UAE Menswear Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2025-2033

UAE Menswear Market Overview:

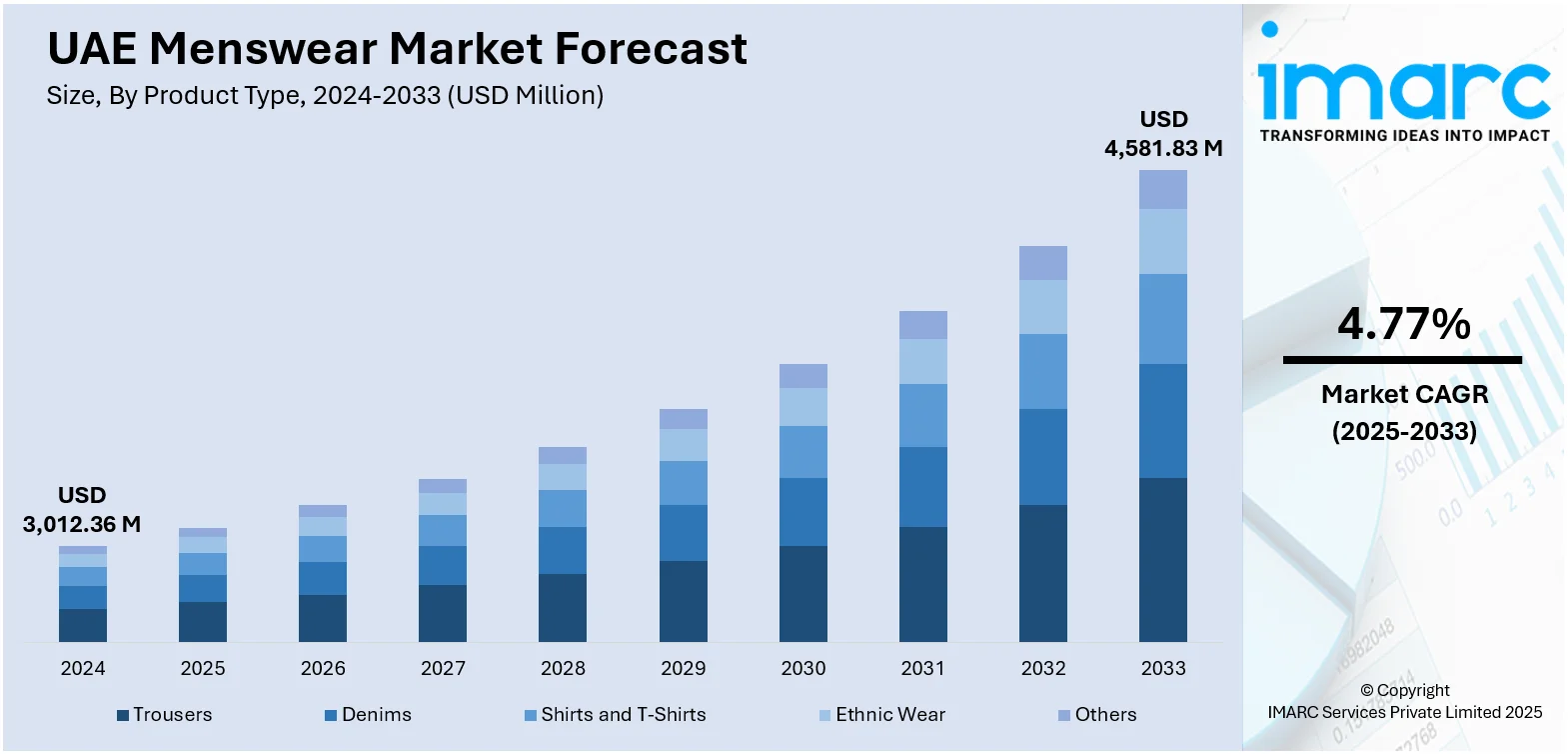

The UAE menswear market size reached USD 3,012.36 Million in 2024. Looking forward, the market is projected to reach USD 4,581.83 Million by 2033, exhibiting a growth rate (CAGR) of 4.77% during 2025-2033. The market is experiencing steady growth, driven by rising fashion consciousness, a blend of traditional and modern styles, and increasing demand for premium and luxury apparel. The market benefits from a diverse population, strong retail infrastructure, and expanding e-commerce presence. As consumers seek quality, innovation, and cultural relevance in their clothing choices, the UAE menswear market share continues to expand across various style and price segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,012.36 Million |

| Market Forecast in 2033 | USD 4,581.83 Million |

| Market Growth Rate 2025-2033 | 4.77% |

UAE Menswear Market Trends:

