UAE Ice Cream Market Size, Share, Trends and Forecast by Flavor, Category, Product, Distribution Channel, and Region, 2025-2033

UAE Ice Cream Market Overview:

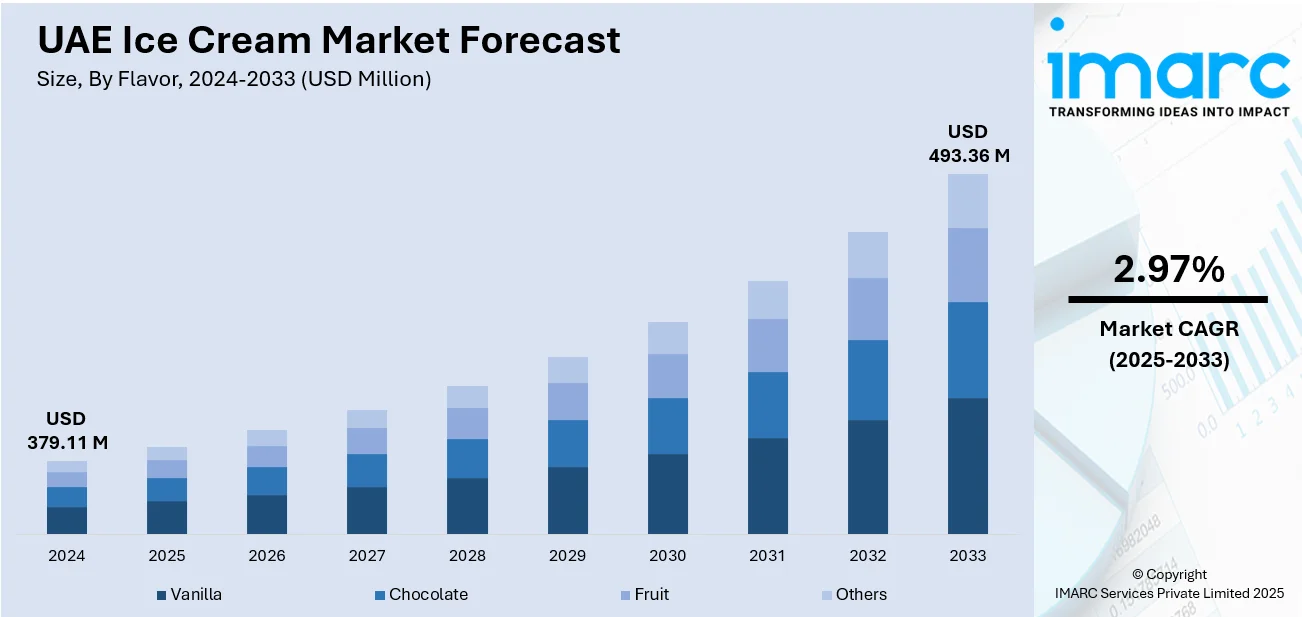

The UAE ice cream market size reached USD 379.11 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 493.36 Million by 2033, exhibiting a growth rate (CAGR) of 2.97% during 2025-2033. The market is underpinned by boosting consumer demand, premiumization, and innovation in health-orientated and culturally inspired products. With a young, multicultural population and increased disposable income, the consumption of ice cream is growing in both retail and foodservice channels. Product-formulation innovation and experiential formats are also propelling market interaction. Furthermore, these along with tourism and digital, continue to support robust performance and competitive positioning in the frozen desserts market in the region, adding substantially to UAE ice cream market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 379.11 Million |

| Market Forecast in 2033 | USD 493.36 Million |

| Market Growth Rate 2025-2033 | 2.97% |

UAE Ice Cream Market Trends:

