UAE Lingerie Market Size, Share, Trends and Forecast by Product Type, Material, Price Range, Distribution Channel, and Region, 2025-2033

UAE Lingerie Market Overview:

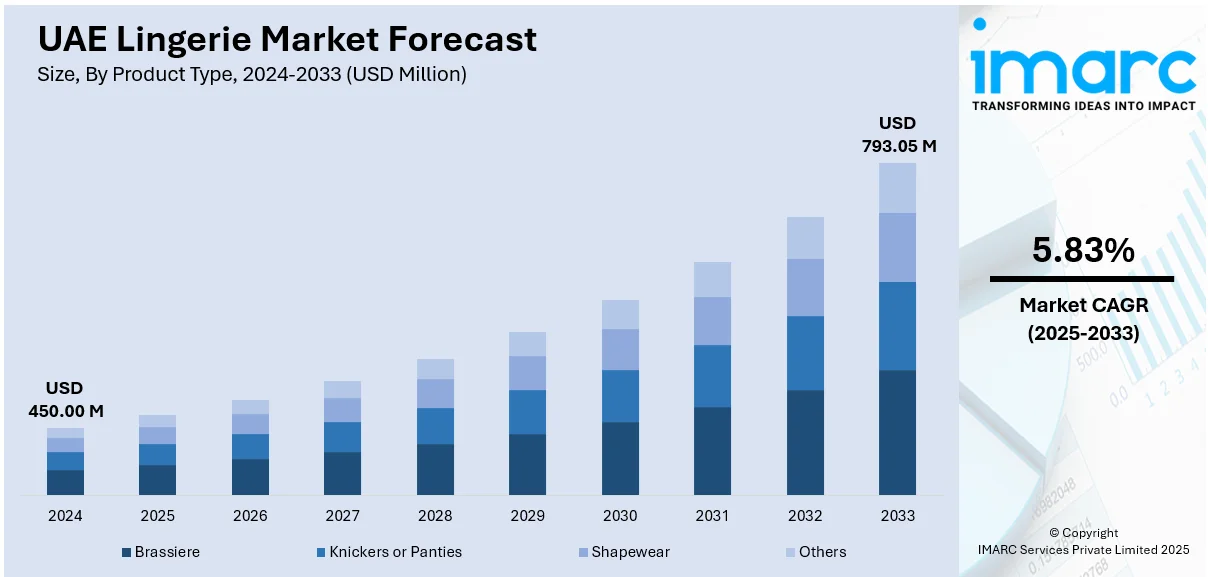

The UAE lingerie market size reached USD 450.00 Million in 2024. Looking forward, the market is expected to reach USD 793.05 Million by 2033, exhibiting a growth rate (CAGR) of 5.83% during 2025-2033. The market is fueled by cultural diversity, growing disposable incomes, and heightened personal wellness and luxury concerns. Shoppers looking for high-quality, comfortable intimate apparel that balances both modesty and contemporary fashion and the country's upscale retail infrastructure, particularly in high-end malls, has led to the development of international and specialty lingerie brands. Personalized service as well as shopper-centric, privacy-driven shopping experiences also enhance consumer loyalty and trust, supporting substantial growth in UAE lingerie market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 450.00 Million |

| Market Forecast in 2033 | USD 793.05 Million |

| Market Growth Rate 2025-2033 | 5.83% |

UAE Lingerie Market Trends:

A Mélange of Modesty and Modern Fashion

One of the most characteristic trends in the UAE lingerie market is the subtle mix of modesty and modern fashion. Being a multicultural society, the UAE has a lingerie market influenced by a blend of Islamic values and universal fashion trends. Most consumers, particularly Emirati women, desire lingerie that satisfies coverage and comfort without having to compromise on femininity and elegance. As such, non-translucent fabrics, high-waisted panties, and full-coverage bras are popular. Expat communities, on the other hand, introduce a heterogeneous set of tastes, creating demand for a broader range of cuts and styles. Luxury lingerie companies tend to launch fashion collections that include specially chosen designs appealing to fashion-conscious and more conservative tastes. Boutiques and shopping malls in urban hubs such as Dubai and Abu Dhabi often include private fitting rooms and exclusively female sales staff to maintain discretion and comfort. This culturally sensitive practice has generated a distinctive shopping environment in which modesty and luxury exist in perfect harmony.

To get more information on this market, Request Sample

Luxury and Premiumization of Intimate Wear

The UAE's high demand for luxury products has also spilled over into the lingerie market, where premium and exclusive brands have found a willing following. With a high per capita living standard and a population that is familiar with international luxury brands, there is substantial demand for lingerie that offers exclusivity, craftmanship, and comfort. at the UAE market, international labels like La Perla, Victoria's Secret, and Agent Provocateur are well-known and typically found at upscale shopping centers like The Dubai Mall or Mall of the Emirates. These brands are appreciated for their beauty and for the customized customer service and boutique feel that they provide. Additionally, consumers typically view undergarments as a byproduct of their personal care routine and overall lifestyle, favoring items composed of premium materials like lace and silk. Bespoke fittings and limited-edition collections are also becoming popular among upscale buyers. This premiumization trend is also seen in the UAE's larger luxury retail environment, cementing lingerie as a prestige category and further contributing to the UAE lingerie market growth.

