UAE Hair Care Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

UAE Hair Care Market Overview:

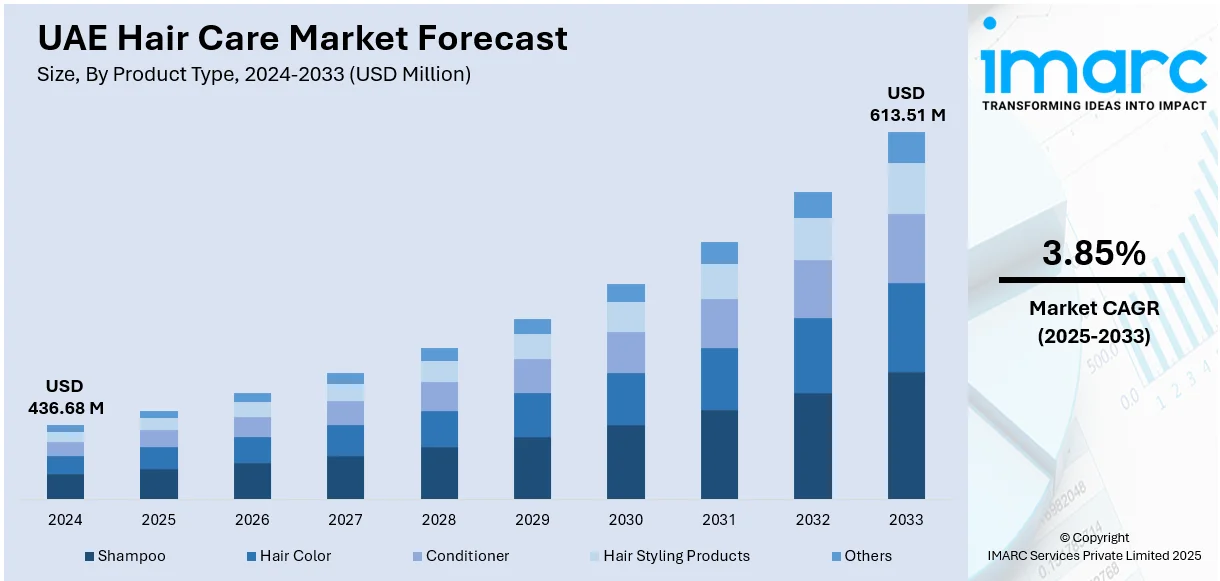

The UAE hair care market size reached USD 436.68 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 613.51 Million by 2033, exhibiting a growth rate (CAGR) of 3.85% during 2025-2033. The market is experiencing growth due to increasing consumer demand for premium and specialized products, including those for hair restoration and scalp health. Rising awareness about personal grooming, alongside a growing focus on natural and organic ingredients, is driving the market. With innovation in hair care solutions and expanding product ranges, the sector is poised for further development, contributing to the UAE hair care market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 436.68 Million |

| Market Forecast in 2033 | USD 613.51 Million |

| Market Growth Rate 2025-2033 | 3.85% |

UAE Hair Care Market Trends:

Rising Awareness About Personal Grooming and Beauty Trends

The growing awareness about personal grooming, styling, and beauty trends is a key factor driving the market expansion in the UAE. People increasingly consider hair health, appearance, and hygiene as integral to their overall image, motivating them to invest in high-quality shampoos, conditioners, serums, oils, and styling products. Fashion magazines and digital platforms play a significant role in shaping hair care routines and promoting new product launches. Both men and women are actively seeking professional-grade hair care solutions at home or through salons. Additionally, the younger population is experimenting with hair coloring, treatments, and styling tools, which is catalyzing the demand for protective and specialized products. As the beauty and personal care products industry is thriving across the country, the market is set to expand. According to the IMARC Group, the UAE beauty and personal care products market size reached USD 2,554.9 Million in 2024.

To get more information on this market, Request Sample

Influence of Beauty and Lifestyle Media

Beauty, fashion, and lifestyle media play a pivotal role in shaping user behavior in the UAE hair care market. Television shows, online platforms, and social media influencers showcase hair care routines, product demonstrations, and styling trends, educating people on new products and techniques. As per the DataReportal, in January 2024, the United Arab Emirates had 10.73 Million users of social media. Viral tutorials and celebrity endorsements often encourage experimentation with hair treatments, color, and styling tools. Brands are leveraging digital marketing to target tech-savvy users with personalized recommendations. The exposure is increasing brand awareness, encouraging product trials, and building loyalty towards premium and niche hair care solutions in the UAE.

E-Commerce and Digital Retail Expansion

The rapid growth of e-commerce platforms and online retail in the UAE is offering a favorable market outlook. As per the IMARC Group, the e-commerce sector in the MENA region, valued at USD 1.80 Billion, expanded by 30% in 2024. People increasingly prefer the convenience of online shopping, where they can compare products, read reviews, and access a wide variety of domestic and international brands. E-commerce platforms often offer attractive discounts, subscription services, and doorstep delivery, increasing purchase frequency and product accessibility. Social media integration, influencer marketing, and targeted online campaigns are further promoting product awareness and trials. This digital retail expansion is especially important during seasonal demand spikes, festive promotions, and new product launches.

Key Growth Drivers of UAE Hair Care Market:

Expanding Salons and Professional Hair Care Services

The rapid growth of salons, beauty clinics, and professional hair care services in the UAE is driving the demand for high-quality hair care products. Salons rely on premium shampoos, conditioners, treatments, and styling solutions to cater to a diverse clientele seeking personalized services. Hair professionals recommend trusted brands to clients, encouraging home use and repeat purchases. Lifestyle-oriented spending among residents and tourists is contributing to the popularity of salon services, which is further boosting product utilization. Additionally, international salon brands entering the UAE market are introducing advanced hair care formulations and treatments, elevating user expectations. Professional endorsements and in-salon promotions influence purchasing decisions, making salon-based sales a critical driver of the market growth.