Premiumization and Artisanal Appeal in Consumer Choices

The UAE ice cream market is being driven more and more by premiumization, with customers moving towards high-quality and artisanal offerings. This movement is fueled by increasing wealth, worldwide culinary trends, and a need for rich, but refined, dessert experiences. Craft ice creams, distinguished by small-batch manufacturing and the incorporation of natural, organic ingredients, are on the rise with consumers interested in authenticity and distinctive flavor. Unusual flavors like lavender, matcha, and saffron are being used, as well as dairy substitutes providing value and diversity. Texture innovation, such as creamy inclusions or crunchy mix-ins, boosts sensory appeal and takes perceived quality up a notch. The focus on craftsmanship and prestige adds to premium prices, which people are ready to pay. This has opened the door for greater innovation and customer interaction. Accordingly, UAE ice cream market growth is being driven by boosting consumer advancement and desire for luxury treats.

To get more information on this market, Request Sample

Health-Conscious Consumption Driving Product Reformulation

Heightened health-aware lifestyles in the UAE are transforming the ice cream industry, as consumers highly crave products that accommodate their dietary aspirations. Demand for low-sugar, low-calorie, dairy-free, and plant-based ice cream products has increased exponentially, driven by nutrition awareness, sports trends, and food intolerance. For instance, in September 2024, The Brooklyn Creamery introduced its keto-friendly Caramel Pecan Crunch Ice Cream in the UAE, providing only 1g net carbs and 132 calories per serving to health-conscious consumers. Moreover, consumers become more knowledgeable and discerning, sometimes reading nutritional information and ingredients prior to purchase. This trend is prompting producers to re-formulate classic ice cream with natural sweeteners like stevia, lower fat content, and novel non-dairy bases like almond, coconut, or oat milk. The incorporation of functional ingredients like probiotics or added fiber further contributes to digestive health and resonates with well-being-conscious consumers. These innovations not only widen the product category but also reposition ice cream as a guilt-free luxury item. This health-conscious focus is a key characteristic of the latest UAE ice cream market trends, both enabling innovation and broadening consumer use.

Cultural Fusion and Experiential Flavor Innovation

Flavor experimentation within the UAE ice cream market is increasingly varied, fueled by the multicultural nature of the country and a hunger for sensory innovation. Shoppers are gravitating towards ice creams that blend indigenous flavors with international influence, yielding culturally blended flavors like cardamom-pistachio, baklava swirl, or rose-lychee. For example, in November 2024, Barakat introduced limited-edition Kunafa Pistachio Ice Cream Bites in the UAE, combining Emirati classic flavors with contemporary frozen foods as part of its 'Fresh-Made in the UAE' campaign. Furthermore, such new-age blends not only appeal to local sensibilities but also familiarize international consumers with Middle Eastern cuisine. Concurrently, experiential trends like interactive serve styles, customizable toppings, and visually appealing presentations are accelerating consumer interaction. This experiential style of consumption turns eating ice cream into an experience, resonating most with younger generations and visitors. Social media is also a factor, as shareable moments drive product presentation and design. The development of these distinctive taste profiles and serving styles adds to brand differentiation and premium positioning. Therefore, such trends are taking the lead in fueling UAE ice cream market growth, increasing both popularity and market size.

UAE Ice Cream Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on flavor, category, product, and distribution channel.

Flavor Insights:

- Vanilla

- Chocolate

- Fruit

- Others

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes vanilla, chocolate, fruit, and others.

Category Insights:

- Impulse Ice Cream

- Take-Home Ice Cream

- Artisanal Ice Cream

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes impulse ice cream, take-home ice cream, and artisanal ice cream.

Product Insights:

- Cup

- Stick

- Cone

- Brick

- Tub

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes cup, stick, cone, brick, tub, and others.

