UAE Perfume Market Size, Share, Trends and Forecast by Price, Gender, and Perfume Type, 2025-2033

UAE Perfume Market Size and Share:

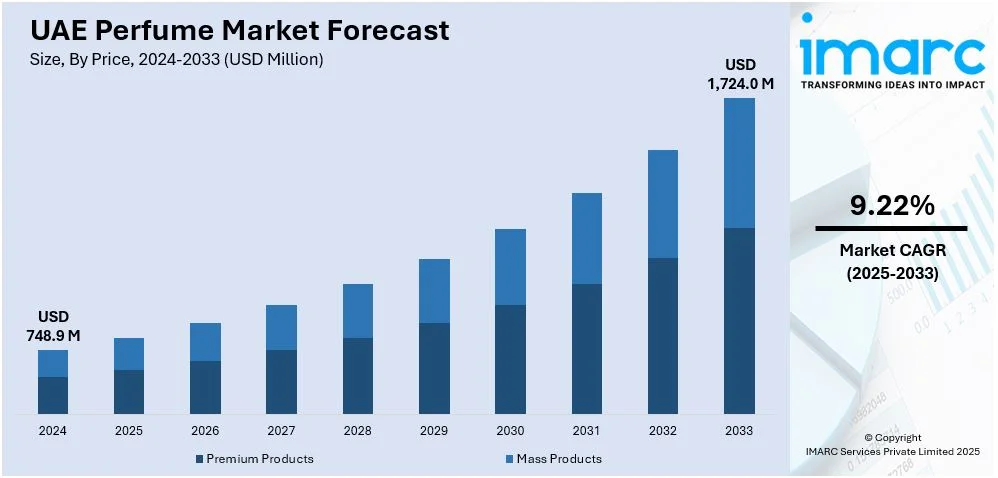

The UAE perfume market size was valued at USD 748.9 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,724.0 Million by 2033, exhibiting a CAGR of 9.22% from 2025-2033. The market is driven by the increasing usage of perfumes in personal care products to provide a delicate fragrance, along with the rising developments of luxury stores that offer high-quality perfumes.

| Report Attribute | Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 748.9 Million |

|

Market Forecast in 2033

|

USD 1,724.0 Million |

| Market Growth Rate (2025-2033) |

9.22%

|

Eco-friendly packaging has been growing in adoption across the UAE, driving the market. Rising concerns with regards to plastic waste and depletion of natural resources have increased eco-conscious individuals to look for perfumes with recyclable or biodegradable materials, which might be in glass, paper, or aluminum, so it does not have to use too much plastic. Refillable bottles from regional perfume companies are reducing waste, saving people money while being an environment-friendly alternative. In addition, some brands are choosing minimalistic packaging to reduce material usage. Companies are also focusing on the use of ethically sourced ingredients, such as organic flowers and natural oils, appealing to those who care about the social impact of their purchases.

With the growing tourism industry, the country is fastly turning into one of the most visited places in the globe. Places like Dubai is known for its upscale mall, duty-free shops with a comfortable retail experience with many tourists seeking exclusive perfumes. Tourists who visited the country are attracted with the rich cultural heritage of aromatic Arabic perfumes and also making fragrance a popular item as a souvenir. Arabic oud, attars, and exclusive blends are highly sought after for their unique and traditional appeal. Many tourists would love to buy these high-end fragrances that are limited editions. International and regional perfume brands are increasing their presence in airports, malls, and duty-free outlets of the region to make their products more accessible to travelers.

UAE Perfume Market Trends:

Growing demand for beauty and personal care products

The rising demand for beauty and personal care products in the UAE is further propelling the growth of the market. As individuals are becoming more conscious of their looks and personal hygiene, there is an increased focus on fragrances as part of their daily routine. Fragrances have become an extension of a person's identity and expression, making them even more popular. Perfumes are added to different beauty practices to give long-lasting fragrances that boost confidence and the overall grooming experience. They find their way into various hygiene daily products, like body sprays, deodorants, and perfumed lotions that give a refreshing and great fragrance to the skin. Apart from this, they are used in facial products such as powders and foundations to offer a mild fragrance. They are also used in hair care products, like shampoos and conditioners, in order to make the hair smell fresh and fragrant with each wash. Additionally, the fragrance can be customized according to individual preferences for skincare products. According to IMARC Group's report, UAE beauty and personal care products market is expected to rise at a growth rate of 5.70% during 2024-2032.

Expansion of e-commerce platforms

The expansion of e-commerce platforms is providing users with greater accessibility and convenience, thereby propelling the market growth. With the rise of online shopping, people can now explore a wide variety of perfume brands and products from the comfort of their homes, making it easier to discover both well-established and niche perfume brands. E-commerce platforms allow individuals to compare prices, read reviews, and browse extensive product catalogs. Since online stores provide worldwide shipping, UAE users have access to a wider selection of international fragrances. E-commerce channels also offer promotions, discounts, and recommendations based on individuals’ preferences and buying behaviors to motivate purchases. Besides this, social media platforms, influencers, and beauty bloggers collaborate with online retailers to promote the use of perfume products. People employ digital payment options and secure checkout systems to make the e-commerce buying process more seamless. According to the IMARC Group’s report, the UAE e-commerce market is projected to exhibit a growth rate (CAGR) of 22.50% during 2024-2032.