Digital Transformation and Omni-Channel Retailing

Digital transformation is at the forefront of remolding the lingerie industry in the UAE. High internet penetration and an educated population that is tech-friendly, e-commerce has emerged as a major distribution channel for lingerie sales, particularly among young, urban women. Online shopping provides privacy and convenience, such that women can browse a range of styles and brands from home. Local e-commerce sites such as Namshi and Ounass, as well as international players, have developed their lingerie portfolios, frequently with such amenities as size charts, online try-ons, and relaxed return options to enhance consumer trust. Social media also has a large impact on buying decisions, as domestic influencers and personal stylists promote new collections and styling advice. Most brands now follow an omni-channel approach, combining physical locations and digital channels to provide end-to-end experiences. With privacy, quality, and assortment all being much-cherished values in this market, the shift to digital is allowing for increased access and interaction, changing the way lingerie is retailed and marketed throughout the UAE.

UAE Lingerie Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material, price range, and distribution channel.

Product Type Insights:

- Brassiere

- Knickers or Panties

- Shapewear

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes brassiere, knickers or panties, shapewear, and others.

Material Insights:

- Cotton

- Silk

- Satin

- Nylon

- Others

A detailed breakup and analysis of the market based on the material has also been provided in the report. This includes cotton, silk, satin, nylon, and others.

Price Range Insights:

- Economy

- Premium

A detailed breakup and analysis of the market based on the price range has also been provided in the report. This includes economy and premium.

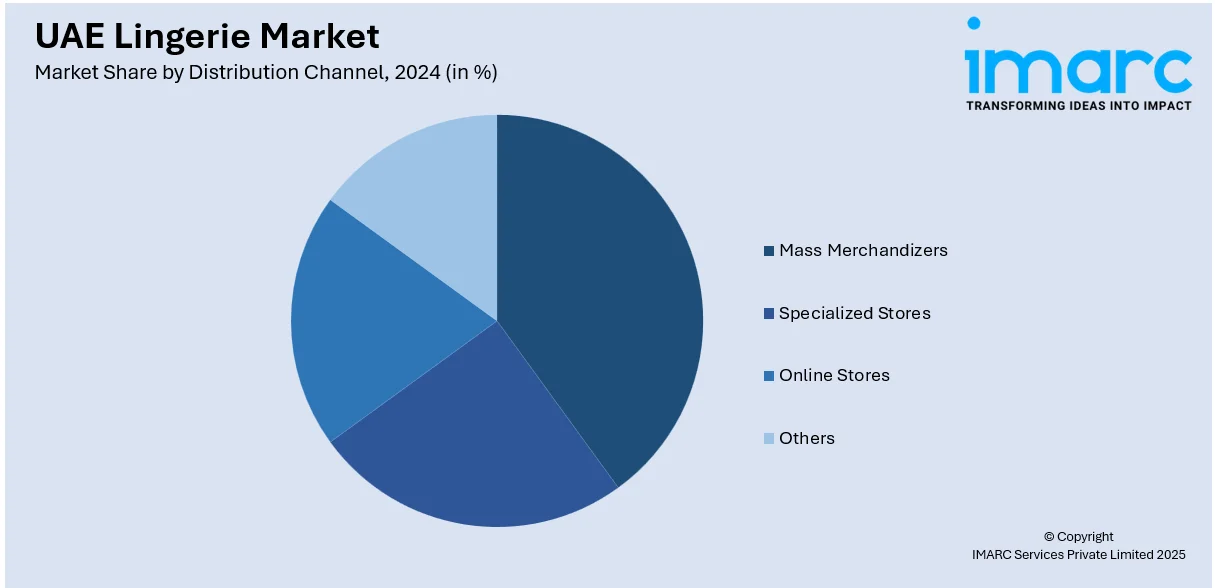

Distribution Channel Insights:

- Mass Merchandizers

- Specialized Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes mass merchandizers, specialized stores, online stores, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Lingerie Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Brassiere, Knickers or Panties, Shapewear, Others |

| Materials Covered | Cotton, Silk, Satin, Nylon, Others |

| Price Ranges Covered | Economy, Premium |

| Distribution Channels Covered | Mass Merchandizers, Specialized Stores, Online Stores, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE lingerie market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE lingerie market on the basis of product type?

- What is the breakup of the UAE lingerie market on the basis of material?

- What is the breakup of the UAE lingerie market on the basis of price range?

- What is the breakup of the UAE lingerie market on the basis of distribution channel?

- What is the breakup of the UAE lingerie market on the basis of region?

- What are the various stages in the value chain of the UAE lingerie market?

- What are the key driving factors and challenges in the UAE lingerie market?

- What is the structure of the UAE lingerie market and who are the key players?

- What is the degree of competition in the UAE lingerie market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE lingerie market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE lingerie market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE lingerie industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)