UAE Higher Education Market Size, Share, Trends and Forecast by Component, Deployment Mode, Course Type, Learning Type, End User, and Region, 2025-2033

UAE Higher Education Market Overview:

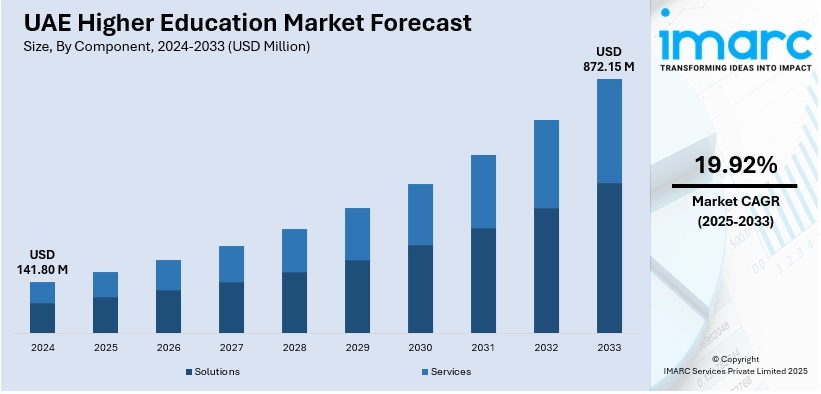

The UAE higher education market size reached USD 141.80 Million in 2024. Looking forward, the market is expected to reach USD 872.15 Million by 2033, exhibiting a growth rate (CAGR) of 19.92% during 2025-2033. The market is evolving rapidly, driven by strong government initiatives, increasing demand for quality academic programs, and growing presence of international universities. A tech-driven learning environment, combined with rising student enrollment and industry-aligned curricula, supports academic excellence and global competitiveness. These dynamics continue to influence the overall UAE higher education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 141.80 Million |

| Market Forecast in 2033 | USD 872.15 Million |

| Market Growth Rate 2025-2033 | 19.92% |

UAE Higher Education Market Trends:

Growing International Student Enrollment

The UAE is emerging as one of the leading global destinations for higher education, with international student enrollment acting as a major driver of the market growth. According to statistics from the Knowledge and Human Development Authority (KHDA), 35% of the student body at private universities consisted of international students, as of May 2025. The country’s strategic location, cultural diversity, and world-class infrastructure make it attractive for students from Asia, Africa, and the Middle East. Universities in Dubai, Abu Dhabi, and Sharjah offer globally recognized degrees in collaboration with prestigious institutions from the US, UK, and Australia, allowing students to pursue international curricula closer to home. English as the primary medium of instruction is further boosting the accessibility. The government’s initiatives, such as student-friendly visa policies and residency pathways for graduates, enhance the country’s appeal. Additionally, international rankings of UAE-based universities continue to rise, further strengthening trust in their educational standards.

To get more information on this market, Request Sample

Expansion of Private and International Universities

Private and international universities are playing a pivotal role in expanding the UAE higher education landscape. As per industry reports, the private education sector in Dubai is set to welcome 25 new schools in the 2025-2026 academic year. This encompasses 16 new early childhood centers (ECCs), six schools, and three international universities for the 2025-26 academic year. Global institutions are setting up campuses, offering students access to globally competitive programs without leaving the country. These universities provide a wide range of degrees, including business, law, technology, and creative fields, meeting the diverse needs of students and industries. The growth of private universities also complements public institutions by introducing innovation in teaching methods, research collaboration, and specialized programs.

Integration of Technology and E-Learning

Technology integration is revolutionizing higher education in the UAE, significantly contributing to the market growth. Universities are adopting online education platforms, digital classrooms, and blended learning models to cater to diverse student needs. As per the IMARC Group, the UAE online education market size reached USD 426.96 Million in 2024. E-learning increases flexibility, enabling students to balance studies with work commitments or access global faculty remotely. Moreover, partnerships with edtech firms enhance the digital learning ecosystem, offering adaptive learning paths and personalized content delivery. Technology also facilitates international collaboration, research projects, and global mobility programs. With a student population that is digitally savvy, this shift ensures higher education in the UAE remains innovative and accessible.

Key Growth Drivers of UAE Higher Education Market:

Government Vision and Policy Support

The UAE government’s strategic initiatives, particularly aligned with Vision 2030 and the National Innovation Strategy, are fueling the market growth. Authorities emphasize building a knowledge-based economy where education, research, and innovation act as the foundation for long-term growth. Policy frameworks are encouraging universities to adopt global best practices, attract international partnerships, and establish specialized programs in science, technology, engineering, and mathematics (STEM). Government incentives, funding, and regulatory support help private and international universities expand their campuses in the UAE. Moreover, ministries regularly assess and accredit institutions to ensure quality standards remain competitive on a global scale. This strong policy backing creates an environment where higher education thrives, preparing students for future industries while positioning the UAE as a regional hub for academic excellence and global talent attraction.