Increasing demand for luxury items

The rising demand for luxury items is significantly encouraging people in the region to seek high-end and exclusive products. As one of the wealthiest regions in the Middle East, the UAE has a large population of high-net-worth individuals and expatriates who prioritize luxury brands and unique products. Individuals in the country are investing in premium and luxury fragrances and viewing them as a symbol of status and sophistication. International luxury brands are establishing their stores in the UAE. These brands offer high-quality perfumes with distinctive scents that feature rare ingredients and elegant packaging. Luxury malls, high-end department stores, and specialized fragrance boutiques provide easy access to a wide variety of premium perfumes. Apart from this, in a culture where gifting plays an important role, luxury perfumes are often seen as a thoughtful and prestigious gift choice. The data published on the website of the IMARC Group shows that the UAE luxury market is expected to reach USD 6.7 Billion by 2032.

UAE Perfume Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UAE perfume market, along with forecasts at the regional levels from 2025-2033. The market has been categorized based on price, gender, and perfume type.

Analysis by Price:

- Premium Products

- Mass Products

Premium products represent the largest segment. In the UAE, there is a high demand for luxury and high-quality products driven by a wealthy user base, particularly in cities like Dubai. Luxury fragrances incorporate unique and natural substances like rare flowers, woods, and spices to enhance their intricate and sophisticated aromas. They contain a higher concentration of fragrance oils to guarantee extended wear in comparison to standard perfumes. They are produced by renowned luxury brands, recognized for their legacy, artistry, and creativity. Additionally, they are frequently manufactured in small numbers, resulting in greater exclusivity and appeal to those who desire distinctiveness. To package them, premium materials like glass, crystal, and gold details are utilized.

Analysis by Gender:

.webp)

- Male

- Female

- Unisex

Unisex comprise the biggest segment due to the country’s diverse and cosmopolitan nature. Unisex fragrances are preferred, as they cater to both men and women and offer a balanced and versatile scent profile. They feature neutral, clean, or floral notes, which makes them suitable for various occasions and personal styles. Apart from this, unisex perfumes are favored for their gender-neutral appeal in a society that values inclusivity and modernity. They come with a single scent that works for everyone and assists in saving money in the long run. Moreover, they reduce the need for multiple bottles and enable convenience and ease for those who want a go-to scent for everyday use.

Analysis by Perfume Type:

- Arabic

- French

- Others

Arabic perfumes hold the majority of the market share of the perfume type segment owing to their deep cultural significance and unique composition. They are known for their rich and complex fragrances, often blending luxurious ingredients like oud, musk, amber, and rose. Among these, the most chosen scent is oud, which represents luxury, elegance, and tradition. The high concentration of oils in Arabic perfumes ensures a long-lasting scent, which is highly valued. Moreover, Arabic fragrances are often associated with prestige and exclusivity, which makes them a sought-after choice for locals and tourists. Their luxurious and complex nature provides a sense of identity and pride.

Competitive Landscape:

Key players in the UAE perfume market are influencing the industry’s expansion and innovation. Major global and regional perfume brands, and international giants are offering a wide range of high-quality products tailored to local preferences. These businesses are making significant investments in marketing and distribution networks to guarantee that their fragrances are broadly accessible in upscale retail locations and online platforms. Additionally, they are wagering on launching new fragrance lines to focus on distinctive combinations and adopt the most recent trends like environment friendly and sustainable packaging. They are also teaming up with renowned influencers, celebrities, and designers to enhance brand visibility and desirability. Furthermore, they are refining their product offerings to meet the rising demand for traditional Arabic and modern UAE fragrances. For instance, in February 2024, SAPIL, the leading perfume manufacturer in UAE, unveiled its new range of perfumes, ‘Solid Oud, Under Cover, Quest, and Consensual’. They offer unique, refreshing, and pleasant aromas to cater to the individuals’ preferences.

The report provides a comprehensive analysis of the competitive landscape in the UAE perfume market with detailed profiles of all major companies.

Latest News and Developments:

- February 2024: Emirates Pride, a prominent perfume manufacturer in UAE, made the announcement about its first ever collaboration with Master Perfumers, Nathalie Lorson and Olivier Cresp, in MENA. The agreement promises to develop a unique fragrance that combines the essence of creativity and craftsmanship.

- October 2024: Ajmal Perfumes, a well-known fragrance producing company, launched its special range of three new scents, namely, ‘Golden Hawk, Blue Hawk, and Feather Blossom’ in the UAE. These products are crafted to provide elegance and a sense of luxury.

UAE Perfume Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Prices Covered | Premium Products, Mass Products |

| Genders Covered | Male, Female, Unisex |

| Perfume Types Covered | Arabic, French, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE perfume market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UAE perfume market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE perfume industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The perfume market was valued at USD 748.9 Million in 2024.

The market is driven by rising disposable incomes, increasing demand for premium and customized fragrances, the growing influence of Middle Eastern culture in global perfumery trends, changing consumer preferences toward natural and sustainable ingredients, coupled with strong tourism and retail sectors.

IMARC estimates the UAE perfume market to exhibit a CAGR of 9.22% during 2025-2033.

In 2024, premium products represented the largest segment by price as their production involves highly skilled perfumers who meticulously blend and balance scents. These perfumes come with a higher price tag due to the use of superior materials, expert craftsmanship, and limited availability, which makes them a symbol of luxury and prestige.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)