Increasing Focus on Natural and Organic Hair Care Products

Rising preferences for natural, organic, and chemical-free hair care products are positively influencing the market in the UAE. Shampoos, conditioners, oils, and masks infused with botanical extracts, essential oils, and plant-based ingredients are gaining traction. Awareness about the potential adverse effects of sulfates, parabens, and silicones on scalp and hair health is motivating people to switch to safer alternatives. Social media and influencer campaigns highlighting sustainable and organic hair care are further catalyzing the demand. Premium and niche brands entering the UAE market capitalize on this trend, offering eco-friendly packaging, cruelty-free formulations, and dermatologically tested products. The focus on holistic hair wellness aligns with broader health and lifestyle movements, expanding the market growth as people continue to prioritize safer, sustainable, and effective hair care solutions over traditional chemical-based options.

Rising Disposable Incomes and Premium Product Usage

Increasing disposable incomes among UAE residents is fueling the utilization of premium and luxury hair care products. High-income households and affluent consumers are willing to invest in advanced formulations, professional-grade treatments, and international brands that promise superior results. The presence of luxury retail outlets, high-end malls, and e-commerce platforms makes these products accessible, catering to users’ preferences for convenience and exclusivity. In addition, lifestyle-oriented marketing campaigns are encouraging repeat purchases and brand loyalty. People are also drawn to products offering multifunctional benefits, such as anti-frizz, hair repair, ultraviolet (UV) protection, and color preservation. The combination of higher purchasing power, brand consciousness, and the desire for enhanced hair aesthetics is significantly supporting the expansion of the market in the UAE, particularly in premium segments.

UAE Hair Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Shampoo

- Hair Color

- Conditioner

- Hair Styling Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes shampoo, hair color, conditioner, hair styling products, and others.

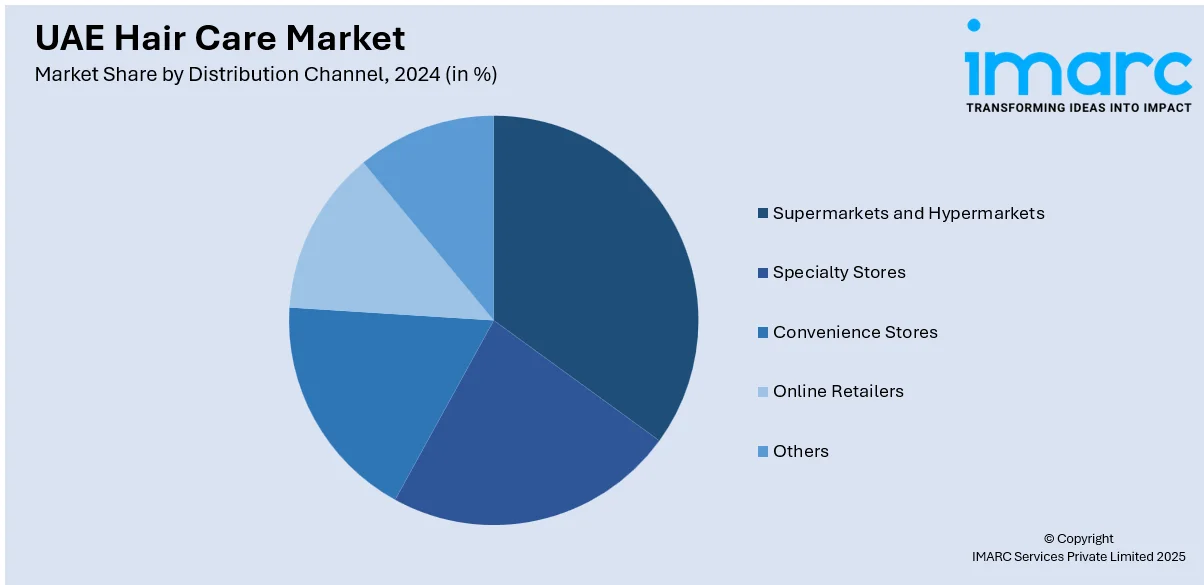

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retailers

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, convenience stores, online retailers, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Hair Care Market News:

- August 2025: UKLASH introduced its inaugural complete hair care range, UKHAIR, in the UAE. It launched a seven-product range featuring a hair growth serum, shampoo, conditioner, repair mask, vitamins, and styling tools, intended to combat hair thinning and enhance scalp health.

- June 2025: Sheikha Mahra of Dubai unveiled a new hair and skin care brand named 'Xtianna' under her label 'Mahra M1'. The product line featured camel milk shampoo, conditioner, serum, and body oil, acclaimed for their nourishing advantages.

- June 2025: The Brazilian vegan haircare brand TRUSS debuted in the UAE, offering high-quality products and a specialized training academy for salon experts. Dedicated to sustainability, TRUSS utilized eco-friendly packaging and backed social initiatives. The firm would offer practical training in sophisticated haircare methods and ethical standards.

UAE Hair Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Shampoo, Hair Color, Conditioner, Hair Styling Products, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Retailers, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE hair care market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE hair care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE hair care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hair care market in the UAE was valued at USD 436.68 Million in 2024.

The UAE hair care market is projected to exhibit a CAGR of 3.85% during 2025-2033, reaching a value of USD 613.51 Million by 2033.

High demand for premium, organic, and specialized hair care products, such as anti-hair fall and anti-dandruff solutions, is fueling the market growth. Urbanization and increasing disposable incomes are encouraging people to spend more on advanced hair care solutions. Additionally, the impact of social media, beauty influencers, and international brands is shaping user preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)