally, international travelers, particularly from Europe and North America, are placing greater importance on sustainability credentials when choosing accommodation, making eco-glamping a competitive differentiator. Apart from this, brands are also investing in educational programming around conservation and local ecology, creating an immersive experience that aligns with global sustainability values. As a result, sustainability is no longer a niche feature but a core component of glamping development strategies in the UAE.

To get more information on this market, Request Sample

Government-Backed Tourism Diversification and Regional Development

The UAE government's national plans to diversify the tourism industry and develop regional economic growth are propelling the UAE glamping market growth. A larger plan to shift from dependence on oil revenues is encouraging investments in non-traditional sectors of tourism, such as nature-based and adventure travel. In addition, UAE Tourism Strategy 2031 also targets raising the contribution of the tourism industry towards the GDP to AED 450 Billion (approximately USD 122.4 Billion) with a targeted growth of AED 27 billion (approximately USD 7.35 Billion) annually. Glamping is being positioned as one of the strategic pillars in this endeavor, especially in regions such as Ras Al Khaimah, Fujairah, and Sharjah, which have mountainous topography, coastal strips, and desert areas with immense opportunities for innovative outdoor experiences. Government agencies like the Ras Al Khaimah Tourism Development Authority (RAKTDA) are introducing focused initiatives to license and promote glamping resorts, integrating local communities and SMEs within the value chain. These developments aim to create a year-round tourism appeal beyond traditional city hubs like Dubai and Abu Dhabi. Furthermore, upgrading public infrastructure by providing more road accessibility, digital delivery in isolated regions, and eco-friendly transportation is making glamping sites accessible, supporting the segment's sustainability throughout the UAE.

UAE Glamping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on age group, accommodation type, and booking mode.

Age Group Insights:

- 18-32 years

- 33-50 years

- 51-65 years

- Above 65 years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 18-32 years, 33-50 years, 51-65 years, and above 65 years.