Rising Demand for Athleisure and Smart Casual

The surge in popularity of athleisure and smart casual wear is transforming the fashion scene in the UAE menswear sector. An increasing number of men are opting for multifunctional clothing that merges comfort with style facilitating smooth transitions between work, social outings, and leisure activities. For instance, in June 2025, Allen Solly launched its first exclusive store in Dubai, showcasing stylish menswear and chic womenswear. The store is located in City Center Deira features bold designs and comfortable apparel appealing to fashion-forward consumers. This marks a significant step in the brand's global expansion bringing Nottingham-inspired fashion to the Middle East. This shift mirrors the modern lifestyle trends where rigid dress codes are increasingly being superseded by adaptive, fashionable alternatives. Pieces such as stretch fabrics, slim joggers, polo tops, fitted chinos, and light blazers are becoming staples in daily outfits. These outfits are fashionable and also suit the climate of the region, providing ease of movement and breathability. Retailers are reacting to this shift by expanding their product offerings to match the changing demands of consumers. As comfort takes precedence without sacrificing style, this trend is significantly contributing to the UAE menswear market growth in both premium and mass-market segments.

To get more information on this market, Request Sample

E-Commerce & Digital Influence

The menswear market in the UAE is undergoing a significant transformation due to e-commerce and digital platforms, which are altering how consumers discover, assess, and buy fashion. With widespread internet accessibility and smartphone use, shopping online has become a key part of the purchasing experience. Social media, influencers, and targeted online advertisements are shaping male style preferences and boosting interest in popular menswear trends. Brands are harnessing visually engaging content and interactive campaigns to connect with fashion-savvy men. Additionally, features such as virtual fitting rooms, sizing guides, and rapid delivery services are improving the online shopping experience. E-commerce platforms are broadening access to both international and local brands while offering personalized and convenient options. For instance, in November 2024, Indian fashion brand Beyoung partnered with Noon.com to launch in the Middle East, targeting Saudi Arabia, Egypt, and the UAE. This move marks the start of Beyoung's global expansion plan, aiming to open 300 stores by 2027. As digital usage continues to rise, online and social media channels are anticipated to remain pivotal to sales and customer engagement, playing a crucial role in the growth and evolution of the UAE menswear sector.

UAE Menswear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, season, and distribution channel.

Product Type Insights:

- Trousers

- Denims

- Shirts and T-Shirts

- Ethnic Wear

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes trousers, denims, shirts and t-shirts, ethnic wear, and others.

Season Insights:

- Summer Wear

- Winter Wear

- All-Season Wear

A detailed breakup and analysis of the market based on the season have also been provided in the report. This includes summer wear, winter wear, and all-season wear.

