UAE PVC Pipes Market Report by Application (Sewerage and Drainage, Plumbing, Irrigation, HVAC, Oil & Gas, Water Supply) 2025-2033

Market Overview:

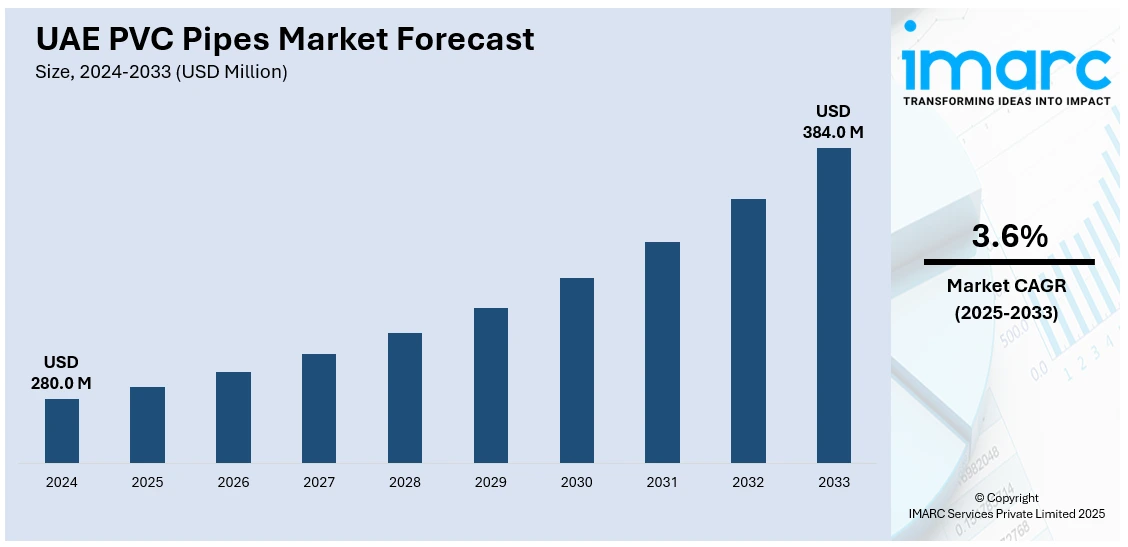

The UAE PVC pipes market size reached USD 280.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 384.0 Million by 2033, exhibiting a growth rate (CAGR) of 3.6% during 2025-2033. The rising infrastructure development and urbanization, rapid growth in the construction industry across the country, and heightening awareness about the advantages of PVC pipes, are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 280.0 Million |

| Market Forecast in 2033 | USD 384.0 Million |

| Market Growth Rate 2025-2033 | 3.6% |

PVC pipes, also known as Polyvinyl Chloride pipes, are a type of plastic piping commonly used in various applications for fluid transportation and drainage systems. They are made from a synthetic polymer called PVC, which offers excellent properties such as durability, corrosion resistance, and cost-effectiveness. PVC pipes are lightweight and easy to install, making them a preferred choice in construction, plumbing, irrigation, and wastewater management. They come in a range of sizes and configurations, suitable for both above ground and underground applications. With their widespread use and versatility, PVC pipes have become an integral part of modern infrastructure development and play a crucial role in maintaining water supply and sanitation systems in residential, commercial, and industrial settings.

To get more information on this market, Request Sample

The country’s rapid infrastructure development and continuous construction projects has contributed to PVC pipes uptake in the UAE. As the UAE experiences rapid urbanization and population growth, there has been a rise in need for reliable and cost-effective piping solutions. Moreover, the significant expansion in the construction industry, due to the ongoing real estate developments and commercial projects, has augmented the demand for PVC pipes. Apart from this, the escalating demand for PVC pipes for plumbing, irrigation, and wastewater management applications in both residential and commercial sectors owing to their favorable properties, including durability, corrosion resistance, and ease of installation is positively influencing the market growth. Besides this, emerging trends in the UAE toward green building practices and water conservation is another major growth-inducing factor. Furthermore, the increasing focus of the country on sustainable practices and environmental compliance that encourages the use of PVC pipes, as they are recyclable and have a lower carbon footprint compared to some other piping materials is contributing to the market growth.

UAE PVC Pipes Market Trends/Drivers:

Growing Construction Industry

The flourishing construction industry in the UAE is another major factor propelling the demand for PVC pipes. As the country experiences continuous urbanization and population growth, the need for modern residential, commercial, and industrial buildings has surged. PVC pipes are widely adopted in construction projects due to their versatility and adaptability to a variety of applications, such as plumbing, irrigation, and wastewater management. Their ease of installation and lower maintenance requirements make them an attractive choice for builders and contractors. Additionally, the UAE's emerging tourism sector has led to an increase in hospitality and leisure projects, further driving the demand for PVC pipes in the construction industry. As the country remains committed to expanding its built environment, PVC pipes continue to play a vital role in supporting the growth of the construction sector in the UAE.

Rapid Infrastructure Development

The UAE's relentless pursuit of rapid infrastructure development is a key driver of the PVC pipes market. The country's ambitious plans to expand its urban landscape, build new commercial centers, and modernize transportation networks necessitate reliable and efficient water supply, drainage, and sewerage systems. PVC pipes have become the go-to choice for these applications due to their excellent properties, including long-term durability, resistance to corrosion and chemical degradation, and cost-effectiveness. Their lightweight nature also simplifies transportation and installation, contributing to faster project timelines. With a growing emphasis on creating sustainable and resilient infrastructure, PVC pipes have emerged as a reliable and eco-friendly solution for meeting the demands of the country’s infrastructure development goals.

UAE PVC Pipes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the UAE PVC pipes market report, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on application.

