UAE Office Furniture Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, Price Range, and Region, 2025-2033

UAE Office Furniture Market Overview:

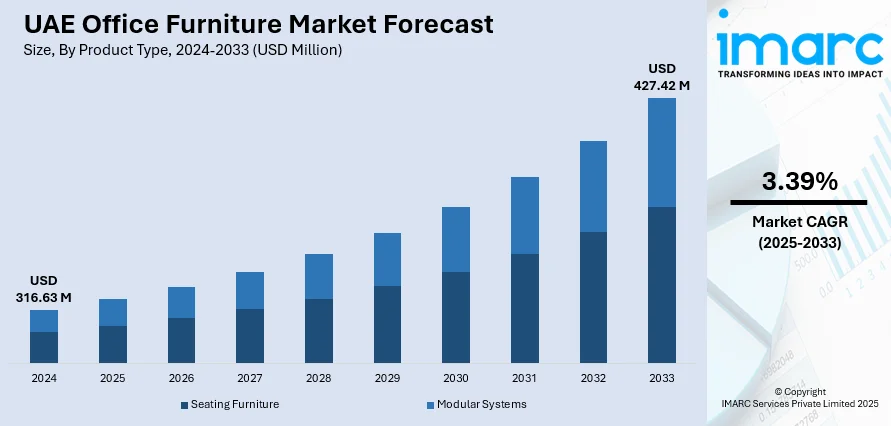

The UAE office furniture market size reached USD 316.63 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 427.42 Million by 2033, exhibiting a growth rate (CAGR) of 3.39% during 2025-2033. Expansion of local manufacturing, rising demand for customization, and progressive flexible work policies are reshaping how offices are furnished. Shorter lead times, sustainability goals, ergonomic needs, and adaptable layouts together contribute to the expansion of the UAE office furniture market share and align with evolving workforce expectations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 316.63 Million |

| Market Forecast in 2033 | USD 427.42 Million |

| Market Growth Rate 2025-2033 | 3.39% |

UAE Office Furniture Market Trends:

Local Manufacturing Expansion

With companies and government bodies increasingly valuing shorter lead times, reliable supply, and customization, the expansion of local manufacturing directly supports these priorities. In 2024, BOSQ demonstrated this commitment by expanding its operations in Sharjah with a new 20,000 sqm joinery facility dedicated to producing ergonomic office furniture. This investment enhances the company’s capacity for innovative design and precision manufacturing while contributing to job creation within UAE. By establishing advanced production infrastructure locally, manufacturers like BOSQ can respond faster to client specifications, adapt products to regional tastes, and offer tailored solutions that imported ranges may not provide as efficiently. This development also supports sustainability goals by reducing reliance on long-distance shipping and enabling greater control over raw materials and waste management. The presence of large, well-equipped facilities encourages competitive pricing, boosts trust in domestic brands, and motivates other local firms to raise their production standards. As more clients across government, corporate, and private sectors prioritize quality, design flexibility, and reliable service, the growth of modern manufacturing bases within the UAE positions the market to meet this rising demand with greater efficiency and alignment to national economic and employment objectives. This momentum plays a vital role in strengthening the overall UAE office furniture market growth.

To get more information on this market, Request Sample

Flexible Work Policies and Evolving Workplace Needs

Progressive government policies that support remote and flexible work are reshaping office layouts and driving the demand for adaptable furniture solutions. The UAE’s commitment to building a modern, competitive workforce is resulting in structural changes to how workspaces are planned and furnished. In 2025, the UAE government launched a remote work system that allows public sector employees to perform their duties from outside the country. This step underscores a strategic focus on attracting international talent and increasing productivity through greater flexibility. Such initiatives encourage organizations to reconfigure existing offices to balance remote work with collaborative in-office functions. Firms now require furniture that can be quickly reconfigured for hot-desking, shared meeting spaces, and temporary workstations that accommodate fluctuating headcounts. Ergonomic considerations gain priority, as employees expect professional standards whether working on-site or in hybrid modes. This shift places continuous pressure on suppliers to provide modular, ergonomic, and technology-compatible furniture that supports diverse working arrangements. Flexible layouts demand furniture that is lightweight, easy to move, and durable enough for frequent rearrangement. As public and private sectors adjust to changing work models, the need for thoughtfully designed, flexible furniture supports the market expansion and establishes the UAE as a region attuned to global workforce trends and contemporary business practices.

