UAE Online Education Market Size, Share, Trends and Forecast by Type, Provider, Technology, End-User, and Region, 2025-2033

UAE Online Education Market Overview:

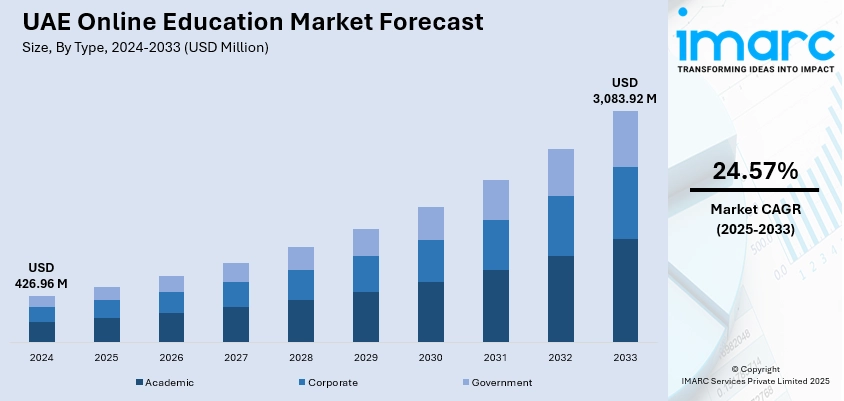

The UAE online education market size reached USD 426.96 Million in 2024. The market is projected to reach USD 3,083.92 Million by 2033, exhibiting a growth rate (CAGR) of 24.57% during 2025-2033. The market is driven by robust government initiatives to digitalize education, which promote the integration of technology in classrooms. Along with this, the increasing internet penetration and high smartphone usage further support the adoption of online learning platforms across K–12, higher education, and professional training segments. Additionally, the demand for flexible, skill-based courses aligned with labor market needs is encouraging edtech firms to expand digital offerings, which is further augmenting the UAE online education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 426.96 Million |

| Market Forecast in 2033 | USD 3,083.92 Million |

| Market Growth Rate 2025-2033 | 24.57% |

UAE Online Education Market Trends:

Government-Led Digital Transformation in Education

A key trend in the market is the government’s sustained commitment to digital transformation in the education sector. Government initiatives have laid a strong foundation for integrating digital tools into teaching and learning. For instance, ‘The Digital School’ is an initiative designed to deliver accredited online education to students lacking access to traditional schooling, with a primary focus on underserved populations in the Arab region and beyond. It specifically supports youth in refugee camps and disadvantaged communities, regardless of their socioeconomic or educational circumstances. The program aims to have one million learners by 2026. These policies emphasize not only infrastructure development but also the training of teachers and the modernization of curricula. In addition to this, the Ministry of Education has collaborated with global tech firms to develop virtual classrooms, digital content, and AI-powered educational solutions. Furthermore, during the COVID-19 pandemic, the government rapidly deployed nationwide remote learning solutions, which have now become an integral part of the educational framework. Besides, the UAE also invests in advanced technologies such as AR/VR and data analytics to personalize learning experiences. As a result, public and private institutions are aligning their offerings with national digital goals, leading to increased adoption of e-learning platforms and fostering a culture of continuous innovation in education.

To get more information on this market, Request Sample

Expansion of EdTech Ecosystem and Private Sector Involvement

The robust growth in the edtech ecosystem is driven by increased private sector participation, and startup activity is contributing to the UAE online education market growth. Numerous local and international edtech firms have established a strong presence in the market, offering specialized platforms for K–12, test preparation, language learning, and professional certifications. For instance, on 13 August 2024, Indian edtech startup 90+ My Tuition App entered a strategic partnership with UAE-based Our Own Service LLC to expand access to high‑quality tuition services in Sharjah and the Northern Emirates. The collaboration leverages the partner’s regional network to enroll students in a hybrid learning model combining pre‑recorded and live CBSE‑aligned classes with added Arabic content and local instructors to meet cultural needs. Within its first year in the Gulf region, the platform attracted over 1,200 students. Apart from this, venture capital investment in UAE-based edtech startups has been on the rise, supported by innovation hubs such as Dubai Internet City and Abu Dhabi’s Hub71. These entities provide funding, mentorship, and technological infrastructure, supporting the rapid development and deployment of digital learning solutions. The proliferation of AI-driven personalized learning tools, gamified content, and adaptive learning platforms is enhancing user engagement and learning outcomes. In addition, regulatory frameworks are evolving to support edtech innovation while maintaining quality and accreditation standards, further facilitating the sector’s growth.

