UAE Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2025-2033

UAE Medical Tourism Market Overview:

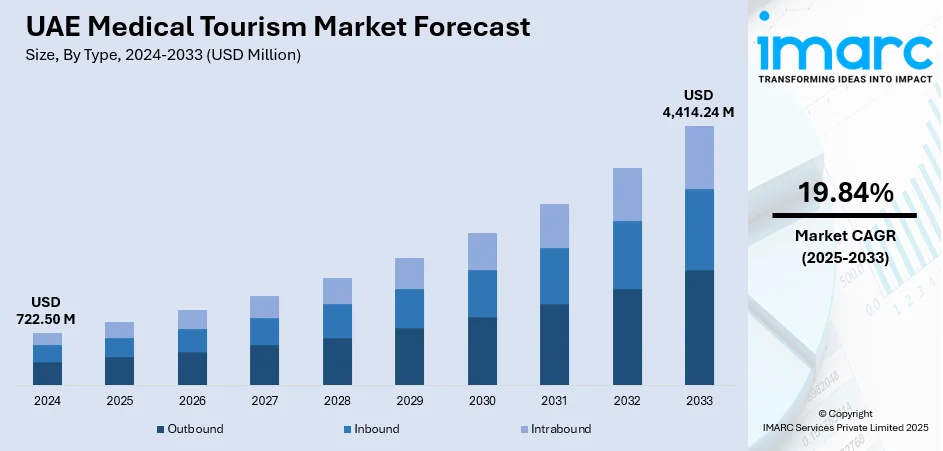

The UAE medical tourism market size reached USD 722.50 Million in 2024. Looking forward, the market is projected to reach USD 4,414.24 Million by 2033, exhibiting a growth rate (CAGR) of 19.84% during 2025-2033. The market is driven by globally accredited hospitals offering high-quality care, supported by digital booking platforms and concierge services. The UAE’s location, simplified visa processes, and luxury hospitality create a seamless experience for international patients. Competitive treatment pricing, strong specializations in high-demand segments, and integrated wellness offerings are further augmenting the UAE medical tourism market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 722.50 Million |

| Market Forecast in 2033 | USD 4,414.24 Million |

| Market Growth Rate 2025-2033 | 19.84% |

UAE Medical Tourism Market Trends:

World-Class Healthcare Infrastructure and Accreditation

The UAE has emerged as a leading destination for medical tourism by investing extensively in world-class healthcare infrastructure and international accreditations. Cities like Dubai and Abu Dhabi are home to state-of-the-art hospitals and specialty clinics that meet global standards, with many facilities accredited by the Joint Commission International (JCI). These institutions offer advanced diagnostics, robotic surgeries, and personalized treatment plans delivered by multilingual, internationally trained healthcare professionals. In 2023, Dubai attracted over 691,000 international health tourists, reflecting its rise as a premier destination for high-quality, holistic medical care. These visitors spent more than AED 1.03 Billion (≈ USD 280 Million), highlighting the city's strong integration of healthcare excellence and luxury recovery experiences. The UAE’s focus on service excellence ensures minimal waiting times, high patient privacy standards, and luxurious post-treatment recovery environments. Government initiatives such as the “Dubai Health Experience (DXH)” platform allow medical tourists to access verified providers, compare services, and book treatments seamlessly online. Additionally, healthcare facilities offer bundled packages for medical and wellness services, often including airport transfers, accommodation, and concierge services. The availability of high-quality medical care, supported by global certifications and competitive pricing, makes the UAE a preferred destination for patients from GCC nations, Africa, Europe, and South Asia. These strengths continue to support UAE medical tourism market growth and reinforce the country’s vision of becoming a regional healthcare hub.

