UAE Health and Wellness Market Size, Share, Trends and Forecast by Product Type, Functionality, and Region, 2025-2033

UAE Health and Wellness Market Overview:

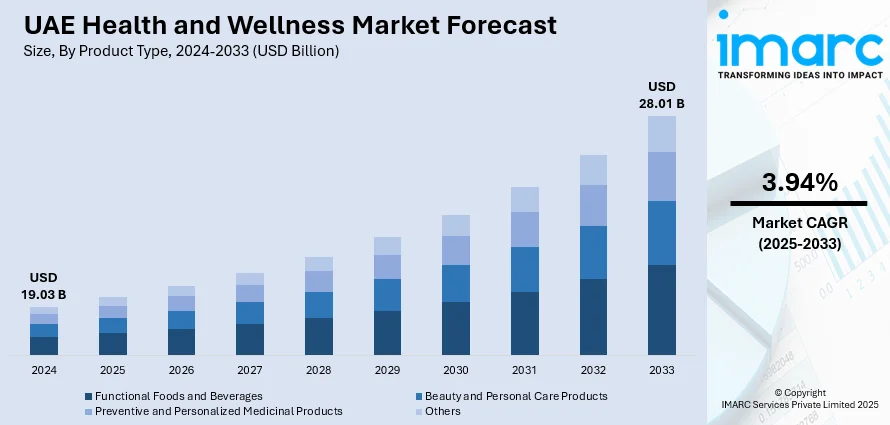

The UAE health and wellness market size reached USD 19.03 Billion in 2024. Looking forward, the market is expected to reach USD 28.01 Billion by 2033, exhibiting a growth rate (CAGR) of 3.94% during 2025-2033. The market is propelled by increasing health consciousness, spurred on by active living, preventive care, and the management of chronic disease through government campaigns. Expatriate and local high-end consumers are also enthusiastic adopters of high-quality fitness services, spa treatments, and medical tourism. Innovative digital health technologies, including remote diagnostics, wellness apps, and telemedicine platforms, along with rising demand for clean-label, organic, and plant-based solutions demonstrates increased environmental awareness, further contributing to the UAE health and wellness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19.03 Billion |

| Market Forecast in 2033 | USD 28.01 Billion |

| Market Growth Rate 2025-2033 | 3.94% |

UAE Health and Wellness Market Trends:

Luxury-Health Wellness Tourism and Destination Medicine

The UAE quickly established itself as a wellness tourism and destination healthcare global hub, combining luxury experiences and whole person healing in legendary settings. Ranging from tranquil desert hideaways in Ras Al Khaimah to spas within Burj Al Arab and luxury resorts on The Palm, wellness tourism is a top trend. Guests are attracted by high-end services like thalassotherapy, personalized nutrition plans, and biomedical diagnostics, all presented in luxurious facilities with personal wellness concierges. The combination of medical professionals and wellness coaches is attractive to health-oriented tourists who want to revitalize themselves using traditional treatments and advanced preventive medicine. Luxury spas and resorts also provide integrated wellness programs targeting physical wellness, along with emotional and mental well-being, such as mindfulness, stress relief, and detoxing ceremonies. With increasing demand for carefully curated wellness experiences, the UAE's tourism industry has adopted wellness as a lifestyle indicator and as a worldwide attraction factor, transforming the hospitality industry to incorporate specialized wellness services as a norm.

To get more information on this market, Request Sample

Tech-Enabled Preventive Care and Digital Health Adoption

Technological innovation is significantly contributing to the UAE health and wellbeing market growth, with an emphasis on preventive medicine and personalized health management. With the omnipresent use of smartphones, wearables, and AI-based diagnostics, residents can track vitals, control nutrition, and participate in fitness programs while on-the-move. Teleconsultations and remote healthcare services are also mainstream, providing easy access to healthcare experts across several languages and specializations. In Abu Dhabi and Dubai, DNA-based nutrition guidance, AI-supported mental health services, and remote physiotherapy with real-time biometric monitoring are provided. This digital first strategy supports national measures to reduce visits to hospitals and promote early treatment. In addition to convenience, these solutions assist expats in having continuity of care and offer Arabic and English support for multicultural populations. As more people incorporate digital technology into everyday wellness regimes, the UAE is becoming a leader in markets for technology-facilitated, preventive healthcare that combines international best practice with local accessibility.