UAE Online Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, provider, technology, and end-user.

Type Insights:

- Academic

- Higher Education

- Vocational Training

- K-12 Education

- Corporate

- Large Enterprises

- SMBs

- Government

The report has provided a detailed breakup and analysis of the market based on the type. This includes academic (higher education, vocational training, and K-12 education), corporate (large enterprises and SMBs), and government.

Provider Insights:

- Content

- Services

A detailed breakup and analysis of the market based on the provider have also been provided in the report. This includes content and services.

Technology Insights:

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes mobile E-learning, rapid E-learning, virtual classroom, and others.

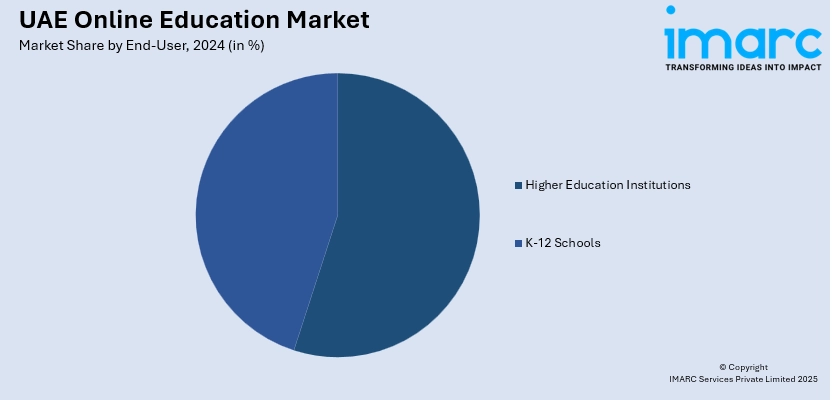

End-User Insights:

- Higher Education Institutions

- K-12 Schools

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes higher education institutions and K-12 schools.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Online Education Market News:

- On 4 July 2024, e& UAE introduced its new platform, GoLearning, an AI‑powered e‑learning platform offering over 10,000 certified courses—including 4,000 free options, through partnerships. The freemium service delivers personalized learning paths across professional, personal, and children’s education, with subscription packages available from AED 25 per month and flexible payment models. The platform aims to democratize access to cutting‑edge skills in AI, technology, languages, and business, reinforcing e& UAE’s commitment to shaping the future of digital education in the region.

- On 28 May 2025, Zimbabwe and the UAE formalized a partnership to train over 10,000 teachers and lecturers annually in artificial intelligence and digital literacy, with a focus on improving digital skills in rural areas. Also, the agreement includes collaboration with UAE-based digital schools and global skills academies to deploy solar-powered infrastructure and expand competency-based education reforms. Additionally, the initiative seeks to stimulate economic growth, bolster technological innovation.

UAE Online Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Providers Covered | Content, Services |

| Technologies Covered | Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| End-Users Covered | Higher Education Institutions, K-12 Schools |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE online education market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE online education market on the basis of type?

- What is the breakup of the UAE online education market on the basis of provider?

- What is the breakup of the UAE online education market on the basis of technology?

- What is the breakup of the UAE online education market on the basis of end-user?

- What is the breakup of the UAE online education market on the basis of region?

- What are the various stages in the value chain of the UAE online education market?

- What are the key driving factors and challenges in the UAE online education market?

- What is the structure of the UAE online education market and who are the key players?

- What is the degree of competition in the UAE online education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE online education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE online education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE online education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)