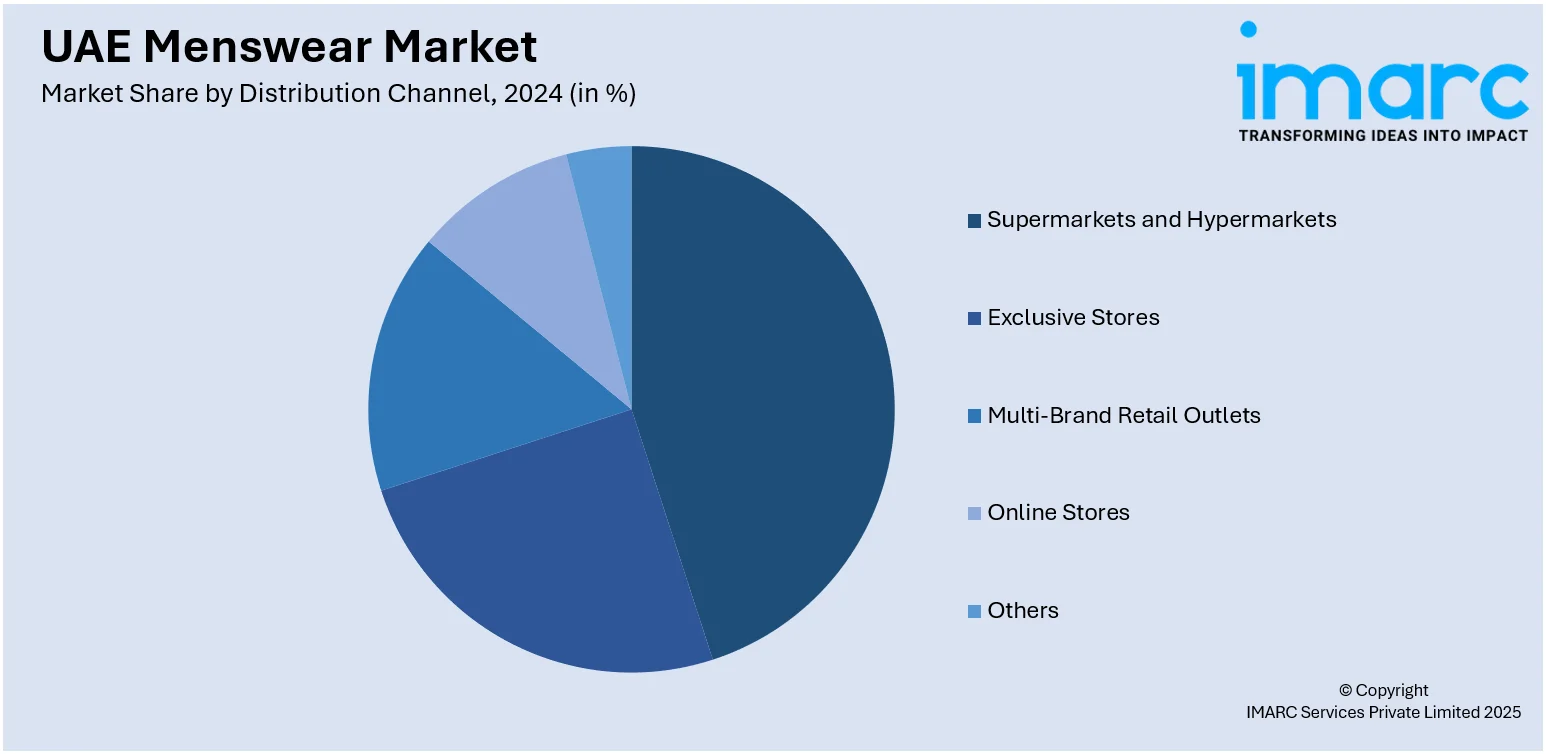

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Exclusive Stores

- Multi-Brand Retail Outlets

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, exclusive stores, multi-brand retail outlets, online stores, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Menswear Market News:

- In March 2025, Apparel Group celebrated the grand opening of Hackett London's second UAE store at Dubai Hills Mall, highlighting its commitment to menswear. The launch event attracted over 100 guests, featuring exclusive collections and bespoke services. With plans for 25 new stores, Hackett aims to enhance the region’s fashion landscape.

- In January 2025, Gymshark unveiled its first permanent flagship store outside the UK in Dubai Mall, following a successful pop-up last year. The 4,300-square-foot store features collections for men, including Tectonic and Heritage lines, alongside women's activewear. This move highlights Gymshark's commitment to global expansion and elevating its brand presence.

UAE Menswear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Trousers, Denims, Shirts and T-Shirts, Ethnic Wear, Others |

| Seasons Covered | Summer Wear, Winter Wear, All-Season Wear |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Exclusive Stores, Multi-Brand Retail Outlets, Online Stores, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE menswear market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE menswear market on the basis of product type?

- What is the breakup of the UAE menswear market on the basis of season?

- What is the breakup of the UAE menswear market on the basis of distribution channel?

- What is the breakup of the UAE menswear market on the basis of region?

- What are the various stages in the value chain of the UAE menswear market?

- What are the key driving factors and challenges in the UAE menswear market?

- What is the structure of the UAE menswear market and who are the key players?

- What is the degree of competition in the UAE menswear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE menswear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE menswear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE menswear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)