To get more information on this market, Request Sample

Competitive Pricing and Specialized Treatment Segments

One of the key attractions for medical tourists in the UAE is the cost-effectiveness of high-quality care across a range of specialties. Compared to Europe and North America, the UAE offers substantial savings on elective procedures, cosmetic surgery, fertility treatments, and dental care—without compromising on quality or outcomes. Bundled pricing models with transparent cost breakdowns allow patients to plan treatments with financial clarity. UAE healthcare providers focus on areas that are in high demand among medical tourists, such as orthopedics, cardiology, dermatology, bariatrics, and reproductive health, often supported by cutting-edge technologies and personalized rehabilitation services. Cosmetic and aesthetic procedures, in particular, are a strong growth area, attracting clients from across the GCC and wider MENA region. In 2023, Dubai generated AED 2.3 Billion in indirect revenue from medical tourism, significantly contributing to its GDP and related industries. Women made up 58% of international patients, with top arrivals from Asia (33%), GCC Arab nations (28%), and Europe/CIS (23%). Health tourism authorities and private hospitals also promote wellness packages, including spa therapies, detox programs, and preventive health checkups, further broadening the appeal. Strategic marketing campaigns across target markets, including Russia, India, Nigeria, and the UK, have been effective in reinforcing the UAE’s image as a premium but accessible destination for specialized care. These strengths in pricing transparency and specialization are central to the sustained expansion of the UAE’s medical tourism ecosystem.

UAE Medical Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and treatment type.

Type Insights:

- Outbound

- Inbound

- Intrabound

The report has provided a detailed breakup and analysis of the market based on the type. This includes outbound, inbound, and intrabound.

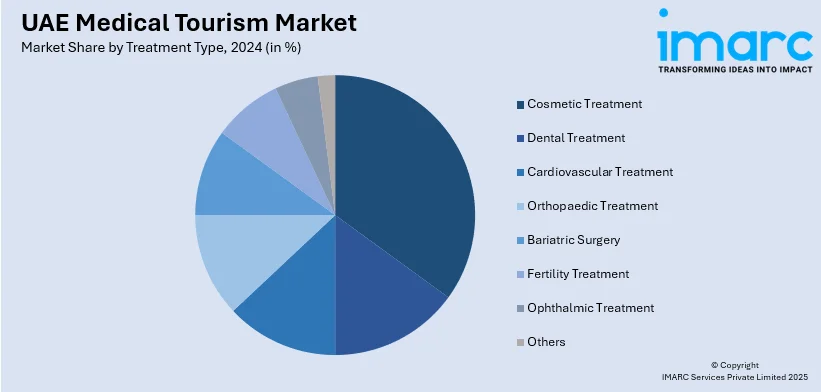

Treatment Type Insights:

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopaedic Treatment

- Bariatric Surgery

- Fertility Treatment

- Ophthalmic Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment type. This includes cosmetic treatment, dental treatment, cardiovascular treatment, orthopaedic treatment, bariatric surgery, fertility treatment, ophthalmic treatment, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Medical Tourism Market News:

- On December 11, 2024, Burjeel Holdings signed a strategic partnership with Aasandha Company Ltd to provide Maldivian patients access to advanced treatments in Abu Dhabi, including multi-organ transplants and oncology care. The collaboration enables patients under the Maldives’ National Social Health Insurance Scheme to receive complex medical services at Burjeel Medical City, enhancing Abu Dhabi’s reputation as a medical tourism hub. With direct flight connectivity and streamlined services, this partnership is expected to significantly boost UAE medical tourism by attracting international patients seeking high-quality care.

UAE Medical Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Outbound, Inbound, Intrabound |

| Treatment Types Covered | Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE medical tourism market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE medical tourism market on the basis of type?

- What is the breakup of the UAE medical tourism market on the basis of treatment type?

- What is the breakup of the UAE medical tourism market on the basis of region?

- What are the various stages in the value chain of the UAE medical tourism market?

- What are the key driving factors and challenges in the UAE medical tourism market?

- What is the structure of the UAE medical tourism market and who are the key players?

- What is the degree of competition in the UAE medical tourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE medical tourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE medical tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE medical tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)