UAE Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Region, 2025-2033

UAE Real Estate Market Overview:

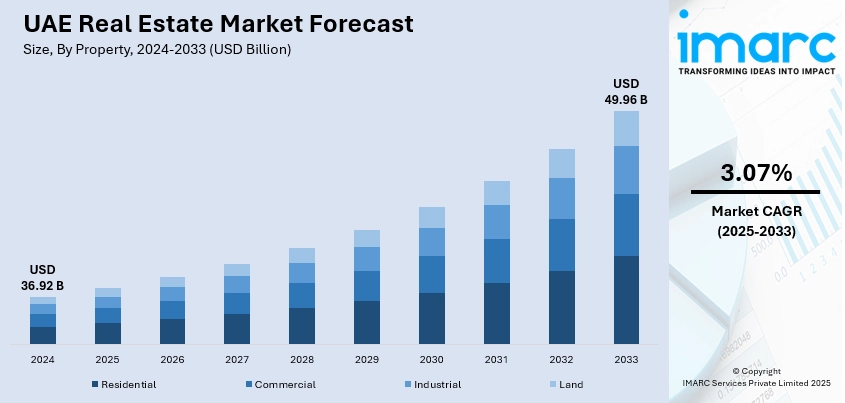

The UAE real estate market size reached USD 36.92 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 49.96 Billion by 2033, exhibiting a growth rate (CAGR) of 3.07% during 2025-2033. The market is fueled by high population growth, high expatriate inflow, and high demand for residential and commercial properties. Long-term visas, foreign freehold ownership, and government diversification of the economy entice foreign investors. The hospitality and tourism industries' booming nature also increase the demand for high-end property, holiday homes, and mixed-use properties. These elements, along with mega infrastructure developments such as the Dubai 2040 Urban Master Plan, thereby strengthening the UAE real estate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 36.92 Billion |

| Market Forecast in 2033 | USD 49.96 Billion |

| Market Growth Rate 2025-2033 | 3.07% |

UAE Real Estate Market Trends:

Tourism, Hospitality & Luxury Segments

Tourism and luxury lifestyles continue to be the primary drivers of the UAE property market in general, and specifically in Dubai and Abu Dhabi. In the first half of 2024, Dubai had 9.31 million international visitors—a 9% increase year-on-year—10.62 million tourists as of July, driving demand for short-term rentals and upscale hotels. Beverly Hills-style developments such as Palm Jumeirah, Downtown Dubai, and Yas Island draw high-end tourists and international investors looking for premium lifestyle homes. The growth of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) with approximately 6,700 millionaires projected to move to the UAE in 2024 has fueled luxury villa and branded residence transactions. Furthermore, the growth of the hospitality industry, with hotel revenues of AED 33.5 billion and among the highest occupancy levels globally, enhances demand for mixed-use developments. This convergence of tourism, hospitality, and real estate strengthens the global investment attractiveness of the UAE.

To get more information on this market, Request Sample

Government Policies & Strategic Initiatives

The other major UAE property market trend is the turn towards government intervention. Plans like the Dubai 2040 Urban Master Plan are tasked with improving livability, infrastructure, and green areas, driving demand in future zones. Policies like foreign freehold ownership, the launch of real estate investment trusts (REITs), and e-property transactions have eased investment processes, drawing regional as well as international capital. Furthermore, the roll out of long-term visas and citizenship routes on the basis of property investment has also raised confidence among international investors. Expo 2020's legacies and economic diversification initiatives have driven demand for commercial, hospitality, and industrial properties. Not only do these policies drive growth, but they also bring about market stability, as real estate development is kept in line with the nation's overall vision for sustainable economic and social development.

Population Growth & Expatriate Demand

The UAE’s real estate market is strongly driven by its expanding population, with expatriates comprising nearly 90% of residents. The country's safe environment, excellent infrastructure, and business-friendly policies attract global talent in sectors such as finance, technology, and tourism, fueling steady demand for residential and rental properties, particularly in Dubai and Abu Dhabi. In 2024 alone, Dubai rents surged by approximately 16% year-over-year, with villa rental demand jumping 20% due to rising family relocations. Government initiatives like long-term residency and Golden Visas have encouraged more expatriates to invest in property rather than rent temporarily, diversifying market demand from luxury to affordable housing. Evolving demographics, including young professionals, families, and retirees, keep the housing market active and varied. This sustained population and investment influx reduces market volatility, strengthens investor confidence, and supports consistent UAE real estate market growth across both residential and commercial real estate sectors.

UAE Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on property, business, and mode.

Property Insights:

- Residential

- Commercial

- Industrial

- Land

The report has provided a detailed breakup and analysis of the market based on the property. This includes residential, commercial, industrial, and land.

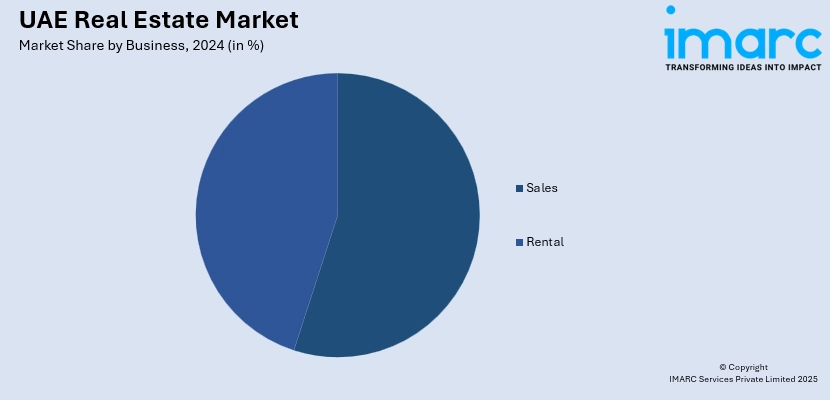

Business Insights:

- Sales

- Rental

A detailed breakup and analysis of the market based on the business have also been provided in the report. This includes sales and rental.

Mode Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the mode. This includes online and offline.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Real Estate Market News:

- In June 2025, Global real estate developer One Group officially entered the UAE market with the launch of its premium project, Elevate. The company plans to develop a $1 billion property pipeline, starting with luxury beachfront branded residences. This strategic move marks One Group’s expansion into the region’s booming real estate sector, focusing on high-end, lifestyle-driven developments in line with the UAE’s growing demand for luxury living and premium investment opportunities.

- In June 2025, Dubai is launching its second tokenised property listing on June 11, 2025, after the rapid success of its first offering, which sold out in under 24 hours. The new listing features a one-bedroom apartment in Kensington Waters, Mohammed Bin Rashid City, valued at Dh1.5 million—below its estimated market value of Dh1.875 million. Investors can participate in fractional ownership starting from just Dh2,000, making real estate investment more accessible.

- In June 2025, One Group officially entered the UAE real estate market with the launch of its lifestyle-focused brand, ELEVATE. The brand’s debut project will be a flagship beachfront development, with details to be revealed soon. Backed by a $1 billion pipeline, ELEVATE aims to redefine luxury living by integrating community, wellness, and design. The Group is also in talks with top global hospitality brands for exclusive branded residences in the UAE.

UAE Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE real estate market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE real estate market on the basis of property?

- What is the breakup of the UAE real estate market on the basis of business?

- What is the breakup of the UAE real estate market on the basis of mode?

- What is the breakup of the UAE real estate market on the basis of region?

- What are the various stages in the value chain of the UAE real estate market?

- What are the key driving factors and challenges in the UAE real estate market?

- What is the structure of the UAE real estate market and who are the key players?

- What is the degree of competition in the UAE real estate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE real estate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)