UAE Office Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, distribution channel, and price range.

Product Type Insights:

- Seating Furniture

- Modular Systems

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seating furniture and modular systems.

Material Type Insights:

- Wood

- Metal

- Plastic and Fiber

- Glass

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes wood, metal, plastic and fiber, glass, and others.

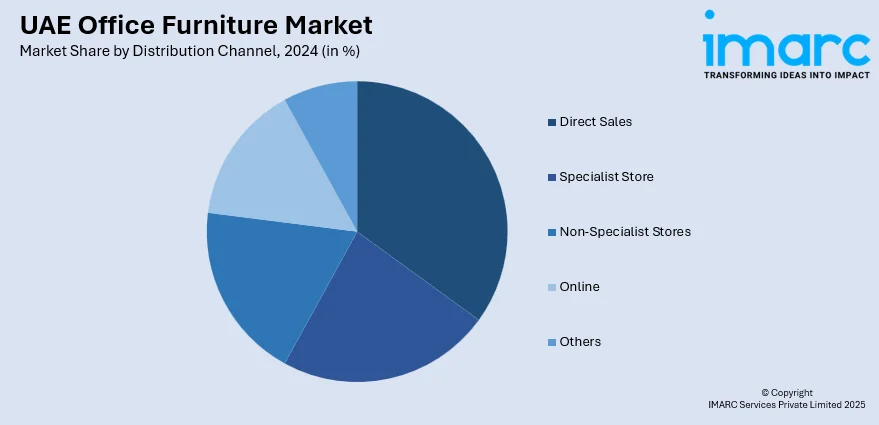

Distribution Channel Insights:

- Direct Sales

- Specialist Store

- Non-Specialist Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales, specialist store, non-specialist stores, online, and others.

Price Range Insights:

- Low

- Medium

- High

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low, medium, and high.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Office Furniture Market News:

- In June 2025, the Office Furniture & Smart Technologies Innovation Expo (WorkSpace Dubai 2025) opened at the Dubai World Trade Centre, featuring over 120 brands from 60 countries. Themed “Orchestrating Tomorrow’s Workplace,” the event showcases innovations in office technology, wellness, and interiors. It includes expert panels, smart office tours, and industry networking events.

- In February 2025, Design Infinity launched an exclusive showroom in Dubai for Global Furniture Group, Canada’s leading office and healthcare furniture manufacturer. The showroom features ergonomic and innovative furniture solutions for workplaces, healthcare, and education sectors. This collaboration marks a strategic expansion of Global’s presence in the UAE’s dynamic commercial market.

UAE Office Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seating Furniture, Modular Systems |

| Material Types Covered | Wood, Metal, Plastic and Fiber, Glass, Others |

| Distribution Channels Covered | Direct Sales, Specialist Store, Non-Specialist Stores, Online, Others |

| Price Ranges Covered | Low, Medium, High |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE office furniture market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE office furniture market on the basis of product type?

- What is the breakup of the UAE office furniture market on the basis of material type?

- What is the breakup of the UAE office furniture market on the basis of distribution channel?

- What is the breakup of the UAE office furniture market on the basis of price range?

- What is the breakup of the UAE office furniture market on the basis of region?

- What are the various stages in the value chain of the UAE office furniture market?

- What are the key driving factors and challenges in the UAE office furniture market?

- What is the structure of the UAE office furniture market and who are the key players?

- What is the degree of competition in the UAE office furniture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE office furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE office furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE office furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)