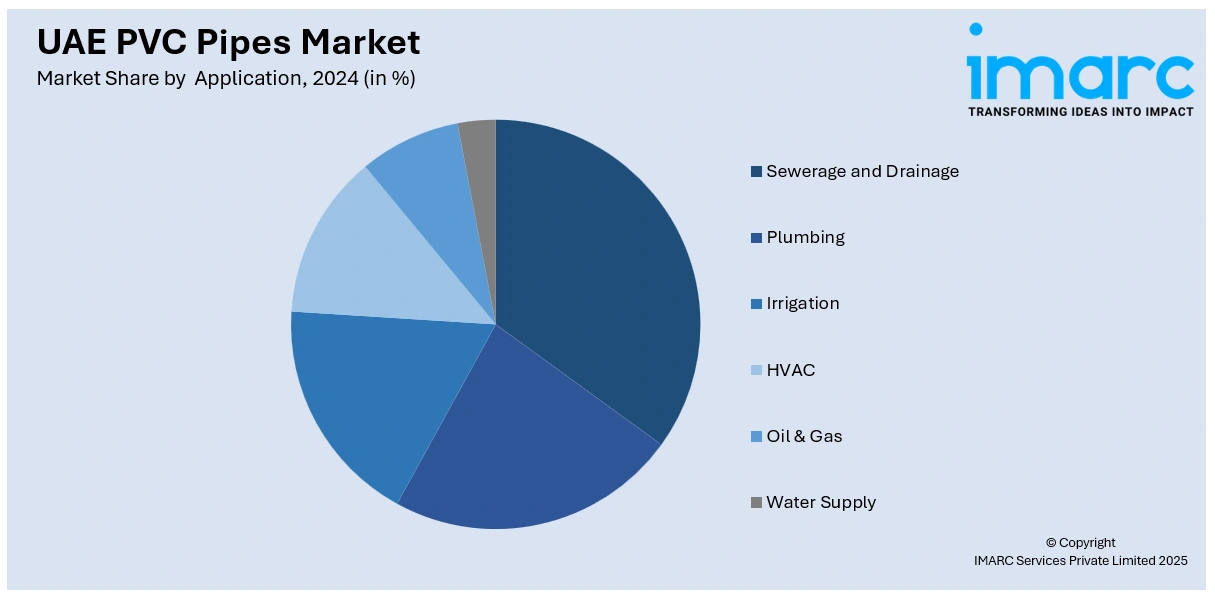

Breakup by Application:

- Sewerage and Drainage

- Plumbing

- Irrigation

- HVAC

- Oil & Gas

- Water Supply

Sewerage and drainage represents the leading application segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes sewerage and drainage, plumbing, irrigation, HVAC, oil & gas, and water supply. According to the report, sewerage and drainage represented the largest segment.

The UAE PVC pipes market is strongly driven by the demand for sewage and drainage applications. As the country witnesseses rapid urbanization and infrastructure development, the need for efficient and reliable sewage and drainage systems becomes paramount. PVC pipes offer the ideal solution for these applications due to their excellent properties, including corrosion resistance, durability, and cost-effectiveness. They can withstand the harsh conditions of sewage systems and effectively transport wastewater without compromising structural integrity. Additionally, PVC pipes' smooth inner surface minimizes friction, ensuring efficient flow and preventing clogs, thus reducing maintenance requirements. Furthermore, the lightweight nature of PVC pipes simplifies installation, speeding up project timelines and reducing labor costs. The growing emphasis on sustainable and eco-friendly infrastructure further bolsters the demand for PVC pipes, as they are recyclable and contribute to water conservation efforts. Overall, the increasing focus on sewage and drainage systems in the UAE fuels the sustained growth of the PVC pipes market.

Competitive Landscape:

The key players in the market have made several innovations and advancements to meet the evolving demands of consumers and businesses. These players are introducing advanced PVC formulations with improved resistance to temperature fluctuations, chemicals, and impact, making the pipes suitable for a broader range of applications and environmental conditions. Innovations in pipe design and technology aim to reduce friction and increase hydraulic efficiency, optimizing water flow in sewage and drainage systems. Additionally, the leading manufacturers are developing more sustainable PVC pipes with reduced environmental impact owing to the growing emphasis on eco-friendly practices. Recycled PVC materials are being incorporated into the manufacturing process, promoting circular economy principles and contributing to a greener construction industry. Moreover, innovative jointing methods, such as push-fit and heat fusion techniques, streamline installation processes and reduce the need for chemical adhesives, ensuring quicker and safer installations.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players include:

- Cosmoplast Industrial Company (L.L.C.)

- Shamo Plast Industries Ltd.

- Hepworth Group

- National Plastics

UAE PVC Pipes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD, 000 Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Sewerage and Drainage, Plumbing, Irrigation, HVAC, Oil & Gas, Water Supply |

| Companies Covered | Cosmoplast Industrial Company (L.L.C.), Shamo Plast Industries Ltd., Hepworth Group, National Plastics, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE PVC pipes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE PVC pipes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE PVC pipes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UAE PVC pipes market was valued at USD 280.0 Million in 2024.

We expect the UAE PVC pipes market to exhibit a CAGR of 3.6% during 2025-2033.

The rising adoption of PVC pipes in electrical fittings, owing to their excellent heat and electrical insulation properties, is primarily driving the UAE PVC pipes market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of various manufacturing units for PVC pipes.

Based on the application, the UAE PVC pipes market can be bifurcated into sewerage and drainage, plumbing, irrigation, HVAC, oil & gas, and water supply. Currently, sewerage and drainage exhibits a clear dominance in the market.

Some of the major players in the UAE PVC pipes market include Cosmoplast, Shamo Plast Industries Ltd., Hepworth, and National Plastic.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)