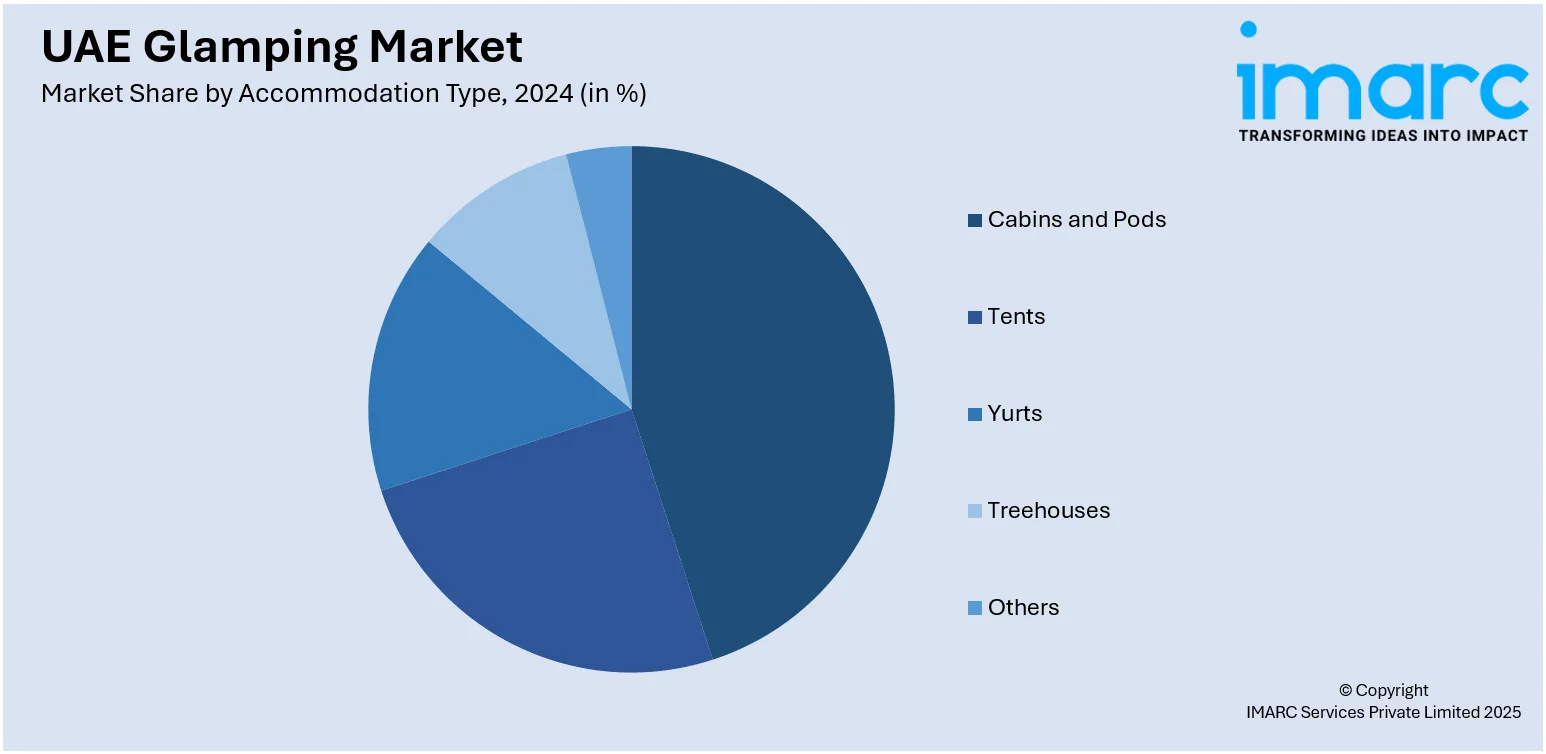

Accommodation Type Insights:

- Cabins and Pods

- Tents

- Yurts

- Treehouses

- Others

A detailed breakup and analysis of the market based on the accommodation type have also been provided in the report. This includes cabins and pods, tents, yurts, treehouses, and others.

Booking Mode Insights:

- Direct Booking

- Travel Agents

- Online Travel Agencies

The report has provided a detailed breakup and analysis of the market based on the booking mode. This includes direct booking, travel agents, and online travel agencies.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Glamping Market News:

- On September 23, 2024, Hatta Resorts and the Wadi Hub officially launched Season 7, introducing enhanced accommodation options, including upgraded glamping domes with private pools and a fleet of vintage campers arriving in November. The season expands its adventure offerings with spear throwing, a shooting range, a dedicated children’s zone, kayaking, mountain biking, and hiking across the Hajar Mountains, alongside a new outdoor yoga space. Additionally, guests can enjoy various dining options, supporting community-based entrepreneurs while enjoying immersive outdoor experiences.

- On February 3, 2025, Mleiha National Park in Sharjah unveiled its “Come Closer” campaign, highlighting its 34.2 km² conservation area as a multifunctional destination blending heritage, nature, adventure, culture, and stargazing. The campaign showcases immersive offerings such as guided tours to Fossil Rock and Jebel Buhais, eco‑luxury glamping under pristine night skies, traditional Majlis experiences, and thrilling desert activities, including dune drives, paragliding, and sand surfing.

UAE Glamping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Age Groups Covered | 18-32 years, 33-50 years, 51-65 years, Above 65 years |

| Accommodation Types Covered | Cabins and Pods, Tents, Yurts, Treehouses, Others |

| Booking Modes Covered | Direct Booking, Travel Agents, Online Travel Agencies |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE glamping market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE glamping market on the basis of age group?

- What is the breakup of the UAE glamping market on the basis of accommodation type?

- What is the breakup of the UAE glamping market on the basis of booking mode?

- What is the breakup of the UAE glamping market on the basis of region?

- What are the various stages in the value chain of the UAE glamping market?

- What are the key driving factors and challenges in the UAE glamping market?

- What is the structure of the UAE glamping market and who are the key players?

- What is the degree of competition in the UAE glamping market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE glamping market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE glamping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE glamping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)