UAE Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033

UAE Meat Market Overview:

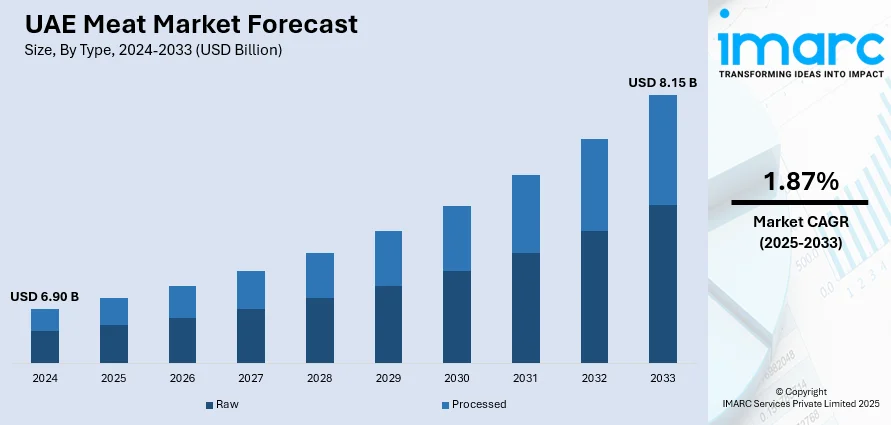

The UAE meat market size reached USD 6.90 Billion in 2024. The market is projected to reach USD 8.15 Billion by 2033, exhibiting a growth rate (CAGR) of 1.87% during 2025-2033. The market is driven by a diverse and growing population with varied dietary preferences, increasing demand for halal and imported meats. Rising health awareness fuels interest in organic, hormone-free, and premium-quality meats. Government regulations ensure strict food safety and halal compliance, while national food security initiatives support local production and stable imports. Together, these factors boost consumption across retail and foodservice sectors, making the market dynamic and responsive to evolving consumer needs and regulatory frameworks further surging the UAE meat market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.90 Billion |

| Market Forecast in 2033 | USD 8.15 Billion |

| Market Growth Rate 2025-2033 | 1.87% |

UAE Meat Market Trends:

Population Growth and Expatriate Diversity

The UAE’s expanding population comprising around 88% expatriates from Asia, Europe, and the Middle East—drives strong demand in the meat market. This multicultural mix results in diverse dietary preferences and sustained consumption of beef, lamb, chicken, mutton, and veal. The average UAE resident consumes about 85 kg of meat annually, nearly 18 times the global average, with poultry accounting for ~49% and red meat ~26%. Expat communities preserve their culinary traditions, increasing demand for halal-certified imports from origin countries. Urbanization and rising disposable incomes further fuel consumption, especially among younger consumers who frequent fast food and casual dining outlets. In response, the UAE government has invested in livestock farming and modern abattoirs to enhance food security and local supply. This diversity in demand pushes retailers and foodservice providers to maintain a consistent, varied meat selection year-round, making population growth a key UAE meat market trend.

To get more information on this market, Request Sample

Rising Health Consciousness and Demand for Quality Meats

A rising focus on health and wellness in the UAE is reshaping consumer behavior in the meat market. In the GCC, 87% of consumers prioritize health-promoting products, and 64% actively seek organic options. UAE buyers increasingly prefer lean cuts, organic, grass-fed, antibiotic- and hormone-free meat, and demand greater traceability from trusted halal-certified brands. Premium meat categories like wagyu beef and free-range chicken are gaining popularity among affluent, health-conscious consumers. Retailers and foodservice providers are responding with health-focused labeling, clearer segmentation, and transparency in sourcing. Fine dining establishments now emphasize quality, sustainability, and meat origin. Growing concerns about obesity, diabetes, and other lifestyle diseases are pushing consumers to reduce red meat intake in favor of healthier protein sources. This shift is driving innovation in product offerings and transforming the retail and hospitality landscape, making wellness-driven purchasing a major force in the UAE meat market growth.