Strong Industry-Academia Collaboration

Collaborations between universities and industries are positively influencing the market. Employers demand graduates equipped with real-world problem-solving skills, encouraging institutions to partner with industries for internships, research projects, and training initiatives. Fields like engineering, business, healthcare, and technology benefit greatly from such linkages, as students gain exposure to applied knowledge while industries access a talent pipeline tailored to their needs. The government is encouraging these collaborations through innovation hubs, research parks, and incubator programs within universities. This ecosystem not only strengthens employability but also fosters entrepreneurship and startup creation. Industry-academia cooperation ensures that curricula remain relevant, producing graduates who can contribute effectively to the UAE’s diversification goals. Such partnerships also enhance the reputation of UAE universities, making them more attractive to international students seeking career-ready education.

Rising Demand for Skill-Based and Professional Programs

The market is increasingly driven by rising demand for skill-based and professional programs that prepare students for evolving job markets. With industries, such as technology, renewable energy, healthcare, and finance, growing rapidly, employers require graduates with practical expertise and industry-relevant skills. Universities are designing specialized programs in artificial intelligence (AI), data science, sustainability, and entrepreneurship to bridge the skill gap. Vocational training and executive education courses are also gaining traction as professionals seek continuous learning opportunities to remain competitive. Government encouragement of STEM education and emphasis on innovation are further catalyzing this demand. The trend ensures that higher education institutions are not just academic hubs but also talent incubators aligned with market needs.

UAE Higher Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, course type, learning type, and end user.

Component Insights:

- Solutions

- Student Information Management System

- Content Collaboration

- Data Security and Compliance

- Campus Management

- Others

- Services

- Managed Services

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (student information management system, content collaboration, data security and compliance, campus management, and others) and services (managed services and professional services).

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Course Type Insights:

- Arts

- Economics

- Engineering

- Law

- Science

- Others

A detailed breakup and analysis of the market based on the course type have also been provided in the report. This includes arts, economics, engineering, law, science, and others.

Learning Type Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the learning type have also been provided in the report. This includes online and offline.

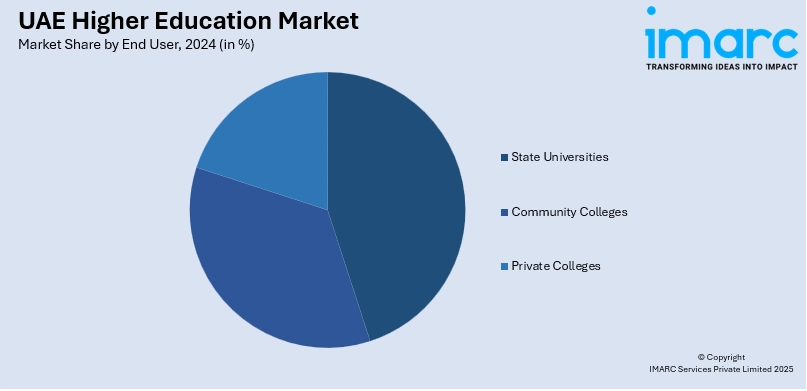

End User Insights:

- States Universities

- Community Colleges

- Private Colleges

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes states universities, community colleges, and private colleges.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Higher Education Market News:

- September 2025: Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai, Deputy Prime Minister, and Minister of Defence of the United Arab Emirates, inaugurated the first overseas campus of India's prominent business school, the Indian Institute of Management Ahmedabad (IIMA), located in Dubai. The UAE and India assessed their collaboration in higher education and committed to strengthening knowledge connections, making knowledge, innovation, and research essential elements of the Comprehensive Strategic Partnership.

- May 2025: The Ministry of Higher Education and Scientific Research (MoHESR) released updated directives for the acknowledgment of academic credentials issued by international higher education institutions (HEIs). These revised procedures corresponded with the goals of the Zero Government Bureaucracy initiative, seeking to simplify processes and minimize administrative obstacles for the acknowledgment of foreign degrees. Attending higher education in the UAE is poised to be more attainable for international students.

- September 2024: The Crown Prince of Abu Dhabi attended the inauguration of IIT-Delhi Abu Dhabi, signifying the creation of India's prestigious Indian Institute of Technology's first international campus in the UAE's capital.

UAE Higher Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Course Types Covered | Arts, Economics, Engineering, Law, Science, Others |

| Learning Types Covered | Online, Offline |

| End Users Covered | State Universities, Community Colleges, Private Colleges |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE higher education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE higher education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE higher education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The higher education market in the UAE was valued at USD 141.80 Million in 2024.

The UAE higher education market is projected to exhibit a CAGR of 19.92% during 2025-2033, reaching a value of USD 872.15 Million by 2033.

Partnerships with globally recognized universities and the presence of international campuses are enhancing academic standards and appeal. The growing demand for programs in technology, business, and healthcare reflects the changing market needs and economic diversification goals. Digitalization in education, along with blended and online learning models, is further widening access and flexibility for students.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)