Wellness-Focused Lifestyle and Local Culture Integration

The growing affinity for health and wellness in the UAE is reshaping everyday lifestyles, as residents embrace conscious nutrition, fitness, and mental resilience within both private and public spaces. Abu Dhabi’s beachfront wellness paths, Sharjah’s urban yoga trails, and Dubai’s community fitness zones reflect government and city-driven infrastructure that encourages active living. Local food culture is changing as well, as farmers' markets in Al Ain and organic cafes in Dubai provide clean label, locally made products alongside global health food trends. Emirati and expatriate communities increasingly integrate traditional wellness routines like Arabic herbal infusions, spa hammams, and oudh-infused detox treatments into their own lifestyles. Wellness has mainstreamed, spreading into workplaces with in-house wellbeing coaches and mindfulness programs, along with large retail and entertainment complexes that stage wellness expos and experiential events. For example, a recent survey conducted by Bupa Global shows that 88% of UAE companies intend to boost their spending on employee wellbeing initiatives in 2025, motivated by a distinct Return on Wellbeing Investment (ROWI). Wellbeing programs, proven to greatly enhance employee productivity, involvement, and retention, are increasingly vital factors for organizational success. An impressive 94% of top executives have stated that wellness initiatives improve productivity, highlighting the direct effect of health spending on overall company performance. This integrated approach combines cultural heritage, city planning, and lifestyle choice, making wellbeing an overt, accessible, and integral part of life in the UAE.

UAE Health and Wellness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and functionality.

Product Type Insights:

- Functional Foods and Beverages

- Beauty and Personal Care Products

- Preventive and Personalized Medicinal Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes functional foods and beverages, beauty and personal care products, preventive and personalized medicinal products, and others.

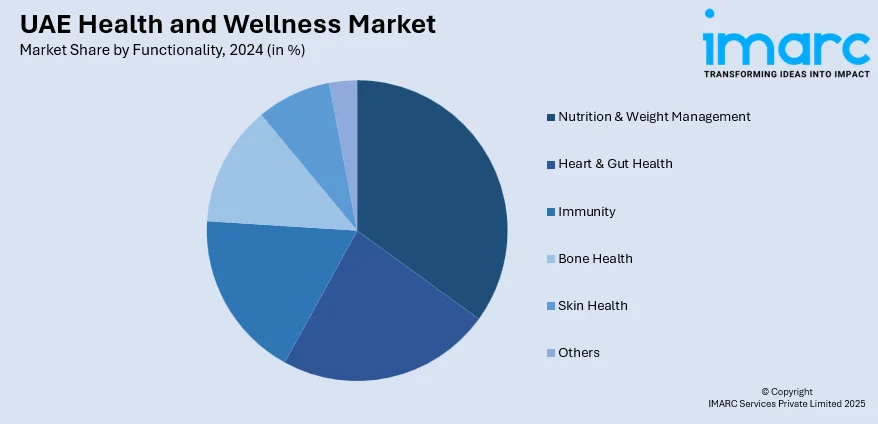

Functionality Insights:

- Nutrition & Weight Management

- Heart & Gut Health

- Immunity

- Bone Health

- Skin Health

- Others

A detailed breakup and analysis of the market based on the functionality has also been provided in the report. This includes nutrition & weight management, heart & gut health, immunity, bone health, skin health, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Health and Wellness Market News:

In March 2025, Lift Brands, the worldwide wellness company that owns Snap Fitness, Fitness On Demand, and has a minority stake in 9Round and Fitstop, regained the Snap Fitness master franchise for the United Arab Emirates, intending to establish a substantial number of new locations throughout the nation in the upcoming years. The announcement arrives as the UAE keeps drawing interest from the fitness sector, with companies such as UBX, GymNation, Anytime Fitness, and UFC Gym aiming to establish their presence.

UAE Health and Wellness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Functional Foods and Beverages, Beauty and Personal Care Products, Preventive and Personalized Medicinal Products, Others |

| Functionalities Covered | Nutrition & Weight Management, Heart & Gut Health, Immunity, Bone Health, Skin Health, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE health and wellness market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE health and wellness market on the basis of product type?

- What is the breakup of the UAE health and wellness market on the basis of functionality?

- What is the breakup of the UAE health and wellness market on the basis of region?

- What are the various stages in the value chain of the UAE health and wellness market?

- What are the key driving factors and challenges in the UAE health and wellness market?

- What is the structure of the UAE health and wellness market and who are the key players?

- What is the degree of competition in the UAE health and wellness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE health and wellness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE health and wellness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE health and wellness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)