Government Regulations and Food Security Initiatives

The UAE government plays a vital role in shaping the meat market through stringent regulations and robust food security strategies. With over 840,000 food products, including meat, registered in the ZAD system as of August 2020, the nation ensures traceability, quality control, and food safety. Strict halal standards, hygiene protocols, and regular inspections apply to both local and imported meat, the latter forming the bulk of supply. Under the UAE Food Security Strategy 2051, the country aims to boost local meat production, reduce import dependency, and enhance supply chain resilience. Key efforts include investments in livestock farming, vertical farming for animal feed, and incentives for agribusiness. Public-private partnerships are advancing smart abattoirs and cold chain infrastructure. Moreover, strategic trade relations with major meat-exporting nations such as Brazil, India, and Australia help diversify sources and stabilize prices. Together, these policies make government regulation a core market driver.

UAE Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

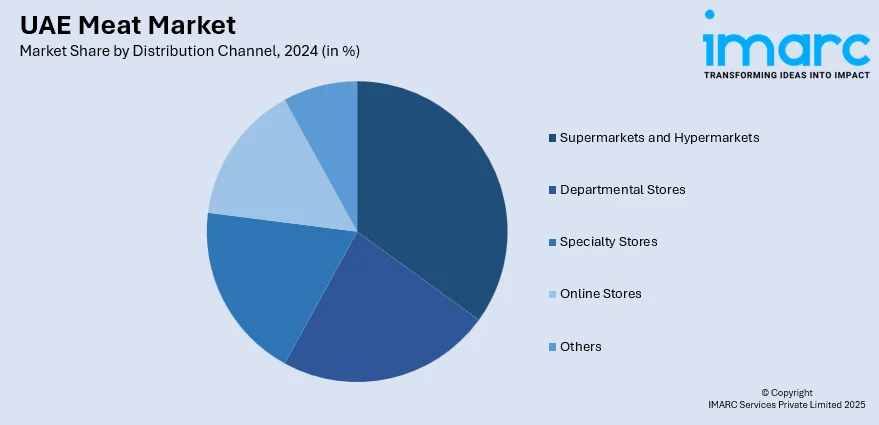

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Meat Market News:

- In May 2025, Switch Foods, the UAE’s first homegrown plant-based meat brand, was founded in 2022 by Edward Hamod after a family health scare. Motivated by the health risks linked to traditional meat, the company offers 100% plant-based, allergen-free alternatives tailored to Middle Eastern tastes, including kebab, kafta, and shawarma.

- In November 2024, Al Islami Foods, a UAE-based halal food pioneer, launched its new processed food range in Qatar, including burgers, nuggets, kebabs, and more. Known for hand-slaughtered, no-stunning halal practices, the brand emphasizes convenience without compromising quality or taste. With over 50 years of heritage, Al Islami aims to meet modern consumer needs while maintaining authentic halal standards. The launch reinforces its position as a global leader in the halal food industry.

- In June 2024, AGWA, Abu Dhabi’s food and water cluster, is partnering with Believer Meats to develop cultivated meat capabilities in the UAE. The collaboration includes plans to establish commercial, production, and R&D centers in Abu Dhabi, supporting regional expansion and innovation. AGWA will also help create a regulatory pathway for halal-certified cultivated meat. The partnership aligns with AGWA’s mission to enhance food security and address global water and nutrition challenges through advanced technologies.

UAE Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE meat market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE meat market on the basis of type?

- What is the breakup of the UAE meat market on the basis of product?

- What is the breakup of the UAE meat market on the basis of distribution channel?

- What is the breakup of the UAE meat market on the basis of region?

- What are the various stages in the value chain of the UAE meat market?

- What are the key driving factors and challenges in the UAE meat market?

- What is the structure of the UAE meat market and who are the key players?

- What is the degree of competition in the UAE meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)