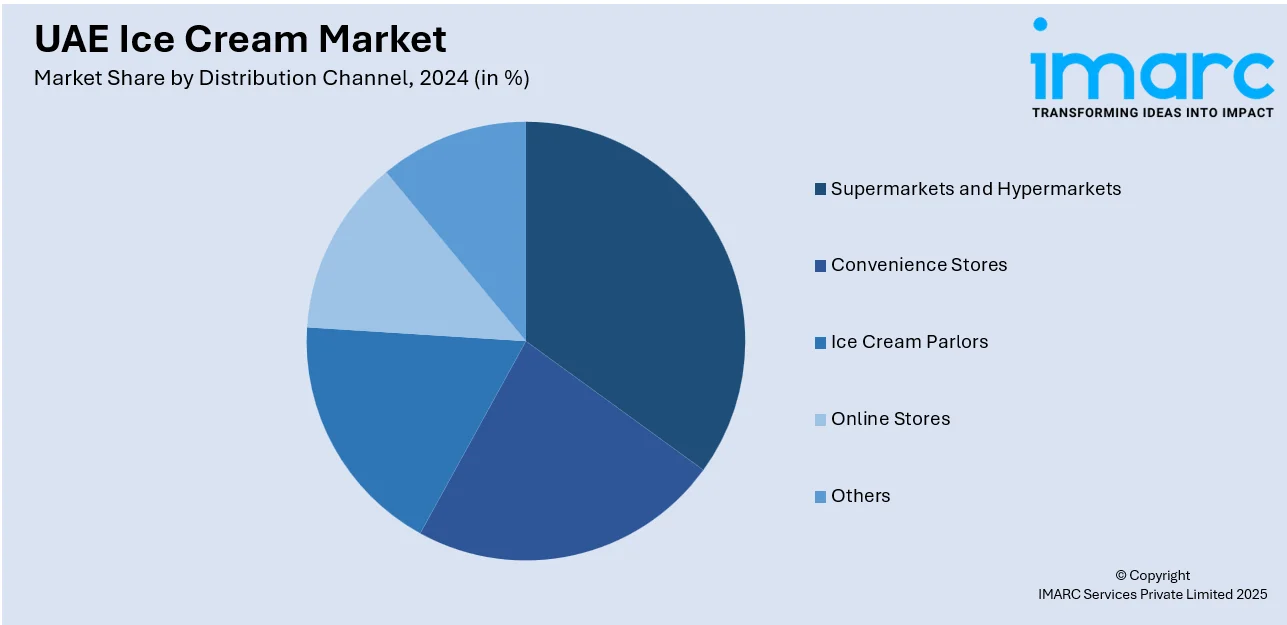

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Ice Cream Parlors

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, ice cream parlors, online stores, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Ice Cream Market News:

- In December 2024, The Brooklyn Creamery launched low-calorie, no added sugars creamsicle ice cream bars in the UAE. In Alphonso Mango and Raspberry flavors, the 55ml bar has only 55 calories and 50% less fat, a healthier version of the classic treat, only through Noon Minutes for easy delivery.

- In May 2024, Ferrero rolled out its new range of ice creams in the UAE with some of the most loved flavours like Kinder Bueno, Ferrero Rocher, and Raffaello. The launch ceremony in Palm Jumeirah, Dubai, was a wow with a phenomenal drone light show, signalling the brand's foray into the UAE ice cream segment.

UAE Ice Cream Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Flavours Covered | Vanilla, Chocolate, Fruit, Others |

| Categories Covered | Impulse Ice Cream, Take-Home Ice Cream, Artisanal Ice Cream |

| Products Covered | Cup, Stick, Cone, Brick, Tub, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Ice Cream Parlors, Online Stores, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE ice cream market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE ice cream market on the basis of flavor?

- What is the breakup of the UAE ice cream market on the basis of category?

- What is the breakup of the UAE ice cream market on the basis of product?

- What is the breakup of the UAE ice cream market on the basis of distribution channel?

- What is the breakup of the UAE ice cream market on the basis of region?

- What are the various stages in the value chain of the UAE ice cream market?

- What are the key driving factors and challenges in the UAE ice cream?

- What is the structure of the UAE ice cream market and who are the key players?

- What is the degree of competition in the UAE ice cream market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE ice cream market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE ice cream market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE ice cream industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)